It takes only two things to keep people in chains:

The ignorance of the oppressed

And the treachery of their leaders

========================================================================

Some economists, perhaps feeling pangs of inferiority about economics as a science, try to make it seem more “scientific,” and for them, that requires mathematics.

The belief is: Include a bunch of formulas, then claim these formulas prove economics is a “real science,” like astronomy and physics.

That is why economics papers usually include so much math. It’s part of the desperate hope this pseudo-specificity will justify the WAGs (Wild-Ass Guesses) that too many economics papers include.

That desperate need for mathematical justification is one reason why the Debt/Gross Domestic Product ratio was created — that plus the efforts by the rich to “prove” that social programs are unaffordable and “unsustainable” (a favorite word for debt guerillas).

The Federal Debt/GDP ratio is absolutely meaningless, a useless, designed-to-be-misleading number that has been foisted on an innocent public.

The so-called “Federal Debt” isn’t even “debt” in the usual sense. It is the word describing the current total of open deposits — similar to bank savings deposits — into Treasury security accounts, made for the past 30 years.

By contrast, GDP is the total of Spending and Net Exports this year. Putting these two, unrelated measures into one fraction yields a classic apples/oranges ratio, measuring nothing.

It’s akin to creating a ratio of Chicago Cubs hits in yesterdays game vs. the number of games the Cubs won last year. Meaningless.

If, instead of misnaming it “debt,” we called it “deposits in T-security accounts,” the entire misunderstanding might disappear.

Here are a few things the Debt/GDP ratio does not indicate:

-

- It does not indicate the federal government’s ability to pay its obligations

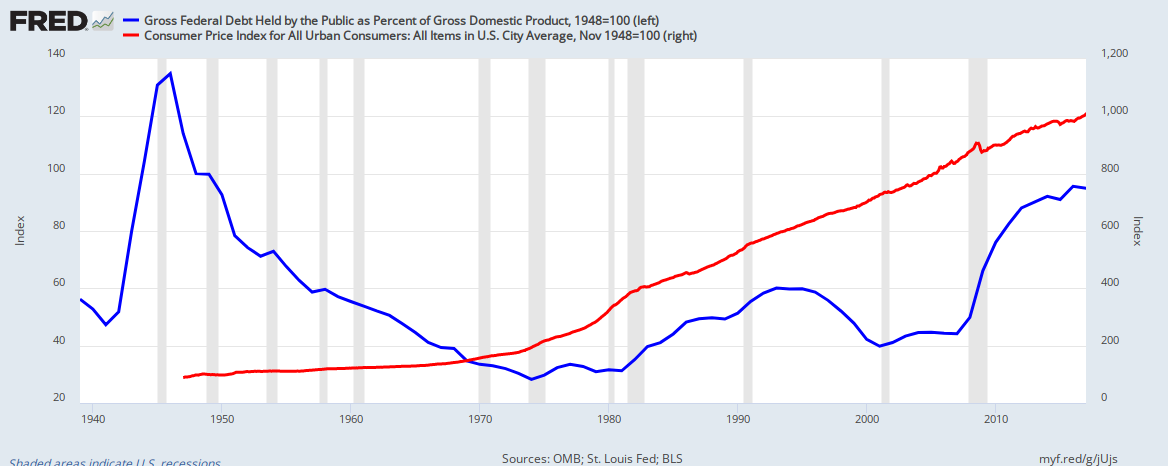

- It does not indicate the likelihood of inflation

There is no relationship between Debt/GDP growth (blue line) and inflation (red line). - It does not indicate the health of the economy

There is no relationship between Debt/GDP growth (blue line) and GDP growth (red line).

Those are the facts. They are easily obtainable. Yet here is an example of the disinformation that continually has been spread, to brainwash the public:

Forget Debt As A Percent Of GDP, It’s Really Much Worse

Jeffrey Dorfman, Forbes MagazineWhen central bankers, macroeconomists, and politicians talk about the national debt, they often express it as a percent of gross domestic product (GDP) which is a measure of the total value of all goods produced in a country each year.

The idea is to compare how much a country owes to how much it earns (since GDP can also be thought of as national income). The problem with this idea is that it is wrong.

The government does not have access to all the national income, only the share it collects in taxes.

The 1st paragraph is correct. The 2nd paragraph is misleading in that our Monetarily Sovereign government’s access to dollars is not taxes but rather its unlimited ability to create dollars (See the statements by Greenspan, Bernanke, and the Federal Reserve, above).

Even if all federal tax collections were zero, the federal government could not unintentionally run short of its own sovereign currency, the U.S. dollar.

Then the article goes completely off the rails:

Looked at properly, the debt problem is much worse.

I collected national debt, GDP, and tax revenue data for thirty-four OECD countries (roughly, the developed countries worldwide) for 2010.

The data are a bit old, but that is actually the last year available for government tax revenue numbers. The debt figures are for central government debt held by the public (so the debt we owe to the Social Security Trust Fund does not count) but the central government tax revenue includes any social security taxes.

Some people hate the notion of comparing a country’s financial situation to a family, but I think it is useful in many cases with this being one of them.

For a family, debt that exceeds three times your annual earnings is starting to become quite worrisome. To picture this, just take your home mortgage plus any auto, student loan, or credit card debt, then divide by how much you earn.

First, he properly reveals that “some people” (i.e. people who understand Monetary Sovereignty) hate improperly comparing federal finance to personal finances.

Then he proceeded to make that improper comparison. What he failed to recognize is:

A family can run short of dollars. A state or local government can run short of dollars. A business can run short of dollars. You and I can run short of dollars. We all are monetarily non-sovereign.

The federal government, being Monetarily Sovereign, cannot unintentionally run short of dollars.

Economists and central bankers know this is not the same as the family debt to income concept, which is why they warn of danger at the level of 100, 90, or even 70 percent depending on which economist you talk to or exactly how you define the total amount of debt.

Yes, knowledgeable economists and central bankers (like Bernanke and Greenspan, above) know federal finances are not the same as family finances, but ignorant economists warn of “danger at 100, 90, or even 70 per cent.”

The article was written four years ago, when the ignorant economists were, in fact, delivering that warning to an innocent public. Today, the ratio is about 106% and we are entering our 9th year of economic growth, with low inflation.

Sadly, that fact has not penetrated the skulls of the debt “Henny Pennys,” who have been screaming, “The sky is falling” since 1940.

The reason for the different standard is that the government cannot claim all your income as taxes or we would all quit working (or emigrate).

No, the reason for the different standard is that Monetary Sovereignty is different from monetary non-sovereignty.

The article continues spreading disinformation:

A better comparison is to examine each country’s debt to government tax revenue, since that is the government’s income.

This also offers a better comparison because different countries have very different levels of taxation.

A country with high taxes can afford more debt than a low tax country. Debt to GDP ignores this difference. Comparing debt to tax revenue reveals a much truer picture of the burden of each country’s debt on its government’s finances.

All of the above is completely false. The federal government neither needs nor uses federal tax dollars. It creates dollars, ad hoc, each time it pays an obligation.

Tax dollars cease to be part of any money supply measure, the instant they are received. In short, tax dollars are destroyed upon receipt.

The federal government collects taxes, not to provide spending funds, but rather to exert control over the economy and over the voting public.

Federal “debt” (deposits) are not paid back with tax dollars, but rather with dollars that already exist in T-security accounts.

The article’s nonsense continues:

When I compute those figures, Japan is still #1, with a debt as a percentage of tax revenue of about 900 percent and Greece is still in second place at about 475 percent.

The big change is the U.S. jumps up to third place, with a debt to income measure of 408 percent. If the U.S. were a family, it would be deep into the financial danger zone.

Yes, if the U.S. were a family . . . but that is the whole point. The U.S. is not a family. It is the creator of the U.S. dollar by, as Bernanke said, the electronic equivalent of a printing press.

If a family created dollars with its own printing press, it too could pay all its bills, and it would have no need for, nor use of, income.

To add a bit more perspective, the countries in fourth, fifth, and sixth place are Iceland, Portugal, and Italy, all between 300 and 310 percent. In other words, these three are starting to see a flashing yellow warning light, but only three developed countries in the world are in the red zone for national debt to income.

The U.S. is one of those three.

You can see a list of nations according to their tax revenue to GDP ratio here.

Near the bottom of the list are nations with what the author considers to be the “best” ratio, among which are Lybia, Burma, Nigeria, Iran, Haiti, Panama, and similar. Consider what you know about the strength of those economies.

Take a moment to glance at the list, and you’ll see that there is zero relationship between the ratio and any measure of economic success, inflation or any other success criterion.

In short, just like the Debt/GDP ratio, the Tax Revenue/GDP ratio is completely useless, partly because it does not differentiate between Monetarily Sovereign vs. monetarily non-sovereign nations. (Nor does it differentiate between degrees of socialism, which would increase the ratio.)

This does not factor the several trillion dollars owed to Social Security, yet it includes the Social Security taxes collected. If Social Security taxes are not counted, the U.S.’s debt to income ratio rises to 688 percent (still in third place).

This tells you something about the likelihood of increasing Social Security taxes in conjunction with declining Social Security benefits.

Unfortunately, it is true that Social Security taxes will be increased, though not because tax dollars are needed or used.

Rather, FICA, the most regressive tax in America, will be increased because the rich, who control the politicians, want to foster the belief that the federal government “can’t afford” to pay Social Security benefits.

Finally, we come to the misleading summary of a misleading article:

Without quick and significant action on the federal budget, as soon as interest rates begin to rise toward normal the burden of the national debt on the federal budget will become heavy indeed. Something will have to give.

Somebody needs to drag the President and Congress to a credit counselor quick to begin repairs on the government finances. Otherwise, one day sooner than we think, the creditors will be knocking on the door.

What does that goofy phrase, “the creditors will be knocking on the door” mean? Does it mean creditors will want to be paid?

I have news for the author: Creditors always want to be paid, and the U.S. federal government never has failed to pay a creditor. And it never will fail.

The federal government “prints” all the dollars it needs, just as Bernanke, Greenspan and the Federal Reserve said.

I should mention that the article, and its dire warnings, was published back in 2014, and today, while our economy continues to grow, I had hoped the author has learned from reality, and no longer claims the sky is falling.

But, oops. He’s still at it. Here’s an article he wrote just last December, 2017: 10 Things You Need To Know About The Debt Ceiling And Potential Government Shutdown.

In this article he says,

“Spending can be cut to balance the budget, but not without cutting entitlements.”

And there you have the true purpose of the deception, to cut social programs and to widen the Gap between the rich and the rest.

Of the people who spread disinformation in the face of contrary fact, some do it out of ignorance and some are paid to do it.

I do not know which camp Mr. Jeffrey Dorfman lives in.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Guaranteed Income)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

The only real foreseeable problem with the debt/GDP ratio being so high is psychological. And fortunately, if the size of that big scary number really bothers people so much, it can literally be *zeroed out* in a matter of minutes with a few clicks of the computer by our Monetarily Sovereign federal government. Problem solved. Next.

Also, keep in mind that Japan’s debt/GDP ratio is actually well above 200% and growing. And the sky still has yet to fall over there. Their biggest problem is literally that the yen is too damn *strong*. Yes, really. Though their Monetarily Sovereign government can solve so many problems if they simply 1) zero out their debt, 2) implement Mitchell’s Laws so they never have to borrow one penny ever again, 3) implement Quantitiative Easing for the People (aka an Economic Bonus, Citizen’s Dividend, or UBI), and 4) shorten their second-highest-in-the-developed-world (after the USA) workweek. (As should we.) Result? Their yen will then finally drop, deflation will end, their competitive advantage will return, their so-called “lost decades” will finally end, and perhaps their “lowest low” birthrates will finally rise above a TFR of 1.5 after all these decades.

LikeLike

Yes!

See if you can find a pattern: https://tradingeconomics.com/country-list/government-debt-to-gdp

LikeLike

Related to this, what does one do about the debt-hawks tendency to list payments on the debt as a major line item in the federal budget, usually about third place after military and medicare? The scare these people wish to put into us is that payment on the debt – which they’ll show as being from taxes – will soon “consume” all our taxes, squeezing out spending on everything else. If you tell them that the government is monetarily sovereign and can never run out of money, they’ll point to official charts that still show taxes go to paying down the debt and say you’re crazy to think the government can pay their own debt off, or that to try will bring inflation, and then you get into an argument about controlling inflation, and they get even more skeptical…and so on.

Bernanke, Greenspan and the St. Louis Fed may occasionally let the truth out, but those official tax revenue charts stick in people’s minds because that’s how THEY would create a budget for their family or business.

LikeLike

The U.S. government is controlled by the rich, who want the public to believe that federal spending for social programs must be limited. The public has been brainwashed into accepting cuts to social programs as being “necessary.” Those who understand the truth need to keep fighting in hopes that a nationally respected figure helps educate the public.

LikeLike

The only time to worry about the debt is when it grows so large that the private sector finds itself holding far more of it than it wants, and thus has to be offered a high rate of interest to dissuade it from trying to spend away that surplus. But it’s hard to say where that point is. The fact that Japan has a debt/GDP ratio of over 200% combined with near zero interest rates does not prove the same would apply to the US, because the Japanese are much keener on saving than Americans. So my hunch is that the ratio for the US needs to be kept below around 100%, but that’s only a hunch.

LikeLike

Total Public Debt already exceeds GDP. Federal Debt Held by the Public is more than 75% of GDP. When it hits 100%, nothing will happen.

The federal government, being Monetarily Sovereign, has no need to borrow. It issues T-securities for two main reasons:

1. To provide a safe parking place for dollars, which helps to stabilize the dollar.

2. To assist with interest rate control.

In the very unlikely event that the federal government wishes to accept more dollars into T-security accounts, and these dollars are not forthcoming from the private sector, the Federal Reserve simply could invest with newly created dollars.

LikeLike