Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………..

It takes only two things to keep people in chains: The ignorance of the oppressed and the treachery of their leaders.

…………………………………………………………………………………………………………….

Let’s begin with several facts:

- Educating our young people is important to the future of America.

- For that reason, free elementary education has been provided by every state and every town in America.

- Since WWII, America’s need for college-educated young people has grown, in a more sophisticated, more competitive world. College educated students no longer are a luxury for America; they are a necessity.

- Many of America’s bright students are unable to afford a college education, especially not in better colleges.

- The U.S. federal government is Monetarily Sovereign, meaning it creates dollars at will. It never can run short of dollars. The federal government has the unlimited ability to pay for anything.

- The federal government’s responsibility is to advance the interests of the United States.

- Putting America’s young people into debt, a debt so suffocating it cannot even be discharged in bankruptcy, does not advance the interests of the United States.

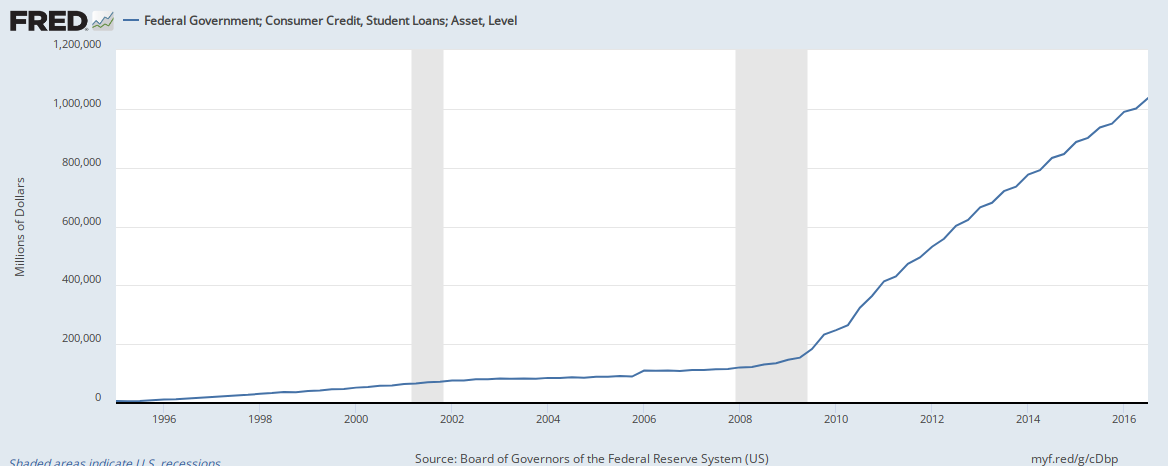

An article titled, “The Fed’s Financial Accounts: What Is Uncle Sam’s Largest Asset?” by Doug Short, 12/9/16, includes the following graph.

The single largest asset on the Federal government’s balance sheet is Student Loans — the amount students owe to the federal government.

And the following graph — Federal government; consumer credit, student loans; asset, Level — came from the St. Louis Fed:

l

l

Here we see the massive increase in student indebtedness to the federal government, especially in just the past six years.

Quoting from the 2013 post titled, “Five reasons why we should eliminate school loans”:

Senator Elizabeth Warren and the New York Times have talked about student loans. The Times said:

Student Debt Slows Growth as Young Spend Less

By ANNIE LOWREY, Published: May 10, 2013The anemic economy has left millions of younger working Americans struggling to get ahead. The added millstone of student loan debt, which recently exceeded $1 trillion in total, is making it even harder for many of them, delaying purchases of things like homes, cars and other big-ticket items and acting as a drag on growth, economists said.

Rather than stimulating America’s economic growth, college educations funded by loans actually “act as a drag on growth.”

Senator Warren said:

“Right now, a big bank can get a loan through the Federal Reserve discount window at a rate of about 0.75%,”

“But this summer, a student who is trying to get a loan to go to college will pay almost 7%. In other words, the federal government is going to charge students interest rates that are nine times higher than the rates for the biggest banks — the same banks that destroyed millions of jobs and nearly broke this economy.”

The federal government not only lends money to students — money it should give without asking for its return — but it charges students interest. And these are not low rates.

See the site: “Student Loan Hero”:

Impoverishing loans must be paid back with high interest rates.

If you wanted a plan to discourage college while also discouraging economic growth, this is it.

“Some may say that we can’t afford this proposal. I would remind them that the federal government currently makes 36 cents in profit on every dollar it lends to students. Add up all of those profits and you’ll find that student loans will bring in $34 billion next year.”

She’s beating the drum, but with the wrong stick.

The federal government making a profit on students is ridiculous.

Being Monetarily Sovereign, the government neither needs nor uses profits. All dollars sent to the federal government disappear from the money supply. In other words, they are destroyed upon receipt. Federal profits are a net loss to the economy.

Senator Warren complains about interest rates when she should complain about the loans themselves.

The big debate in Congress is how much interest to charge students. And there are several complex, convoluted plans afoot. But, the federal government never can run short of dollars. It never needs to ask anyone for dollars — not you, not me, not China, not our students.

It is the U.S. states that are monetarily non-sovereign, so can and do run short of dollars. Nevertheless, they spend billions to support schools, grades K through 12.

So college attendance — which benefits all of America — has become a widespread hardship.

If the monetarily non-sovereign states can support grades K-12, surely our Monetarily Sovereign government can and should support grades 13+.

We already have a model plan. It’s called “Medicare.” Although there are differences between healthcare and education, we can learn from the parallels.

There are more than five thousand public and private hospitals in the United States. Each is unique in terms of geography, reputation, specialties, size, tuition, staff, etc.

Coincidentally, there are almost five thousand public and private colleges in the United states. Each is unique in terms of geography, reputation, specialties, size, costs, staff, etc.

Medicare has determined procedures for compensating the great variety of hospitals and healthcare personnel. Similar procedures could be used for compensating the great variety of colleges and educational personnel.

We could call the program “College-aid” or something similar.

Tuition, books & materials, tutoring, housing, and a meal stipend all would be covered according to limits set by “College-aid” — similar to the way Medicare pays.

Regarding college:

- College education helps America to be economically competitive.

- Federal deficit spending costs taxpayers nothing, and grows the economy.

- College loans discourage college attendance and damage the ability of college students to create new businesses.

- The federal government should institute a “College-aid” program, similar in methods to the Medicare program.

…………………………………………………………………………………………………………………..

The above focuses on college financing. K-12 financing has its own difficulties. Like college, which largely is financed by monetarily non-sovereign students and parents, K-12 is largely financed by monetarily non-sovereign state and local communities.

As with college education, and healthcare, the richer receive the best and the poorer receive the worst. But the biggest difference, regarding K-12, is not just the money spent on schools, but also the school and family environments.

Consider two high schools in Illinois, New Trier Township High School, and Dunbar High School, Chicago.

New Trier High School straddles two upscale suburbs of Chicago. The following is from their website:

“New Trier offers a rigorous college preparatory curriculum and routinely ranks among Illinois’ very top schools for academic achievement.

“For the Class of 2014, New Trier’s mean composite score on the ACT was 27.4, the highest in Illinois for an open enrollment public school. Approximately 98 percent of the Class of 2014 enrolled in college.”

“New Trier offers numerous opportunities for learning and involvement outside of the classroom in activities, athletics, fine/performing arts, and social service.

“Its 35 interscholastic athletic teams have won more athletic state championships than any high school in Illinois interscholastic history.

“New Trier also offers more than 150 student clubs, many with a service component. A comprehensive Student Services program serves students’ social and emotional growth in a variety of ways, from social work and special education services to student support groups and tutoring.

“Service Learning is also an important part of the New Trier experience, and students are asked to participate in service projects throughout their four years at the school.

Dumbar High School is located in Chicago. Its student population is 99% “low income.” It has a very modest website, but from what we can glean on the Internet, Dunbar’s mean composite score on the ACT was 14.4

Aside from the huge ACT difference, we see another difference: New Trier spends an average of $24K per student, while Dunbar spends an average of $10K.

The figures may not be directly comparable, because Dunbar doesn’t break out Operational spending from Educational spending, but two facts are clear: New Trier spends more and has better results; Dunbar spends less and has worse results.

And this is where the arguments begin. Is there a cause/effect relationship between school spending and results? There is plenty of research on both sides, but two things are clear:

- Learning environment counts. Lack of heating or air conditioning, lack of books, computers and other materials, lack of non-academics like music, art, and gym all mitigate against the average overall learning experience.

- Clubs and other social programs produce a more well-rounded learning experience.

