On February 10, 2016, we published, “From ‘ticking time bomb’ to ‘looming collapse.‘”

The post described the fact that in 1940 the following article was published:

Sept 26, 1940, New York Times: Deficit Financing is Hit by Hanes: ” . . . unless an end is put to deficit financing, to profligate spending and to indifference as to the nature and extent of governmental borrowing, the nation will surely take the road to dictatorship, Robert M. Hanes, president of the American Bankers Association asserted today.

He said, “insolvency is the time-bomb which can eventually destroy the American system . . . the Federal debt . . . threatens the solvency of the entire economy.”

At the time, the federal debt was a paltry $40 billion.

In the 78 years that followed, week after week, month after month, many thousands of similar articles have been published by “experts,” each warning about the imminent crisis we faced because of the increasing federal debt.

Today, the misnamed “debt” has reached $16 Trillion, a gigantic 40,000% increase from the 1940 level, and the economy is humming.

You might wish that after 78 years of being wrong, wrong, wrong, the “experts” might have learned something, if not facts, then at least, humility. Sadly, your wish has not been granted.

According to the latest “expert” to pontificate, John Steele Gordon, the debt crisis still “looms.”

The Looming Debt Crisis

SEPTEMBER 27, 2018 BY JOHN STEELE GORDON

Everyone has a credit limit.The New York Times has a frontpage story this morning on how the rising federal debt will soon begin to crowd out other federal spending.

His impressive bio reads, “He specializes in business and financial history. He has had articles published in Forbes, Forbes ASAP, Worth, the New York Times and The Wall Street Journal Op-Ed pages, the Washington Post’s Book World and Outlook. He is a contributing editor at American Heritage, where he has written the “Business of America” column since 1989. “

“Everyone” may have a credit limit, but the U.S. federal government is not like “everyone.” It does not have a credit limit. What it does have is the unlimited ability to create its own sovereign currency.

Do you have a sovereign currency? No? Neither do I. But the federal government has one, and it’s called, “the U.S. dollar.” The sovereign federal government can create endless sovereign dollars, with which to pay its bills.

How does federal “debt,” which actually is the total of deposits into Treasury Security accounts, at the Federal Reserve, “crowd out” other spending?

How can interest-paying bank deposits “crowd out” federal spending?

Does “crowd out” mean that paying interest on the “debt” (deposits) will leave less for other spending? No.

Perhaps the clue to Mr. Gordon’s “thinking” can be found in his article:

In the not too distant future, interest payments on the debt could pass military spending.

The Times is right, although it ascribes the impending crisis to both the Trump tax cuts and the rise in interest rates, which the Fed has slowly increased to normal levels after years of near-zero rates following the onset of the recession in 2008.

