Which of the following is a story with a false narrative: “The Boy Who Cried Wolf!” or “Henny Penny announcing, ‘The sky is falling,”or “The CRFB claiming, “Social Security and Medicare will be insolvent”?

Answer: All three are false narratives. The first two are meant to teach children valuable lessons. The third should teach adults a valuable lesson.

That lesson is: Don’t believe the Committee for a Responsible Federal Budget (CRFB) when it howls like a wolf, squawks like a chicken, and pontificates in solemn terms that Social Security and Medicare “trust funds” are running short of dollars.

It’s all lies.

Here is what the CRFB now says:

Trustees: Social Security and Medicare Headed for Insolvency in 13 and 6 Years The Social Security and Medicare Trustees just released their 2022 reports on the financial status of the Social Security and Medicare programs.

The Trustees show that the Social Security and Medicare Hospital Insurance (HI) trust funds rapidly approach insolvency. Their funding imbalances need to be addressed sooner rather than later to prevent across-the-board benefit cuts or abrupt changes to tax or benefit levels.

In effect, the CRFB claims:

1. Social Security and Medicare benefits are paid for by trust funds.

2. These “trust funds” will run short of money.

3. The solution to Medicare or Social Security insolvency requires cutting benefits and/or increasing taxes.

All three are factually FALSE.

1. SOCIAL SECURITY AND MEDICARE BENEFITS ARE PAID FOR BY TRUST FUNDS

Wrong.

To quote from the Peter G. Peterson Foundation website:

Federal trust funds bear little resemblance to their private-sector counterparts, and therefore the name can be misleading.

A private sector “trust fund” implies a secure source of funding.

(A federal trust fund merely tracks inflows and outflows for specific programs. There is no secure source of funding.)

In private-sector trust funds, receipts are deposited, and assets are held and invested by trustees on behalf of the stated beneficiaries.

In a federal trust fund, the receipts — as part of the M2 money supply measure — are destroyed upon receipt. They no longer are part of any money supply measure.

There are no stated beneficiaries, as the criteria for beneficiaries change daily.)

The federal government owns the accounts and can, by changing the law, unilaterally alter the purposes of the accounts and raise or lower collections and expenditures.

The federal government (Congress and the President) can do whatever they wish with the “trust funds”: Add to them, subtract from them, or change them to pay for anything or nothing.

At the click of a computer key or the passage of a law, the balance in any federal “trust fund” could be changed to $100 trillion or $0 or anywhere in between.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

If Congress and the President wished, the Medicare “trust fund” could be changed to pay for Las Vegas vacations, jewelry, Congressional vacations, etc. Almost every year, the federal government arbitrarily changes what Medicare will pay for and how much it will pay.

In fact, that is exactly what the CRFB suggests when it writes about “benefit cuts or abrupt changes to tax or benefit levels.”

In a real “trust fund,” the trustees would not have that control.

2. THESE TRUST FUNDS WILL RUN SHORT OF MONEY

Wrong.

The United States government is unlike state and local governments. It also is unlike euro governments, private businesses, you, and me. The U.S. government uniquely is Monetarily Sovereign. It is sovereign over the United States dollar.

In the 1780’s it created the original dollars from thin air and gave them an arbitrary value. Today, the government continues to create dollars from thin air and continues to provide them with an arbitrary value.

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

The government never unintentionally can run short of its own sovereign currency, the dollar. Even if the federal government didn’t collect a penny in taxes, it could continue spending forever.

This absolute control over the U.S. dollar means no federal government agency can run out of dollars unless Congress and the President will it.

The only way Medicare or Social Security or any other federal agency can run short of dollars is if Congress and the President want them to run short of dollars.

3. THE SOLUTION TO SOCIAL SECURITY AND MEDICARE INSOLVENCY REQUIRES CUTTING BENEFITS OR INCREASING TAXES

Wrong.

Despite all the pretense about fake “trust funds,” Federal taxes (which include FICA) do not fund Medicare or Social Security. Those FICA dollars deducted from your paycheck (but tellingly, not deducted from other sources of income received by the wealthier among us) — those FICA dollars do not pay for anything.

They merely become part of the federal government’s infinite supply, and effectively are destroyed. (You mathematicians know that infinity plus any amount still = infinity. Thus, your tax dollars do not increase the federal government’s supply of dollars by even one cent.)

In fact, with regard to Medicare Part B, there is a wholly different pretense.

While Medicare Part A (pays for hospitals and doctors, Part B pays for clinical research, ambulance services, durable medical equipment, and some drugs. And Medicare recipients are charged extra, above FICA, ostensibly to pay for Part B.

But in reality, those charges, like all dollars coming into the federal government, are destroyed upon receipt.

The solution for Social Security and Medicare insolvencies is simply for the federal government to pay for them, which it could do the same way it pays for everything: By creating new dollars, ad hoc.

So group the warnings about Social Security and Medicare “trust fund” insolvency along with the boy who cried, “wolf” and Henny Penny’s “the sky is falling” as silly, little lies. There are no “trust funds.” Congress and the President have absolute control over all federal agency finances.

All your tax dollars are for naught. The federal government could and should provide free, comprehensive, no-deductible Social Security and Medicare for every man, woman, and child in America.

Continuing with the CRFB’s charade:

The Social Security Trustees estimate the Social Security Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2034 and the Social Security Disability Insurance (SSDI) trust fund will not become depleted within the 75-year projection window for the first time since the 1983 Trustees’ report.

On a combined theoretical basis, assuming revenue is allocated between the trust funds in the years between OASI and SSDI insolvency, Social Security will become insolvent by 2035. Upon insolvency, all beneficiaries will face a 20 percent across-the-board benefit cut, which will grow to 26 percent by 2096.

The Trustees estimate a 75-year actuarial shortfall of 3.42 percent of taxable payroll for Social Security, which is slightly lower than the 2021 report’s estimate of 3.54 percent of payroll, but higher than any other year prior.

And blah, blah, blah. The CRFB substantiates the old saying, “Figures don’t lie, but liars figure,” by providing statistics to make their lies sound factual.

Ooh, it must be true. There even is a graph. Except the graph is phony. The “Trust Fund Exhaustion” is based on the lie that Social Security benefits are paid by the fake “trust fund.” It’s not a trust fund and it pays for nothing. It’s just a record of ins and outs.

And here is another graph of lies:

Same story. The “Trust Fund Exhaustion” is based on a lie. The phony “trust fund” pays for nothing.

Why does the CRFB tell such big lies?

I suppose it’s possible they don’t know they are lying, and that they are providing the misinformation out of economic ignorance.

Actually, I don’t think so. My belief, based on no data, is that they know it’s a lie. If I am correct, why are they lying?

It all comes down to Gap Psychology, the human desire to distance ourselves from lower income/wealth/power people, while coming closer to the higher income/wealth/power people.

Rich is a comparative word, not an absolute. You only can be rich if someone else is poorer. Without the Gaps, no one would be rich. We all would be the same. So, to become richer, you need the Gap below you to widen and/or the Gap above you to narrow.

And that even includes the rich, who want to be richer, which they can accomplish by making the rest of us poorer.

Because the rich control the politicians, it is no coincidence that FICA is deducted from salaries rather than from the investment income that is the major part of the income received by the rich.

And there even is a cap on the income subject to FICA.

And then there are all the tax loopholes available to the rich — you know, those loopholes that made it possible for billionaire Donald Trump to avoid paying any taxes at all in 8 of the past 10 years. (How does it feel to know you’ve paid more taxes than a billionaire?)

Part of the plan by the rich, to widen the Gap below them, is to make you pay unnecessarily for Social Security and Medicare, and not only to pay more, but to have your benefits cut and taxed.

So the CRFB, as a paid mouthpiece for the rich, does everything it can to “prove” you should pay more taxes and receive less in benefits, thereby widening the Gap between you and the rich.

And they have been quite successful. Now that you have seen their phony statistics, here are some real statistics: Inequality is rising. The rich are growing richer; the poor are becoming poorer.

