Now that Senator Sinema has signed on, the Inflation Reduction Act will pass by the scant majority of 51 to 50, including the Vice President’s vote.

Sinema had opposed closing the so-called carried interest tax loophole. Carried interest is treated as a long-term capital gain. Because it’s taxed at a lower rate than ordinary income, private equity, venture capital, and hedge fund operators benefit.

Presumably, she is in bed with those people.

Giving these over-paid number pushers an extra benefit is an anathema to anyone who wants the Gap between the rich and the rest narrowed. So, on that basis, the loophole should be closed.

But it is a federal tax, and federal tax dollars do not fund anything — they are destroyed upon receipt. So whatever reduces federal taxes (i.e., leaves more money in the private sector) benefits the economy.

The dollars you use to pay federal taxes are part of the M2 money supply measure. When those dollars reach the U.S. Treasury, they cease to be part of any money supply measure. Those dollars are destroyed.

When the government spends, it creates new dollars, ad hoc.

Because the Monetarily Sovereign Treasury has the infinite ability to create dollars, there is no answer to the question, “How much money does the Treasury have?” Thus, no measure includes Treasury dollars.

So, there is good and bad in that loophole, but on balance, including the loophole is good because it benefits the entire private sector.

If the Committee for a Responsible Federal Budget’s numbers are correct, and federal deficits are reduced by $305 billion, that would be recessionary.

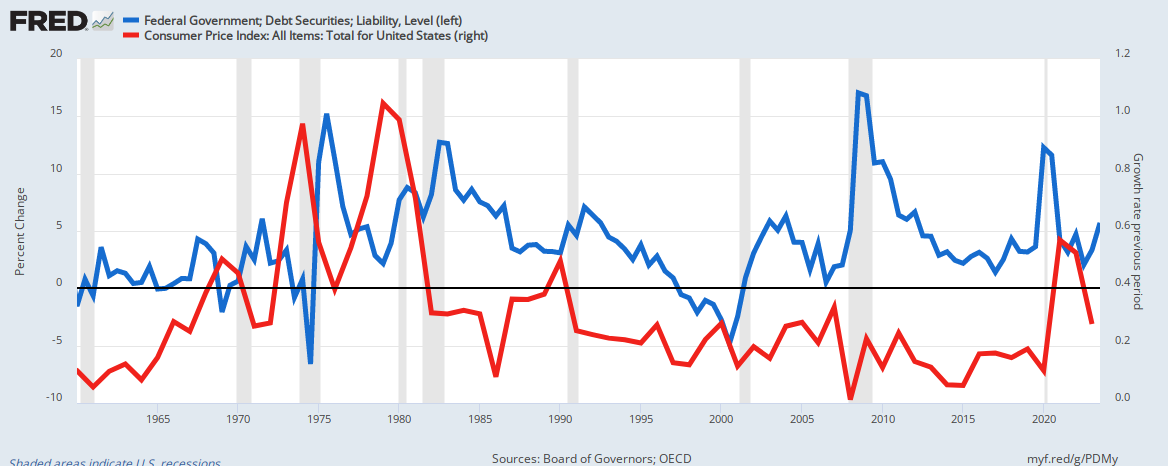

Even worse than deficit growth reduction is debt reduction. That leads to depressions:

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. A recession began 2001.

The CRFB predicts the federal debt would be reduced by nearly $2 trillion.

This means the federal government will take $2 trillion from the private sector (aka “the economy”) and destroy those dollars.

The most popular measure of an economy is Gross Domestic Product (GDP). It measures the total spending by the federal government everyone else in America, plus the net dollars flowing in from across our borders.

Mathematically, for GDP to grow, the private sector must have more dollars. A growing economy requires a growing supply of dollars; when the dollar supply shrinks, GDP shrinks. Simple arithmetic.

When GDP shrinks for two or more months, we call that a “recession,” and if the recession is exceptionally severe, we call it a “depression.”

[Depressions are often defined as recessions lasting longer than three years or resulting in a drop in annual GDP of at least 10 percent.]

The CRFB predicts a depression, though you wouldn’t know it from the tone of their article.

The Congressional Budget Office (CBO) just released its score of the Inflation Reduction Act (IRA) of 2022, legislation which would use Fiscal Year (FY) 2022 reconciliation instructions to raise revenue; lower prescription drug costs; fund new energy, climate, and health care provisions; and reduce the budget deficits.

Mixed bag:

- Raising revenue is bad. That means “take more dollars from the private sector.” The federal government neither needs nor uses the dollars, while the private sector does both, need and use.

- Lowering prescription drug costs would be good if it meant the government was going to pay. Unfortunately, it means the pharmaceutical companies will pay. Dollars will be shifted around in the private sector, and fewer will be available for research and development.

- Fund new energy is good if “new energy” will mean “renewable” and “non-polluting.”

- The climate and healthcare provisions seem good, depending on how they are implemented. One good thing, the Affordable Care Act will be strengthened financially.

- “Reduce the budget deficits” is bad, bad, bad.

Unfortunately, getting the bill through the reconciliation process was legally and politically necessary. But reducing deficits does not reduce inflation.

Inflation is caused by shortages of crucial goods and services, most often oil and food. The only part of the Act that comes even close to reducing inflation is the “fund new energy” part, and again, we’ll have to see how that is implemented.

To call the bill the “Inflation Reduction Act” is both humorous and cynical, but that’s government.

Based on the CBO score, the legislation would reduce deficits by $305 billion through 2031 – including over $100 billion of net scoreable savings and another $200 billion of gross revenue from stronger tax compliance.

Again, that’s $305 billion taken from Gross Domestic Product at a time when the economy is in a recession and needs more, not fewer dollars.

Because the prescription drug savings would be larger than new spending, CBO finds the legislation would modestly reduce net spending by almost $15 billion through 2031, including by nearly $40 billion in 2031.

It’s unclear what the above paragraph is saying, but either $15 billion or $40 billion will be taken from pharmaceutical companies, a loss for the economy.

Once fully phased in, the plan would also slightly cut net taxes by about $2 billion per year – with expanded energy and climate tax credits roughly matching the size of new tax increases.

Cutting taxes benefits the private sector.

The legislation would generate nearly $300 billion of net revenue over a decade.

Translation: The legislation would generate nearly $300 billion of net loss for the economy over a decade.

Unlike prior versions of this reconciliation bill, such as the House-passed Build Back Better Act, this legislation would reduce deficits. Along with other elements of the bill, it is likely to reduce inflationary pressures and thus reduce the risk of a possible recession.

The above paragraph is wrong. Reducing deficits does not reduce inflationary pressures, and it absolutely does not reduce the risk of a possible recession.

SUMMARY Inflation, i.e., a general price increase, is caused by shortages, not federal deficit spending.

Federal deficit spending can cure inflation when the spending helps cure the shortages. Example: Deficit spending to fund more oil/gas production.

Deficit reductions mathematically lead to GDP reductions by taking dollars from the private sector.

The Inflation Reduction Act will do many things, some good and some bad, but it will not reduce inflation.

——-//——-

[No rational person would take dollars from the economy and give them to a federal government that has the infinite ability to create dollars.]

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: Ten Steps To Prosperity:

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

“To call the bill the “Inflation Reduction Act” is both humorous and cynical, but that’s government.” So on the mark. I have been totally bemused by trying to understand how in the heck much of this, or all of it perhaps, does little to effectively and quickly reduce inflation.

LikeLike

Forgot to mention the worst part: Larry Summers was involved.

LikeLike