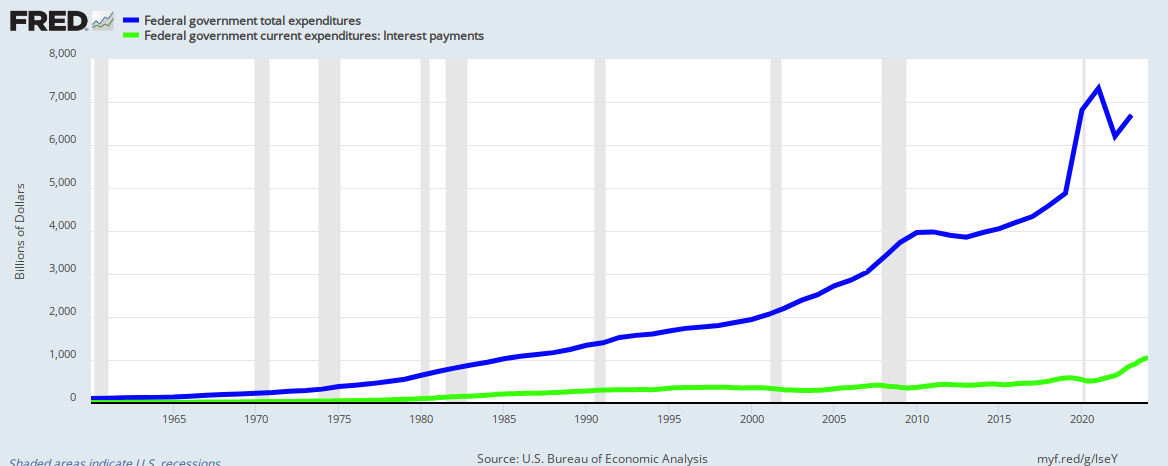

Crowding out? Check the following graph:

The “crowd out” claim is utter nonsense.

In essence, Mr. Gordon tells you the federal government is running short of dollars. Yikes!

He seems to believe that because the Treasury will take in fewer dollars (because of tax cuts), and will spend more dollars (because of interest rate increases), the U.S. Treasury will experience a dollar shortage. That’s the “impending crisis.”

Despite Mr. Gordon’s “expert” credentials, and his gloomy predictions, the federal government cannot run short of dollars to pay for goods, for services, for interest, for benefits, and for anything else it wants to pay for.

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills.

So what is the crisis? Again, no one knows. It’s a fake crisis. It’s been a fake crisis since 1940.

Gordon’s article continues:

But federal receipts are up in 2018 by $24 billion, not down, arguably because of the tax cuts.

A booming economy automatically increases tax receipts as companies have higher profits, employees have bigger incomes, and Wall Street has greater capital gains.

The problem lies not with the tax cuts but, as always, with spending. We spent in deficit during the recession, as we always have.

The deficit in 2009 was $1.412 trillion, higher than the entire national debt as recently as 1983. But in times of prosperity, the government should spend in surplus, or at least hold spending steady.

Oh, geez, this really is getting bad. Gordon says, “The problem lies not with the tax cuts but, as always, with spending.”

I hate to break it him, but from the standpoint of the so-called deficit “problem,” tax cuts and spending are identical. One reduces Treasury income; the other increases Treasury outgo. Same result.

But so what? The Treasury cannot run short of dollars. Even if all tax collections were $0, and federal spending tripled, the government could continue paying its bills, forever.

Fed Chairman Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Gordon does not understand that the federal government not only has no need for income, but it actually destroys the dollars it receives.

That’s right. The U.S. Treasury destroys every one of those precious tax dollars you work so hard to earn. The instant those dollars are received, they cease to be a part of any money supply — not M1, not M2, nor M3, not L, not any. Gone.

If you were to ask how much money the federal government has, the question would be nonsensical, for the answer would either be “infinite” or “none.” The U.S. federal government creates brand new dollars, every time it spends dollars.

Side note: State and local governments, being monetarily non-sovereign, don’t have this ability. Your tax payments to your state and local governments are needed and used, not destroyed.

That is a fundamental difference between Monetary Sovereignty and monetary non-sovereignty.

Gordon’s article continues:

In 1946, the debt was $269 billion, equal to almost 130 percent of GDP. But in the next 14 years, we added only $17 billion to the debt and the booming American economy of those years reduced the debt/GDP ratio to 58 percent.

By 1970, it had fallen to 39 percent of GDP. The roaring inflation of the 1970s reduced the percentage to 34 percent, despite a tripling of the debt in dollar terms.

In the 1980s, inflation waned but spending did not and the debt-to-GDP ratio climbed sharply.

After the Republicans swept the election of 1994, Congress kept spending in check. Outlays between 1994 and 2000 rose by 22 percent, while receipts rose by fully 61 percent. Again, the debt-to-GDP ratio fell from 69 percent to 57 percent.

This past May, we published, “Enough already, with the Debt/GDP ratio.” The post included this line:

The Federal Debt/GDP ratio is absolutely meaningless, a useless, designed-to-be-misleading number that has been foisted on an innocent public.