While “throwing money at the problem,” won’t always produce better results — there are too many other variables in play — “starving the beast” is almost guaranteed to produce worse results.

So, where there may be doubt about how much per-pupil spending is best, one may wish to err on the higher side especially if money is free.

And, that is the point.

Grades K-12 are funded by the public, either through state and local taxes or through direct tuitions. And unlike the federal government, the public has limited funds.

All states are financially challenged in that they are monetarily non-sovereign. Unlike federal taxpayers (who do not pay for federal spending), state and local taxpayers do pay for state and local government spending.

State and local taxpayers pay for one of the largest expenses each state has: K-12 education.

As a result of taxpayer resistance, many K-12 schools, especially schools in low-income areas, are insufficiently funded, some lacking even the most basic educational assets.

The federal government should fund grades K-12 and remove that financial burden from the states and cities, and from their taxpayers. The federal government also should fund grades 13+, and remove that financial burden from parents and students.

Because the U.S. federal government is Monetarily Sovereign, it neither has, nor can have, a financial “burden.” It creates dollars, ad hoc, by paying bills.

No defense can be made of a system in which the financially challenged are required to pay for a service the financially unchallenged should support.

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Guaranteed Income)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE (See also: Five reasons why we should eliminate school loans)

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE CORPORATE TAXES

Corporations themselves exist only as legalities. They don’t pay taxes or pay for anything else. They are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the government (the later having no use for those dollars).

Any tax on corporations reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all corporate taxes come around and reappear as deductions from your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and corporate taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Ho hum. Donald Trump lies again.

Is this even news anymore?

LikeLike

Here is an article for those who always, ALWAYS, say the problem is not money, and you can’t fix the problem “by throwing money at it.”

Oftentimes, the problem IS money.

States are monetarily non-sovereign. Their spending is funded by taxpayers, and they can run short of money. The federal government is Monetarily Sovereign, its spending is not funded by taxpayers, and it cannot run short of money.

Right-wingers tend to claim that the poor are hopeless, lazy, and beyond help, and that any money (aka “free stuff”) given them will make them even more hopeless, even lazier, and further beyond help.

This is a vicious lie, brainwashed by the upper-income groups to keep the lower-income groups “in their place.” It was the excuse for slavery, and it remains the same excuse today.

LikeLike

I think you should add that all K-12 scoops in the United States should get an equal amount for funding per student. Funding should not be based on the value of local real estate.

LikeLike

A good idea: New Study Finds Cancelling Student Debt Provides Broad Economic Benefits at Low Cost

LikeLike

Excellent idea, Rodger! Unfortunately, there are quite a lot of people who don’t seem to see the forest for the trees in that that regard. Take a look at this on Twitter and see all of the silly talking points against making college free:

https://mobile.twitter.com/chlosiphus/status/1397286148766986247

The ignorance is so astounding, they can’t see the irony in their own beliefs, lol.

LikeLike

Wow! What a list of stupid comments. Perhaps someone might tell these dopes that a college education is not just for earning a living. Have they never heard of Albert Einstein?

The trouble with stupid people is they are too stupid to realize how stupid they are.

LikeLike

Indeed, the Dunning-Kruger effect is strong with people like that.

There are three types of people who oppose free college for all even after being told that it won’t cost them anything personally: 1) those who never went to college and are zealously jealous and resentful of those who did, because REASONS, 2) the elites and their sycophantic lackeys who want to use today’s high college costs for gatekeeping their own rarefied socioeconomic class by keeping the lower classes out, and 3) self-styled LOLbertarians who knee-jerkedly oppose it purely on ideological grounds. Or some combination of the above. The lone exception to this rule is a public school teacher I know who is a bit jaded and still wants there to be “skin in the game”, despite that being superfluous if funded by Monetary Sovereignty unless one really wants to be paternalistic.

My favorite comment is the one that says that making college free will just somehow “raise the bar” even higher, making it even harder for the lower classes to “get ahead”, all while making college degrees “worth less” at the same time. Seriously, they really didn’t think that one through. By that pseudo-logic, then high school should be abolished or be made to cost an arm and a leg then if we want to give the lower classes a leg up.

And to all those who comment about trade school: fine, there is nothing wrong with that at all. For some people that is indeed the more sensible option. But it is not a zero-sum game to expand access to college either, and not just for the top X% of students either.

QED

LikeLike