Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

======================================================================================================================================================================================================================================

Welcome to the United States of Lemming.

Like the proverbial lemmings, who commit suicide by following their leaders off a cliff, our leaders take our nation off an economic cliff and we blindly follow. In the United States of Lemming, there is a myth and there are facts. “Everyone” believes the myth, and “no one” believes the facts.

Here is the myth. The federal deficit and debt are too high, unsustainable, a drag on our economy, a burden on our government and an impediment to economic growth.

Here are the facts:

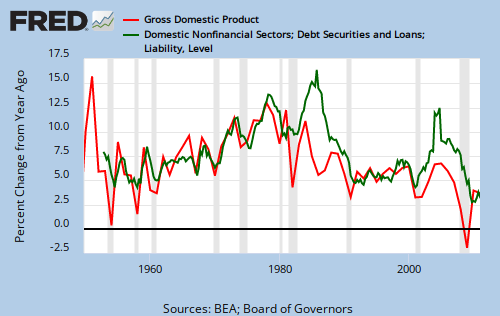

1. Reduced deficit growth leads to recessions. Look at this graph and tell me when recessions begin and how they are ended:

That’s right. Recessions begin after a series of declines in deficit growth. Recessions end with increases in deficit spending. Now our government again plans to cause the next recession by cutting deficit spending.

Our lemming government leads us over the economic cliff.

2. Federal deficits = net non-federal savings – current account deficit. This is an accounting identity.

The current account = money flowing out the the country. This includes imports above exports (balance of trade), interest paid and foreign aid. For the U.S., the current account almost always is negative, meaning more money flows out of the country than into the country. To keep the domestic money supply from falling, the federal government always must run a deficit.

The rest of the deficit goes to net savings. In simplest terms, net savings are your dollars minus your debt. If you have $1,000 in the bank, but owe $200, your net savings are $800. The only source of net savings is federal government deficits. Without federal deficits, there can be no net savings. This is an accounting fact.

A deficit reduction of $1 trillion = a net savings reduction of $1 trillion for the non-federal sector (you and me). With 300+ million people in America, every $3 trillion in deficit reduction causes a $10,000 loss in each person’s net savings. That’s $10,000 taken out of your pocket, an additional $10,000 taken from your spouse, and $10,000 taken from each of your children. What do you think that will do to our economy and your personal finances?

Our lemming government leads us over the economic cliff.

3. Debt reduction (federal surplus) results in depressions:

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

The reason is clear. Federal surplus = economic deficit. This too is an accounting identity. Federal debt is a reflection of federal deficits — the amount of money the federal government adds to the economy. For debt to be reduced, not only must deficits be reduced; they must be entirely eliminated. Federal surplus is an extreme form of deficit reduction.

Our current account already draws money from our economy. Combine that draw-down with a federal surplus, which also pulls money from our economy, and you create a massive, economic money loss. Our most recent federal surplus came at the end of the Clinton administration. Because the surplus was brief, it caused only a recession, which was cured by the Bush deficits. Had the surplus lasted longer, it would have caused a depression.

Our lemming government leads us over the economic cliff.

4. In 1971, the U.S. went off the gold standard, and became Monetarily Sovereign.. The purpose and the effect was to give the U.S. the unlimited ability to pay any bills of any size at any time.

To pay a bill, the federal government instructs a creditor’s bank to mark up the creditor’s checking account. This process erroneously is termed “printing money,” but nothing is printed.

When you and I pay a bill, money is transferred from our account to our creditors account. By contrast, when the federal government pays a bill no money is transferred. Instead, the creditor’s checking account is marked up and money is created by the payment of the government’s debt.

Because no money is transferred, no taxes or borrowing are required for the government to send these mark-up instructions. If taxes and borrowing fell to $0 or rose to $100 trillion, neither event would affect by even one penny, the federal government’s ability to pay its bills.

Despite concerns that deficits may cause inflation, historically this has not been the case. The value of money is determined by two factors: supply and demand. Inflation concerns center on increased supply. But increased demand is anti-inflationary. Demand increases when interest rates rise or when the value of goods and services increases. Both effects have been responsible for this graph, showing no relationship between federal deficits and inflation:

Deficit spending has not caused inflation. Yet, for unknown reasons, the federal plan, agreed to by virtually all media, all politicians and all old-line economists, is to cut deficits and reduce the money supply and our savings.

Our lemming government leads us over the economic cliff.

5. “Debt Outstanding Domestic Nonfinancial Sectors” is the measure of all forms of money in the nation. As you can see, this total debt growth parallels Gross Domestic Product, the most commonly used measure of economic growth.

By cutting federal deficits, the government will reduce Domestic Nonfinancial Debt which will reduce Gross Domestic Product.

The only way to stop this suicidal march is for each of us to contact the media, contact the politicians, even contact a professor you may know, and give them the facts.

Or, like the mythical lemmings, we can follow the crowd, accept our fate and jump over the recession and depression cliff.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY

Roger, I am new to MMT, having discovered it only about 4 weeks ago. The logic seems inescapable, but leaves me with numerous questions, primary among them is “Why does the government borrow?” Is this simply a holdover from the gold standard days? Mosler states that the Fed and Treasury people know full well that the government creates money. Whether or not they also believe MMT is unclear, but if they know they can create money, why continue to issue bonds?

Similarly, it is clear that taxes are not used simply to regulate the economy and avoid inflation as called for by MMT. Ignoring all of the misuse of taxes to influence behavior, is our tax system also simply a pre gold-standard holdover?

Have you considered the psychological impact on the country, especially Congress, if cherished “common sense” beliefs were replaced by MMT. I fear that Congress would run amok.

LikeLike

Murray,

Welcome to the world of reality. Yes, federal borrowing is a relic of the gold standard days. Not only does the federal government not need the money, it doesn’t even receive the money. All dollars paid for T-securities are destroyed.

Then, when the T-securities are redeemed, all T-securities received for dollars are destroyed.

I do not know the Fed’s motivations, though I suspect they are political. Because “everyone” knows the government needs to borrow, it would be impolitic for the Fed to announce, “What we’ve been doing for the past 40 years has been a needless, indeed harmful, charade.”

As for taxes, Warren Mosler and Randy Wray helped contribute to Ten Reasons to Eliminate FICA.

You’re afraid Congress would run amok? Hilarious. That’s like being afraid Bernie Madoff might steal money.

Rodger Malcolm Mitchell

LikeLike

Treasures offer the banks and the uber wealthy a RISKLESS vehicle to hoard their money. For this privilege, the Fed will even pay them interest. What a deal. FDIC only insures up to $250K. Where else can you stash several tens of million of dollars without risk.

The Fed uses T-securities as a monetary tool in open market operations to control interest rates. However, this can be accomplished with short-term notes with a rate close to zero. Long bonds only serve the wealthy.

Monetary policy, since the Greespan Fed, has lower rates as a blunt instrument (The retiree’s dilemma.) to incentivize money out of T-securities, but not necessarily into the productive economy. In fact, money coming out of Treasuries now goes into financial assets, speculation, and the creation of bubbles.

For this reason, I believe taxes should be raised back to pre Reagan tax rates. At one time, tax policy was used to force the hoarding back out into the productive economy, such as the oil and gas depletion allowance to stimulate the production of energy.

Tax all income over one million dollars (arbitrary) at a marginal rate of 90% and use tax deductions to eliminate the tax all the way down to an effective rate of zero. Higher tax rates with outsized incentives can eliminate hoarding and stimulate the economy. Good tax policy can be an effective tool to steer the economy.

I agree with the elimination of FICA taxes, as it only takes money out of the hands of those who will spend it into the economy.

LikeLike

Vincent,

Taxing removes money from the economy. There is no mechanism by which removing money from the economy can stimulate the economy. There is no good tax policy; there is only bad and less bad tax policy.

The purchase of T-securities exchanges a more liquid form of money for a less liquid form. It would be a slight anti-stimulus, except for the fact that the interest is pro-stimulus.

Money cannot be hoarded. Aside from T-securities, which move slowly, money never stops. Money going into “financial assets and speculation,” quickly spreads through the economy into everyone’s hands. Visualize what happens to a dollar that leaves the hand of a speculator. Who receives it? Then who receives it next? Next?

Rodger Malcolm Mitchell

LikeLike