The misnamed federal “debt” actually is the total of deposits into T-security accounts, which are similar to bank savings accounts.

GDP is total spending in the U.S. Why on earth would anyone worry about the ratio of deposits in the Federal Reserve Bank vs. spending? The federal government does not use GDP to pay its debts.

Gordon’s misleading article drones on:

If the federal government was able to restrain spending to match receipts in the postwar years in the 1990s, it can obviously do so now.

At some point, even the United States can max out its credit card.

Gordon, the professional economics writer, doesn’t understand the fundamental differences between federal (i.e. Monetarily Sovereign) financing and personal (i.e. monetarily non-sovereign) financing.

The federal government doesn’t have or need anything remotely resembling a “credit card.” It creates unlimited dollars, ad hoc, every time it pays a bill.

Fed Chairman Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

But since Congress seized control of the budget process in 1974 with the wildly misnamed Budget Control Act, fiscal discipline has been in short supply.

A Congress elected on a fiscal discipline platform can do it, as it did in the 1990s.

But unless the government starts keeping honest books and the president is given the power to control total spending, we are going to stumble into disaster sooner rather than later.

If you owned a money machine, and like the U.S. government, you had the unlimited ability to create dollars, what would be the meaning of “fiscal discipline”?

If you owed a million, a billion, or a trillion dollars, but you could create unlimited dollars, would you be “stumbling into disaster”?

The worst financial disaster currently facing America is the ongoing, incessant series of articles like Gordon’s, warning America that the federal deficit and debt are too large.

The effect of these articles, if not the purpose, is to make you believe the federal government cannot afford your social benefits, or your taxes must be raised. Both are lies.

The federal government easily could afford the “Ten Steps to Prosperity” (below), while cutting taxes. And because the government is sovereign over the dollar, it has the unlimited power to control the value of the U.S. dollar, i.e to control inflation.

How? Interest rate control is the method the Fed uses. (Raising interest rates increases the demand for dollars, making dollars stronger, i.e. more valuable.)

In more extreme cases, a Monetarily Sovereign government simply can set the value of a dollar by fiat. When the Monetarily Sovereign UK devalued the pound in 1967, and the Monetarily Sovereign Mexico devalued the peso in 1994, they did so by fiat. They had absolute control over their sovereign currencies.

Even the U.S. often has revalued its dollar by fiat, when it has changed the relationship to silver and gold.

In summary:

- The U.S. cannot run short of dollars to pay its bills. Even if federal tax collects fell to $0 and spending tripled, the federal government could continue to spend and pay creditors, forever.

- Social programs like Social Security, Medicare, Medicaid, food stamps and other poverty aids cannot run short of funding unless Congress wills it.

- The federal government could afford to eliminate the FICA payroll tax and income taxes, while providing such benefits as Medicare for every man, woman, and child in America, monthly bonuses for all, free education for all, even a salary for attending school.

- Being sovereign over the dollar, the U.S. government has the unlimited ability to set the value of the dollar by fiat, i.e. to control inflation.

Pay no attention to scare stories about how the federal deficit and debt are too high, when they, in fact, are too low. Deficit and debt reductions lead to recessions and depressions.

Economic growth requires money growth; the federal government is the one agency that has the unlimited ability to grow the economy.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. Eliminate FICA2. Federally funded medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

And no sooner do we publish the above post than this appears: “Top House Budget Dem warns deficits, debt must be addressed soon.”

The only question: Is it ignorance or intent to deceive? I suspect the latter.

LikeLike

“…debt must be addressed soon.”

OK, here’s the address “https://mythfighter.com/.

No ONE has unlimited ability, but our MS system “does.” It is greater than the sum of the parts of the system taken separately. Stepping back and Legally viewing the system, you must notice its inherent Legal abilty stands ready to do what science and the natural order cannot do: It can create credit from nothing to whatever sum necessary without inflation.

LikeLike