We’ll begin with a few facts:

- The U.S. federal government is Monetarily Sovereign (See: Monetary Sovereignty.) It created the first U.S. dollars from thin air, and it retains the unlimited ability to create more U.S. dollars. The government never unintentionally can run short of U.S. dollars. Even if all federal tax collections ended, the federal government could continue spending forever.

- State and local governments are monetarily non-sovereign. They can and often do run short of dollars.

- Because the U.S. government cannot run short of dollars, it has no need for tax dollars. In fact, it destroys all tax dollars upon receipt at the Treasury. (See: “Does the Federal Government Really Destroy Your Tax Dollars?“) Taxes are paid with dollars from the M2 money supply, and when they reach the Treasury, they cease to exist in any money supply measure. Thus, the federal government does not spend taxpayers’ dollars.

- By contrast, state/local governments do need and spend taxpayers’ dollars.

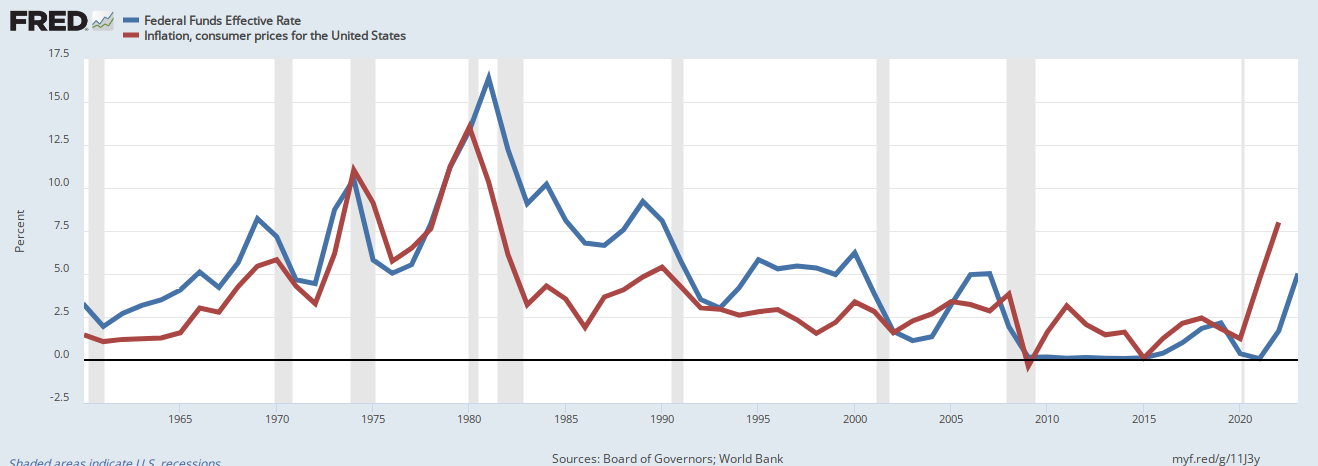

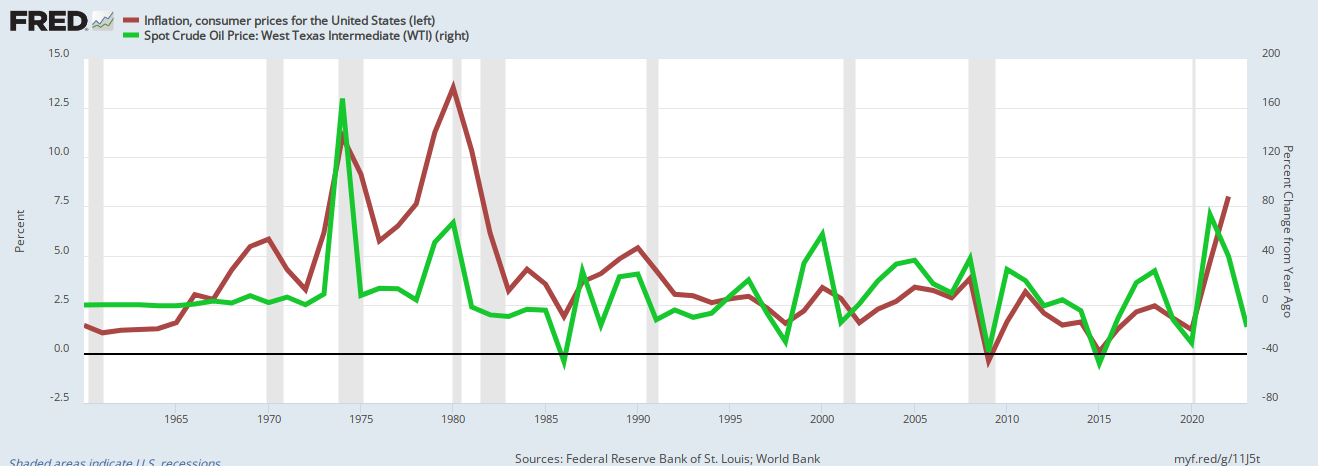

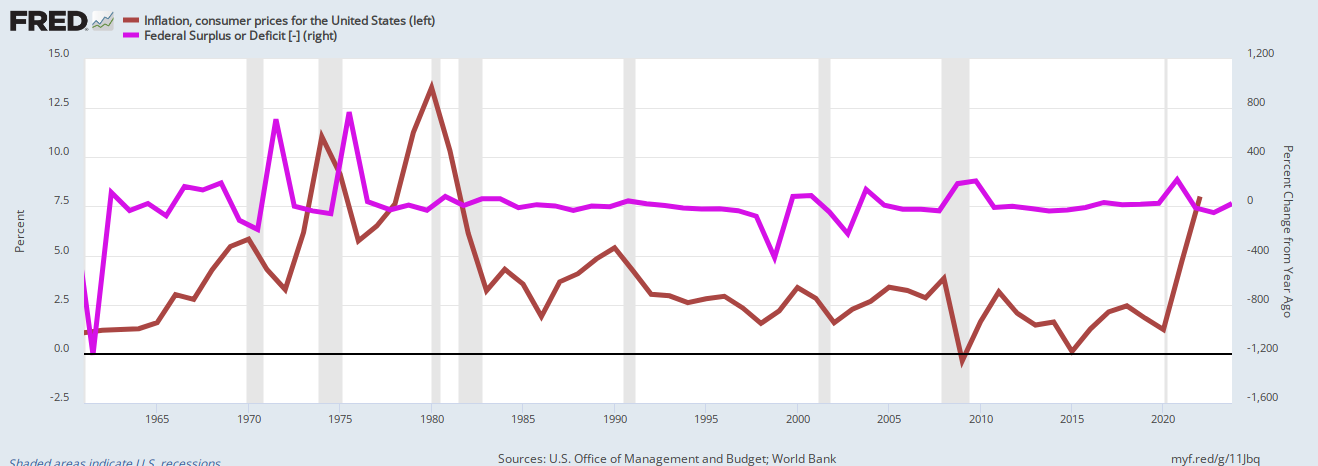

- Contrary to popular wisdom, federal spending does not cause inflation. Inflation always is caused by shortages of critical goods and services, usually oil, food, and labor. (See: “Cause of Inflation.”) Inflations can be cured by additional government spending to cure shortages.

- Federal deficit spending is necessary for economic growth. The greater the spending, the greater the growth. (See: “Four Reasons Why Federal Deficits Are Absolutely Necessary.“)

Keep those facts in mind as you read excerpts from the following article:

The Commonwealth Fund Health Care Affordability Survey, fielded for the first time in 2023, asked U.S. adults with health insurance, and those without, about their ability to afford their health care — whether costs prevented them from getting care, whether provider bills left them with medical debt, and how these problems affected their lives.

Many Americans have inadequate coverage that’s led to delayed or forgone care, significant medical debt, and worsening health problems.

While having health insurance is always better than not having it, the survey findings challenge the implicit assumption that health insurance in the United States buys affordable access to care.

Difficulties affording care are experienced by people in employer, marketplace, and individual market plans, as well as people enrolled in Medicaid and Medicare.

Private insurance is burdened by the profit motive, which restricts the number and amount of benefits offered. However the federal government has no profit motive and has the unlimited ability to create dollars. So why is Medicare inadequate?

For the survey, our analysis focuses on 6,121 working-age respondents, those 19 to 64.

Survey Highlights

-

-

Large shares of insured working-age adults surveyed said it was very or somewhat difficult to afford their health care: 43 percent of those with employer coverage, 57 percent with marketplace or individual-market plans, 45 percent with Medicaid, and 51 percent with Medicare.

-

Many insured adults said they or a family member had delayed or skipped needed health care or prescription drugs because they couldn’t afford it in the past 12 months: 29 percent of those with employer coverage, 37 percent covered by marketplace or individual-market plans, 39 percent enrolled in Medicaid, and 42 percent with Medicare.

-

Cost-driven delays in getting care or missed care made people sicker. Fifty-four percent of people with employer coverage who reported delaying or forgoing care because of costs said a health problem of theirs or a family member got worse because of it, as did 61 percent in marketplace or individual-market plans, 60 percent with Medicaid, and 63 percent with Medicare.

-

Insurance coverage didn’t prevent people from incurring medical debt.Thirty percent of adults with employer coverage were paying off debt from medical or dental care, as were 33 percent of those in marketplace or individual-market plans, 21 percent with Medicaid, and 33 percent with Medicare.

-

Medical debt leads many people to delay or avoid getting care or filling prescriptions: more than one-third (34%) of people with medical debt are in employer plans, 39 percent in the marketplace or individual-market plans, 31 percent in Medicaid, and 32 percent in Medicare.

-

Healthcare insurance, whether private or government-funded, is inadequate. Given the fact that the federal government has infinite dollars, why are so many Americans suffering with too-costly-but-inadequate insurance?

Medicare, for instance, is far less than comprehensive. Why does Medicare have Part A, Part B, Part C, and Part D, each with different options and costs? Why not simply a Medicare that covers everything for everyone at no cost?

Why, if the federal government has infinite money, are these expenses not covered, and why are there deductibles and added costs to complete coverages?

You have been told, falsely, that the federal government is like state/local governments, business, you and me, in being monetarily non-sovereign. You have been told falsely, that the federal government spends taxpayers’ dollars and can run short of dollars.

You have been told, falsely, that to provide benefits, the federal government must levy taxes and spend taxpayers’ money.

It’s all a lie.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: “It’s not tax money… We simply use the computer to mark up the size of the account. The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

The U.S. government is not the only Monetarily Sovereign entity. For example:

Press Conference: Mario Draghi, President of the ECB, 9 January 2014

Question: I am wondering: can the ECB ever run out of money?

Mario Draghi: Technically, no. We cannot run out of money.

Given its infinite money supply, why does the federal government not provide free, comprehensive, no-deductible insurance to every man, woman, and child in America? Why must you, as an American, risk bankruptcy, sickness, and death because your insurance is inadequate?

What is the Big Lie? The Big Lie is the claim that federal taxes fund federal spending. To pay its bills, the federal government creates new dollars ad hoc by tapping computer keys. Whenever you read an article claiming the federal government is “spending taxpayers’ dollars; it is a lie.

State and local governments spend taxpayers’ dollars; the federal government does not.

Why are you being lied to, and where are the lies coming from?

The lies are coming from the healthcare insurance industry, the media, the economists, and the politicians.

It’s easy to understand why the insurance industry lies about the federal government’s not funding healthcare insurance: The profit motive. The insurance industry does not want to lose the huge profits in selling healthcare coverage.

But why do the media, economists, and politicians lie?

Because they are bribed.

The media are bribed by advertising dollars and by ownership. The economists are bribed by university contributions and by promises of lucrative jobs in “think tanks.” The politicians are bribed by campaign contributions and by promises of lucrative jobs with industry.

Who is doing the bribing? The very rich?

Why are the rich bribing? Gap psychology says people grow richer and more powerful by widening the Gap between them and those below them in any income/wealth/power measure. That is the primary way the rich make themselves more affluent.

How do the rich widen the Gap below them? They get more for themselves, but importantly, they make sure those below them get less. They use their influence to reduce the federal benefits paid to those less wealthy.

The rich disseminate the lie that Medicare and Social Security are running short of dollars, so benefits must be reduced, and taxes must be increased (See: “Starve the Poor.”)

What should be done?

First, the useless, harmful FICA tax should be eliminated. Like all federal taxes, it funds nothing. Worse, it punishes the low-income worker and widens the Gap between the rich and the rest.

Second, the federal government should pay for free, comprehensive Medicare for All, with no limits and no deductions. One free plan for everyone; no Part A, B, C, D. No Medicaid. No “Donut holes.” No Medicare Advantage plans.

The public must learn that federal spending is beneficial, and it costs nothing. The more the federal government spends on healthcare, the more the overall economy will grow and prosper.

Ignorance is the weapon used by the rich to dominate the rest. That is the reason medical services are unaffordable for so many Americans.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY