In an August 10th post titled, “Unfunded Govt. Liabilities — Our Ticking Time Bomb? Nah!,” and in several earlier posts, we referred to the above as, “The inevitable, phony debt clock sign, which is funded, and then referred to, by those least knowledgeable about economics.”

In short, it is The Sign of Ignorance.

Now, here we are, only three days later, and we come upon an article in which the sign is top, center and huge.

The title of the article is, “It’s the Spending, Stupid,” — written by John Merline. The theme is the usual nonsense that federal deficits and debt are bad (for some unknown reason), and the solution is to cut benefits to the middle-classes and the poor.

Here are some key paragraphs from the article, :

The deficit is already bigger now than it was for all of last year, and heading to more than $1 trillion.

Two-thirds of the entire increase in spending is due to just other three items in the budget: health care spending (Medicare, Medicaid, and Obamacare), Social Security, and interest payments on the debt.

In other words, it’s entitlement spending – and more specifically, health care spending – that is driving up the deficit, not tax cuts.

The truth is that getting the deficit under control is not hard. It doesn’t require tax hikes, just a modicum of spending restraint.

What that exercise in misinformation doesn’t tell you:

1. So-called federal “deficits” should be called economic surpluses. When the federal government runs a deficit, it actually pumps growth dollars into the economy.

2. When the government fails to run deficits, we suffer recessions and depressions.

3. Unlike you and me, our Monetarily Sovereign federal government has the unlimited ability to create dollars, which it does, ad hoc, every time it pays a creditor.

4. Though state and local governments, being monetarily non-sovereign, do use taxes to pay creditors, the federal government does not use taxes, and in fact, it destroys tax dollars upon receipt.

Another paragraph from Mr. Merline’s article:

Every Democrat running for president is busy trying to find new ways to double or triple the size of the federal government, while pretending that it all can be paid for simply by making the rich pay their “fair share.”

Here, the authors conflate federal government size (i.e. personnel) with spending. They try to use the popular “government is too big” meme, to imply falsely that spending on your social programs should be cut.

But, government spending cuts on the Social Security benefits you receive will not reduce the size of the Social Security Administration. Nor will stingier payments for Medicare reduce the size of the Centers for Medicare & Medicaid Services.

Writing smaller checks does not reduce the number of check writers.

The authors are correct, however, that Democrats are almost (though not quite) as guilty as Republicans in broadcasting the notion that federal finances are like personal finances.

Consider Bernie Sanders, trying to justify his good Medicare for All idea, by claiming it will be paid for by cost savings and tax increases.

Wrong, Bernie. If Medicare for All ever is adopted, it will not be paid for by cost savings, and federal taxes pay for nothing.

Medicare for All will be paid for by federal deficit spending, which the federal government can do endlessly, and which will pump growth dollars into the economy.

Sanders knows this, because early on, he had hired Professor Stephanie Kelton to advise him on economics, and she told him.

(Sadly, Sanders did not have the courage to pass this information on to the electorate. He believed they would not believe him, so it would cost him votes.)

Not one politician, Democrat or Republican, has had either the knowledge or the courage to reveal the facts to the American public.

(Warren Mosler tried, and it repeatedly cost him elections. But Mosler was a relatively unknown, local politician. The facts await strong support from a well-known, respected national politician.)

Returning to the article, here is another shameful paragraph:

Overall spending growth averaged just 3% from 1994 to 1999.

The economy boomed, and the budget went from a $255 billion deficit to a $236 billion surplus in just six years.

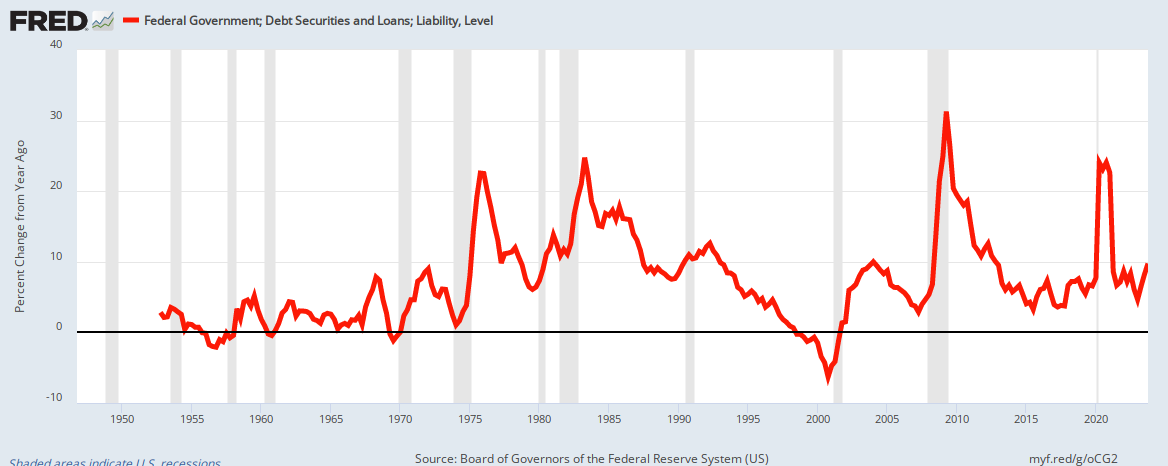

Hmmm. . . . so from 1994 to 1999, federal defict spending declined and the economy boomed?

Let’s look at what really happened.

As you can see, the writer failed to mention one simple fact: The federal surplus (economic deficit) caused the recession, which was cured only when federal deficits again began.

The reason should be obvious. Federal surpluses remove dollars from our economy. Federal deficits pump growth dollars into our economy.

And it has happened before. If you are a fan of depressions, here is how to start one:

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

That’s right, to start a depression, just run a federal surplus (i.e., reduce the federal debt).

And, if you would prefer just a recession, just keep cutting the federal deficit until you get one.

And now one final word from Mr. Merline’s article:

That’s how it always works in Washington. Spend like a drunken sailor today, and promise to sober up tomorrow.

The problem is that with the national debt now topping $22 trillion, and scheduled to go up another $13 trillion in just a few years, tomorrow will be too late.

Oh, dear. “Tomorrow will be too late.“ Is that phrasing similar to “ticking time bomb”?

For 80 years, since 1940, ignorant pundits have bemoaned the federal debt as a “ticking time bomb,” ready to explode at any second. And for 80 years they have been proven wrong.

Does that unblemished record of failure deter them? Apparently not, for it certainly has not deterred Mr. Merline.

And whoever now pays for the Sign of Ignorance — and I refer to, the voting public.

(The infamous debt clock was installed in 1989, by real estate investor (not an economist) Seymour Durst.

And it still exists — in a new location — appropriately semi-hidden in a little alley called “Anita’s Way,” in NYC, where it broadcasts its ignorance to passers-by.)

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereigntyFacebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve the excessive income/wealth/power Gaps between the richer and the poorer.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Oh, dear. No sooner did I push the “Publish” button for the above post than I received a letter from Senator Dick Durbin that said, in part, “The Congressional Budget Office calculated that the ACA would decrease deficits by $1.8 trillion over the next 20 years and extend the solvency of the Medicare program by over a decade.”

OMG! He claims not to realize that:

1. Deficits add growth dollars to the economy.

2. Medicare, being a federal agency, cannot become insolvent unless Congress wants it to become insolvent.

And this is a guy who has been a Senator, forever. Pitiful.

LikeLike

Stephanie Kelton coined a wonderful term: Negameganumaphobia, defined as the irrational fear of large negative numbers. Seems to be a common psychological disorder among our political leaders. As far as the “debt clock”, it should be renamed to what it truly is “The National Savings Clock”. Might help alleviate that large negative number phobia running rampant is Washington.

LikeLike

Funny.

If we rename it “The National Savings Clock,” it will be a large positive number. Problem solved.

Meanwhile, the stock gurus fear the interest inversion will cause a recession. But if the “deficit” keeps rising, we will not have a recession, despite Trump’s best efforts to tank the economy.

LikeLike

Harvard economists Jason Furman and Larry Summers both served in the Obama White House. Their essay in the March/April 2019 Foreign Affairs argues that standard textbook warnings against budget deficits are overwrought. Thus, they agree with the general point of your post. They point out that “real” interest rates (nominal rate minus inflation) have equilibrated around 1% and will hold there for the next decade. This is well below the real rate of 4.5 – 5% that prevailed from 1980 to 2000. As a result, “the U.S. government currently pays around the same proportion of GDP in interest on its debt, adjusted for inflation, as it has on average since World War II.”

Nevertheless, they advise that mounting debt should not be cavalierly ignored, because real interest rates could increase in the future. In that case, the central bank would either force us to accept a recession (as you point out) or would allow inflation to (artificially) lift us out of debt, eating away at pensions and savings. So, they recommend, “instead of passing unfunded legislation, Congress should pay for new measures with either spending cuts or extra revenues… If something is truly worth doing, it should be worth paying for.”

I apply this logic in my blog about healthcare spending – see http://fixushealthcare.blog/2019/03/06/paying-the-high-cost-of-u-s-healthcare

LikeLike

Thank you, Duncan, for your interesting comments.

The U.S. federal government is Monetarily Sovereign. It has absolute control over all aspects of the dollar, including interest on federal securities and the value of the U.S. dollar (i.e. inflation).

The U.S. government never is forced to accept any economic event. That is, it creates all the laws regarding the dollar and can prevent/cure recessions and depressions at will.

The illusion of recessions and depressions being unplanned, unavoidable events is just that: An illusion. The government can prevent/cure recessions at will.

Being Monetarily Sovereign, the U.S. government has the unlimited ability to create dollars, and thus has no difficulty paying any interest rate. In fact, the more interest the federal government pays, indeed, the more deficit spending the federal government does, the more growth dollars it pumps into the economy.

Finally, federal spending does not preclude additional federal spending. Federal finances are not like personal finances. Unlike state and local governments, the federal government has the infinite ability to pay its bills.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets (borrowing) to remain operational.

In short, the United States government cannot become run short of dollars.

LikeLike