If you are not rich, the rich do not care about you. Nor do they care about your children and grandchildren. Nor do they care about poverty and hardship. As a group (and yes, there are some exceptions), they care solely about relative status, i.e. the Gap between the rich and the rest.

Without the Gap, no one would be rich, and the wider the Gap, the richer they are.

These are the people who will follow the rich by voting to cut Social Security. Look closely. Are you in there?

A vote for billionaire Donald Trump is a vote to cut Social Security:

Trump Supports Cutting Social Security From A ‘Moral Standpoint:’ Report

The presumptive GOP presidential nominee has been saying the opposite on the campaign trail.

05/28/2016; Daniel Marans, Reporter, Huffington PostDonald Trump supposedly told House Speaker Paul Ryan (R-Wis.) he supports cutting Social Security but will not admit it publicly because it would hurt his election chances, according to a report in Bloomberg BusinessWeek.

(Trump) reportedly made the comments during a May 12 meeting with Ryan aimed at mending ties between the two top Republican leaders, Bloomberg reported.

“From a moral standpoint, I believe in it,” Trump said of cutting Social Security. “But you also have to get elected. And there’s no way a Republican is going to beat a Democrat when the Republican is saying, ‘We’re going to cut your Social Security’ and the Democrat is saying, ‘We’re going to keep it and give you more.’ ”

Translation: For the rich, “morality” is cutting benefits to the non-rich.

“Morality” also is lying to the non-rich about one’s intentions, because lying to the ignorant masses is no worse than lying to your dog. They don’t care. No matter what you say, they just follow you around, wagging their tails.

Ryan, who repeatedly criticized Trump before the mogul effectively secured the GOP nomination, has made proposing dramatic reductions in the popular social insurance programs a defining feature of his congressional career.

Trump policy advisor Sam Clovis had already appeared to reverse course on May 11, indicating that Trump would be willing to consider cuts as president.

Of course, what Trump reportedly said to Ryan is consistent with what he told Fox News host Sean Hannity back in 2011: “Things have to be done, but it has to be done with both parties together,” Trump said at the time. “You can’t have the Republicans get too far ahead of this issue.”

Translation: “Things have to be done,” means, “We have to cut benefits to the poor, the middle-classes and the elderly.”

“. . . get too far ahead . .. ” means “We need to sneak it through so we don’t get the blame.”

“It is really clear: Donald Trump would 100 percent go along with the Republican donor class position of cutting Social Security,” said Alex Lawson, executive director of Social Security Works, a group that promotes benefits expansion. “He openly says he will lie to the people about it because he knows that the people are against it.”

“In his eyes the ‘moral’ thing to do is to steal people’s hard-earned benefits and not talk about it,” Lawson added.

Prediction: When asked about this Trump will “Do The Trump”:

- Deny it (“That’s not what I said. Do you have a tape? I’ll look into it. That’s not my voice. That doesn’t sound like my voice.”)

- Change the subject (Hillary’s Emails will cost us more than any cuts to Social Security. My wall will reduce the number of people who illegally receive Social Security. There’s a lot of fraud in Social Security; we have to cut the fraud.”)

- Lie (I will not cut Social Security. I will expand Social Security. I love poor people. I employ many poor people. Some of my best friends are poor people. I never promised not to cut Social Security.)

The Democratic party has adopted steadily more progressive positions on Social Security in recent years, arguing not only that the shortfall should be closed entirely through revenue increases — such as lifting the cap on earnings subject to Social Security taxes — but also that benefits should be expanded to address a growing retirement income deficit.

Trump isn’t the only liar in Congress. Social Security benefits should be given to every man, woman and child in America, without “revenue increases.” In fact, FICA could be eliminated, entirely, and Social Security benefits still could be increased. (See Step #1 in the Ten Steps to Prosperity, below)

Contrary to popular myth, and what you repeatedly have been told, FICA does not fund Social Security. Federal taxes do not fund federal spending. (State and local taxes fund state and local spending, but the federal government’s finances are different from state and local government finances.)

The United States government cannot run short of its own sovereign currency. It is Monetarily Sovereign over the U.S. dollar. It creates dollars, ad hoc, by spending dollars.

Both Democratic presidential front-runner Hillary Clinton and her rival Sen. Bernie Sanders (I-Vt.) support increasing benefits and have pledged that they will not cut the program.

Bernie’s chief economics adviser is Stephanie Kelton, who understands Monetary Sovereignty, and is well aware that federal taxes do not support federal spending. She also is aware that the federal government never can run short of dollars.

Presumably, she will advise Democrats on this, after the election, when it is safer to educate the masses.

Meanwhile, those ignorant of economics, believe the politicians who tell them Social Security is going broke, and benefits must be cut, in order to “save” Social Security.

Now go look in the mirror and ask yourself:

- Do I believe it will help “make America great again,” to cut Social Security benefits and to increase FICA collections?

- Do I believe it is in my own best interests to cut Social Security and to increase FICA collections?

- Do I believe the U.S. federal government is running short of dollars?

- Do I believe the politicians, economists and media writers, who tell me my benefits must be cut to save Social Security?

- Do I believe the Email I received from that Nigerian prince?

If you answered “Yes,” to any of those questions, vote for Trump. If you’re going to be lied to and screwed, you might as well choose the best.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich afford better health care than the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE AN ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA, AND/OR EVERY STATE, A PER CAPITA ECONOMIC BONUS (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONEFive reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefiting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE CORPORATE TAXES

Corporations themselves exist only as legalities. They don’t pay taxes or pay for anything else. They are dollar-tranferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the government (the later having no use for those dollars).

Any tax on corporations reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all corporate taxes come around and reappear as deductions from your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.)

Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and corporate taxes would be an good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

========================================================================================================================================================================================================================================================================================================10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

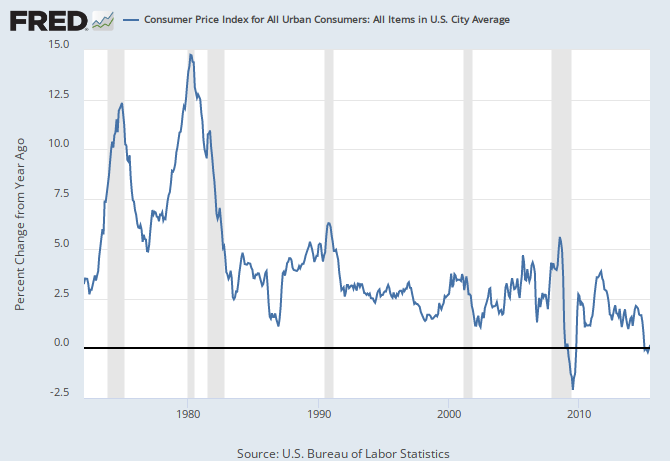

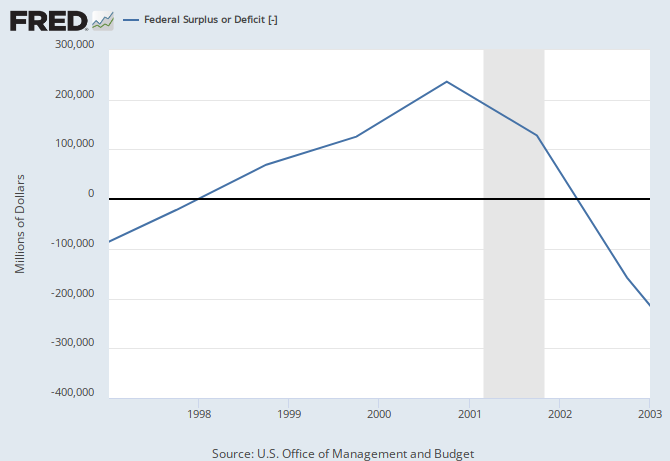

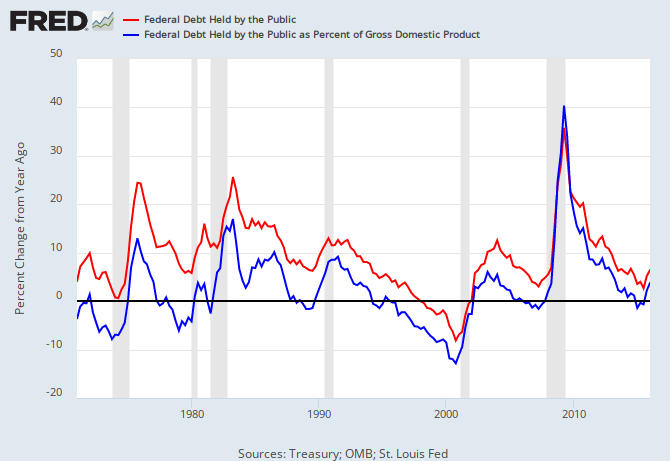

THE RECESSION CLOCK

Recessions begin an average of 2 years after the blue line first dips below zero. A common phenomenon is for the line briefly to dip below zero, then rise above zero, before falling dramatically below zero. There was a brief dip below zero in 2015, followed by another dip – the familiar pre-recession pattern.

Recessions are cured by a rising red line.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

————————————————————————————————————————————————————————————————————————————————————————————————-

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•No nation can tax itself into prosperity, nor grow without money growth.

•Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

•A growing economy requires a growing supply of money (GDP = Federal Spending + Non-federal Spending + Net Exports)

•Deficit spending grows the supply of money

•The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

•The limit to non-federal deficit spending is the ability to borrow.•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..MONETARY SOVEREIGNTY