Modern Monetary Theory (MMT) is a cousin to Monetary Sovereignty (MS), in that both concepts acknowledge the indisputable fact that the U.S. federal government’s ability to spend is not constrained by the availability of funds.

In short, the Monetarily Sovereign federal government cannot run short of dollars. It cannot “go broke.” It neither needs nor uses tax dollars.

Similarly, no agency of the federal government (Medicare, Medicaid, Social Security, et al) can run short of dollars unless Congress wants it to.

Even if all federal tax collections were $0, the government could continue spending, forever.

This is true of all sovereign issuers of a sovereign currency.

Federal taxes do not pay for federal spending.

The federal government pays for all spending by creating new dollars. Federal tax dollars are destroyed upon receipt.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Quote from Ben Bernanke when, as Fed chief, he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

Statement from the St. Louis Fed:

“As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

Press Conference: Mario Draghi, President of the ECB, 9 January 2014

Question: I am wondering: can the ECB ever run out of money?

Mario Draghi: Technically, no. We cannot run out of money.

Sadly, MMT believers go astray with two false beliefs: MMT’s Jobs Guarantee and the belief that federal deficit spending can cause inflation.

I. JOBS GUARANTEE

Briefly, JG is just what it sounds like: The government guarantees it will find or provide (it’s not clear which) a job for anyone who wants a job.

We have published many articles describing the foolishness of that proposal. Rather than repeat the many, many reasons why the JG is naive, wrongheaded, and damaging, we’ll just provide you with these references:

How the MMT “Jobs Guarantee” ignores humanity.

MMT’s “Jobs Guarantee”: The final nail in the coffin of this naive, foolish program

One more reason why the MMT Jobs Guarantee is a con job

The MMT Jobs Guarantee con job

More proof the MMT’s “Jobs Guarantee” can’t work

Another word on MMT’s Jobs Guarantee and “The Rise Of Bullshit Jobs”

Life in a Jobs Guarantee (JG) World

The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)

Now, circumstances have arrived to demonstrate reality in the face of MMT’s academic ignorance.

All those people quitting jobs, where are they going?

Kristin Schwab, Oct 28, 2021You may have heard the news that last week’s initial unemployment claims fell to a new pandemic low. But even though layoffs are decreasing, it’s also true that lots of workers are leaving their jobs and lots of employers are still having trouble filling them.

So, where are the workers who are leaving jobs going?

Right now, it is statistically more difficult to become a receptionist than to get into Harvard. That’s according to data from ZipRecruiter, where Julia Pollak is chief economist.

“I have a lot of bad news for job seekers in certain occupations. Some are much more competitive even,” Pollak said.

Some of these jobs are specialized or senior roles, but a lot of them are what Pollak calls pleasant jobs with predictable schedules, such as in customer service or communications — and fields like airport security.

Guess what, MMT? People aren’t simply mindless pegs to be fitted into crap-job holes as JG would do. Human beings have desires. They want — no, demand — good jobs: Good pay, good conditions, good futures.

MMT’s JG program, designed by academics who have not experienced reality, relies on people being so desperate they will take any job offered.

When people are selective about their lives, JG falls apart.

“So, jobs where you have some degree of prestige, perhaps a uniform and a union looking out for your interests,” Pollak said.

The growing interest in jobs that are more stable and offer better pay and benefits makes sense when you compare them to jobs that require similar skills and are begging people to come back — think less predictable or less protected industries like trucking and restaurants.

Imagine that, MMT, people want stability, better pay, and better benefits, not what a federal JG bureaucracy offers them.

“If you’re a worker at a restaurant and suddenly the restaurant is short-staffed, it’s going to be that much harder for you to actually manage your shift,” said Daniel Zhao, an economist at Glassdoor.

People are tired, burned out and fed up. And a lot of them are looking for a new work-from-home lifestyle. Glassdoor said searches for remote roles is up more than 350% in the last year. Whether everyone can get one is a different story.

The paternalistic Jobs Guarantee was a depression-era solution, that is as appropriate as a hand-crank calculator in today’s computer age. Sadly, MMT still doesn’t get it.

Instead of JG nonsense, we finally are leaning toward Step #3 of the Ten Steps to Prosperity: Social Security for All.

II SOCIAL SECURITY FOR ALL

The following article calls it, “Guaranteed Basic Income” (GBI). Different name, same fundamental concept: Instead of finding crap jobs for the poor, simply give people money.

Guaranteed basic income is coming

By Alice Yin and John Byrne Chicago Tribune, The Tribune’s Gregory Pratt contributedThousands of struggling Chicago residents will receive monthly cash payments from the city of Chicago as it becomes home to one of the largest guaranteed income programs in the U.S.

Mayor Lori Lightfoot’s $31.5 million basic income program is just a sliver of the total $16.7 billion budget, which will be buoyed by federal COVID-19 relief funds and won City Council approval Wednesday.

