The word is “debt.”

Virtually everyone believes they know what it means—I assume you do—but virtually everyone, including economists, is confused by the term.

Here is a dictionary definition:

Debt is an obligation that requires one party, the debtor, to pay money or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state , country, local government, company, or individual.

Loans, bonds, notes, and mortgages are all types of debt.

Here is what an AI (Artificial Intelligence) says about federal debt. Read it, keeping in mind that the Monetarily Sovereign U.S. government has the infinite ability to create its own sovereign currency.

As we will discuss, the so-called federal debt isn’t debt and it isn’t federal.

The U.S. government never, unintentionally, can run short of U.S. dollars:

The federal debt of the United States is the total national debt owed by the federal government to Treasury security holders.

It encompasses the accumulated borrowing and the associated interest owed to investors who purchased these securities.

Federal debt is the same as national debt?? Immediately we arrive at confusion because “national” debt can include the debt of the non-federal (private) sector, i.e., the total of mortgages, car loans, business loans, etc., and state/county/city debt.

Because the federal government is Monetarily Sovereign and the other entities are monetarily non-sovereign, one rightly should assume that federal debt should be treated differently.

Let’s break it down further:

Federal Deficits:

- Federal deficits occur when the government spends more money than it collects in revenue during a fiscal year. To cover these deficits, the government borrows money by issuing Treasury bonds, bills, and other securities.

- These deficits contribute to the overall national debt because they represent the accumulated borrowing over time.

Treasury Securities:

- Treasury securities are financial instruments issued by the U.S. Department of the Treasury to raise funds for government operations.

- There are several types of Treasury securities:

- Treasury bills, Treasury notes, Treasury bonds, Treasury inflation-protected securities (TIPS), Floating rate notes (FRN):

- These securities are issued to the public and other entities, including individuals, corporations, state or local governments, foreign governments, and other non-federal entities.

Federal Debt Held by the Public:

- The federal debt held by the public consists of securities held outside the government. It includes:

- Interest-bearing marketable securities: These are marketable Treasury securities (bills, notes, bonds, TIPS, and FRN) held by various entities.

- Interest-bearing nonmarketable securities: These include Government Account Series held by fiduciary and certain deposit funds, foreign series, state and local government series, domestic series, and savings bonds.

- Non-interest-bearing marketable and nonmarketable securities: These include matured and other types of securities.

- The total federal debt held by the public is calculated based on face value less net unamortized premiums and discounts, including accrued interest.

The federal debt represents the total outstanding obligations owed by the U.S. government, including both deficits and the issuance of Treasury securities. It reflects the financial position of the government and its ability to meet its obligations.

That is generally what most people believe. It is wrong on several counts.

First, the federal debt does not “reflect the financial position of the government and its ability to meet its obligations. The federal government has the infinite ability to meet its obligations.

Read it again while again keeping in mind the Monetarily Sovereign U.S. government has the infinite ability to create its own sovereign currency. It never, unintentionally, can run short of U.S. dollars.

Now ask yourself: Why would the federal government borrow dollars? The answer: It doesn’t.

Notice the definitions of federal debt encompass two completely different things:

- The total of federal deficits, i.e. the net total difference between what the government has spent and what it has received in taxes.

- The total of Treasury Security accounts.

1. Total Federal of Deficits: In most years, the federal government spends more than it receives in taxes. This is called a “deficit.” Over the years these deficits total to what is called the “federal debt.”

All forms of debt require at least one debtor and at least one creditor. But with regard to federal deficits, who is the debtor and who is the creditor, and what is owed?

A quick response might be that the government is the debtor, and those supplying the government with goods and services would be the creditors. But that quick response would be wrong.

Although the federal “debt” is upwards of $30 trillion, the federal government does not owe its suppliers $30 trillion. They all have been paid.

Clearly, the total of deficits is not federal debt. There are no creditors, no debtor, and nothing is owed.

2. The Total of Treasury Security Accounts: Are they “federal debt”? If so, how and why did the “debt” occur.

Look back at the definitions: The Treasury Securities are bills, notes, and bonds, issued by the federal government to raise funds for government operations.

A “bill” is a request for payment of money owed, or the piece of paper on which it is written. In the private sector, a bill is created by a creditor and sent to a debtor as a demand for payment. The way most people understand it.

But federal terminology is diametrically different. Here, the “debtor” (the government) creates and issues the T-bill and the creditor buys it, as though it were a bond.

Consider a dollar bill. It is not a request for payment by a creditor, but rather a document created by the debtor — the federal government, which owes the holder one dollar. The dollar bill itself is not the dollar. It is an IOU for a dollar.

The dollar is just a number in the federal government’s financial books.

You cannot see, feel, smell, or taste a dollar. It has no form or substance. If someone asked you what does the number “five” look like would your answer be: “5,” or “V,” or “(2+3);” or the binary “101,” or “√25.”

Although you can describe a five dollar bill, you cannot say what five dollars look like. Dollars result from laws, and again, no one can say what a law looks like. Like dollars, laws are just concepts, not physical entities.

That fact that dollars are not physical gives the federal government the infinite ability to create them just by pressing computer keys.

But that’s a minor, though confusing, semantic issue. The major, and even more confusing, semantic question: Why does a Monetarily Sovereign entity, having the infinite ability to create dollars, ever borrow dollars?

As two former Chairmen of the Federal Reserve have said:

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Question: If the U.S. government cannot become insolvent, can create as much money as it wants, and can pay any debt, why does it borrow dollars? Why does it pay interest when it can produce as many dollars as it wishes at essentially no cost?

Answer: It doesn’t borrow, and the interest is produced at no cost.

Because of words like “bill,” “note.” and “bond,” many people, including even economists, believe these represent federal borrowing and debt.

They do not. The federal government never borrows dollars. It creates all the dollars it needs by spending dollars. Spending is how the government creates new dollars. The process is:

When an agency of the federal government pays an invoice (a bill) from a creditor, it sends instructions (not dollars) to the creditor’s bank. The instructions may be in the form of a check or a wire (“Pay to the order of ____”)

The bank obeys the instructions by increasing the balance in the creditor’s checking account. At that instant, new dollars are created and added to the M2 money supply measure.

The bank balances its books by informing the Federal Reserve of the instructions, which debits the government’s account.

At no time are any physical dollars exchanged because there are no physical dollars. It’s all numbers in bookkeeping accounts.

But what is the purpose of those T-security accounts? They have two purposes, neither of which is to provide spending money for the government:

A. To provide a safe place to store unused dollars, which stabilizes the dollar. Because dollars have no physical existence, they can’t be stored in a box and watched. So, it is especially important that large, unused sums be kept on trusted books

No books are more trusted with dollars than the U.S. government’s.

B. To help the Fed control interest rates. Because T-securities are known to be safe, the interest paid by federal storage sets a floor for all private sector interest rates.

T-security accounts resemble bank safe deposit boxes in that the contents are not owed to the depositors and not used by the bank. They are not federal in that the contents of the accounts are wholly owned by the depostors. The federal government never touches those dollars.

Just as they are not debts, they also are not federal. To close an account, the bank and the government simply return the contents to their owners, the depositors. The government does not owe the money because it never takes ownership of the money.

Why then, does the federal government need to lend rather than give money (for instance, student loans) or need to collect taxes.

It doesn’t.

The federal government could forgive all student loans and continue spending forever, all without collecting a single penny in taxes. It could accomplish this simply by creating dollars.

Some claim that “excessive” federal deficit spending would cause inflation. That claim is false; the reasons are described here. While a government response to inflation may be to print currency, the cause of all inflations has been shortages of critical goods and services.

The most recent inflation was caused not by federal spending, which had been go on for many years, but by new, COVID-relaed shortages of oil, food, computer chips, lumber, paper, shipping, steel, and many other products, and labor.

While state/local taxes and borrowing help monetarily non-sovereign government pay for things, the purpose of federal taxes is not to pay for things but rather:

- To control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward.

- To support demand for the U.S. dollar by requiring taxes be paid in dollars.

But the biggest, unofficial reason for taxes is to support the myth that federal debt is paid by taxes, and that taxes are necessary to fund spending. It’s a myth promulgated by the people who really run America, the rich.