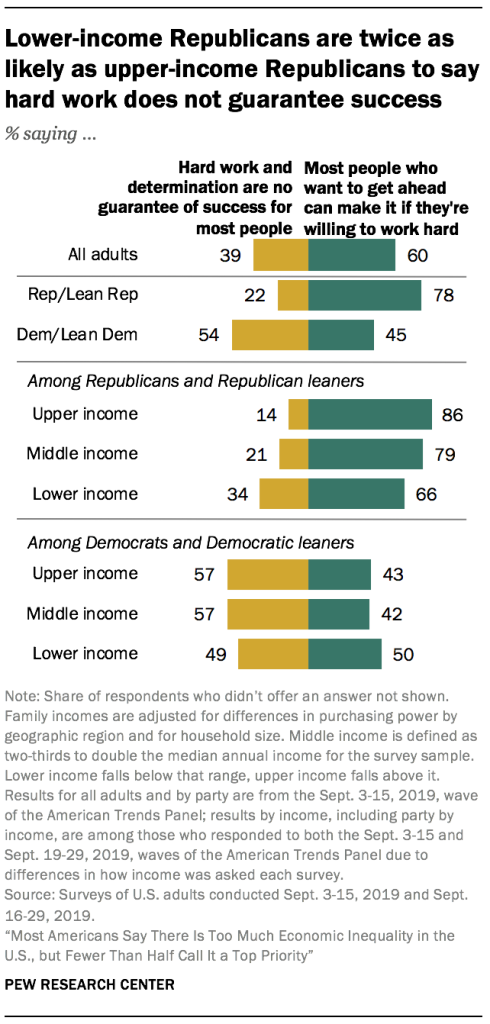

And finally, of the two major political parties, one, the Republicans, tend to believe the poor are poor because they are dumb and lazy, while the rich are rich because they are smart and work hard. Here is one example of that belief:

IN SUMMARY

- The U.S. federal government is Monetarily Sovereign. It never unintentionally can run short of its own sovereign currency, the U.S. dollar. Even if $0 federal taxes were collected, the federal government could continue spending forever.

- Medicare and Social Security, as agencies of the U.S. government, cannot run short of dollars unless that is what Congress and the President want. The federal government funds all its agencies’ pending by creating new dollars, ad hoc. All tax income is destroyed upon receipt.

- The Medicare and Social Security “trust funds” are not trust funds. These fake trust funds do not pay for benefits, but only keep records of dollar inflow and federal spending. As mere record keepers, they neither can be solvent nor become insolvent.

- There is no financial reason to cut Medicare or Social Security benefits or to increase taxes, or even to continue collecting taxes. The federal government funds benefits paid by both programs regardless of tax income.

- “Rich” is a comparative, not an absolute. According to Gap Psychology, people generally wish to widen the income/wealth/power Gaps below and to narrow those Gaps above. The rich can become richer by acquiring more for themselves and/or by forcing those below to acquire less.

- The rich run America by bribing politicians, the media, and economists. To make themselves richer, the rich widen the Gap below by backing false narratives and laws that reduce federal benefits to the poorer while increasing taxes on the poorer.

Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: Ten Steps To Prosperity:

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

Monetary sovereignty would also solve the GUN problem. If everyone has a good income and the future is secure, people will eventually stop shooting each other. Monetary sovereignty would plant the seed of universal consciousness and reduce the need to kill. The news media is preaching making some guns illegal. But the answer is most likely making debt illegal.

LikeLike

Yes, as the saying goes, “Poverty is the mother of crime.” In affluent communities, street crime is close to zero, yet these upper-income people own plenty of guns. Narrowing the Gap would go a long way toward eliminating the shooting problem.

LikeLike

The 99% should be allowed more income. That way the rich would have even more to get their hands on, assuming the 99% would spend it on whatever the rich have to offer… win-win.

LikeLike

Read this article: https://www.vox.com/future-perfect/23141405/violence-crime-cbt-therapy-cash-shootings?utm_medium=email&utm_source=pocket_hits&utm_campaign=POCKET_HITS-EN-RECS-2022_06_06&sponsored=0&position=6&id=66e6e816-3eaf-441c-8f78-fcd72e8fe13b

I may publish a post about it.

LikeLike