It takes only two things to keep people in chains: The ignorance of the oppressed and the treachery of their leaders.

………………………………………………………………………………………………………………………………………………………………………………

As everyone knows, deficit spending is a primary cause of inflation — except it isn’t.

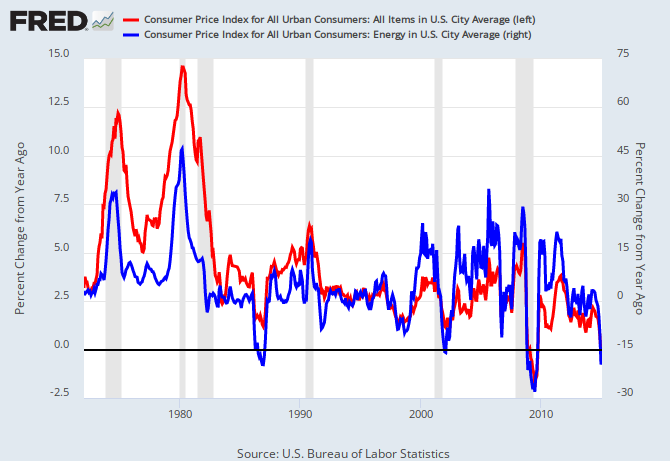

Back on April 6, 2010, we published an article titled, Federal deficit spending doesn’t cause inflation; oil does, where we demonstrated there is no measurable relationship between deficit spending and inflation — there seems to be somewhat of a reverse relationship — plus a strong relationship between oil prices and inflation.

The reasons are straightforward:

- Price Inflation = (Supply of Money/Demand for Money) * (Demand for Goods & Services/Supply of Goods and Services). In plain English, increasing the Demand for Money more than the Supply of money reduces inflation.

- The Demand for Money = Reward/Risk. The Reward for owning money is interest. Bottom line: The Fed fights inflation by increasing interest rates, which it can do arbitrarily, instantly, and incrementally.

- In theory, inflation also could be fought by reducing the Supply of money, via federal deficit spending and/or increasing taxes. However, this method could not be done by any federal agency arbitrarily or instantly. (Both parties in Congress would have to debate it.) And it could not be done incrementally because Congress would need to debate how much to cut the supply incrementally, and be prepared to keep cutting, on a weekly or even daily basis, if necessary.

The cost of oil is baked into the cost of Goods & Services for almost every Good and every Service. Thus, oil price increases affect the prices of almost everything.

Though the Fed has the unfettered ability to prevent/cure inflation by raising interest rates, it always is reluctant to do so, because of the (false) belief that higher interest rates are economically recessive and lower rates are stimulative.

Contrary to popular wisdom, raising interest rates actually stimulates the growth of the economy. One reason is higher rates require the federal government to pay more interest on its T-securities, which increases the Supply of money, which is stimulative for the economy.

All of the above constitutes a prelude to the real subject of this post: The effect of predicted increases in oil prices.

Oil demand is ‘absolutely soaring’ and the price will rise, analyst warns.

*Analyst says oil market has tightened in last 3 months

*Inventories said to be drawing at “phenomenal pace”

*This month the IEA raised demand forecast for 2017As the market wrestles with the fallout from Hurricane Harvey, at least one analyst says the wider picture for oil is for prices to grind higher.

Last month the International Energy Agency (IEA) said global demand will outpace previous estimates in 2017.

Amrita Sen, chief oil analyst at Energy Aspects said, “Particularly if you adjust for global oil demand growth, demand is absolutely soaring right now,” she told CNBC Tuesday.fun

The analyst added that despite strong supply levels, the oil price should move higher.

“It should be going up because inventories have been drawing at a phenomenal pace over the past few weeks and months,” she added.

The Fed now is hung on its own petard. Rising oil prices will cause rising inflation, which in turn, would call for higher interest rates to control inflation.

But the Fed also is sensitive to stock market prices. And stock market prices are based less on actual sales and profits than on traders’ predictions about what the market will do in the coming weeks and months.

And because of the widespread, but false, belief that interest rate increases are functionally recessive, the Fed may be tempted not to raise rates, lest the market fall.

Here is my prediction: The Fed will be forced to raise rates as inflation pressures grow. Many stock prices will fall, due to predictions that they will fall. But, there are certain companies that benefit directly from higher stock prices.

(Disclosure: I own a few shares of a company called AGNC, which “invests in residential mortgage pass-through securities and collateralized mortgage obligations (CMOs) for which the principal and interest payments are guaranteed by a government-sponsored enterprise.”)

AGNC earns money from interest and so, reacts well to interest rate increases. But, as the old line goes, “Nothing is harder to predict than the future.” There are colliding forces at work with regard to this particular security, and indeed, to every security. For instance:

- The predicted Fed’s interest response to oil price changes

- The actual Fed’s interest response to oil price changes

- The predicted profit effect of interest rate changes

- The actual profit effect of interest rate changes

- The predicted profit effect of oil price changes

- The actual profit effect of oil price changes

- The company’s predicted response to interest rate changes

- The company’s actual response to interest rate changes.

- The company’s predicted business response to oil price changes

- The company’s actual business response to oil price changes

So we have at least ten variables, and if these were the only variables, and if each variable had only two outcomes, there still could be more than 3.6 million results.

But, in fact, each variable has a multitude of outcomes, mostly having to do with the words, “How much.” (i.e. “how much” will the Fed raise interest rates; “how much” profit will each rate increase provide, etc.)

So, there can be trillions of outcomes, and this is the difficulty with prediction in economics. I can tell you why reductions in deficit spending growth lead to recessions (By definition, GDP growth requires overall spending growth, which comes from money growth, which is facilitated by federal deficit growth).

But the enormous number of variables and the differing weights of each variable make economic prediction a very, inexact endeavor.

More than ten years ago, I predicted that disaster awaited nations adopting the euro, simply because they were giving up the most valuable asset any nation can have: their Monetary Sovereignty.

But I didn’t know how much or how fast, and as it turns out, that train wreck has been different for each nation.

So, I’m guessing there will be some oil shortage, which will add some inflationary pressure, which will cause the Fed to raise interest rates some, and that will reduce most security prices some, but will increase the prices of certain interest-related securities some, so I own some AGNC.

It’s like baking a cake without measuring any ingredients.

And that could turn out wrong, but the security is trading at less than 5 times price/earnings ratio and pays a 10% annual dividend monthly. So maybe that cake will taste good.

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

THOUGHTS

•All we have are partial solutions; the best we can do is try.

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money no matter how much it taxes its citizens.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•No nation can tax itself into prosperity, nor grow without money growth.

•Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

•A growing economy requires a growing supply of money (GDP = Federal Spending + Non-federal Spending + Net Exports)

•Deficit spending grows the supply of money

•The limit to federal deficit spending is an inflation that cannot be cured with interest rate control. The limit to non-federal deficit spending is the ability to borrow.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Progressives think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between the rich and the rest.

•Austerity is the government’s method for widening the Gap between the rich and the rest.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

MONETARY SOVEREIGNTY