Have you ever been outraged by the work of a bad plumber, a bad carpenter, a bad barber, or a bad surgeon?

Have you ever been outraged when your favorite sports team hired bad players, and your team performed poorly?

Under the “birds-of-a-feather” philosophy, President Donald Trump routinely hires the worst man (or woman) — incompetents and/or criminals — for the job.

Do you remember Michael Flynn, Anthony Scaramucci, Omarosa Newman, Scott Pruitt, John McEntee, Michael Cohen, Paul Manafort, et al?

Trump’s hires seldom benefit America. Their main talent is telling Trump how great he is.

Which brings us to Larry Kudlow, Trump’s Director of the National Economic Council.

We have written about Kudlow in the past, here. He is a perfect Trump appointment, an economist who denies science for the sake of Trump’s politics.

Example:

Washington Post: June, 2018: President Donald Trump’s top economic adviser, Larry Kudlow, said Friday that the federal deficit is “coming down rapidly,” contradicting estimates by nonpartisan analysts, Congress’s official scorekeeper and a branch of the White House.

That was only three months ago. This is now:

Kudlow suggests entitlement reform is coming

CNBC, Jacob Pramuk, Published Tue, 18 Sept 2018Asked Monday if the Trump administration would address “entitlement reform,” White House chief economic advisor Larry Kudlow said it will “probably” look at “larger entitlements” next year.

Entitlement reform generally refers to changes or cuts to large government social programs such as Social Security, Medicare, Medicaid or food stamps.

“I don’t want to be specific, I don’t want to get ahead of our own budgeting, but we’ll get there,” Kudlow said at the Economic Club of New York. “But I agree, we have to be tougher on spending.”

Let’s analyze the above “Kudlowisms”:

First, Kudlow was lying about the deficit coming down. Trump doesn’t like deficits, so obediently, Kudlow denied the facts (a favorite Trump tactic), and made a ridiculous declaration based on the lie (another favorite Trump tactic).

Second, deficit reduction would be harmful to America (yet another favorite Trump tactic). The federal government is uniquie. It is Monetarily Sovereign.

The U.S. federal government never can run short of its own sovereign currency, the U.S. dollar. Thus, there is no financial reason to cut federal deficits.

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills.

By contrast, the U.S. economy requires an influx of dollars in order to grow. So when the federal government runs a deficit it sends some of its infinite supply of growth dollars into the economy.

Without deficit spending, the economy falls into depressions or recessions:

1804-1812: U. S. Federal Debt reduced 48%. Depression began in 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began in 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began in 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began in 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began in 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began in 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began in 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began in 2001.

Deficit dollars are not tax dollars. The federal government, unlike state and local governments, does not spend tax dollars. The federal government spends dollars created, ad hoc, each time the federal government pays a bill.

These growth dollars are absolutely necessary to prevent recessions and depressions.

Third, entitlement “reform” is a euphemism for slashing Social Security, Medicare, Medicaid, food stamps and anything else that benefits the lower- and middle-income groups (still another favorite Trump tactic).

It’s not reform; it’s deform. Cutting deficit spending deforms the economy. There is no financial or economic benefit that comes from being “tougher on spending.”

Your taxes do not fund federal spending, which is why the so-called “debt” is now above $15 trillion. In fact, our Monetarily Sovereign federal government has the power to double federal spending, while cutting taxes in half.

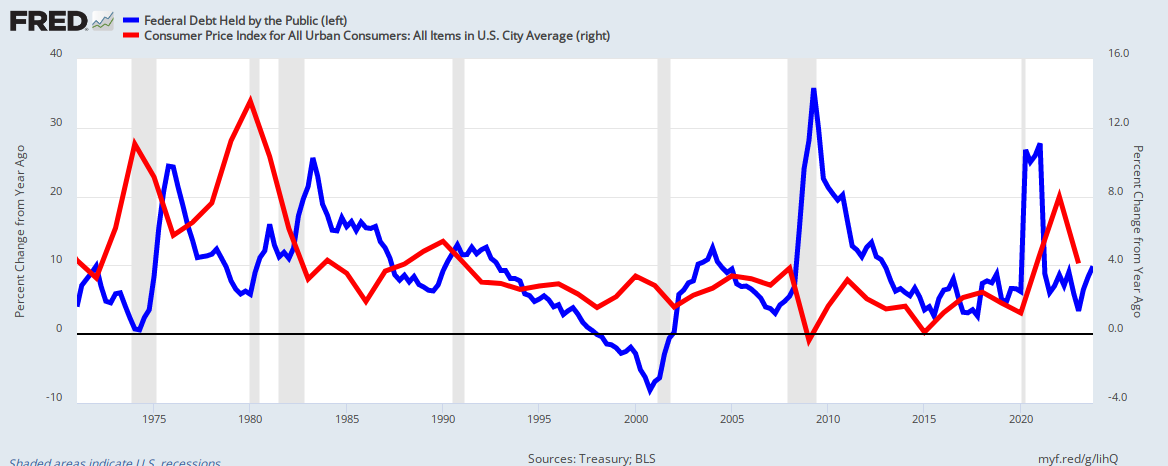

And no, deficits do not cause inflation. There is no relationship between federal deficit spending and inflation:

(If deficits don’t cause inflation, what does? Shortages, most often of food and/or of energy. Because federal deficit spending tends to reduce shortages, there actually is an inverse relationship between deficits and inflation.)

Shielding Social Security and Medicare has always been a winning message for political candidates.

But now, numerous Democrats have sounded alarms about Republicans trimming spending on those programs in order to make up for the estimated $1 trillion or more last year’s GOP tax cuts are projected to add to budget deficits.

Jeff Merkley, a Democratic senator from Oregon and potential 2020 presidential candidate, tweeted that “Social Security and Medicare are on the line” in November’s midterms.

Fourth, there is one reason, and one reason only, to cut Social Security, Medicare, Medicaid, or food stamps: To widen the Gap between the rich and the rest.

The rich, who run America, always want to be richer. One way for the rich to be richer is for the rest of us to be poorer, in short, for the Gap to be wider.

And Trump’s willing lackey, Larry Kudlow, is just the man for the job.

An election is coming. There are only two reasons for you to vote for a Republican:

- You are in the upper 1% income/wealth group, and

- You don’t care what happens to Social Security, Medicare, Medicaid, and other social benefits.

Trump, Kudlow and the rest of the GOP wish to kill your benefits, not for any financial purpose, but rather to please the rich.

Are you outraged?

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. Eliminate FICA2. Federally funded medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Trump Lashes Out Over Lack Of Wall Funding In ‘Ridiculous’ Spending Bill

LikeLike

Federal deficit spending tends to reduce shortages. Also I would add, more importantly, mass production capacity. We have never tested that capacity. If we did, we’d find out that it would be hard to outstrip the supply sector. Maybe that’s why the .1% like keeping spending down in the name of “judicious, conservative frugality.” Shame! on those wasteful spenders.

LikeLike

Larry Kudlow ‘unravels’ after CNN airs video of him saying in February that the coronavirus was ‘contained’

Published: May 3, 2020 at 12:31 p.m. ET

By Shawn Langlois

LikeLike