Preface: Monetary Sovereignty means just what it says: Being sovereign over your form of money.

The U.S. government is Monetarily Sovereign over its sovereign currency, the U.S. dollar. The federal government created the very first dollars out of thin air.

It continues to create dollars at will. Even without collecting taxes or receiving any other form of income, the federal government can pay any debt denominated in dollars. It never can run short of dollars. It can control the value of the dollar by controlling interest rates.

U.S. cities, counties, and states are monetarily non-sovereign. They have no sovereign currency. Instead, they use the U.S. dollar.

They cannot create dollars at will. They need taxes or other forms of income, in order to pay their debts. They can run short of dollars with which to pay their bills.

England is Monetarily Sovereign over the British pound. Germany is monetarily non-sovereign. It uses the euro, over which it has little control. It can run short of euros and be unable to pay its debts denominated in euros.

Japan and China are Monetarily Sovereign over their currencies. They never can run short. Italy and Greece are monetarily non-sovereign. They use the euro.

For reasons I will explain, Monetarily Sovereign nations pretend they are monetarily non-sovereign.

They pretend to borrow, when they really don’t. They collect taxes, though they have no financial need for income. They strive to export more, though increased importing would be more beneficial.

They allow poverty, though they easily could cure it. And they allow the Gap between the rich and the poor to be excessive, though they easily could cure that, too.

I mention all this because recently I read the following article excerpts:

Quantitative Easing vs. Currency Manipulation

1. In general, countries prefer their currency to be weak because it makes them more competitive on the international trade front.A lower currency makes a countries exports more attractive because they are cheaper on the international market. For example, a weak U.S. dollar makes U.S. car exports less expensive for offshore buyers.

2. Secondly, by boosting exports, a country can use a lower currency to shrink its trade deficit.

3. Finally, a weaker currency alleviates pressure on a country’s sovereign debt obligations.

After issuing offshore debt, a country will make payments, and as these payments are denominated in the offshore currency, a weak local currency effectively decreases these debt payments.

Consider the Monetarily Sovereign United States. It has the unlimited ability to create U.S. dollars.

Exports are a method by which the U.S. sends goods and services, created by the natural assets and labor of its citizens, to a foreign nation, in exchange for dollars.

The article says countries wish to make exports more attractive and shrink their trade deficit. But why?

It’s easy to understand why a monetarily non-sovereign nation, like Portugal for instance, would want to acquire money in exchange for natural assets. To Portugal, which uses the euro, money is in limited supply.

Portugal needs income to pay its bills.

To all nations, natural assets are limited; labor is limited. But to the U.S., dollars are unlimited. The U.S. needs no income to pay its bills.

Why should the U.S. exchange its limited assets to gain an asset of which it has an unlimited supply?

A common answer is that U.S. exports help U.S. businesses grow and profit, and with those profits, pay employees. But the answer is illogical.

“Grow and profit” means to acquire dollars, of which the federal government has an unlimited supply.

The easier and more sensible plan would be for the federal government to do what businesses are designed to do, i.e. provide dollars to employees. This would cost the government nothing (remember that unlimited money supply), and more importantly, no scarce natural resources would be expended.

One such method would be to implement the Ten Steps to Prosperity. (See below.)

The article says,

“A weaker currency alleviates pressure on a country’s sovereign debt obligations.

“After issuing offshore debt, a country will make payments, and as these payments are denominated in the offshore currency, a weak local currency effectively decreases these debt payments.”

The whole idea is illogical and factually wrong.

First, federal so-called “debt” actually is nothing more than deposits into Treasury security accounts. When you “lend” to the federal government, you don’t really lend. You make a deposit into your T-bill, T-note, or T-bond account at the Federal Reserve Bank.

Your dollars remain in your account, gathering interest, until your account matures, at which time your dollars are returned to you. Your dollars never leave your account until maturity.

The exchange rate of those dollars is irrelevant. Whether a dollar is worth one pound, two yen, or three partridges in a pear tree makes no difference. To pay off the misnamed “debt.” the government returns whatever is in your account.

The federal government does not use your dollars, but even if it did, giving you your money back would be no burden on a government that has the unlimited ability to create its own sovereign currency.

Third, making a currency weaker is inflationary because imported goods instantly become more expensive. (Fortunately, the U.S. government has the unlimited ability to strengthen the dollar, simply by increasing interest rates.)

This increases the demand for dollars, which makes them more valuable.

Bottom line:

- Increasing the level of exports does not benefit a Monetarily Sovereign government

- Shrinking the trade deficit similarly does not benefit a Monetarily Sovereign government

- Federal “debt” and federal finances are substantially different from personal (monetarily non-sovereign) debt an finances. Unlike you and me, the Monetarily Sovereign federal government needs no income, can produce dollars at will, can control the value of those dollars, and never can run short of dollars.

Why then does the federal government pretend dollars are scarce to it? Why does it pretend that total deposits in T-security accounts are a burden and a threat? Why the claim that a trade surplus is superior to a trade deficit.

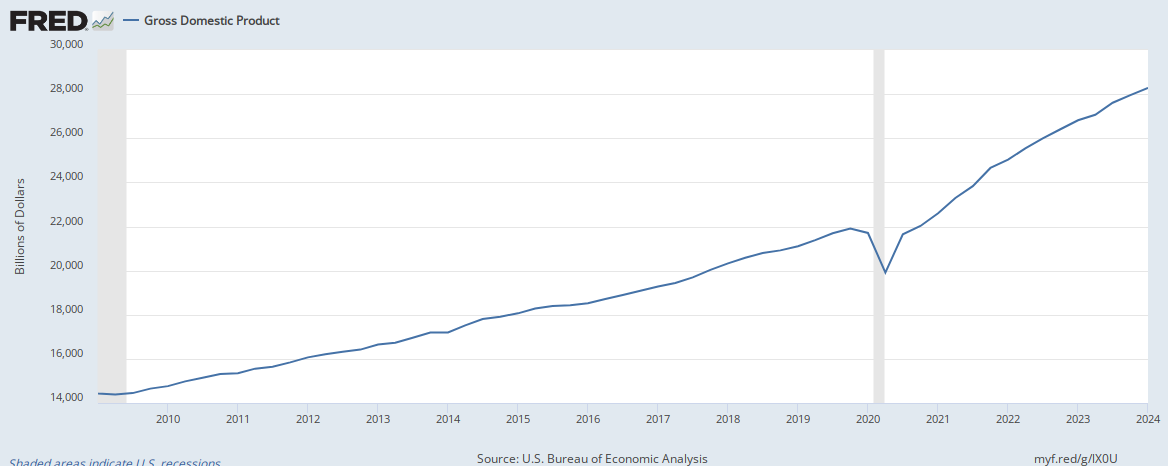

For the past 10 years the U.S. has run persistent trade deficits. During that same period, Gross Domestic Product has risen from $14.5 trillion, to $21.3 trillion, a massive 47% increase.

Clearly, trade deficits have not prevented GDP growth. The reason is that federal deficit spending has more than made up for the dollar loss trade deficits cause.

And that is the whole point and the reason why trade deficits do not harm a Monetarily Sovereign nation. Any dollar loss easily is overcome by federal deficit spending.

The question then is, “Why do nations pretend not to understand Monetary Sovereignty?” Why everywhere you turn, do your information sources — the politicians, the media, the economists — tell you that the federal deficit and debt are so high as to be “ticking time bombs“?

The answer is this: The rich run America.

“Rich” is a comparative word. The farther distant one is from the poor the richer one is.

Owning a million dollars makes one rich if everyone else owns one dollar. Owning a million dollars does not make one rich if everyone else also owns a million dollars.

Being “rich” depends on the Gap between the rich and the rest. To be richer, the rich want to widen the Gap between the rich and the rest. That is called, “Gap Psychology.”

So:

–The rich bribe the politicians via campaign contributions and promises of lucrative employment when their political careers end.

–The rich bribe the media via advertising dollars and via ownership.

–The rich bribe the economists via gifts to their universities and employment in “think tanks.”

The rich do not want you to learn that the federal government has the unlimited ability to provide you with free medical care, free schooling, fine housing, food and clothing, and the other benefits that the rich receive.

The rich don’t want you to know you can have all these benefits, without paying a penny in taxes.

If you understood that you could have a much better life, you naturally would want it. But, that would narrow the Gap between the rich and the rest. And narrowing the Gap would make the rich less rich.

So, in addition to trying to gather more for themselves, the rich also want you to have less, thus widening both sides of the Gap.

We’ll finish with a few excerpts from an article in the TILJournal, a massive exercise in ignorance, demonstrating the point:

The National Debt: America’s Ticking Time Bomb

By D.T. Osborn

Each taxpayer in America owes approximately 250,000 dollars to places including China through its state-controlled institutions of finance. Here comes the worst news of all; 22 trillion is only a small part of the real National Debt.That’s because the official dollar amount does not include America’s unfunded liabilities. Unfunded liabilities are those items the Federal government must pay for by American law.

By far the largest and most significant of these are Social Security, Medicare, and Medicaid. Together they currently total more than 50 trillion dollars. When added to the Debt, the total becomes slightly more than 73 trillion dollars… for the moment.

The final figure also includes items such as Federal pensions for workers and elected officials and interest paid on the Debt. The grand total of America’s real debt is about 130 trillion dollars!

This means each American taxpayer owes over 1 million dollars of the real debt as it exists today. So, what do you say, fellow taxpayer? Got an extra million to chip in for poor old Uncle Sam? Yeah, me neither.

This is a path which will lead to the eventual bankruptcy of America.e

And that lie, that you owe someone over 1 million dollars, is the ridiculous scare tactic being fed to you and the rest of the American public. It wrongly assumes that federal financing is similar to personal financing.

It isn’t.

Personal financing requires a person must have some form of income — salary, interest, borrowing, inheritance, etc. — in order to acquire the dollars with which to pay his bills. That is known as “monetary non-sovereignty.”

By contrast, the federal government is Monetarily Sovereign. It needs no form of income — not even taxes — because it has the unlimited ability to create its own sovereign currency, the U.S. dollar, to pay an infinite number of bills.

Former Federal Reserve Chairman, Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Former Federal Reserve Chairman, Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.

And here, in one sentence, By author D.T. Osborn expresses the big lie the rich want you to believe:

“Any real solution to stave off national insolvency requires massive changes in how unfunded liabilities are handled.”

The rich want the federal government to cut Social Security, cut Medicare, and cut Medicaid, thus widening the Gap between the rich and the rest.

That is how they make themselves richer.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereigntyFacebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve the excessive income/wealth/power Gaps between the richer and the poorer.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Excellent post Rodger, core MS, I will be linking to and quoting from this one for a long time.

Thanks

Alan

LikeLike

Amen.

LikeLike

Private debt in the world is too high. Especially in the western world. No possibility to spend. Would lead to a global financial crisis.

LikeLike

Thanks, Charles.

Do you have any data on that?

LikeLike

The key word here, is PRIVATE debt. THAT is the real elephant in the room, since the private sector is NOT Monetarily Sovereign, and thus can all too easily become insolvent.

LikeLike

To paraphrase a wise man, never expect someone to understand something if their salary depends on them not understanding it. And nowhere is this maxim more true than when oligarchs and their sycophantic lackeys in government pretend not to understand Monetary Sovereignty.

LikeLike