Those of us who at least make a cursory attempt to separate fact from fiction often remain astounded at the wild beliefs of self-described “conservatives.”

They are not what formerly was considered to be normal. If Donald Trump told them the sky is green, they would attempt, not just to agree with him, but to murder you for claiming the sky is blue.

This combination of naivete and anger is confounding. Many normal human beings believe that exposing right-wing hate-filled cruelty will open Republican voters’ eyes and perhaps even shock them.

But, no. Right-wing hate-filled cruelty is not a bug. It is the feature followers find most attractive.

While, unfortunately, many people of all stripes support hatred and cruelty, here are a few examples of what Republicans, more than Democrats, tend to believe or support:

- Separating children from their parents at the border to instill fear in prospective border crossers.

- Long prison sentences as a deterrent to crime.

- The death penalty

- White supremacist groups (Proud Boys, neo-nazis, etc.)

- Bullying

- The elimination of ACA (Obamacare) thus depriving poor people of health care.

- The reduction or elimination of Medicare, Social Security, food stamps, and other supports for the poor and middle classes

- Laws against abortion, particularly those with no exceptions for rape or incest.

- Anti-teaching of factual history about slavery and bigotry.

- Pro-guns, include military weaponry in everyone’s hands

- Threats of civil war

- Aggression, either by an individual or in a mob

- Pro-monuments to rebel traitors and rebel flags as part of “southern heritage”

- Bigotry against blacks, browns, yellows, reds, gays, and non-Christians.

- Conspiracy theories, especially those promulgating hatred

- Admiration for dictators

- Love for God and America, along with hatred of people.

- Anti-science

- Anti-government

- Belief that compassion is a weakness.

Yes, there is some meanness in even the best of us, but what kinds of people are particularly attracted to today’s conservatism?

I suggest the most common elements shared by right-wingers are feelings of fear, inferiority, and ignorance.

FEAR: The mother of hatred is fear.

You will find it challenging to hate someone or something unless you also fear them or it. Think of what you hate, and you will find you fear it to some degree.

You hate Russians because you fear them. You hate blacks, Jews, your neighbor, the police, bullies, child-abusers, gays, foreigners, strangers, Donald Trump, etc., because to some degree, you fear them.

When the Nazis march chanting, “You will not replace us,” they are tapping into white Christian fear that non-Christians and/or non-whites are “taking over,” a fear that spills over into hatred of immigrants.

How else would you explain the draconian exercise of ripping children from their parents, shipping the children away, and not even keeping track of them so they could be reclaimed by their parents?

This torture of children and parents requires a certain level of cruelty that cannot be explained away by any rational immigration policy.

The GOP stresses a border wall because it has instilled in followers, or taken advantage of, their fear of foreigners.

Every day the Republican party stresses fear. When Mar-a-Lago was searched, the Republican false mantra was, “If this could happen to him, it could happen to you.” (True, only if you keep secret government documents hidden in your home.)

And, you should carry guns, massive, powerful guns in public because you fear. And Donald Trump will protect you from “them.”

Conservatives fear change. They wish to conserve a mythical past. They are the most fear-ridden people on earth; change is fearsome to them.

INFERIORITY: Feelings of personal inferiority support all cults, including the cult of Trump. People join and defend the cause when they need to belong to something, lest they themselves will be invisible.

Hiding among like-minded people provides the strength that weaker people do not possess. It is the courage of the mob. Not one of the January 6th attackers would have had the courage for a lone foray. It was the mob that gave them the bravery they personally lacked.

The cult allows them to say, “I am somebody. I have meaning, strength, and power. I can accomplish. You cannot ignore me. You cannot replace me.”

Trump’s continual “they-are-picking-on-me” victimhood pretense can be empathized by those who feel the entire world is picking on them.

IGNORANCE: We are not talking about mere intelligence; we are talking about knowledge and education.

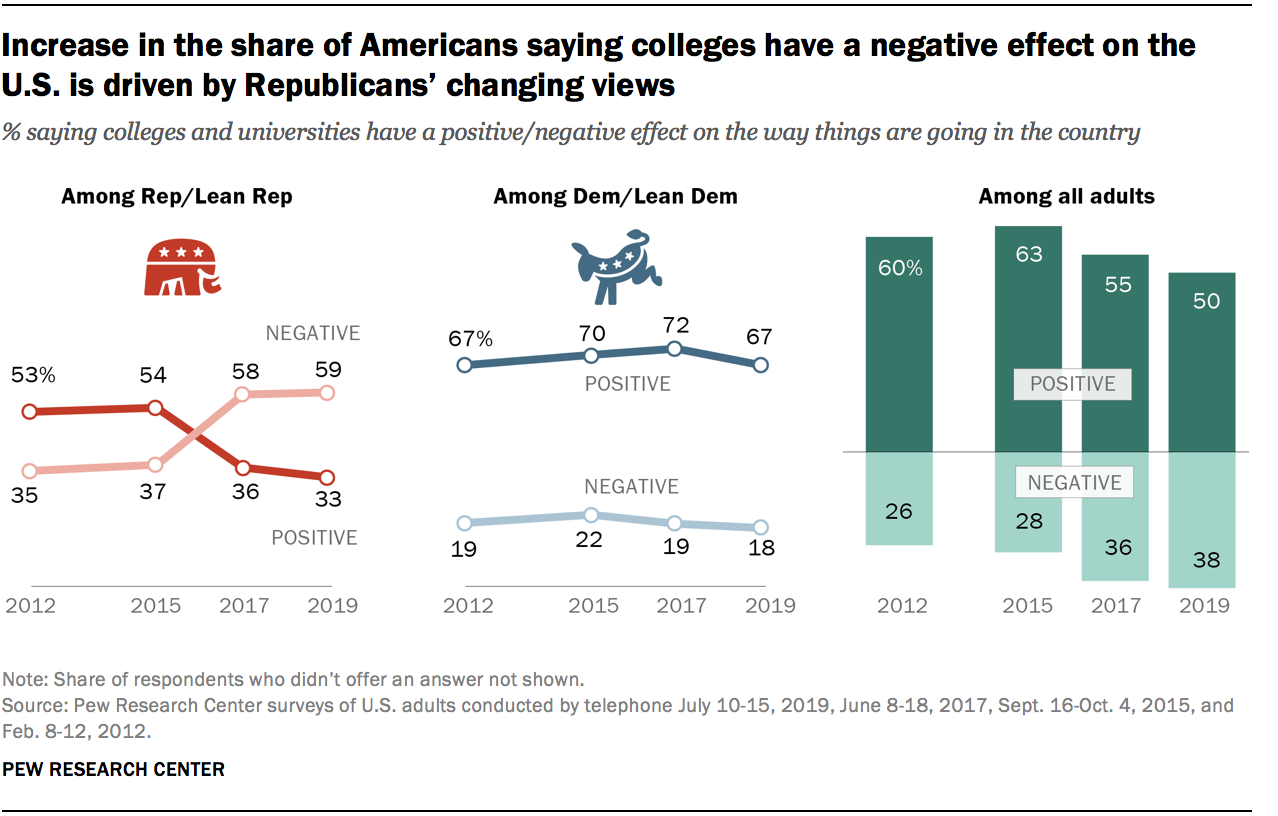

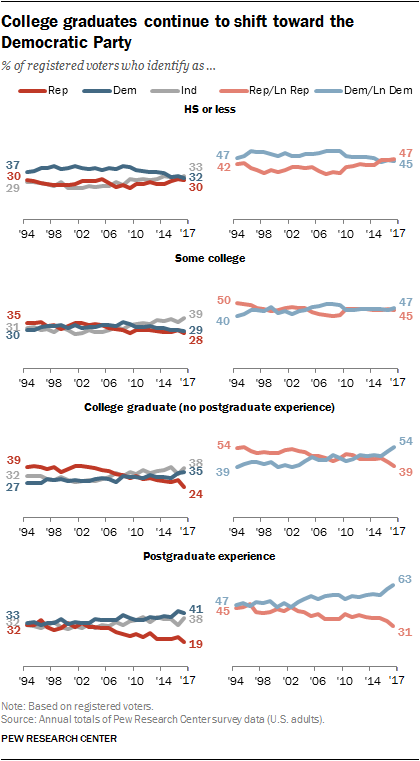

A new Pew Research survey shows that the less educated you are, the more likely you are to have Republican leanings.

Right-wingers are less exposed to mainstream media. They receive nearly all their information from Fox News, Breitbart, and other conspiracy theorists.

The more outrageous the claims, the more they are believed: Hillary has a pedophile ring in the basement of a fast-food restaurant. Kennedy still is alive. A mass murder never happened; it was all staged to blame Republicans. The moon landing was faked.

Rather than learning facts, which are not to be trusted, the right-wing wants to know the “inside, secret facts.”

Republicans wish to say, “You may think I’m ignorant, but I know something you don’t know.” That more easily is said about outrageous claims than about facts.

Ignorance often comes from a lack of schooling. Trump has popularized the notion that not going to school embodies one with native, home-spun thinking ability that education eliminates. Trump himself has said, “I love the poorly educated.”

Indeed he does, for they are the most malleable.

Sneering at college is part of mocking education, science, and fact. Conspiracy theories fill the void. And when they demean all usual sources of factual information, they turn to unusual sources.

There seems to be, among right-wingers, particular pride in not being “spoiled” by a college education but rather having learned from street experience or from peers.

Again, where formal education is lacking, non-factual conspiracy theories tend to fill the void.

That tendency begets easier acceptance of lies, where facts matter less than the sources.

Having “learned” from Fox News that Trump won the 2020 election he lost, one may be more accepting when Fox News says Trump is an innocent victim of a crooked FBI or the FBI planted incriminating information at Mar-a-Lago.

Not being educated, right-wingers do not understand how science works.

They easily can be convinced that scientific ambivalence (“most scientists say,” “there is a 70% likelihood of”) is inferior to the 100% certain, dogmatic, false teachings of conspiracy theorists (the lie that “Trump was proven innocent by Mueller”).

Together, feelings of fear, inferiority, and ignorance lead to resentment, which manifests as hatred and cruelty instead of compassion.

To feel or demonstrate compassion requires a strength of character missing in right-wing followers.

They do not intervene in bullying situations but instead actively participate.

They do not correct false “facts” but knowingly promulgate patently false narratives.

They sneer at “sheeple” — those who follow mainstream beliefs — when it is they who are weak-minded.

As Trump so presciently said, “I have the most loyal people — did you ever see that? I could stand in the middle of Fifth Avenue and shoot somebody, and I wouldn’t lose any voters, OK?”

Loyalty is a form of intentional blindness. It can be wonderful blindness when you are, for instance, loyal to your wife, i.e., blind to her weaknesses. But being blind to a politician’s or political movement’s facts and flaws evidences feelings of fear, inferiority, and ignorance.

Those burdened with those emotions flock to the nonsensical, right-wing world of white supremacy and its partner, cruelty.

The GOP has become the party of straight, white, Christian, male, bigoted cowards who find their courage in guns, cults, and mobs.

Even our Supreme Court, the arbiter of fairness, no longer is blind justice.

It now is led by Clarence Thomas, a man who was appointed on a lie, and who has spent his life trying to prove he is not black.

They and their ilk are a cruel danger to all that is America.

Our great American experiment in democracy is failing.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: Ten Steps To Prosperity:

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY