Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==================================================================================================================================================================================================================================================================================================

Here are two brief questions to those who wish to cut the federal debt:

-When do recessions begin?

-What cures them?

Recessions begin with reduced debt growth and are cured by increased debt growth.

=====

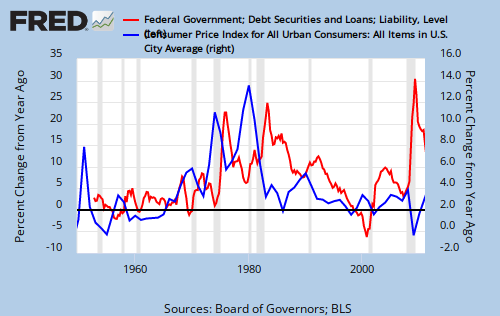

The following is a brief message to those who claim federal deficit spending is in danger of causing inflation or hyperinflation.

In more than 60 years, there has been no relationship between deficit spending and inflation, which today is at a low level.

=====

The following is a brief message to those who claim removing debt from the economy will stimulate economic growth:

Debt growth and GDP growth parallel.

=====

The following is a brief message to those who feel inflation is a greater, more imminent problem than recession:

Inflation is low; GDP growth is low.

So tell me, what is the greatest threat to our economy?

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY

Roger, I’m a big fan of MMT, but I’m not convinced the first chart proves that reducing debt (or deficits) leads to recessions. One could argue the opposite, i.e. recessions lead to higher debt/deficits as automatic stabilizers kick in, while a stronger economy leads to lower debt/deficits.

Secondly, are you related to Bill?

LikeLike

Not related to Bill.

First consider the logic. Under what circumstances could reducing government purchases of goods and services strengthen the economy?

Then look at the graph. Recessions do lead to increased deficit growth, because during recessions, the government spends more to stimulate the economy.

However, if a “stronger economy leads to lower debt/deficit totals,” why does this inevitably end in recession? What causes the recessions?

In short, higher deficits end the recession and lower deficits lead to recession, because higher deficits add more money to the economy and lower deficits add less money to the economy.

Unless you can explain a mechanism by which adding money to the economy causes recessions and taking money from the economy is stimulative, I’ll stick with that.

LikeLike

Thanks for your reply, Rodger. Of course I understand that government spending adds money to the economy, and is therefore stimulative. However, I don’t think the chart necessarily proves the point. You are giving too much credit to the government for “causing” recessions or “stimulating” our way out of one. Just as much credit should be given to the revenue side of the equation, which I think is demonstrated by your chart. Strong economy equals higher tax revenue equals lower deficit. Weak economy equals lower tax revenues equals higher deficits.

LikeLike

Right, the automatic stabilizers. I agree. The point is that deficits are the key to economic growth, whether they come from increased spending, reduced taxes or both. I would be happy to see FICA eliminated and income taxes reduced, with only a modest increase in spending. We need the spending on many social and infrastructure initiatives.

This all leads to the question, what causes recessions, if reduced deficit growth is merely a function of automatic stabilizers?

There is a hint at: Is federal money better than other money?

Rodger Malcolm Mitchell

LikeLike

Ok, thanks for the hint! I think I get where you are coming from, but I’m still having a tough time accepting that the government consciously causes a recession by reducing the deficit. Maybe I have to think of it from a sectoral balance perspective. If the private sector wants to increase their net financial savings, the govt better accommodate with a deficit, or else there will be trouble.

Anyway, your site is great. You have a way with words that some other MMTers would do well to follow.

LikeLike

I don’t believe the politicians consciously cause recessions. I think they unconsciously cause recessions, as most of them seem unconscious.

I may institute a Benedict Arnold club. He was the American general, who because he didn’t receive promotions and accolades, switched sides, effectively hurt America and became our most famous traitor.

Washington politicians, in their selfish effort to be elected and admired, hurt America, which makes them traitors.

Rodger Malcolm Mitchell

LikeLike