Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

I previously have written about Modern Monetary Theory’s JG (Jobs Guarantee)

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

I won’t repeat the many, many reasons why I believe JG to be a bad idea — or bad ideas, as every time I discuss JG with an adherent, I am treated to a different version, beginning with the fundamental question, “Who is the employer, the government or the private sector?” — and that is but one of my complaints.

I also feel that lack of money, not lack of jobs, is the key problem. There are millions of jobs available. Look in your local newspaper or at such sites as Monster.com, and you’ll see thousands upon thousands of jobs being advertised. Private industry spends millions to find people to fill those jobs.

But they are the wrong jobs from the standpoint of pay, geography, skills needed, time, etc., etc. — and those are exactly the kinds of jobs JG would provide.

No, I don’t think having the government compete with private employment agencies, newspapers and online job searches will benefit the economy.

Given the choice of JG vs GI (Guaranteed Income), I’d lean toward GI. It’s simpler, accomplishes the primary goal of providing money to people who need money, and we already do something in the same genre: Social Security.

Yet GI also has a fundamental problem. If, for instance, everyone were guaranteed an annual income of, say, $10K, who would accept a full-time job paying $12K (assuming GI is a net income guarantee)? In essence, that employee would be working full time for $2K.

So the minimum wage functionally (though not legally) would be at least $20K annually, which would punish many employers, while not adding much to the economy’s money supply.

I suggest the problem(s) facing our economy are two-fold:

1. The economy has too little money.

2. The “not-rich People” (the 99%) have too little money.

So I propose we simply give a monthly Economic Bonus (EB) to every man, woman and child in America, regardless of any other income or wealth they may have. You would receive the same EB as I receive and as Bill Gates receives.

No need to go through the convoluted steps our gigantic tax code demands, to determine what is income, and what kind of income it is, and when you received it and how you received it, etc., etc. If you live in America, and you’re alive, you receive your monthly EB.

The economy benefits by receiving dollars and the 99% also benefit by receiving dollars. The rich benefit, too, but that’s good. It’s just more dollars for the economy, and it costs no one anything.

How much should the EB be? My early thought is $1K per month for everyone above the age of 21, and $500 per month for everyone below that age. You may have a different amount in mind.

The government already has done something similar, though it unnecessarily took into consideration income. In a weak attempt to moderate the Great Recession, the government mailed every taxpayer a check for as much as $500. (Had they sent $5,000 instead, the recession would have ended, but that’s another issue.)

I know that sending money to “lazy” people who don’t work, goes against our Puritan grain, but we should get over that notion. There are many reasons people don’t have enough money, and laziness isn’t anywhere near the top of the list.

Bottom line: Send every man, woman and child in America an Economic Bonus, and we will have solved the vast majority of economic problems facing America.

Or is that solution too easy for those who believe the medicine must be bitter, to be effective?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

====================================================================================

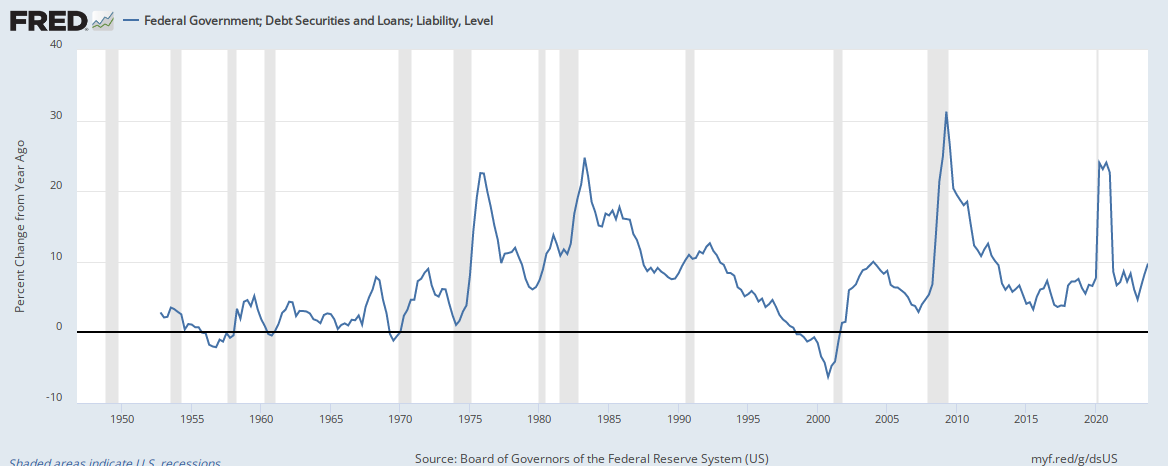

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise. Federal deficit growth is absolutely, positively necessary for economic growth. Period.

#MONETARY SOVEREIGNTY

LikeLike

Hi Rodger,

A big thing that would be helpful in educating people about monetary sovereignty/MMT and its approach to macroeconomics (and its accompanying rationale for effectively managing government finances and offering solutions) is to explain why this approach is NOT considered socialism or communism.This is a major misconception from my impression when a try to explain it to others. Uneducated people tend to think that any kind of government involvement is inherently leading to socialism which it is not.

You may have already done this explanation, but I just did not find it on your blog.

LikeLike

This is a fantastic thread! BTW, thanks for repro-ing the PEW poll results. Very informative.

LikeLike

Hi Rodger,

What do you think of Obama’s proposed “retirement savings bond” (MyRA)?

http://www.usatoday.com/story/news/2014/01/28/obama-state-of-the-union-myra-savings-plan/4992743/

LikeLike

It’s a “forced” savings, which is good. It’s safe, as far as actual dollars go, which also is good.

But the interest is pegged lower than inflation, which is awful.

Not sure what the advantage is for the average worker.

LikeLike

The current inflation rate is 1.5 %:

http://www.usinflationcalculator.com/inflation/current-inflation-rates/

The current interest rate on the G-Fund of the federal TSP is 2.5%.

https://www.tsp.gov/planningtools/loan/loan.shtml

What if the federal government offered the G-Fund to all citizens? How about the entire TSP plan as a national retirement plan in addition to social security?

LikeLike

Or 1.89%, depending on the date: (https://www.tsp.gov/investmentfunds/monthly/monthlyReturns.shtml)

In the past 10 years, inflation has ranged from 4% to effectively 0%, depending on who’s counting. http://research.stlouisfed.org/fredgraph.png?g=rtJ

But, we’re talking about pennies, even in the unlikely event that inflation is lower than the G-fund for the next 10 years. A net return of 1% is OK for a multi-billion dollar bank, but not for the average saver.

How about simply cutting taxes ala #7 in the “Nine Steps to Prosperity.” Why all the convoluted solutions to a convoluted tax system. They write dopey tax laws, then come up with dopey solutions to those tax laws.

In essence, you asked me which Rube Goldberg machine I prefer.

LikeLike

@Rodger: Where is the factual proof that federal taxes do not fund the federal government? For example, where is it codified in the federal register as to what happens to the money collected by the IRS? My tax check that I send in with my federal return is made payable to the “U.S. Treasury” – Where is it in the regulations (or anywhere else) that explicitly states that this money is just “deleted” from my checking account, and not actually transferred to some “federal government” account to fund federal government operations? If this is indeed true, then federal income taxes and the IRS should be abolished – what is the point? Aren’t there more effect ways to drain dollars from the economy and manage the dollar supply?