They are rich because of the income/wealth/power Gap between the rich and the rest. The wider the Gap, the richer they are.

The debt/taxation myth limits the federal spending that supports the middle- and the lower-income groups, but allows for the federal tax breaks that are given to the rich. Contrary to popular belief, federal taxation widens the Gap between the rich and the rest, making the rich richer.

Without the debt/taxation myth we could fund free, comprehensive, no-deductible Medicare for every man, woman, and child in America, no-FICA Social Security for everyone, an end to poverty in America, free college for everyone who wants it, and many other benefits (free public transportation, housing support, local infrastructure improvements, lower local taxes, etc.) all of which are of no interest to the rich.

Donald Trump didn’t pay less taxes than you paid the past ten years, not just because he cheated, but also because, being rich, he took advantage of the tax breaks that you can’t.

Tax breaks are financially the same to the federal government as such benefits as Social Security and Medicare, the difference being there is no financial limit put on tax breaks while the benefits are limited by tax collections.

SUMMARY

Unlike state/local governments, businesses, you and me, the federal government is Monetarily Sovereign. It cannot unintentionally run short of dollars. It can pay any financial obligation immediately.

The federal government and its taxpayers are not burdened by federal debt. The federal government does not borrow dollars. It creates dollars ad hoc, by spending.

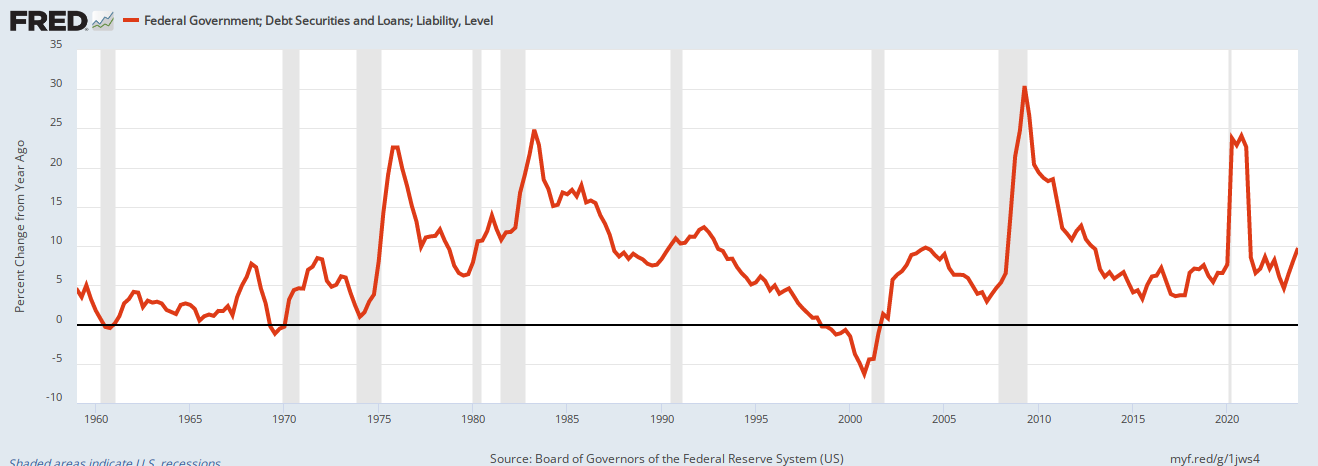

People have complained about the fictional “federal debt” since 1940, calling it a “ticking time bomb.” yet after all these years the ticking time bomb hasn’t exploded. In that time, the “federal debt” rose from $40 billion to $30 trillion, the economy is healthy, the government is paying its bills, and all the scare stories have proved to be false.

The federal debt, whether it be the total of deficits or the total of T-securities, neither is federal nor debt. It is not a burden on taxpayers nor on the federal government. It doesn’t cause inflation or recession.

Deficit spending is necessary to grow the economy and attempts to reduce deficit spending have caused causes recessions and depressions.

Accepting deposits into T-bill, note, and bond accounts does not constitute borrowing or debt, for a Monetarily Sovereign entity never borrows its own sovereign currency.

It’s not debt if there is nothing owed, nothing borrowed, no creditors, no debtors, an no payment burden.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY