Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Alan Greenspan: “Central banks can issue currency, a non-interest-bearing claim on the government, effectively without limit. A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e.,unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.

—————————————————————————————————————

Reader Koen Hoefgeest kindly called my attention to this article: The myth of monetary sovereignty

By Frances Coppola – November 02, 2018

Here are some excerpts from an article that “proves” Monetary Sovereignty (MS) is a myth:

How many countries can really claim to have full monetary sovereignty?

The simplistic answer is “any country which issues its own currency, has free movement of capital and a floating exchange rate.”

I have seen this trotted out MANY times, particularly by non-economists of the MMT persuasion. It is, unfortunately, wrong.

“Trotted out” is a pejorative, that immediately displays a supercilious contempt for the many economists who each day provide ample proof of Monetary Sovereignty’s existence.

In any event (spoiler alert), at no time will Ms. Coppola prove the above-mentioned “simplistic answer” is wrong.

Instead, she will attack another “more complex” definition, from a “prominent MMT economist.”

This is a more complex definition from a prominent MMT economist:

1. Issues its own currency exclusively

2. Requires all taxes and related obligations to be extinguished in that currency

3. Can purchase anything that is for sale in that currency at any time it chooses, without financial constraints. That includes all idle labour

4. Its central bank sets the interest rate

5. The currency floats

6. The Government does not borrow in any currency other than its own.This appears solid. But in fact, it too is wrong.

The big hole in this is the external borrowing constraint – item 6 in the list. If a government genuinely could purchase everything the country needed in its own currency, then it would indeed be monetarily sovereign.

But no country is self-sufficient. All countries need imports. So item 3 on the list is a red herring.

Hmmm . . . The “big hole” is #6, but #3 is a “red herring”?

Actually, #6 is not a requirement for Monetary Sovereignty, partly because MS nations do not borrow their own currency. They have no need to, because they have the unlimited ability to create their own currency.

(See the Bernanke, Greenspan, Federal Reserve comments above.

And #3, the “without financial constraint” definition, is absolutely, 100% correct. An MS nation cannot unintentionally run short of its own sovereign currency.

A government may be able to buy anything that is for sale in its own currency, but that doesn’t include oil, or gas, or raw materials for industrial production, or basic foodstuffs.

To buy those, you need US dollars. Indeed, these days, you need dollars for most imports. Most global trade is conducted in US dollars.

Here, Ms. Coppola displays ignorance of foreign exchange, which is the device all nations use for imports.

Even the mighty U.S. cannot purchase all its goods and services using U.S. dollars. It exchanges its sovereign currency for the exporting nation’s currency.

Perhaps this would be clearer to her if #3 read, “Can purchase anything that is for sale in exchange for its sovereign currency at any time it chooses, without financial constraints.”

The only country in the world that can always buy everything the country needs in its own currency, and therefore never needs to borrow in another currency, is the United States, because it is the sole issuer of the US dollar.

Completely wrong. Again she ignores the FX issue. Perhaps she never has traveled abroad, but what is the first thing many Americans do, when landing on foreign soil? Right. They exchange their dollars for the local currency.

Contrary to popular opinion, the United States government does not borrow, not dollars and not any other currency.

What erroneously is termed “borrowing,” actually is the acceptance of deposits into T-security accounts. The purpose of these accounts is not to provide the federal government with the dollars it can produce at essentially no cost (See Bernanke, above), but rather to:

- Provide a safe depository for dollars, which stabilizes the dollar, and

- Assist the Fed’s interest rate control, which helps it control inflation

The dollars deposited into those T-security accounts remain there — they are not used by the federal government — until the accounts mature, at which time the dollars are returned to the account owners.

Having the unlimited ability to create dollars, the U.S. has no need to borrow. It creates dollars ad hoc, by paying creditors.

The dollar creation system is this:

- In paying creditors, each federal agency sends instructions (not dollars) to each creditor’s bank, instructing the bank to increase the balance in the creditor’s checking account. The instructions can be in the form of a check or wire (“Pay to the order of . . .”)

- At the instant the bank obeys those instructions, and not before, brand new dollars are created and added to the nation’s M1 money supply.

- The instructions then are cleared through the Fed.

This, by the way, is identical with how you pay your bills. You send instructions (checks) to creditors’ banks, and at the moment the bank obeys your instructions, new dollars are created.

Then, when your check clears, your bank deducts them from your checking account, and M1 dollars are destroyed.

The difference is the no dollars are destroyed when the Fed clears federal government checks, which is why federal paying of bills creates net dollars.

However, the dark side of this is that the US is obliged to run wide current account and fiscal deficits, because global demand for the dollar far exceeds US production.

When it attempts to close these deficits, global trade and investment shrinks, causing market crashes and triggering recessions around the world.

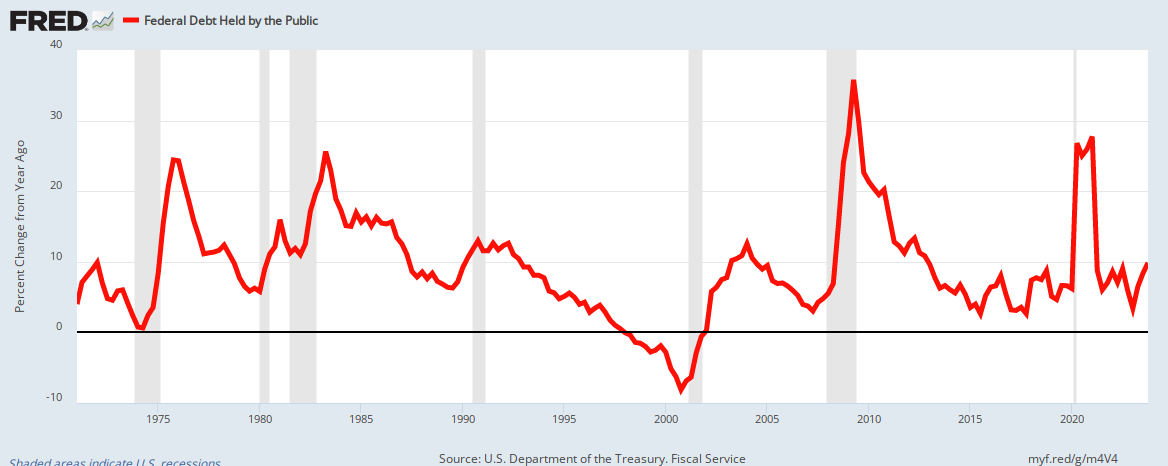

Sometimes, there is even a recession in the US itself. The US’s last attempt to run a fiscal surplus ended in the 2001 market crash and recession:

Not understanding the differences between federal financing and personal financing, Ms. Coppola believes the U.S. federal government needs to “close those deficits.”

But why would a nation, having the unlimited ability to create dollars, need to “close deficits”? What is wrong with deficits? America’s deficits already have accumulated to $15 Trillion in debt, and despite hand-wringing from debt hawks, the U.S. economy has not suffered.

For individuals and others in the private sector, deficits and debt are burdens. For the U.S. government, they are no burden on the government or on taxpayers.

As stated, that thing erroneously termed U.S. “debt,” actually is the total of deposits into T-security accounts, somewhat similar to bank savings accounts.

To pay off the so-called “debt,” the federal government merely returns the dollars in those accounts. It does this every day. No tax dollars are involved in paying off U.S. “debt” (deposits).

MMT adherents like to cite this as evidence that eliminating the government deficit in any country will result in a recession. But this is stretching things considerably.

FRED shows us that even in the U.S., only one recession in the last century has been preceded by a government surplus.

Ms. Coppola is confused again, this time between reducing deficits (while still increasing debt) and reducing debt (i.e running surpluses).

Here is what happens when the federal government runs a surplus:

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

While reducing federal debt tends to cause depressions, reducing deficit growth tends to cause recessions.

Reduced deficit growth leads to recessions (vertical gray bars), while increased deficit growth cures recessions.

Reduced deficit growth leads to recessions (vertical gray bars), while increased deficit growth cures recessions.

The reason is rather simple. An economy either grows or shrinks. A growing economy requires a growing supply of money.

By definition: GDP = Federal Spending + Non-federal Spending + Net Exports. Thus, a growing GDP involves a growing money supply.

Federal deficit spending grows the money supply, which increases both Federal Spending and Non-federal Spending, thus increasing GDP.

Of course, many developed countries do in practice pay for imports in their own currencies. Governments, banks and corporations meet dollar funding requirements by borrowing in their own currency and swapping into dollars in the financial markets.

This diminishes the need for dollar-denominated borrowing, either by government or the private sector. These countries therefore have a considerable degree of monetary sovereignty. But it is not absolute as it is in the United States.

Whether or not nations pay for imports in their own currencies is irrelevant to the question of Monetary Sovereignty. Of real importance is whether they have their own currencies, which they produce at will.

The euro nations do not. Cities, counties, and states do not. Businesses do not. You, and I, and Ms. Coppela do not. We all are monetarily non-sovereign.

We monetarily non-sovereign entities can run short of currency. Monetarily Sovereign entities cannot.

Sadly, Ms. Coppola does not seem to understand this fundamental difference.

It crucially depends on the stability of their currencies and the creditworthiness of their borrowers, both of which are a matter of market confidence.

For most countries, the need for external borrowing crucially depends on the external balance. If the current account is balanced or in surplus, then they will earn the dollars they need to pay for essential imports. But any country that runs a current account deficit inevitably borrows dollars.

Wrong. A Monetarily Sovereign nation creates its own currency, which if it chooses, it can exchange for dollars or other currencies. Stability and creditworthiness, merely influence exchange rates, not the fact of Monetary Sovereignty.

If the local currency depreciates significantly (see item 5 in the list), local banks and corporations can find themselves unable to service dollar debts, because dollars become far more expensive.

No. “Local banks and corporations” are monetarily non-sovereign. A Monetarily Sovereign nation can service any amount of dollar debts, merely by exchanging their unlimited sovereign currency for dollars.

If banks stop lending cross-border, as they did in 2008, local banks and corporations can find themselves unable to refinance dollar debts.

. . . because “local banks and corporations” are monetarily non-sovereign entities. They can run short of money. A Monetarily Sovereign nation cannot.

During the “Great Recession” of 2008, monetarily non-sovereign Greece, France, and Portugal ran short of euros. But MS Canada, China, and Australia never ran short of their own sovereign currencies.

The world is littered with examples of countries that have had to run down public sector FX reserves to provide dollar liquidity to local banks and corporations after they are effectively shut out of global markets by local currency depreciation.

A Monetarily Sovereign nation cannot unintentionally “run down” public sector FX reserves. It has the unlimited ability to create its sovereign currency. It can create all the reserves it wishes.

If the public sector doesn’t have sufficient dollar reserves, it must borrow them, or face financial crisis, widespread debt defaults and economic recession.

In an FX crisis, private sector external debt becomes public sector external debt.

Nonsense. The entire world running short of dollar reserves?? (Where would those dollars be???) In any event, the Bernanke “printing press” would immediately solve the problem.

Thus, when currencies are allowed to float freely (item 5), no government that runs a current account deficit can possibly guarantee that it will never borrow in any currency other than its own (item 6).

The list therefore contains an internal contradiction.

Again, she is confusing between a Monetarily Sovereign nation, which never needs to borrow its own currency, and a monetarily non-sovereign entity, which never can borrow its own currency (It doesn’t have one.)

Monetary sovereignty is perhaps best regarded as a spectrum.

No country on earth is completely monetarily sovereign: the closest is the US, because of its “exorbitant privilege”, but even the US cannot completely ignore the effect of its government’s policies on international demand for its currency and its debt.

She is correct that Monetary Sovereignty is a spectrum, but not because of the demand for dollars. Instead, the spectrum has to do with the nation’s own laws.

For instance, even the U.S. is not absolutely Monetarily Sovereign. We are hamstrung by our own ridiculous “debt limit” laws, which have the potential of reducing our ability to create dollars.

In general, the major reserve currency issuers tend to have more monetary sovereignty than other countries, because there is international demand for their currencies and their debt.

The primary reserve currency issuer is the US, but the Eurozone (for which Germany is the primary safe asset issuer), the UK, Japan, Switzerland, Canada, and – now – China, all fall into this category.

However, there is a hierarchy even among reserve currency issuers. High on the list comes Japan, because its debt is held almost exclusively by its own citizens (and its central bank), and investors regard it as a “safe haven” in troubled times.

But the ostensibly similar Switzerland has less monetary sovereignty than Japan, because it has extensive trade and financial ties to its much larger neighbour the Eurozone.

The Eurozone countries have relinquished their monetary sovereignty in the interests of developing ever-closer links. However, the Eurozone as a bloc has a high degree of monetary sovereignty, because its currency is the second most widely used currency for trade after the dollar.

Ms. Coppola confuses Monetary Sovereignty with credit rating and currency demand.

The fact that Japan’s yen may or may not have a better credit rating than China’s yuan has absolutely nothing to do with the degree to which either nation is Monetarily Sovereign.

Both are sovereign over their own currencies, subject to their own laws regarding the creation of those currencies.

The rest of her article drifts into further musing about “more or less Monetary Sovereignty” when she really means better or worse credit.

Bottom line: Monetary Sovereignty means exactly what it says: Being sovereign over a currency. The U.S., Australia, Canada, China, the UK et al are sovereign over their currencies. Germany, France, and Italy are not.

And by the way, a very good example of Monetary Sovereignty is the Bank in the game of Monopoly. By rule, it too cannot run short of Monopoly dollars, and never needs to borrow dollars or to obtain dollars from any source.

Contrary to the title of Ms. Coppola’s paper, Monetary Sovereignty not only is not a myth, but it is the foundation of economics.

If one does not understand Monetary Sovereignty, one simply cannot understand economics.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. Eliminate FICA2. Federally funded medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Rodger, thank you for your comprehensive assessment of the article. Appreciate it.

LikeLike

Ms. Coppola’s inaccurate and misleading critique of MMT and MS is rooted in her background as financial and foreign exchange analyst for private banks. Mainly, she has issue with the fact that the US dollar is primus inter pares among other currencies because most of the goods and services being bought and sold in international trade are priced in dollars.

A Bangladeshi gov’t, for example, who needs to buy Saudi Arabia’s oil has to scourge for US dollars in their own central bank’s reserves because the Saudis wouldn’t accept the Bangladeshi taka as payment.

Thus Ms. Coppola’s number 3 list is, contrary to her assertion, not a red herring but a validation of MS/MMT principle. If the Saudi oil were priced in takas, then the Bangladesh gov’t could purchase as much oil as they want without any financial constraint.

While Bangladesh has its own sovereign currency, current rules in international trade makes it less monetarily sovereign than the US or the UK or the Euro for that matter.

LikeLiked by 1 person

Great stuff as always, Rodger. Keep up the good fight.

LikeLike

“Why Monetary Sovereignty is a ‘Myth’ ; because it is a fallacy to believe that any nation or group can create wealth. They can create a currency to be honored as Real Money as long as they are capable of redeeming their issuance with already or future existing wealth.

Yes, any “MS” can create any amount of their own ‘currency. Period.

The “systemic failure” or “money collapse” becomes apparent when redemptions exceed the “MS”s storage of wealth.

LikeLiked by 1 person

In the 1970s, the late, great Buckminster Fuller, the Leonardo da Vinci of the 20th century, took an Inventory of the World’s Resources. And what did he find? There was enough resources in the world for everyone on this planet to live like a millionaire. So surely the richest country in the world can exercise its Monetary Sovereignty to the fullest, given how we have more than enough wealth to back it up.

LikeLiked by 1 person

I took a quick look at Ms. Coppola’s blog. It is one of those blogs which skirt close to MMT but think differently about some important aspects, such as partial MS. MS can be partial. The UK has accepted the Treaty of Lisbon’s rule to sell “gilts” to match the deficit.It doesn’t stop it having a deficit, so its Monetary sovereignty is close to total. The fact that it is a totally idiotic rule doesn’t mean it can be ignored, however. It’s a law.

I actually don’t see why Ms. Coppola bothers with such a blog, which sows half-truths and outright errors. Does she accept MMT and hopes to point out errors, or is she just trying to put a spoke in it? She is sensitive enough to vow never to read Bill Mitchell’s work since he criticized her recently.

Let’s see if she responds to your blog which you linked to her yesterday. I would ask her some questions myself but I’m not convinced her site is kosher.

LikeLiked by 1 person

Rodger, it was interesting to read your responses.

It seems you made 2 typing-errors:

‘The fact that Japan’s yen may or may not have a better credit rating than China’s yen’ => China has the renminbi

‘By rule, it to cannot run short’ =>’too’ is correct

LikeLiked by 1 person

Thanks. Yes, the “renminbi” is correct, but I actually meant to type “yuan,” the other word used for China’s currency. I very much appreciate the free editing from my readers.

LikeLiked by 1 person

Frances Coppola clearly has not read much of the seminal MMT literature by Bill Mitchell, Randall Wray, Stephanie Kelton, and Warren Mosler.

If she had, should would understand MMT’s emphasis on the real resource constraints and exchange rate vulnerabilities faced by developing countries that are unlucky in terms of geographic location, climate, topographical features, and natural resource endowments.

The founding MMT economists ALWAYS stress the importance of real resource constraints. They ALWAYS emphasise that monetary sovereignty merely gives a national government the capability to mobilise all idle real resources that are for sale in its own currency. Monetary sovereignty by itself does not overcome domestic real resource constraints. Monetary sovereignty does not necessarily encompass the capacity to buy necessary amounts of goods and services that are for sale in foreign currencies.

LikeLike

Ms. Coppola won’t respond to anything that threatens her view of reality.

LikeLike