Not one person in a thousand can answer these questions correctly, but almost everyone thinks they know the answers. How many can you get right?

Question #1: Can the U.S. government (or the governments of Canada, Mexico, Australia, China, and the UK, etc.) run short of their own sovereign currency?

Answer: No. The U.S. government (like the abovementioned governments) is Monetarily Sovereign. It is sovereign over the dollar. It can create, destroy, and/or give dollars any value it chooses.

In the 1780s, it created the first U.S. dollars from thin air. It arbitrarily created as many dollars as it wished and gave those dollars the value it chose.

Since then, the U.S. government has created many trillions of dollars from thin air, and changed the value of those dollars several times, at will.

Even if the U.S. government were presented with an invoice for $100 trillion or $1,000 trillion today, it could instantly pay that invoice in full by creating dollars. The government can create infinite dollars at the touch of a computer key.

Former Federal Reserve Chairman Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

Question: #2. Can France, Germany, Italy, Portugal, etc., which use euros, run short of euros to pay their bills?

Answer: Yes. These nations are monetarily non-sovereign. They do not control a sovereign currency. They use the euro, which is the sovereign currency controlled by the European Union, not by any individual nation.

In this regard the euro nations resemble American states, counties, and cities, which use the dollar, controlled by the U.S. government.

Question #3, Do federal taxes — income tax, payroll tax, luxury tax, etc. help pay for federal spending?

Answer: No. U.S. tax dollars are destroyed the instant they are received by the U.S. Treasury.

When you send your tax payment to the IRS, the money comes from the M2 money supply measure. (M2 includes cash, checking deposits, and other deposits readily convertible to cash, such as CDs.)

When your payment is received by the Treasury, those dollars cease to exist in any money supply measure.

They are effectively destroyed. All federal spending is paid for by newly created dollars ad hoc.

Why?

Having the infinite ability to create dollars, the federal government does not use any income. It makes new dollars by paying bills. This is the process:

A. To pay a bill, the federal government sends instructions, not dollars, to the creditor’s bank, instructing the bank to increase the balance in the creditor’s checking account. These instructions can be a check (“Pay to the order of) or a wire.

B. When the bank does as instructed, new dollars are added to the M2 money supply measure.

C. To balance its books, the bank then clears the transaction through the Federal Reserve. In essence, one federal agency approves another agency’s check.

D. Because the federal government can issue infinite laws and instructions, it can never run short of dollars.

Every time you see or hear someone talking about federal taxpayers paying for something, know they are wrong. Federal taxpayers pay for nothing. Absolutely nothing. Think about that when you send the federal government your check.

This contrasts with state and local taxpayers whose dollars are used by their state and local governments — perhaps not always used well, but at least used — compared to federal tax dollars, which are destroyed.

Question #4. Since the federal government neither uses nor needs tax dollars to pay its bills, why does it collect taxes?

Answer: While monetarily non-sovereign entities—state/local governments, businesses, euro nations—must have income to pay their bills, the U.S. federal government needs and uses no income.

So rather than supplying spending money to the federal government, the purpose of federal taxes is:

a. To help the government control the economy by taxing what the government wishes to discourage and giving tax breaks to what the government wishes to reward.

b. To assure demand for the U.S. dollar by requiring taxes to be paid in dollars.

c. To help the rich by providing tax breaks allowing the rich to pay a lower tax percentage of their income than do middle-income Americans.

Question #5. Will Social Security and Medicare, which collect FICA taxes, soon run short of dollars?

Answer: FICA dollars, like all other federal tax dollars, are destroyed upon receipt by misnamed “trust funds.”

To quote from the Peter G. Peterson Foundation web site:

A federal trust fund is an accounting mechanism the federal government uses to track earmarked receipts (money designated for a specific purpose or program) and corresponding expenditures.

The largest and best-known trust funds finance Social Security, portions of Medicare, highways and mass transit, and pensions for government employees.

Federal trust funds bear little resemblance to private-sector counterparts; therefore, the name can be misleading.

A “trust fund” implies a secure source of funding. However, a federal trust fund is simply an accounting mechanism that tracks inflows and outflows for specific programs.

In private-sector trust funds, receipts are deposited, and assets are held and invested by trustees on behalf of the stated beneficiaries.

In federal trust funds, the federal government does not set aside the receipts or invest them in private assets.

Instead, the receipts are recorded as accounting credits in the trust funds. The federal government owns the accounts and can, by changing the law, unilaterally alter the purposes of the accounts and raise or lower collections and expenditures.

In short, a federal “trust fund” is just a record-keeping device that can publish whatever numbers the federal government wishes. It does not contain dollars, just arbitrary numbers, like all other federal bookkeeping.

The federal government can change the numbers in the Social Security and Medicare “trust funds” at will. The claims that these funds are running short of dollars are false, designed to deceive,

Question #6: Since the Social Security and Medicare trust funds are not real trust funds and do not contain dollars, what is their purpose:

President Roosevelt, the founder of Social Security, is reported to have insisted on collecting payroll taxes because it would give recipients “a legal, moral, and political right to collect their pensions and their unemployment benefits. With those [payroll] taxes in there, no damn politician can ever scrap my social security program.”

Roosevelt was wrong. The existence of FICA and trust funds set a false limit on what could be paid out.

Hardly a day passes without someone claiming that the Social Security and Medicare trust funds are running out of money, so taxes would need to be raised or benefits reduced.

It is false. The federal government never needs to cut benefits, never needs to raise taxes, and never needs to tax at all. It already has infinite dollars.

FICA does not fund anything. Like all federal tax dollars, FICA dollars are destroyed upon receipt.

Because the government has infinite dollars, no federal agencies — Social Security, Medicare et al, — can run out of money unless Congress and the President want it.

Question #7. If FICA and all other federal taxes do not fund anything and, in fact, limit benefits, why continue to collect them?

Answer: The reason is devious. The very rich control American thought by bribing thought leaders. They bribe politicians via campaign contributions and promises of lucrative employment.

They bribe the media writers via advertising dollars and media ownership. They bribe the economists via university endowments and jobs in “think tanks.”

The purpose of the bribes is to make the rich richer. “Rich” is a comparative term. A man with a thousand dollars is rich if everyone else has only a hundred, but that same man is poor if everyone else has ten thousand.

Thus, the ways to become richer are to obtain more for oneself or force everyone else to have less.

At the behest of the rich, the media, politicians, and economists convince the voters that they need to pay more taxes and/or receive lower Social Security and Medicare benefits.

The thought leaders make the rich richer by making the people agree to become poorer.

Question 8. Is the federal debt a burden on the federal government?

Answer. No. The so-called “federal debt” isn’t even a debt, and it isn’t federal. It’s the total of deposits into Treasury Security accounts, the contents of which are wholly owned by the depositors, not by the federal government.

The federal government never touches those dollars except to return them, with low interest, to the owners, i.e., the depositors, upon maturity. The government merely holds the dollars in safekeeping, much like banks hold the contents of safe deposit boxes. They, too, are not a burden on the holder.

Question 9. Do federal taxpayers owe the federal debt?

Answer: Again, no one owes the misnamed federal “debt.” No taxpayer dollar is used to pay off the federal “debt.” The so-called “debt” is paid off by returning existing dollars to their owners, the depositors in Treasury Security accounts.

Question 10. Is the federal debt too high?

Answer. No. In addition to being total deposits into T-security accounts, the federal debt is the difference between federal taxes collected and federal spending, i.e., the total of federal deficit spending.

Federal deficit spending adds growth dollars to the economy. When federal deficit spending declines, we have recessions, which are cured by increased deficit spending.

Even worse for the economy are federal surpluses when federal taxes exceed federal spending.

By definition, a large economy has a larger money supply than a small economy. Therefore, a growing economy requires an increasing supply of money. QED

But federal surpluses remove dollars from the economy, so federal surpluses tend to cause recessions and depressions.

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Question 11: Is the Federal Debt/GDP ratio too high?

Answer: No, it is irrelevant.

Quoting that ratio makes two false assumptions: That “federal debt” actually is a debt of the federal government (It isn’t. See Question 10) and that, in some mysterious way, GDP funds federal “debt” repayment (It doesn’t.)

The oft-quoted Federal Debt/GDP ratio is the ultimate apples/zebras comparison. Totally meaningless.

Here are a few things the Federal Debt/GDP ratio does not indicate with regard to a Monetarily Sovereign nation:

A. It does not indicate the federal government’s ability to pay its obligations.

B. It does not indicate the likelihood of inflation, recession, depression, or stagflation.

C. It does not indicate the current or future health of an economy

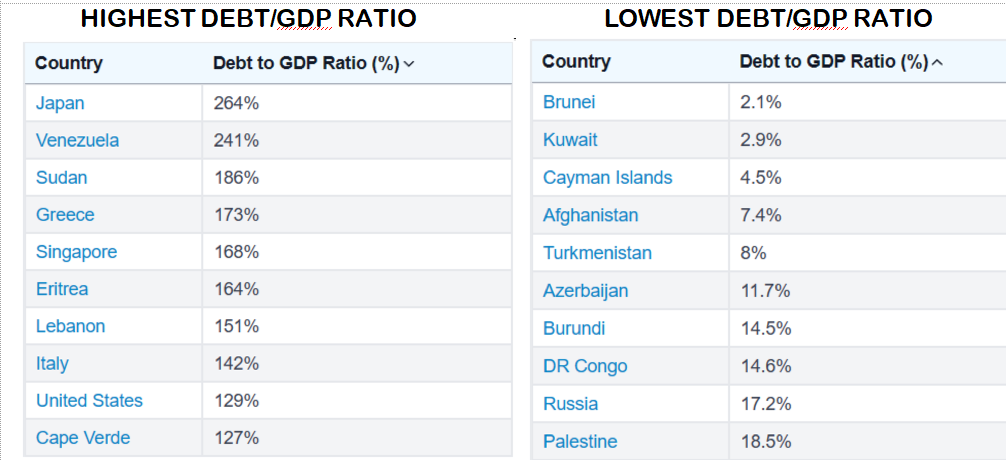

Here are the ten nations with the highest and the lowest Debt/GDP ratios.

For a Monetarily Sovereign nation, having a high or a low Federal Debt/GDP tells you nothing about the past, present, or future unless you would rather own Burundi bonds than U.S. bonds.

Question 12. Does the U.S. government borrow U.S. dollars?

Answer: No. As a Monetarily Sovereign government, the U.S. government has the infinite ability to create dollars from thin air. It does not need to borrow dollars.

U.S. Treasury bonds, notes, and bills do not represent borrowing. They merely confirm deposits into Treasury accounts.

The words “bond,” “note,” “bill,” and “debt” have one set of meanings when applied to monetarily non-sovereign entities like cities, counties, states, businesses, you and me.

The words have totally different meanings when applied to our Monetarily Sovereign government.

For example, a Treasury “bond” is just evidence of a deposit into a T-security account, not a loan to the federal government.

Question 13. If the U.S. government does not borrow dollars, what is the purpose of Treasury Securities?

Answer: To provide dollar users with a safe, interest-paying place to store unused dollars. This helps stabilize and ensure demand for the U.S. dollar. They also help the Fed control interest rates.

Some people worry about China owning T-securities and the possibility of them not “lending to us” anymore. The U.S. does not need to accept deposits from China or anyone.

Even if the entire world suddenly stopped investing in T-securities, the U.S. could continue spending and paying its obligations as always.

Question 14. Does “excessive” federal spending cause inflation?

Answer: No. Prices rise when demand exceeds supply. So, the false theory is that by increasing the money supply, federal spending causes everyone to demand too much. But the reality is quite different.

Inflation is a general increase in prices. Federal spending may cause specific increases in the demand for certain products, but seldom can cause a general increase in demand or a decrease in supply.

Instead, all inflations are caused by shortages of products that have a widespread effect on prices — most notably, oil and food.

Even during wartime, when federal spending increases, inflation is caused by shortages of crucial goods and services, especially oil, food, and labor.

If federal deficit spending doesn’t cause inflation, what does?

In the past 60+ years, oil supplies have been the most reliable predictor of inflation. When oil is scarce, oil prices and inflation rise. When oil is plentiful, oil prices and inflation fall.

Increased federal spending to decrease oil scarcity (increasing total supply or rewarding alternative energy sources) cures inflation.

Question 14. Does raising interest rates prevent and cure inflations?

Answer: No. Despite what various Federal Reserve chairmen, the media, politicians, and economists have said, raising interest rates is a misguided way to fight inflation. It’s like applying leeches to cure anemia.

When interest rates rise, the price of everything bought on time rises. This includes homes, cars, large appliances, land, and other property.

For example, a $500,000, 30-year, 3% mortgage costs, in total, $632,409. The same 30-year mortgage raised to 6% costs $899,325. Does that sound like inflation-fighting?

Increased interest rates not only affect consumers directly but businesses, most of which borrow to finance their purchases. Those inflated costs are passed on to consumers.

The Fed chairmen speak of “cooling” an “overheated” economy. What they really mean, but are reluctant to say, is that they want to cut economic growth to prevent inflation. In short, they want to come as close to a recession as possible without technically causing one.

They ignore the fact that recession is not the opposite of inflation as witnessed by “stagflation,” the simultaneous plagues of economic stagnation and inflation.

The most recent recession and inflation were caused by COVID-related shortages of oil, food, steel, lumber, computer chips, shipping, labor, etc.

The cure for those shortages was not to cut economic growth or raise interest rates but to reduce the shortages via federal spending to obtain and make available the scarce items.

The massive federal spending of the last three years helped cure the shortages and thus helped cure inflation. The interest rate increases exacerbated the inflation by raising the prices of everything.

Question 15. Why does the Fed raise rates to fight inflation if that doesn’t work?

Answer: If your only tool is a hammer, you will view every problem as a nail. The Fed’s primary, most accessible tool is interest rates, which it can raise or lower by fiat.

Congress mistakenly has given the Fed the assignment to prevent/cure inflations, so the Fed uses the tool it has.

But it is Congress that has the obligation to prevent and cure inflation. It has the financial power to obtain and distribute whatever scarce items are causing inflation.

Most inflations are caused by oil shortages, so Congress and the President can spend to facilitate drilling, refining, and distribution, and/or to give consumers and businesses tax credits for gas and oil purchases. Those steps would reduce inflation.

Another example: Eliminate the FICA tax. That would reduce business costs directly and also allow businesses to pay lower wages without cutting employees’ income. Eliminating FICA would cut inflation.

Question 16. Does providing federal benefits make people lazy?

Answer: Social Security and Medicare are the biggest benefits of the federal government. Before 1965, there was no Medicare, and before 1935, there was no Social Security. Now we have both.

Have Social Security and Medicare made people lazy?

The “lazy” notion seems only to be applied to the poor, especially by conservatives. The rich receive substantial tax breaks (officially known as “tax expenditures”) and have, on average, less strenuous jobs than the poor, but somehow those are felt to be “earned.”

While SNAP (food stamps) and other poverty aids often are sneered at, tax expenditures for the rich don’t receive the same negative treatment:

Here are eight of the most expensive tax breaks for individuals and corporations; together, they accounted for more than two-thirds of the total annual cost of tax expenditures in 2023:

*Exclusion of pension contributions and earnings and individual retirement arrangements ($369 billion). Contributions to pension or retirement plans — such as to 401(k)s and IRAs — are not taxed as income when received but taxed in the future when the employee withdraws the funds.

*Exclusions and reductions on dividends and long-term capital gains ($311 billion). Income from capital gains (the profit from the sale of a property or investment) and qualified dividends (generally from shares in domestic corporations that have been held for a specified period) are taxed at a lower rate than other forms of income. Defenders argue that such preferential rates encourage investment and risk-taking that spur economic growth, but critics note that they disproportionately benefit the wealthy and promote tax avoidance.

*Exclusion of employer contributions for medical insurance and care ($202 billion). Employers’ premiums for their employees’ healthcare are exempt from federal income and payroll taxes. While this tax break benefits a wide swath of Americans by reducing the after-tax cost of health insurance, it is worth more to taxpayers in higher tax brackets than those in lower brackets.

*Child Tax Credit ($122 billion). This tax credit is designed to make raising children more affordable by easing the financial burden faced by families. A portion of the credit is refundable, which means that if the total value of the credit is more than a family’s total tax liability, the Internal Revenue Service returns part of the difference as a tax refund. Research has shown that the child tax credit has a significant impact on low-income families.

*Subsidies for insurance purchased through health benefit exchanges ($80 billion). U.S. corporate shareholders are eligible for a credit for foreign income taxes paid.

*Earned Income Tax Credit ($71 billion). This tax credit is primarily available to low-income working parents, and the credit is refundable. Research shows that the Earned Income Tax Credit encourages people to work and that recipients use the credit to cover essential costs.

*Exclusion of capital gains at death ($58 billion). Unrealized capital gains on assets held at the owner’s death are not subject to income tax.

*20-percent deduction for qualified business income ($56 billion). This tax credit deduction allows eligible self-employed and small-business owners to deduct up to 20 percent of their qualified business income on their taxes.

No one wants to be poor. Most people – rich and poor – want to earn more money than they have. Very few people are satisfied to linger in poverty if they can work.

For the 2023 tax year, the maximum Earned Income Tax Credit amounts were:

Number of children Maximum earned income tax credit

0 $ 600

1 $3,995

2 $6,604

3 or more $7,430

If you had 3 or more children, would a payment of $7,430 be enough to discourage you from working the next twelve months? Far too many claim that this paltry sum is enough to discourage work.

Question 17. Is there a benefit to federal frugality? Or asked another way, does wasteful federal spending cost taxpayers money?

Answer: It depends. We have seen that federal taxes do not fund federal spending. So, all federal spending, even wasteful spending, is free to taxpayers and by adding dollars to the economy, stimulates economic growth.

But the reality is that many people, not just the rich, deplore spending that benefits the poor.

There is resentment that some of “us” work hard for money while “they” receive money for not working.

Not as widely understood is the fact that supporting the poor benefits all of us, even we who are wealthy.

Obviously, giving money to the poor makes them better customers, so businesses owned by the middle and the rich profit.

But beyond that, there is the question of crime. Poverty is the mother of crime. —Marcus Aurelius (121-180AD), Emperor of the Roman Empire.

Crime exerts a massive cost on everyone.

In a 2002 study by World Bank economists Pablo Fajnzylber, Daniel Lederman, and Norman Loayza, it was found out that crime rates and inequality are positively correlated within countries and also between countries.

The correlation is a causation – inequality induces crime rates.

This finding is parallel with the theory on crime by American economist Gary Becker, who pronounces that an increase in income inequality has a big and robust effect of increasing crime rates.

Not only that, but a country’s economic growth (GDP rate) has significant impact in lessening incidence of crimes.

Since reduction in income inequality gap and a richer economy has an alleviating effect on poverty level, it implies that poverty alleviation has a crime-reducing effect.

Intuitively, it makes sense. So-called “bad neighborhoods” have lower incomes and more crime, at least more street crime.

Criminality has many causes; an important one is cultural factors and the effect of grievances. Some groups tend to have more criminality, regardless of income.

Yet one thing is clear, violent criminality goes down for all groups when financial inequality is reduced.

Movement up the social ladder to the middle class is associated with sharp declines in violent crime. When a poor man has a grievance, he may reach for a gun. A richer man calls his lawyer.

If you fear crime — who doesn’t — helping to lift the poor is as important as funding the police. The former approach addresses the causes of crime, while the other focuses on punishment.

Federal spending on benefits for the poor and middle classes, costs taxpayers nothing. The federal government creates the dollars from thin air.

But the spending itself grows the economy and the aid to the poor reduces crime, and benefits all potential victims.

IN SUMMARY

Unlike local governments, businesses, euro nations, you and me, the federal government is Monetarily Sovereign. Its agencies (like Medicare, Social Security, the White House, Congress, SCOTUS, et al), cannot run short of dollars, unless that is what Congress and the President want.

The federal government has infinite dollars. Even if all federal tax collections ended, the federal government could continue spending forever.

Federal tax dollars fund nothing They are destroyed upon receipt.

Federal deficit spending costs federal taxpayers nothing and does not cause inflation but has many benefits to the populace.

It can reduce crime, hunger, homelessness, and inequality, while improving healthcare, education, scientific advances, and the overall wellbeing of the populace.

Far from being a problem, federal deficits and so-called “debt” are necessary for economic growth. GDP=Federal + Nonfederal Spending + Net Exports.

Raising interest rates raises prices. Price increases are not a method for reducing inflation, which is a general increase in prices.

You now know more about America’s finances than most of your friends, relatives, media writers, politicians, and even economists. When it comes to government finances, you now might be the smartest one in the room.

Save this post as your reference.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

“…can publish whatever numbers the federal government wishes…”

Who exactly is the person or position title representing the “federal government?”

LikeLike

Congress and the President.

LikeLike

What I do not understand, if the USA was always monetarily sovereign (ms), why did they say there was a Gold Standard? I live in Canada, where we were told the value of the Canadian Dollar depended on the Gold Standard till sometime in the 1970s. What does it depend on now? Why aren’t the Csnadian Dollar and the US Dollar at par if both countries are ms?

I more or less understand ms now, thanks to you, but the way our govrrnments represent it to their cit8zens is confusing, and I am tempted to say downright criminal!

All this tax bullshit is nothing but smoke and mirrors. Why do they even bother?

LikeLike

Monetary Sovereignty is a tool, not a condition. It depends on the government to use it properly.

If you have a hammer, nothing forces you to use that hammer to drive a nail. You might choose instead to use a rock, the handle of a screwdriver, or even the heel of a shoe to drive that nail. Your choice.

Foolish, but there it is.

Similarly, a government may choose not to use its Monetary Sovereignty. It could limit its money creation by tying an arbitrary number of dollars to an arbitrary amount of gold, silver, aluminum, or even water, etc.

Foolish, but there it is.

The fact that you are forced to pay hundreds, thousands, or even millions in taxes to your Monetarily Sovereign government is indeed criminal, but until people understand the facts and elect someone who will tell the truth, they will be cheated.

Ignorance is costly.

The value of the Canadian dollar is determined chiefly by the Canadian government, which can say, “Heretofore, the Canadian dollar will be worth 1.1 U.S. dollars. The government will exchange those currencies at that rate.”

Instead of being on a gold standard, you would be on a U.S. dollar standard.

Your government, being Monetarily Sovereign, can do any damn thing it wishes with the Canadian dollar — create as many as it wishes, trade them for any purpose. The confusion you mentioned is intentional so that people will not realize they are being screwed.

LikeLike

That’s about what I expected you to say, because that’s what I’m getting out of reading your blog. The rich get richer, the poor get poorer, and un less we speak up and cause a furor, nothing will change.

LikeLike

Thanks, rawgod.” If I say what’s expected, then I’ve communicated.

LikeLike

You have one success, st least. A number of friends I tried to turn on to your site are having none of it. They trust their government.

LikeLike

Welcome to my world for the past 25+ years.

They don’t trust the government. That’s just a convenient excuse for: “I can’t believe that everything I’ve been told my whole life is wrong. No matter how much evidence you have, I stopped learning years ago, and don’t intend to start now.”

LikeLike

Rodger is right, of course, but it should be added that while there is no limit to the amount of money a sovereign government can issue, there are human (labor) and natural resource limits. The fear from the earliest days of money creation is that the sovereign will print more money than there are good or labor to produce things. This goes way back before there were “virtual” goods, computers, etc., but even that takes labor to create.

So, since gold is finite, the thinking going back 1,000s of years is that if you base money on gold, it will constrain the worst impulses of governments to create too much money, i.e. inflation.

It doesn’t actually work. As Rodger has shown in numerous articles, there were more booms and busts in the gold standard days than there are now. Credit bubbles are not constrained by gold-backed currency. And restricting the currency like that just takes away a major tool to deal with deflation or depressions.

There’s a reason FDR took America off the domestic gold standard and Nixon off the international version (in the latter case, America didn’t have enough gold when European powers started demanding gold instead of inflated dollars. Sorry, folks, no gold for you!). We’ve had the petrodollar since the 1970s, thanks to Kissenger’s deal with OPEC, especially the Saudis: they would get to charge whatever they want for their oil and in return, they’d have to price it in dollars and also spend those dollars to buy defense weapons from the U.S., paying in dollars.

It’s worked pretty well until lately, when so many sanctions on countries America does, or used to do, business with, forced them to seek alternatives to the dollar. It will be interesting to see what happens to the dollar when it’s no longer the world’s reserve currency, thanks the the BRICS+ nations – up to 30+ now – creating a currency basket alternative.

I wonder how sovereignty will stand up internationally. Will OPEC sell us oil at the old rate, or will it find a better price in other currencies to be created?

LikeLike

A “reserve currency” is just a currency banks keep in reserve to facilitate international trade. Though the U.S. dollar is the most popular reserve currency worldwide, it is not the only one.

Depending on geography, other reserve currencies are, the British pound, the Chinese yuan, the euro, Japanese yen, even the Turkish lira, etc. Although none of them are THE reserve currency, those other reserve currencies do just fine for their international trade.

And then, there’s bitcoin., which could overtake everything, one future day.

LikeLike

You’re on board with bitcoin as a legit currency?

LikeLike

I’m not sure what you mean by “legit.” Please explain.

Bitcoin is a currency. I don’t know whether it will grow, shrink, or disappear.

The appeal of Bitcoin is its secrecy, but I suspect that will end either via law or some fundamental weakness. So far, Bitcoin is more a speculative investment than an exchange currency.

If Bitcoin grows, there is no doubt that the U.S. federal government will take control of it. Allowing a dollar-competing, privately controlled currency is not smart economics for America.

LikeLike

I lean towards the view that, in our fiat system, you cannot divorce the issuance of currency from the state; that only the national gov’t is the legitimate issuer, not a privately generated crypto mining anonymous entity.

All forms of crypto are, imo, cannot become a medium of exchange at scale nor as a store of value because of its high volatility.

LikeLike

Agreed.

LikeLike

This is bullshit. The federal government has infinite money. It could fund Social Security, forever. No FICA needed: “Biden Says He’ll Make the Wealthy Pay More To Fix Social Security. Here’s Why That Won’t Work.”

LikeLike

Insolvency? Geez, who else? None other than Eric Boehm, resident Reason,CON (yes, con) clown.

LikeLike

Indeed, we can easily have a better than Nordic-style welfare state with less than Florida taxes. The only thing that stands in the way is Congress, and their greedy oligarch masters.

LikeLike