Few details of the pilot have been hammered out yet, except that 5,000 households will receive $500 per month for a year — with no strings attached. The lowest-income residents who suffered financial blows from the COVID-19 pandemic will be the focus.

When the funds go out, Chicago will join a contingent of American cities that have warmed up to the concept of guaranteed income.

Once deemed a pipe dream in mainstream politics, the idea of handing unconditional cash directly to those in need has particularly gained steam during the coronavirus-fueled recession, when most Americans saw multiple rounds of stimulus checks and other temporary social safety net expansions.

However, guaranteed income pilots have launched before the pandemic too, such as in Stockton, California, under former Mayor Michael Tubbs.

The program doled out $500 monthly payments to a small subset of low-income families. In June 2020, Tubbs started the coalition Mayors for a Guaranteed Income, which now has more than 50 mayors on board, more than two dozen of whom are piloting the concept in some form.

Though Lightfoot has touted her proposal as the largest in U.S. history, Los Angeles is in the process of implementing its own guaranteed income pilot targeting 3,000 households with $1,000 a month for a year.

Andrew Yang, a Democratic presidential candidate in 2020, has also championed a more far-reaching version of cash assistance known as universal basic income, which would go out to all adults regardless of means.

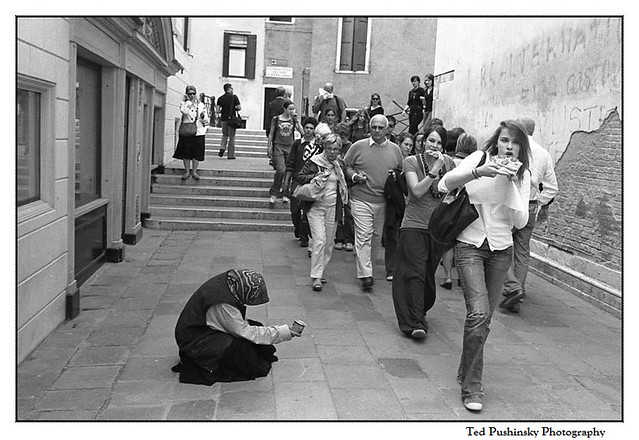

Rather than insisting on the Puritanical demand that people must labor in order to survive (i.e JG), more enlightened city governments recognize that at least at some basic level, poverty is harmful to the whole nation, and Americans have a right to live.

The irony is that monetarily non-sovereign cities (which are financially limited) are doing it rather than the Monetarily Sovereign federal government, which is financially unlimited.

But that is why the efforts are so small, with just a few thousand households receiving benefits.

Not all Chicago aldermen were on board with Lightfoot’s plan. Her overall budget passed 35-15, with some of the opposition pointing to the basic income program.

Southwest Side Ald. Matt O’Shea said after the vote that the pilot won’t work because “in two years, we won’t be able to afford it.” He’d rather see resources spent on boosting child care and “getting people back to work,” he said.

“Just giving money out to people when there’s tens of thousands of jobs in our city right now, that’s not something I can support,” O’Shea said.

But that is the whole point. There are “tens of thousands of jobs” people don’t want. Arrogant academic snobs claim the “underclass” should be grateful to work crap jobs for crap wages.

Those are Gap Psychology words. They serve only to widen the Gap between the rich and those below. JG is cruel and ignorant. It dooms people to failure. It is bad economics.

Giving people money turns them into consumers whose spending helps the entire economy.

Apparently, people are tired of the “work ’til you drop” routine. They have the strange desire to lead pleasant lives, no matter what the rich tell them. If people won’t work, it’s not because of laziness, as the rich love to claim. It’s because the jobs are unattractive.

Back in March, when aldermen held a hearing on a proposal over direct monthly checks, caucus chairman Jason Ervin said it would be a “slap in the face” to proceed with guaranteed income before setting up a reparations programs for descendants of slaves.

That’s a perfect example of the old, “We can’t do this before we do that” stalling routine.

It’s like this: “We can’t feed them until we clothe them, and we can’t clothe them until we house them, and we can’t house them until we educate them, and we can’t educate them until we give them free healthcare, and we can’t afford to give them free healthcare until we raise taxes — and we can’t raise taxes because no one wants that.

“So we can’t do anything. Sorry.”

One of City Council’s loudest voices for direct cash assistance has been Northwest Side Ald. Gilbert Villegas, who said his mother received a monthly $800 stipend through the Social Security survivors death benefits program after his father died.

Villegas introduced a proposal ordinance this spring that largely resembled Lightfoot’s plan of $500 monthly payments to 5,000 households, but it did not pass.

Villegas’s mother received benefits from a federal agency, that is funded from an unlimited source. City governments are not unlimited sources.

Still, Villegas said he’s prepared to go all-in on helping work out the details of Lightfoot’s program. He wants an eligibility threshold of households earning 300% or less of the federal poverty level, and Chicago Public Schools families should be prioritized, he said.

The problem with income eligibility programs is they are expensive to administer, unfair to those who barely miss out, and subject to cheating.

Though most guaranteed income programs are still nascent, researchers have examined the effects — with limitations. The current pilots in place are narrow in size and duration, said Carmelo Barbaro, executive director of the University of Chicago Inclusive Economy Lab.

Still, there is promise in further investigating the results because unlike other safety-net programs, direct cash assistance is simpler to implement, he said.

“Broadly accessible and unconditional cash transfers like Chicago’s guaranteed income pilot are intended to address those limitations of existing programs,” Barbaro wrote in an email. “The cost of such programs is higher, but the benefits could also be higher.”

No deductible, comprehensive Social Security for All is affordable for the federal government (as are all federal expenses). It would be simple to administer, and massively beneficial to the economy.

University of Pennsylvania professor Ioana Marinescu, an economist who has also studied such programs, said the early signs show that some of the outcomes feared by critics may not have materialized.

A 2014 research review on the effect of cash transfers on alcohol and tobacco purchases, for example, found virtually no change in or even a decrease in spending on these so-called temptation goods.

“There’s advantages to cash in terms of flexibility,” Marinescu said. “There could be drawbacks if you’re worried that people misuse the cash. But that doesn’t seem to be the case based on the empirical evidence.”

The rich like to portray the poor as ignorant sloths who will use any extra money for drinking, gambling, smoking, and drugs. That gives the rich a fake excuse to widen the Gap and thereby make themselves richer. Republicans, the party of the rich, invariably vote against money for the poor.

(The Gap is what makes the rich rich. Without the Gap, no one would be rich. We all would be the same. The wider the Gap, the richer the rich are.)

The lack of money is the biggest problem in any economy. The best way to cure that problem is to give people money.

The rich hate it, and invent excuses for not doing it, because they don’t want the Gap between the rich and the rest to be narrowed.

III Inflation

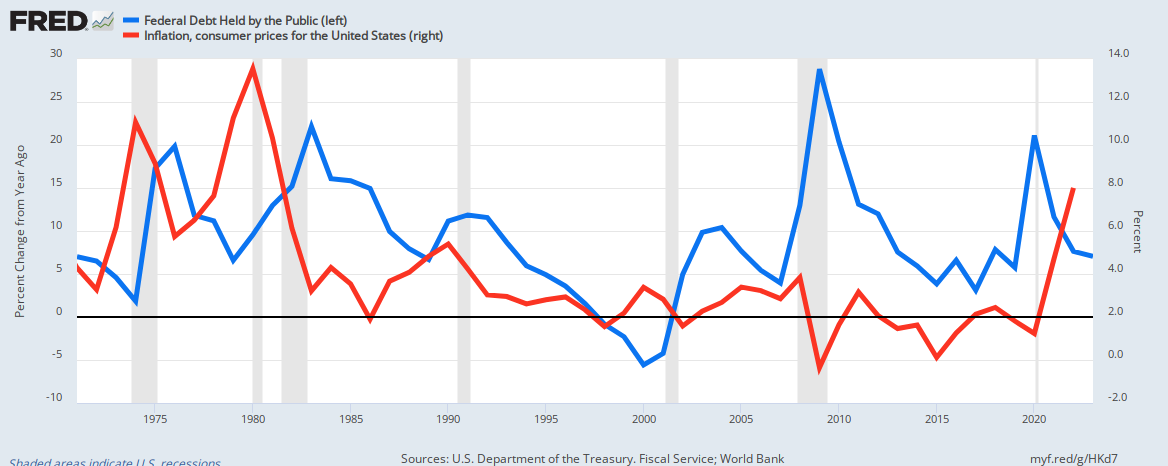

Contrary to popular myth, inflation never is caused by “too much” federal deficit spending. Inflation always is caused by shortages of key goods and services.

Today’s inflation is related to shortages of energy, labor, food, and computer chips.

Inflation actually can be cured by additional federal spending to pay for scarce goods and services.

In Summary

- The Monetarily Sovereign federal government has infinite access to dollars. Neither the government nor any agency of the government can run short of dollars unless Congress wants that to happen.

- Federal taxes do not “pay for” federal spending. Federal spending is paid for by the creation of new dollars, which the government has the infinite ability to do.

- Federal spending does not cause inflation. Inflation is caused by the scarcity of key goods and services. Federal spending can cure inflation by paying for scarce goods and services.

- America is not short of jobs. America is short of good jobs. Modern Monetary Theory’s Jobs Guarantee will solve zero problems, and in fact exacerbate a “crap jobs” economy.

- Poverty, the lack of money, is bad for the American economy. Poverty is not cured by bad jobs, but rather by putting money in the hands of the impoverished. This creates new consumers, whose purchases grow the economy, which grows businesses that are able to provide attractive jobs.

It all begins putting with money into the hands of the people, which the U.S. federal government has the infinite ability to provide.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY