Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

It takes only two things to keep people in chains: The ignorance of the oppressed and the treachery of their leaders.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single greatest economic problem facing the United States and the world is the large and growing Gap between the richer and the poorer.

Background:

As we learned previously, our Monetarily Sovereign nation never can run low on dollars, and also has the unlimited ability to determine the value of the dollar (i.e. to prevent inflation).

Further, federal deficits build the economy, while federal surpluses or deficit reductions (i.e. “austerity”) weaken the economy. Given those facts, what should the federal government do? More generally: What is the purpose of government?

The fundamental purpose of any government is to enhance the wellbeing of its people — all its people — rich and poor, old and young, strong and weak.

In this series describing the Ten Steps to Prosperity, we suggested eliminating FICA as the 1st Step, and federally funded Medicare as the 2nd Step.

The Gap between the richer and poorer is what makes people richer. Without the Gap, no one would be rich. (We all would be the same). The wider the Gap, the richer they are.

While many individual exceptions exist, people tend to work for their own best interests.

Because economics is dominated by psychology, we humans try to widen the Gap below us while narrowing the Gap above. “Gap Psychology” describes that desire.

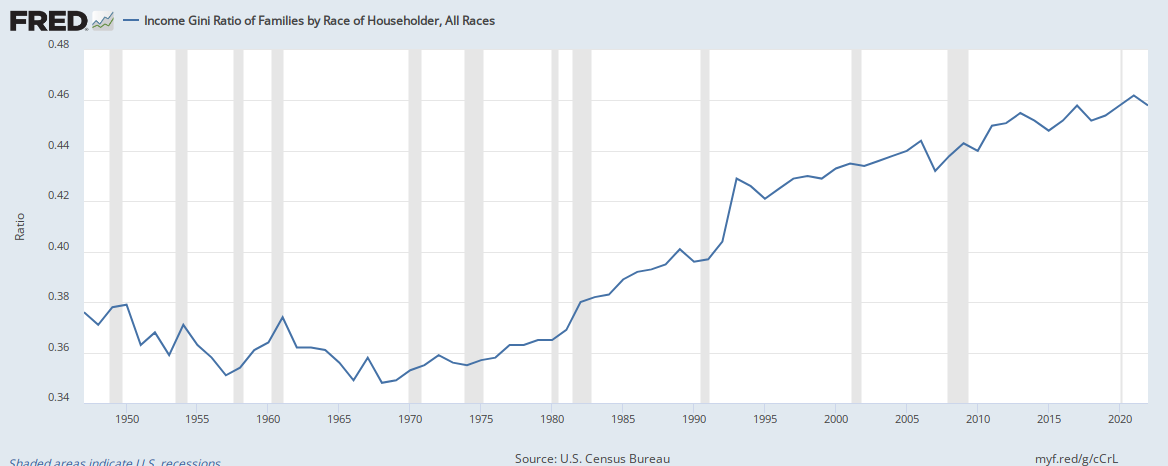

And, because power begets power — i.e. the more powerful create the rules that lead to even greater power — the Gap tends to widen over time. (The Gap reached its low during the administration of the last progressive president, Lyndon Johnson).

Income Gini Ratio for Households, All Races (A score of “0” would mean everyone has the same income. A score of “100” would mean one person has all the income)

The inborn desire to widen the Gap below is what causes men to justify lower salaries for women, and for whites to justify inferior services for blacks. The lower income/wealth/power levels are viewed by higher levels as lazy and self-destructive (“It’s their own fault”).

The middle classes, which one innocently might expect to be more tolerant and compassionate, actually tend to be less so. They lack confidence in their abilities and so, feel more threatened by those below.

Thus, the middle classes easily are influenced by the wealthiest to demean the less powerful, which is why anti-poverty programs are met with resistance by the middle classes.

A widening Gap devolves to a dictatorship, where benefits to the less fortunate are resisted, and the general populace is viewed by the rich as a cheap labor resource.

The middle classes not only accept this notion, but resist changing it. Without the compliance of the middle classes, the growing Gap and the resultant dictatorships could not exist.

Every cruel dictator in history gained his power via not just the acquiescence, but the active, self-destructive assistance of the middle classes.

America has avoided true dictatorship — often narrowly avoided — but the tendency always will remain, so always must be fought. And the fight begins with the middle demanding assistance for the bottom.

As the above graph shows, the distances among the various income/wealth/power groups have risen. The rich simply have too much compared with the rest. Our richest have become America’s version of dictators.

To prevent true dictatorship in America, the range between the richest and the poorest must be compressed. Our poorest have too little money, and much as the middle would like to blame the victims. The fault lies with those who have been taught to believe the poorer deserve their relative poverty.

Each of the Ten Steps to Prosperity is a method to prevent true dictatorship in America.

Step 3: Social Security for all.

This step proposes we give a monthly Economic Bonus (EB) to every man, woman, and child in America, regardless of any other income or wealth they may have.

You would receive the same EB as the poorest receives and as Bill Gates receives.

No need to go through the convoluted steps our gigantic tax code demands, to determine what is “income,” and what kind of income it is, and when you received it and how you received it, etc., etc.

If you live in America, you receive your monthly Social Security check.

The whole economy benefits by receiving dollars from the government, but the poorer would benefit proportionately more from this direct infusion. It’s just more dollars for the economy, and it costs no one anything — not you, not me, not even our federal government, which creates dollars, ad hoc, by paying bills.

How much should the EB be? My early thought is $2K per month for everyone above the age of 21, and $500 per month for everyone below that age.

Why not more? Or less? I wish I could give you a strong reason, but there is none. The government already has done something similar. In a weak attempt to moderate the Great Recession, the government mailed each taxpayer a check for as much as $500, depending on their tax return.

Had the government sent every person $5,000 rather than the $500 maximum per family, the recession would have ended immediately.

Starting with $2K and $500 per month allows time to evaluate results. The program could be stopped during the first year, modified, or extended indefinitely.

Perhaps sending money to the “lazy” poorer, goes against our Puritan grain and our self-image of deserving what we get. But we should move past that notion. There are many reasons people don’t have money, and unwillingness to work isn’t anywhere near the top of the list.

(Additionally, the federal government should send the money to the states; they generally spend their dollars on projects that benefit the middle and lower income groups. A downside would be that the states, which too often are run by dishonest people, might allocate the dollars to powerful friends and relatives, and the poor might never see the money.)

Poorer people spend a greater percentage of their incomes than do the richer, and those spent dollars benefit all of us as they circulate through the economy, stimulating business.

Because Gross Domestic Product = Federal Spending + Non-federal Spending + Net Exports, sending dollars into the economy, by definition, grows the economy, so long as our Monetarily Sovereign government continues to control inflation as it always has (via interest rates.)

Adding dollars to the economy, especially dollars that go to the lower income groups, will stimulate economic growth, narrow the Gaps, and help prevent dictatorships, all of which are moral and financial imperatives for a great nation.

With about 230 million adults and 100 million children living in America, the suggested program would add about $510 billion to the economy each month or about $5 trillion per year. This is only $2.3 trillion more than the federal government currently takes out of the economy, via federal taxation.

Step #3 is an easy step, a fair step, a direct step. The medicine need not be bitter to be effective.

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE SOCIAL SECURITY BENEFITS TO EVERY MAN, WOMAN AND CHILD IN AMERICA , (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE CORPORATE TAXES

Corporations themselves exist only as legalities. They don’t pay taxes or pay for anything else. They are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the government (the later having no use for those dollars).

Any tax on corporations reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all corporate taxes come around and reappear as deductions from your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Also refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and corporate taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Also, click: The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

frod

You might recall, I have come around to this way of thinking.Your EB is just a grant, but weekly is better able to be managed and it’s barely less onerous for the bureaucracy. For me it has to be a living wage equivalent for adults.

One of the issues with the MMT job guarantee is that it is becoming clear there cannot be enough jobs made available. The economy is now too automated to need every person working, but that is then a big problem if they can’t afford living costs. However the JG can still function, more benignly if already everyone has money, and not have to put up with shit jobs.

Right now the economy’s Output Gap is /[was in 2012 estimated to be $T1.8] .so that can be filled with little effect on inflation. But someone needs to do the sums.

LikeLike

Keep in mind that it’s Step #3. It presumes Steps #1 and #2 have been taken. So “living wage” takes on a different meaning.

LikeLike

Certainly helps to have no FICA and free medicare. It makes the bottom line look less expensive. They all go hand in hand.

LikeLike

I agree with nearly everything you say here, Rodger. But in the debate between which is better, an Economic Bonus (aka a Universal Basic Income Guarantee or UBI) or a Job Guarantee (JG) I would argue, why not both? Though I do agree that a JG by itself, though beneficial in the near term, will ultimately prove insufficient as automation accelerates. Also, for the Economic Bonus, just change “21” to “18” and I will agree with you 100%.

I am also glad you came around to supporting progressive taxation on the very rich, while gradually untaxing the bottom 99% by raising the standard deductions each year. Though I do think that the very large mega-corporations should also be progressively taxed as well.

The part about federal ownership of all banks I would be fine with, but it does not necessarily need to be ALL banks. At the very least, the privately-owned FERAL Reserve (which is neither federal nor does it have any reserves) needs to be nationalized into a truly public national bank that creates money interest-free, as Ellen Brown famously advocates in “Web of Debt” and “The Public Bank Solution”. And all remaining private banks going forward should be full-reserve, where only the public national bank and/or the Treasury can create money that didn’t already exist. And for “too big to fail” banks, the federal government should give them a choice: break up, or get nationalized. Then we can really have interest- and inflation-free money.

LikeLike