LikeLike

When you pay state and local taxes, the dollars remain part of the U.S. money supply. They are in the checking and savings accounts at privately owned banks used by your local government and are part of M2.

When you pay federal taxes, the dollars no longer are in the U.S. money supply, and are no long part of any money measure. While the Treasury keeps track of credits and debits, the Treasury holds no actual dollars (otherwise those big sheets of printed “dollars” also would be counted as money.

LikeLike

It seems to me that federal income taxes and the federal “debt” are the biggest frauds in history – This stuff is unbelievable. The American people are being massively deceived.

LikeLike

The Fair Tax people, bless their little hearts, have many things right. They propose to eliminate virtually all federal taxes, including FICA, shut down the IRS, repeal the 16th amendment, and pay every American citizen a “prebate” (way too small unfortunately). The problem is that they think there must be revenue neutrality – that is – replacing lost income tax “revenue” with an equivalent amount of new sales tax “revenue” which amounts to a 23% national sales tax. If they would just adjust that 23% sales tax down to 0% then they might be onto something.

LikeLike

“Yet GI also has a fundamental problem. If, for instance, everyone were guaranteed an annual income of, say, $10K, who would accept a full-time job paying $12K (assuming GI is a net income guarantee)? In essence, that employee would be working full time for $2K.

So the minimum wage functionally (though not legally) would be at least $20K annually, which would punish many employers, while not adding much to the economy’s money supply.”

Could you explain these two paragraphs. Are they even related? Thanks.

LikeLike

Imagine if you do no work at all, you will receive $10K, but if you work for a full year, you will receive $12K. That year’s worth of work will have netted you only $2K extra. You will have worked a year to net $2K.

Would you work a full year to obtain extra $2K? Probably not.

So how much would an employer need to pay you, for you to give up your free $10K in exchange for his salary. My guess was: At least $20K, in which your year’s labor would have netted you an extra $10K.

So a Guaranteed Income of $10K probably would translate into a functional minimum wage of about $20K. Almost no one would accept a job for less.

LikeLike

…and $20K, on a broad average, would equate to a living wage, if I remember the investigations I’ve recently done.

LikeLike

I was thinking of a basic survival (i.e., unconditional) income of say $8K for an adult. Half of that, lets say, for minors (under age 18) living in a household with an adult. Welfare programs such as food stamps, housing, energy, phone and transportation subsidies, Medicaid, etc., would remain in place in the beginning and be phased out or tweaked as new programs such as universal medical coverage, free education, etc., kicked in and as overall economic conditions and job availability changed and improved.

Today an adult on Supplemental Security Income (SSI) (administered by the Social Security Administration) for the disabled poor and the over 65 poor gets about $8K per annum (tax-free) plus a variety of the above named welfare freebies so nothing would change in that respect BUT…

EVERYBODY (including the satanically-inspired Bill Gates and such as Mayor Bloomberg) would be FREE… FREE at last… to work or not to work as many hours and as many jobs as they desired to supplement their basic survival income. Many would work, others would make music, some would kick back and smoke weed, others would invent, others would make love, others would not be able to work or would choose not to work, others would continue spewing out their lies and would continue their thieving ways and would continue running for public office based on those lies and that thievery…

Is not FREEDOM the goal? The end of WAGE, DEBT and WELFARE slavery? We would all be FREE. No more scams and BS promises. No more governmental bureaucratic abuse of the poor. Freedom would start at the BOTTOM, at the REAL grass roots. Where else? All the welfare bums and welfare queens would be FREE at last.

Is not the end of POVERTY the goal? Poverty would end with the stroke of a pen. Ah, say the skeptics, but who would work to produce the goods and services that we all want and need? The answer is simple and straight forward. Healthy people want to work and want to create. Those who don’t have a psychological or a physical problem. We’ll send them to rehab. And we will teach the children the value and dignity of human labor.

LikeLike

@luismagno2010, nice to hear your thoughts. Consider, though, the meaning of a living income/wage. It’s the amount required to keep people out of poverty. The amount to pay for physical and security needs. Right now that figure, which varies on geographical area and other circumstances, is, on a broad average, about $20K-$25K per year (~ $10-$12 per hour). I do agree that (economic) FREEDOM is the goal, but you’ll have to raise your sights. Remember, according to MS theories, the more money in circulation, the better the economy.

Here’s a general math question for anyone. To put a guaranteed living income in perspective, what would it “cost” to pay every household an average of $20K per year, compared to the current $75B per month of QE?

LikeLike

Scrap the Welfare State and Give People Free Money

A guaranteed income would reduce the humiliations of the current welfare system while promoting individual responsibility.

Matthew Feeney | November 26, 2013

http://reason.com/archives/2013/11/26/scrap-the-welfare-state-give-people-free

LikeLike

Unconditional Basic income, (Switzerland is proposing $2800 a Month).

The amount should be enough to live in dignity without a Job.

Any additional Income would be additional to Basic Income.

Employers would need to offer a decent wage to lure workers.

This would likely replace all safety net programs including Social security.

LikeLike

Yes, Unconditional Basic Income is being proposed — in euro countries, of all places!

Sadly, euro countries, being monetarily non-sovereign, can’t afford it, though Switzerland, being Monetarily Sovereign.

The key word is “Unconditional,” which hopefully in execution, will eliminate any form of a means or income test.

See: http://www.basicincome.org/bien/aboutbasicincome.html

Actually, employers would not have to offer much more, if anything, than they now offer. All salaries would be on top of the Basic Income.

LikeLike

Thanks a good site

LikeLike

I think it should be federal law that unemployment insurance pay a minimum of $500 per week.

LikeLike

This solution will cause more issues than we have today. Not only will it punish businesses, it will not help anyone. Not one bit.

How good would it do if you give everyone money – only to see the prices they pay go up by at least the same amount. At the same time, smaller businesses will find it harder to make the changes and weather input price increases. Many smaller businesses will disappear as a result.

You want jobs, there are 2 ways to get them back (but nobody wants them). 1) gold standard 2) remove minimum wage

I am actually writing a post which will provide the answers and solutions to many of the issues around the lack of jobs.

http://sucesofinanciero.blogspot.com/

LikeLike

No need for inflation. The Fed can control inflation with interest rate control, just as it now controls inflation. Raising interest rates increases the demand for money, which fights inflation. The Fed has proved that.

LikeLike

Roger,

The Fed has proved that it has been causing inflation for the last 40 years. The US dollar has lost 82% of purchasing power since full fractional reserve was introduced in 1971.

LikeLike

Most economists believe a small amount of inflation benefits the economy and that deflation injures the economy.

To maintain a small amount amount of inflation, and to prevent deflation, the Fed’s target rate is 2.5% – 3%. Over the past half century, we’ve been averaging about 3%, and recently it’s been more like 1.5%

LikeLike

Of COURSE a small amount of inflation is necessary.

When population & econ activity both evolve (as they do), you need a larger amount of currency every month, simply to maintain adequate liquidity for the new electorate in the new context.

Then it’s a senseless struggle between grandparents hoarding fiat for themselves vs providing options for the grandchildren.

ps: the grandchildren ALWAYS win; otherwise we wouldn’t still be here

http://econintersect.com/b2evolution/blog2.php/2012/12/16/redefining-fiscal-policy-outcomes-so-that-our-definition-of-successful-investing-isn-t-depriving-our-grandchildren-of-options

LikeLike

THANK YOU, MR. ERICKSON. I read the link you posted, and, though I haven’t translated what you’ve written into lay-speak, it seems to me to be tremendously appropriate. I’m very attracted to models that seek unifying principles among disciplines, and your analysis seems transcending and practical. I’ll study it to understand better.

LikeLike

Roger,

They sure won’t win because of those receiving GI (if implemented – which it won’t anyway), that’s for sure.

LikeLike

I am assuming a monetarily sovereign government with no or tightly controlled fractional reserve private banking. I have a problem with the idea of controlling inflation and deflation by manipulating the interest rate.

It seems to me that the cure that you are proposing is the cause of the inflation or deflation in the first place. Inflation and deflation can be controlled by the measured creation of public money directed to productive purposes.

Inflation and deflation arise from the wanton creation of private money for speculative and non-productive purposes. But a monetarily sovereign government would not allow that to occur in the first place.

What am I missing?

LikeLike

I agree that the way to create jobs is to eliminate the minimum wage. In fact, why not lower wages to zero? Plantantion slaves in the antebellum South had no wages, and no unemployment. They lived in paradise.

And why not lower monetary exchanges to zero? Who needs money anyway? Of course, no one will be able to buy anything, which means that all jobs will end, but at least the consumer economy will take off.

Eliminating the minimum wage would cause the wealth gap to grow wider than ever, since the rich owners of capital do not depend on wages for their income.

That’s the spirit!

LikeLike

I appreciate the irony!

LikeLike

Oh puleeze,

Do you really think we will go back to having slaves? What folks don’t understand is that wages are relative. I would rather make $1.50 an hour and be able to put 20% down on a house, have at minimum a family car paid, clothe the family, feed the family, and save a little. Than making $500 an hour and not be able to afford half of that.

I thought money was a scorecard? Why doesn’t that logic apply here?

LikeLike

@sucesofinanciero, IMO, we already have slaves; wage slaves and debt slaves. In general, most people work to live; to provide the “essentials” you mention above, sans house, family car, clothes, and savings. A recent, accredited study shows that 70% of employed people are dissatisfied with their current jobs. Wage slaves.

Again, IMO, we are at the point where it’s possible to create the scenario wherein people can live to work, instead of working to live; to spend their time doing something that’s meaningful to them, instead of spending their time in support of unsustainable continued growth.

LikeLike

Jeff,

It amazes me how you believe that we have wage slaves (I assume you mean they don’t make enough to support themselves), yet you think the solution is giving them a token.

I guess everyone here believes on demand side economics, there must be “more” money for there to be demand. I think this thinking is completely flawed because suppliers produce for real incomes, not nominal incomes. By increasing the money supply, you are increasing nominal incomes – not real incomes. In fact, you are confiscating (or stealing it if you prefer) it.

If the government implements programs such as GI, you can rest assured that real incomes will plummet for businesses (businesses pay to produce goods and services while the folks that will receive GI will not), and the supply side of the equation will also plummet. Not only will not not resolve the issue of inequality, you will make it worst. Businesses are neither stupid nor able to take losses consecutively.

The proof is in our faces, yet we refuse to acknowledge it.

LikeLike

Wage slaves are those who are forced to work a job that is overall meaningless to them in order to provide their physical and security needs: the reported 70% of workers who are disengaged from their jobs (http://www.forbes.com/sites/larrymyler/2013/09/02/why-are-70-of-employees-disengaged-and-what-can-you-do-about-it/).

To have to accept employment that’s not fulfilling in order to meet your survival needs, and not be able to do what inspires you in life is my definition of wage slavery. It is no longer necessary to do this in today’s world of abundance. Thought experiment: why do people usually want to retire? Could it be because they have the economic freedom to do what they really want to do?

Could I politely ask where you got the idea of “giving them a token”? I suggest giving “them” (all of us) a guaranteed living income, or a Basic Income Guarantee.

Still waiting for your analysis of how ending slavery “destroyed” the businesses of slave owners. Waiting…waiting…

LikeLike

“Wage slaves are those who are [forced] to work a job that is overall [meaningless] to them in order to provide their [physical and security needs]: the reported 70% of workers who are disengaged from their jobs”

I highlighted the words that should almost made me cry. First off, all jobs are right to work, meaning the employer can hire you and fire you at will. You can also quit at will. Nobody is forcing anyone to work.

Second of all, it’s not the employee that has to find the job “meaningful”, there is a need, a business wants to fill that need and hires people to fulfill that need. I bet that the output of the job is meaningful, especially when the same employee is receiving the good or service. What you are proposing is that we ban all “meaningless” jobs, only to see you complain how “the private industry is not making it happen”.

Thirdly, I bet that by “physical and security needs”, you are not referring to physical safety from crimes and are referring to “free” stuff.

Jeff,

You want someone to produce some good and service, so that the government can give you money, so that you don’t have to work to pay for that good and service. Are you proposing that we now have slaves to ensure you fulfill your dream?

You either wants slaves or you dont.

LikeLike

@Bapoy, @sucesofinanciero, or whomever you are today, continuing this conversation is not a productive use of time. It’s clear that any points of view outside your own philosophies, apparently aligned with Ayn Rand’s Objectivism and the 19th century Austrian School of economics, are beyond your consideration. You are a “true believer” and incapable of considering the need for monetary reform.

LikeLike

@sucesofinanciero, I interpret your ideas to be locked in neo-Malthusian thinking of scarcity, more appropriate to 18th and 19th century thinking and reality than the new economic paradigm that’s exploding in the 21st century. Consequently, I don’t think you have any answers or solutions to offer. Sorry to be rude, but I encourage you to expand your perspectives.

LikeLike

PS – when you say, “Not only will it punish businesses…”, I understand that to mean it will deprive some businesses of wage slaves. Anyone who works for less than a living wage is, by definition, a wage slave. Again, the analogy…the Emancipation Proclamation deprived slave owners (businesses) of unpaid labor.

LikeLike

Wages in nominal terms mean nothing. Wages in real terms is what is important. As I said on my response to Roger, I would rather make $1.50 an hour if that bought me more than $500 an hour. Wouldn’t you?

Those in the 18th – 19th century thinking are those that see mere digits as goods and services. I see goods and services – which I can purchase using a currency. What’s more important to you – what you get for your money or the money itself?

Sorry if this comes out rude, it’s not meant to.

LikeLike

The “IF” you propose is a false argument. Your relativism – $1.50 vs $500 per hour – isn’t borne out by current reality.

LikeLike

Also,

A “living wage” varies by individual, city, state, region. Maybe someone can live on $600 a month, but many can’t. So what’s a living wage?

We have people living in poverty who would be extremely happy to take a job at any rate, irrespective of what you want to call it. I suggest that this idea of giving them “money” will allow them to buy exactly the same thing they are buying today – and hence will leave them in the same situation, in poverty. Some can’t see the forest from the trees.

Would removing the minimum wage not allow competitors to come back into the market (since labor costs would plummet), with many people willing to take up the job. Would that not allow these folks to put food on the table while at the same time, the same folks will be creating goods and services which would benefit society as a whole.

I get confused by the socialist arguments – some days it’s a social contract, other days it’s not. Yet, today you have folks working extremely hard to survive while others (healthy) are just waiting for the next government check. Does that not sound like a one way street? Where is the social part in that – socialists?

LikeLike

You are correct that, as I said, living wage varies by geographic area, among other factors.

“So what’s a living wage?” (ps – I’d prefer to talk about living income)

It’s self-defining. It’s that amount that provides for the physical and security needs of people, and thus allows them to live. Without these lower level needs being met, people’s lives are at unnecessary risk.

Here’s one way to determine a living wage with relative ease: http://livingwage.mit.edu/

“We have people living in poverty who would be extremely happy to take a job at any rate…”

We have people living in poverty who are already working, sometimes more than one job. This is because of depressed wages/income.

“Would removing the minimum wage…”, etc.

One way that minimum wages could be dispensed with is by providing a living income for everyone. Short of that, removing minimum wages would, as you say, cause labor costs to plummet even further, increasing poverty even more. To what advantage are more goods and services when people can’t afford to buy them? And would you share your thoughts re: my Emancipation/slavery analogy above?

“… socialist arguments…”. Capitalism, socialism, communism: all terms from the past, and becoming more and more irrelevant as a new monetary paradigm is developed that reflects abundance instead of scarcity: a monetary policy that serves We, the People, vis-a-vis the financial aristocracy, in the 21st Century and into the future. GOLD STANDARD? REALLY? So, so retro.

LikeLike

“To what advantage is more goods and services if people can’t buy them?” Jeff..

I guess you have not heard of supply and demand? If you have, than you would know that more goods and services means lower prices – for everyone.

You ask how good is it that we have more goods and services if people don’t have the money to buy them with? Well, how good is “more money” if you don’t have anything to buy with it?

Welfare benefits are up 200% in the last 10 years – why hasn’t that helped the poor? Here is a hint: More money will not help the poor, they need more stuff produced first. You should keep an eye in Venezuela, a really good example of what happens when you try to give everyone “free” things and control the market. I’m sure Maduro is having a really good time – till he lasts.

LikeLike

@sucesofinanciero, yes, I have heard of supply and demand, and since I’m not an economist or a student of the financial arts, I’m still not sure which drives which. If there’s limited supply, costs go up, right, and those on limited incomes are disadvantaged. What if there’s an abundance of money? Wouldn’t the demand for goods and services go up?

Oh, and still waiting for your opinion on how going back to the gold standard is going to help us.

LikeLike

PS – @sucesofinanciero, I have been taking in interest in what’s going on in Venezuela, and, apparently, there are significant problems with their economy. In part, I understand, by collapsing demand for their oil, with much of it committed to China to repay loans; another significant amount of oil subsidized to Cuba and their own populace. Reading between the lines, I also suspect that, being pariahs of International Banking, there may be some forces that we are not aware of. Wouldn’t be the first time the World Bank and IMF tried to apply the Washington Solution. But I’ll stay tuned.

In the meantime, does anyone know if Venezuela is monetarily sovereign?

LikeLike

Jeff,

Gold does a few things that fiat/fractional reserve lacks, and it’s not that’s impossible to print. On a gold standard, the amount of credit that an economy can support is very low, since every credit is a claim on a tangible asset. Government bonds are not backed by tangible wealth,and hence are hard to sell. This meanings that the government or the private sector cannot easily issue credit and confiscate wealth via inflation. This means that all the wealth created stays where it should, with the businesses and the laborers.

Another thing that gold does, the most important, is that debt remains minimal between nations – because gold will flow out of the nations with higher deficits, resulting in a reduction of the money supply, decline in domestic prices, and an increase in competitiveness – the opposite would be true for countries with a surplus. It’s a self correcting mechanism – meaning that all jobs could not go to China, or India.

Because of the limited supply, a gold standard is deflationary. 99% of the economists out there are Keynesians and will immediately discard this, stating that deflation is quote bad unquote. I still haven’t found one that could explain how lower prices are “bad” for me or anyone else. I challenge you to find one single economist that can logically explain why deflation is bad.

So again, money stays with those that produce and jobs stay home. I think that solves alot of the issues we have today.

Keep in mind that the US was NOT on a gold standard after 1913, it was on a gold/fractional reserve standard.

LikeLike

Venezuela has 100% complete control of the Bolivar – it’s a monetary sovereign as per Roger’s definition.

1) collapse in oil demand: OPEC prices have remained at around $105 per barrel since August of 2013. World demand is up over 1% year over year. No, it’s not collapse in demand.

2) Why did Venezuela, a monetary sovereign, get a loan from China? Even if their monetary sovereignty couldn’t save them, why not just repay using Bolivars? I’m sure China would be thrilled and probably won’t bomb them (aren’t they communists buddies after all?). Also, if it was a loan – it means Venezuela received the funds before having to pay them – where did the funds go?

3) Washing solution: by that token, why not just blame everything on your own government – while at the same time asking them to give us handouts. Which one is it – is our government good or bad? It’s Venezuela’s issue if they want to continue down the path of self destruction – just to proof (actually disproof is more like it) that communism works. Bunch of morons.

Keep an eye on Venezuela for a sneak peak at what monetary sovereignty can do for us.

LikeLike

The US could not handle a “lower prices” economy. For example, at the end of the year, the best workers would see their wages drop 5% and the less valuable workers would see their wages drop 10%. In theory this would be ok as long as prices dropped by at least 5-10%, but in practice it would be a mess. You can not have consistently dropping prices without consistently dropping wages because total spending equals total income.

LikeLike

Ian,

You are making a huge mistake by thinking in nominal terms. Say nominal wages did drop – so what? If real wages dropped, than I would call that an issue, otherwise – fine by me. As I said, I would rather make 25k a year being able to supply for my family, than making 50k and not being able to.

In the gold standard, productivity would increase more than today – since the producers and laborers would keep the purchasing power. How’s that for an incentive?

The government should increase taxes as the population deems required – I don’t have an issue with taxes. Taxes are the ethical way of charging people for the services the government produces – inflating the money supply is theft and it’s the way it’s done today. It’s another tax, the symptoms are lower purchasing power for businesses and laborers, and all the complains we hear about poverty. And before anyone comes blasting the “but there is no inflation even with the fed printing” line, there is no inflation today because the inflation already happened. The debt/credit bubble popped and the housing crash destroyed a chunk of that debt (money), hence we are not seeing inflation. Credit acts as money, but is easily defaulted on unlike giving people money – which does not.

The government is playing hudiny on the MMT and MS folks and they are eating it up. Austrian know the truth.

LikeLike

“In the gold standard, productivity would increase more than today . . . ”

Which gold standard? The one we were on during the Great Depression? Or the one we were on when the government came close to not being able to pay its bills, during the Nixon administration?

LikeLike

Roger,

Please read my comment. I stated “Keep in mind that the US was NOT on a gold standard after 1913, it was on a gold/fractional reserve standard.”

The US was NOT on a gold standard during the great depression – in fact, what led to the great depression was the Fed’s attempt to forestall a recession and the inflow of gold from Britain in 1927.

There is no way to stop recessions – those who have attempted have created bigger bubbles – as has our government and Fed today. We are close to another slowdown – thanks the Fed and the government for that.

LikeLike

Regards the Nixon issue… was it gold’s fault that the US issued debt on top of the same gold (fraud) to pay for needless wars and social spending?

No sir,

It was fractional reserve lending which allow the Fed to create the credit out of thin air, hand it over to the government – and devalue the people’s purchasing power.

How can anyone pay debts after pledging the same gold over and over and over and over.

Anyone not seeing the issue with fractional reserve and deficit spending – has their eyes closed.

LikeLike

Suces…thanks for providing opposite views to add to the discussion. You have a good blog. You assume that a basic income will cause inflation, but the key driver of inflation is wage inflation. This should be self evident, since the largest cost of production is labor, either by a direct employee or the labor needed to produce the part. It will be hard to generate wage inflation in 2014 with high unemployment and technological advances. If the basic income were high enough, since total income = total spending, the increase inspending would transfer to a rise in wages. I don’t think $500 per person per month is enough to cause significant wage inflation. Let’s start off with that for a year. The basic income can be adjusted after a year.

LikeLike

Actually, the key driver of inflation, for at least the past 56 years, has been oil prices: See: https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/

LikeLike

EBonus =electronic debit card/account. The prescribed value of the card (or any electronic financial transaction) would based on instantaneous market tendencies. In the not too distant future, real time trans financial data will calculate the correct supply/demand relationships resulting in actual market price(s) including any ‘necessary’ inflation , which will be reflected in the price you pay for goods and services at point of sale. This of course will benefit both suppliers, sellers and consumers. Stop living in the dark ages.

LikeLike

Steve;

There was a time when I thought it was a good idea for a retailer to determine the price he wished to sell, but I have decided to “stop living in the dark ages,” as you suggest.

But you have opened my eyes. I see it’s much better to go to the store for a gallon of milk and have my credit card analyze the stock market and the CPI (by some method) and determine for the retailer and for me, what I should pay for that milk.

(I hope it decides the price is so low, that retailer will lose money. It’s the benefit of advancing into the “light ages.”)

LikeLike

We might one day get a basic income (or guaranteed income) if the public applies enough pressure.

Here’s why…

Since the Big Lie is the source of the wealth gap, the rich will do anything to protect the Big Lie, even if it means promoting a world war, promoting world peace, or letting average people have a basic income. Whatever it takes. As long as the rich can maintain the Big Lie, the wealth gap will widen. Hence the rich will make any superficial concession necessary, since it is no concession at all.

This is why the rich can co-opt any social movement. For the rich, nothing matters except the Big Lie, which they maintain at all costs. They are endlessly flexible about everything except the Big Lie, which they are absolutely rigid about, since everything depends on the Lie.

Thus, with enough pressure, the rich would allow a basic income, as long as the masses continued to believe the Big Lie that federal taxes pay for the basic income.

On a more general level, all societies with extreme inequality are based on some Big Lie. Only idiots believe the Lie, yet each idiot considers the believers of all other Big Lies to be idiots.

For example, many past historical societies maintained the Big Lie that their kings ruled by “divine right.” As long as everyone believed this Lie, the king remained in power. All his concessions were merely symbolic, temporary, and superficial, after which the power structures gravitated back into place.

Today, average Americans ridicule this Big Lie (the “divine right of kings”) yet they revere the Big Lie about federal finances. Americans are as stupid as all peoples that came before, yet they consider themselves uniquely brilliant, as did all peoples that came before.

Where there is a Big Lie, there is inequality, and vice-versa. Indeed, the Big Lie and inequality are mutually dependent. They sustain each other. Spanish conquistadores maintained the Big Lie that Native Americans needed to be “saved” (i.e. slaughtered). Many white people long maintained a Big Lie that black people were inferior, in order to maintain the inequality of slavery. In Muslim countries, inequality is maintained by a Big Lie that involves supernatural religion. In Europe the Big Lie is that the euro must be kept at all costs. All Big Lies cause mass suffering and inequality.

Given this, you can instantly tell the general IQ level of any society. If they have equality, then they are intelligent. On the other hnd, if they have great poverty and inequality, then most of them worship some Big Lie that you can expose with a few minutes’ analysis. The Big Lie (whatever it happens to be) causes mass suffering, yet most people would rather die than stop believing it.

By the way, that basic income web page promotes the Anglo-American Big Lie that the federal government needs tax revenue…

“A basic income needs to be funded….The comparatively rich would need to pay both for their own basic income and for much of the basic income of the comparatively poor. This would clearly hold if the funding were through a progressive income tax, but would also hold under a flat tax or even a regressive consumption tax…The relatively rich should contribute more to its funding than the relatively poor.”

Sigh.

LikeLike

@ quatloosx

I agree with the overall intent behind your comment but I have a problem with your history and with some of your terminology. There are ANGLO-SAXON big lies promoted within the Anglosphere (Great Britain, the USA, Canada, Australia & New Zealand). The rest of the world scoffs at such ethnoracially supremacist and arrogant nonsense.

Moreover, the use of racist terminology like “white people” reveals a false understanding of what a human being is. Identifying people by the color of their skin is racist and dehumanizing but very “American”, i.e., very Anglo-Saxon American.

LikeLike

Sorry you don’t like Americans, and you think I’m ANGLO-SAXON, which you also don’t like. You must be a racist to harbor those feelings. Why do you dislike people based on their nationality and ethnicity?

So, now you tell me “white people” is a racist term? I can’t keep up with the latest fad.

People used to be “colored,” but that became racist, so they became “Negro,” but that became racist, so they became “black.”

But “black” became racist so they became African-American (despite the fact that either all people originated in Africa, or many colored, black, Negro, African Americans never set foot in Africa — depending on how far back you go.)

Now “white” is racist, and I assume “Caucasian” also is racist, so today people are “ANGLO-SAXON” (in all-caps, of course). I cannot imagine how you would know any individual is “ANGLO-SAXON,” since that term very specifically refers to certain German tribes (Sorry if “German” is racist).

Henceforth, based on my heritage, I wish to be called “African-European- Asian-Hebrew-American,” and if you call me anything else, you’re racist!

And please try to rid yourself of your racist bigotry toward ANGLO-SAXON Americans.

But wait, isn’t calling someone “racist” a form of racism? Hmmm . . .

LikeLike

The issue is not racism or “white people,” but group-think, and the way that entire groups (in all races) operate according to Big Lies. You missed this central point because you are blinded by your resentment of the term “white people.” You are race-bound, i.e. brainwashed.

For example…

Suppose I said that the Aztec Indians enslaved other tribes, and took captives for human sacrifice. And when the Spanish came, they slaughtered and enslaved the Aztecs and other tribes.

In response, you would not pause to consider how group-think can afflict any race, any time, any place in the world. No, you would become defensive, protesting that the Aztecs were “just as bad.”

The issue is not who is “just as bad.” The issue is group-think. You are a product of group-think, as is evident from your resentment and your getting caught up in side matters.

I could tell you that blacks are as subject to group-think as anyone else, but you wouldn’t hear me, since you only care about retaliating in knee-jerk fashion, along with millions of other people like you.

My concern is group-think, and how it is always based on lies. Slavery and racial genocide are so hideous that only a racist Big Lie can keep them going. The gap between the rich and the rest is so hideous that only a Big Lie can prevent the gap from destroying society.

Almost every society has a Big Lie.” Thus, almost every society suffers from group insanity. This includes societies of “white people.” Because of group insanity, millions of people consider it “normal” to exterminate millions of others. Whites do it to non-whites. Non-whites do it to each other.

A “culture” refers to how people use symbols to classify and represent experiences. The symbols are based on custom, taboos, and lies. Half of every culture is based on lies. Race is merely a side issue.

Your society’s lies are stupid and false.

My society’s lies are sacred and true. They are objective and universal facts, handed down from God. Their common sense is obvious to all. Anyone who questions them is a terrorist.

In the USA, poverty and inequality are “God’s will.” The poor are sinful. The rich are virtuous. The government “cannot spend money it doesn’t have.” And so on. All these lies interlock to maintain social strata and the wealth gap.

Forget racism and “white people.”

The issue is group-think and Big Lies.

LikeLike

” The Big Lie (whatever it happens to be) causes mass suffering, yet most people would rather die than stop believing it.”

Roger Mitchell said, “You are a Monetarily Sovereign nation, with two major assets: The unlimited power to create your own sovereign currency, and the unlimited power to determine your economic fate.

Obviously, you don’t want such a burden. You’d rather be a slave nation. So what do you do? You voluntarily surrender those most valuable assets, and you put your nations fate into the hands of some unelected, foreign bureaucrats called the EU.

Surprise! That hasn’t worked out so well:…”

May I, Justaluckyfool paraphrase:

America ,you are a Monetary Sovereign nation…..

(read above)…SO what do you do ? You give to the Private For Profit Banks the sovereign rights to CREATE SOVEREIGN CURRENCY and the POWER TO TAX that currency giving the PFPBanks unlimited power to determine your fate !

How is that working for you?

The great USA mystery solved. We have lied as printed on our currency:

“In God We Trust” The truth is : “We Now Trust The Private For Profit Banks”.

Where we went wrong is not in establishing a Federal Reserve Bank; it is in : We have destroyed “In God We Trust” and turned that into “In Private For Profit Banks (PFPB) We Trust”.

It was the fear of giving the awesome power to one institution that allowed for legislation to give PFPB the power TO ISSUE and TAX our sovereign currency.

Whom would you now rather trust?

LikeLike

@justaluckyfool, I’m confused. Some of what you write makes sense, yet I’m still having difficulty understanding what you mean. Are you saying the “answer” lies in “God We Trust”?

You write, “It was the fear of giving the awesome power to one institution…”. What institution were we afraid to give that awesome power to? The Federal Govt? A religious institution? Help me out, here.

LikeLike

Thank you for the questions.@Jeff Rudisill and thank you RMM for allowing dialog.

“In God we trust” would mean IMO that mankind by free will ( something God given?) would allow “we the people ” to …

‘ ***** “Believe nothing merely because you have been told it…But whatsoever, after due examination and analysis,you find to be kind, conducive to the good, the benefit,the welfare of all beings – that doctrine believe and cling to,and take it as your guide.”- Buddha’‘

*The world was created with enough wealth for all mankind to maintain a good standard of living. We need only to form better governance.

After due examination If something in a system can cause ‘systemic failure’,wouldn’t you consider that to be such a major problem that because of its awesome capability , that is : Destruction of the entire system that it should be consider perhaps as the cause of , if not all, maybe most problems.

We have legislated self destruction by allowing Private For Profit Banks to issue our sovereign currency and also allowing Private For Profit Banks to tax that issuance. This is their weapon of mass economical and political destruction that allows inequality, injustice and servitude.

We MUST separate our central bank from the private for profit banks.

Excerpt from:

http://realmoneyecon.org/lev2/answers.html

Real Money Economics: The Details and Results.

Real Money Economics proposes to instill hard ethics into the current monetary system and not just prescribe more regulations meant to firm up an internally unstable system. The solution presented only involves 2 fundamental steps outlined below under A. and B..

Trust Banking System

Under this system, banks would be divided into 2 totally separate parts or “windows”, one being the trust depository side and the other the credit side (lending and investments). In effect this could be called “Glass-Steagall on steroids”.

1. Depository or Payment Window

In a Trust Banking System when a normal deposit is made at a bank into the depositor’s account, the funds would continue to belong to the depositor (versus exchanged for an IOU as under the current system) and the bank is simply given instructions by the depositor as to what to do with the money, e.g., when a check is presented for payment, it will be paid. This would all be covered under the standard depository agreement between the bank and the customer. 100% of the depository base will at all times be covered by cash in the vault or deposits at the Fed. The only source of income for a bank from the Depository Window would be fees for services. No deposit creation would exist in this system and thus no new money created by private banks. Further, because all deposits would at all times be fully covered, the needed oversight would be minimized as the system is autonomously stable.

2. Credit or Investment Window

Under the Trust Banking System banks would become true intermediaries (as most think that banks are today) and offer loans and other investment products from those with cash wishing to have it invested. This would be done through the Credit Window of banks but none of the funds under the Depository Window would be available for this purpose. Instead, savers and investors would subscribe to a series of offered mutual funds in say, car loans, or mortgages, or commercial loans of various kinds, and so on. These could be open or close-ended funds as desired with maturities, risk levels, and return levels published by the bank in advance. Thus credit would now be driven by savings rather than the arbitrary increase (or decrease) of high powered money and deposit creation. Savers would again be rewarded for savings and interest rates would be controlled by the market rather than largely by Fed edict and actions as now.”

SO WHY NOT do as Keynes, Minsky, Soddy and many others state:

“Separation of banks from government”

LikeLike

Thanks for the explanation, @justaluckyfool. You’ve added another item on the recipe for a new monetary paradigm to consider. I’ll look more closely at Real Money Economics.

WOW! In the recent past, I’ve discovered MS, MMT, Positive Money, Zarlanga’s AMI theories, Soddy, Ellen Brown, B.I.G, and other monetary reform ideas. Out of all of these ingredients, I’m sure there’s a solution to provide economic freedom for all of humanity.

LikeLike

Just who, specifically, are these “rich” people who are promoting the “Big Lie”? Can you name names?

LikeLike

Most notorious are the Koch brothers and Pete Peterson. Google “conservative think tanks” and you’ll find many more.

LikeLike

@Rodger: Would any democrat or liberal-leaning people make the list? What about George Soros? Any foreigners (not necessarily in the U.S., but in foreign countries, like the U.K, the E.U, Japan, etc., working to undermine their own countries)?

LikeLike

Add to that list the (rest) of the 85 people recently disclosed as owning as much half of the world’s population. I would not be surprised if George Soros and Warren Buffet were on that list, along with Carlos Slim, et al.

LikeLike

A thirty second solution to Job Guarantee.

January 24, 2014

A thirty second solution to (J)ob (G)uarantee.

*WHAT IF THE …The Fed Reserve were to become the CENTRAL BANK WORKING FOR THE PEOPLE (CBWFTP) instead of working for the Private For Profit Banks (PFPB) .

Let’s try this game: Substitute the words “Central Bank Working For The People” (CBWFTP) whereever” Private For Profit Banks” (PFPB) appears.

****PFPB have $100 trillion in assets as mortgages on residential and commercial real property (RE) loans. The average compound interest rate is 4% for a term of 36 years. The PFPB would have created that $100 trillion ‘out of thin air’ which would have an attachment that would require $400 trillion to be paid to the PFPB in order for the loan to be paid in full. YES, take away the smoke and mirrors. Now we must replace (reduce to zero ) the initial loan amount by subtracting $100 trillion; leaving a profit,income,taxation from ‘somewhere else’ of $300 trillion. This amount goes as profits to the PFPB. Revenue they may use for their own selfish purposes.

READ IT AGAIN,

BUT THIS TIME REPLACE “PFPB” WITH “CBWFTP”.

Why would you not want prosperity for yourselves and your children?

Why would you not want $300 trillion turned over to Congress, to be used..“to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defense, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity,…”

The Federal Reserve would purchase all real estate loans and modify them with terms and conditions, these loans shall be assumable at 2% interest for 36 years. The Federal Reserve would also make available $10 trillion for new residential construction. Also up to $50 trillion available for buyers mortgages.Being an American citizen with an income deems that person as ‘creditworthy’. The real asset value is in the completed product and its land value.

IF $72 trillion in loans, that would produce $4 trillion a year in REVENUE from taxation(interest).

How many jobs ?

What if $1trillion per state being available for infrastructure ?

….disaster relief?

….renewable energy?

$2TRILLION a year that that must be distributed via health,education, and welfare programs so that the loans can be paid without causing deflation. $2 TRILLION should be used to create new loans to perpetuate the system.

What would be the unintended consequence ? Perhaps a need for a larger population? Surely there would be more jobs created than available employable ?

We need only to take the advice of Keynes, Minsky, Soddy and many others: Separate the private for profit banking system from government.Have the Fed do for US what they now do for the PFPB !

LikeLike

@justaluckyfool, what you write here makes a lot of sense to me, and reflects some of the questions I have. As I understand MS, the profit to the PFPB doesn’t matter, and that’s what I still don’t grok about MS. I’m having trouble reconciling my understandings that align with Zarlanga’s model at AMI, and what I understand (and believe) about MS.

LikeLike

Actually, it makes zero sense, because after years of reading this blog, just a lucky fool still has no idea what Monetary Sovereignty means. It repeatedly leaves me shaking my head in wonderment.

He said, “Why would you not want $300 trillion turned over to Congress . . .”

The U.S. government is Monetarily Sovereign. It has the unlimited ability to create its sovereign currency, the dollar. Thus the U.S. government (Congress and the President) cannot run short of dollars. Period.

If the government wished to pay a $999 trillion bill tomorrow, it has the power to do so. Turning over $300 trillion to Congress is nonsensical at best, and deliberately ignorant at worst.

That said, I agree and have stated in every post, that there should be no private banks. All banks should be federally owned as there is no public purpose served by privately owned banks.

See: Point #9 in the “Nine Steps to Prosperity.”

LikeLike

What actually makes sense to me is the overall concept of using sovereign money, an asset of the government, therefore an asset of We, the People, for the “general Welfare if its citizens, vis-a-vis, private Banksters.

I wondered why, during the melt-down, if the issue was “bad mortgages”, why give the banks the money? Why not give the money to the mortgage holders, with the caveat that they had to use it to pay their mortgages? The banks would become solvent, and a big social problem would be averted. But I guess the banks had to keep their debt (cake) AND the money to repay that debt (eat it too).

Also, what hew and cry would arise throughout the US if the government nationalized all banks? Wouldn’t it be politically advantageous, at least for now, to allow banks to continue commercial banking but remove their perceived role in creating and controlling money: to Nationalize the Fed’s missions to stabilize money while moderating unemployment; i.e., getting private banks out of the Fed?

LikeLike

I don’t believe the problem is “money” per se. For example, QE added money to the economy, but it had little effect due to the simultaneous removal of an equivalent amount of bonds. I think the problem is more one of wealth than money.

LikeLike

The problem with QE is that it added no dollars to the economy and in fact reduced the amount of interest the government was paying into the private sector.

When the Fed buys a T-bond owned by an individual, all that happens is the individual’s T-bond account is debited and the individual’s checking account is credited by the same amount.

Dollars merely moved from one the individual’s accounts to another of the individual’s accounts.

Not sure how you define “wealth,” but the federal government easily is able to add money to the economy, and that money buys “wealth,” however you define it.

The lack of money translates into the lack of wealth.

LikeLike

Sorry for being confused again. Did/does the monthly QE, as practiced by the Fed, buy EXISTING T-bonds (and T-bills and T-notes?) from individuals, or does it buy newly created T-securities from the Treasury? If the later, wouldn’t that in effect create new money?

LikeLike

It happens to be the former, but it doesn’t make any difference. The purchase of T-securities by any entity, does not create dollars.

The dollars must exist, first. Then, they are moved from checking accounts to T-security accounts.

LikeLike

NEITHER. The FED made a direct purchase of assets (MBSs) and placed those assets on their balance sheet. No new money issued just a transfer from the TBTF balance sheets to the FED balance sheet.

That’s what a Central Bank working for the Private for profit Banks can do-take their poison fruit and eat it.How great is that for the banks?

Yet if this same Central Bank was working for the PEOPLE it could have made the same purchases while not only helping the homeowners but also could have created more than 2 million jobs. If only it had purchased the “Ms” of the MBSs; the actual mortgages that back the banks securities. Then modify those loans and make then so affordable that the housing market would become stabilized and construction and employment would increase.

Krugman (01-25-14),”Jobs and inequality are closely linked if not identical issues.” Perhaps, just maybe, we might some day agree : The

discovery of the possible “systemic failure” of 2008-9 was the inequality, injustice of the monetary system created by the legislated changes that allows “Private For Profit Banks to issue our currency and to tax that currency.”

QE purchase of assets is the Fed making a purchase without spending.

LikeLike

@justaluckyfool, are you saying that QE transactions involve the purchase of Mortgage Backed Securities from the Too Big To Fail banks, and NOT T-securities? Just trying to understand, here. Thanks.

LikeLike

The purchase of T-securities by the Federal Reserve does indeed create dollars, and that’s exactly what QE is designed to do – in order to keep rates low. It’s putting a bid on bonds when the market didn’t (which would have driven up rates). It’s pure manipulation of the markets.

The issue with QE is that although investors are getting a low interest rate, other investors are losing interest income on a loan. Those losing income at this point are the large pension funds and insurance companies that normally invest in bonds.

The Fed has painted itself into an ugly corner here.

LikeLike

“the problem with QE is that it added no dollars”

QE did indeed add dollars and removed bonds. I agree that private sector net worth or “wealth” remained essentially unchanged, which is the important part. And I agree with the point of your post. But your argument would be clearer if you used a term like net worth, wealth or equity instead of “dollars” or “money”.

Dollars don’t necessarily equal wealth.

LikeLike

“Dollars” (as a sovereign currency) do equal wealth. It is guaranteed exchangeable for ANYTHING (of value).Yes, even should $10,000 has an exchange value of 1cent.

All money is wealth;not all wealth is money.

LikeLike

Exactly correct.

LikeLike

Wealth equals assets minus liabilities. Money is one type of asset. Bonds are another. QE was an asset swap that increased the former and reduced the latter.

LikeLike

Although the propaganda from the Fed might make you think dollars were added, in fact dollars were moved, not added.

The T-securities were purchased from private parties who had dollars in T-security accounts at the Federal Reserve bank. When the Fed bought those T-securities, the dollars in T-security accounts were transferred to private checking accounts. No new dollars were created.

Think of it this way: The federal government creates dollars by paying bills in excess of taxes. T-securities are issued in the same amount as as that deficit spending.

Since dollars already were created by spending, T-securities don’t create additional dollars. Otherwise, double dollars would be created;

LikeLike

BUT in the case of QE3 (infinity) the Fed is making an outright purchase of a bank asset that has been created “out of thin air” a security that is backed by bank loans already in existence . In this case, The Fed is not deficit spending, it is not placing new Treasuries on the market. It is taking the “temporary money” made by the TBTF banks off their (banks) balance sheets and putting it on the Feds balance sheets.

Once again I ask what if the FED were to do for the people what they do for the PFPB ? We could overnight create over 5 million jobs by eliminating FICA and making the first $100,000 of income tax exempt.

Do for us what we have allowed PFPB to do. ISSUE OUR CURRENCY AND TAX IT.

LikeLike

The Basic Income Guarantee is specifically NOT a net income that gets reduced by whatever people earn in a job. It is a fixed amount for every man and woman, and in some plans, every child too.

See the latest B.I.G. newsletter, here: http://www.opednews.com/articles/USBIG-NewsFlash-Vol-14-N-by-Karl-Widerquist-130802-882.html

LikeLike

Right. That’s why I never liked the name, “B.I.G.” It’s not an income guarantee. It does nothing to guarantee Bill Gates’s income.

It’s a bonus — an economic bonus. But I guess it’s too late to change after all these years.

LikeLike

Again, I’d like to think of it as a US Citizen’s Dividend, but a rose by any other name, you know… 🙂

LikeLike

Yes to both – it is a citizen’s dividend AND it would guarantee Bill Gates’ income never falls below the Basic amount. The importance of dropping means-testing cannot be over-stated. This means that people will not be discouraged from looking for work, as the EITC does, since any additional income would be 100% additional (minus taxes on that alone – a topic for another thread). It would mean that people would no longer have to work for employers who don’t pay a living wage, just so they could qualify for gov’t benefits to make up the difference. It would mean real, living wage, jobs would have to be offered. It would also mean that volunteer opportunities, or things that people actually WANT to do but which don’t pay well, would not go unstaffed.

LikeLike

PS – it would guarantee that Bill Gate’s income does not fall below the Basic amount, though, right?

LikeLike

I would call your proposal a “Universal Basic Income Guarantee” (or U-BIG) to distinguish it from a means-tested BIG.

I disagree with you about interest rates alone being enough to control inflation, but we have already debated that issue in the past and I won’t beat it to death.

I favor a means-tested BIG, though I think a U-BIG could be made to work acceptably well.

There are pros and cons to both types of BIGs:

MEANS-TESTED: costs far less so there is less inflationary pressure and less need to raise taxes (you think you can control inflation with interest rates alone but I suspect higher taxes would be required to throttle aggregate demand). In any event, high interest rates are effectively a tax and disproportionately hurt certain sectors of the economy, like construction.

During a boom, higher wages and more and better job opportunities would entice people to leave the BIG and enter the job market. During a bust, more people would draw the BIG — so a means-tested BIG would act as an automatic stabilizer (yes, I realize that automatic stabilizers are not needed if wise economists are running the country, but last time I checked that was not the case).

The disadvantage to a means-tested BIG is, as you pointed out, it creates disincentives to accept low paying jobs. The disincentives could be reduced, but not eliminated, by gradually tapering off the BIG. In any event, if the minimum wage is substantially more than a BIG (say $250/week BIG vs. $360/week minimum wage) there would still be a significant financial incentive to work, plus some people simply like to work, plus many minimum wage jobs are performed by teenagers who would not qualify for my means-tested BIG (let us say that you have to be 18 and out of high school to qualify for my means-tested BIG).

UNIVERSAL: simple to administer and “fair.” People don’t view a U-BIG as “welfare” since everyone gets it (everyone is equally “guilty.”)

But does a U-BIG really eliminate the disincentives to accept low paying jobs? I say it does not. Some people would still be tempted to live off the U-BIG rather than do unpleasant, low paying jobs like flip burgers or clean toilets.

A U-BIG would not provide much of an automatic stabilizer (though if wise economists were running the country they could raise the U-BIG during recessions and lower the U-BIG during booms. Last time I checked, our country was not run by wise economists).

And then there is the inflation issue. If there are 200 million adults in America, our theoretical U-BIG would pump roughly an additional $2.4 trillion into the economy each year (maybe less since the U-BIG could replace some existing welfare programs). People would buy more fuel, fuel prices would go up, and your proposed higher interest rates would have little impact on fuel prices. My guess is that we’d have to raise taxes substantially to throttle aggregate demand. I personally am not opposed to raising taxes as long as it is done in a progressive manor, and I think the U-BIG plus higher progressive taxes combo would still work and still benefit the previously-poor, but higher taxes are always a tough sell, politically speaking.

(Note: a U-BIG might not be very inflationary in a small country like Switzerland, since even if everyone in Switzerland doubled their fuel consumption it would barely make a ripple in global fuel consumption.)

Compare that to the cost of a means-tested BIG — we’ll guess that 20 million people draw the means-tested BIG , pumping an additional $240 billion into the economy (maybe less since the means-tested BIG could replace some existing welfare programs). We can probably agree that our weak economy has enough excess capacity to absorb an additional $240 billion without having to raise taxes.

In conclusion, I agree with you that some sort of BIG would be preferable to a “coercive” (Bill Mitchell’s word) Job Guarantee involving dead end minimum wage jobs. I believe that either a U-BIG or a Means-tested BIG could be made to work acceptably well, but I favor a means-tested BIG because little or no tax increase would be needed, and because a means-tested BIG would provide an automatic stabilizer.

Thank you for posting on this subject.

LikeLike

@ Dan Lynch…

Contrary to what most people believe, inflation is a not a product of the supply of money.

Inflation is a product of the ratio between

[a] the supply of money

and

[b] The demand for money, goods, and services

If the ratio remains somewhat constant, such that demand rises with the money supply, then there is little or no inflation.

However, if the money supply falls (as it is now doing because of austerity), but demand remains high, then there is danger of deflation. This puts downward pressure on prices. Unfortunately prices resist this pressure, and remain high, since energy remains expensive, and there are still debts, rents, taxes, and medical bills to pay.

Put another way, when there is severe deflation (i.e. depression) the price of food does not automatically go down. Instead, people simply make do with less food and with fewer consumer goods and services across the board.

Bottom line: the inflation bogeyman is purely imaginary. Massive infusions of money into the US economy would not cause inflation, as long as the money actually got into the economy, and was not siphoned off by the rich. In the latter case there would not be inflation or deflation. There would simply be a further widening of the wealth gap.

Elsewhere you write, “My guess is that we’d have to raise taxes substantially to throttle aggregate demand.”

Why throttle demand? As long as demand and supply are more or less in balance, everything is great.

You write, “I personally am not opposed to raising taxes as long as it is done in a progressive manor…but higher taxes are always a tough sell, politically speaking.”

Do you mean state, county, and municipal taxes, or federal taxes? The federal government has no need or use for tax revenue, and in fact destroys it upon receipt. The FICA tax does not pay for Social Security or Medicare.

Instead of increasing federal taxes, we should lower them, preferably to zero. That would give workers an instant boost in their take-home pay. It would also boost the profits of businesses, since they would not have to pay an equivalent FICA tax for each employee.