Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

The Washington Times, being right-wing, feels obligated to make increasingly foolish arguments for arming every man, woman and child in America.

Here is the latest such:

White House concedes new gun laws wouldn’t have stopped Va. gunman

What are we supposed to make of that headline? The White House “conceded” something that is quite true. Any current or proposed gun laws can’t stop an armed, angry fool from shooting people.

The Times headline implies that the White House first argued differently, then “conceded” the obvious. Ah, what a “concession” that was.

What next? How about, “White House concedes National Rifle Association (NRA)is paid by gun manufacturers to convince people to buy guns.”

White House press secretary Josh Earnest said it appears that a proposal championed by President Obama to require background checks on purchases at gun shows “would not have applied in this particular case.”

Law enforcement officials said gunman Vester Flanagan used a Glock handgun in Wednesday’s shooting, one of two that he bought last month. He legally bought two Glock model 19 handguns from a Virginia dealer.

Now, that headline might have read:

“White House concedes that arming everyone would not have prevented Flanagan from killing two innocent people.”

or

“White House concedes that if Flanagan could not obtain a gun he probably would not have killed.”

or

“White House concedes that guns really do kill people, and if you own a gun you have a higher probability of being killed by a gun than if you don’t own a gun.”

But, of course, the first two are obvious, and the third is statistical fact, and all three imply our gun laws are stupid at best and suicidal in effect — and that is something a right-winger has been brainwashed (by the gun manufacturers) to resist.

Gun-nuts are taken with mindless slogans, for instance the NRA’s Wayne LaPierre”s famous: “The only thing that stops a bad guy with a gun, is a good guy with a gun.”

Clearly that slogan isn’t true, because it wouldn’t have helped in the above-mentioned case or in thousands of other shootings in America. So I would like to propose a much truer slogan:

“The only thing that stops a bad guy with a gun is the same bad guy without a gun.”

Now there is a true slogan.

Yes, some might be amazed to learn that, in fact, guns actually do kill people, and the more people who have guns the more people who are killed by guns.

Surely, the White House would “concede” those statements.

(To reduce the carnage, we should pass two simple laws:

A. Any person who commits a felony while carrying a gun, shall be sentenced to a prison term of 20 years to life, in addition to the term for the felony itself.

B. Any provider of a gun that is used in a felony shall have the same criminal and civil liability as the actual perpetrator of the felony.

Those should help until someone comes up with a better idea.)

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

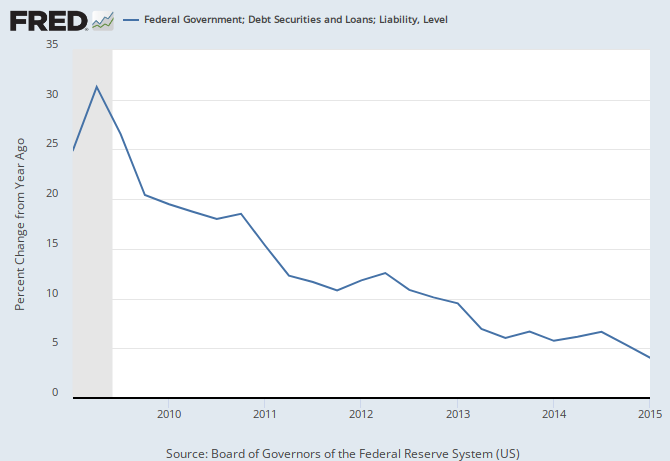

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY