Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

Way back on June 5, 2005, in a talk at the University of Missouri, Kansas City, I said, “Because of the Euro, no euro nation can control its own money supply. The Euro is the worst economic idea since the recession-era, Smoot-Hawley Tariff. The economies of European nations are doomed by the euro.”

On Thursday, Nov 3 2011, this blog published, “There are two, and only two, long-term solutions for Greece and the other euro nations.” The two solutions were then, and remain today:

For Greece and the other euro nations, long term survival requires one of two, and only two, events:

1. Adopt some form of a sovereign currency, and become Monetarily Sovereign

or

2. The EU give (not lend) euros to its member nations as needed.There are no other solutions. None. All the running in circles by the European financial geniuses will be to no avail. Each day they come up with some new lending plan, and the next day abandon it in favor of some other lending plan.

But none of these plans has any long-term benefit. The euro nations are like rats in a cage, scurrying in all directions, with no hope of freedom. But still they scurry, at top speed.

If you read about any plan that does not include #1 or #2 above, know that it will fail.

One version of solution #2 is a financial merger, a sort of United States of Europe.

In 2011, this blog was awarding dunce caps for economic ignorance. The above-mentioned post went further:

I have been awarding one to five dunce caps for economic ignorance, but now the ignorance has grown so pervasive, with the euro nation leaders and our own Tea/Republican, Democrats, and the media and the columnists and the old-line economists –none of whom admit that what happened in August 1971 completely changed economics — I feel even five dunce caps does not do justice to the universal economic ignorance.

So today, I award 1000 dunce caps to all the self-styled experts, who blather on and on, spouting intuitive economics, but know nothing of the facts Monetary Sovereignty exposes.

The award had a further benefit:

There is a second reason I award 1000 dunce caps: To demonstrate what sovereignty can do. I can create all I wish. I never will run short. I cannot be forced into dunce cap bankruptcy. I don’t have to “live within my means.” I don’t need a balanced budget. I don’t need to tax or borrow dunce caps. I don’t need to be dunce cap prudent. I am dunce cap sovereign.

In that sense I am identical with the United States government which is dollar sovereign. It too can create all the dollars it wishes, never will run short, cannot be forced into bankruptcy, doesn’t have to “live within its means,” doesn’t need a balanced budget, doesn’t need to tax or borrow and doesn’t need to be dollar prudent.

All of this is a prelude to an article I read just today:

Is the End Near for the EU?

Existential Threats And Decisions Approach

by Cliff Wachtel, FX Empire, August 26th, 2014Summary

Existential Threat #1: Unsustainable Debt Loads That Could Destroy The EU Require A Fully Empowered ECB

Existential Threat #2: Undercapitalized Banks Present Systemic Risk To EU, Global Banking. This too requires a fully empowered central bank that can act fast with needed cash

Implications: A United States of Europe is the solution, but apparent lack of political will and popular support for implied loss of member state sovereignty may doom the EU.

Yes, a United States of Europe is one of the two basic solutions, if keeping the euro as a common currency is important. And I suppose it is, because admitting that the euro is a failure would simply be too humiliating for Europe’s leaders and economists.

One can only laugh at the “implied loss of member state sovereignty line.” Loss of member state sovereignty? Really? Perhaps they should have considered that before they began the euro experiment, which by its nature, demands the loss of member state sovereignty.

The article continued:

(Mario Draghi, an Italian banker and economist) mistakenly believed austerity programs imposed on GIIPS nations were necessary and correct . . . they were mistakes.

To avoid a repeat of prior EU sovereign and bank debt crises that would follow from a collapse in confidence in peripheral bonds, the ECB needs to have the power to print money needed to buy all the sovereign bonds necessary to keep market confidence up and rates down, inflation risks be damned.

The key idea is that a common currency means a common supreme legislature and central bank with authority over member state budgets. In other words, a United States of Europe, with member states ceding most of their control over their budgets, and thus, their full sovereignty. This is really the choice behind all the others.

Austerity (i.e. deficit reduction) doesn’t work? Euro creation and financial merger are needed? Well, well. Who’da thunk?

It only took many years of suffering by the not-rich populace, for these revolutionary ideas to begin bubbling to the surface. Of course, the rich love cuts to government spending, because these cuts punish the poor more, and so, widen the Gap between the rich and the rest. And it is the Gap that makes the rich rich and the poor poor.

Anyway, being dunce cap sovereign, I now award 1,000 dunce caps to the European Union, for continuing this charade and punishing your citizenry, all these years:

———-1000———-

Don’t worry folks. I won’t run short of dunce caps, and you won’t have to pay me any dunce caps as taxes. And if you did pay me any dunce caps, I’d simply destroy them. Why would I keep them? I’ll simply create new ones whenever I need them. I’m dunce cap sovereign.

Just like the Monetarily Sovereign U.S. government is dollar sovereign.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

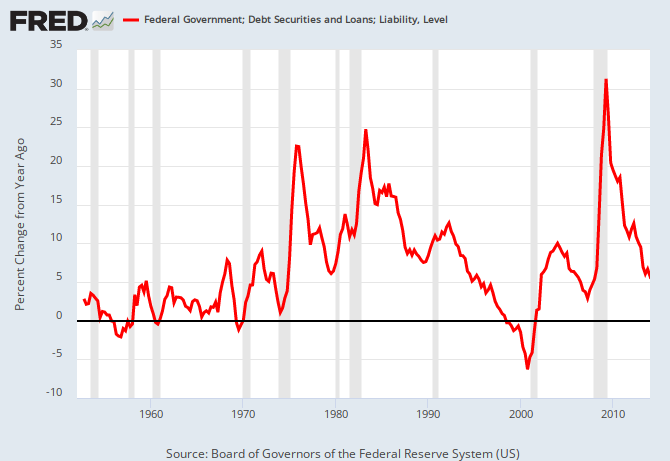

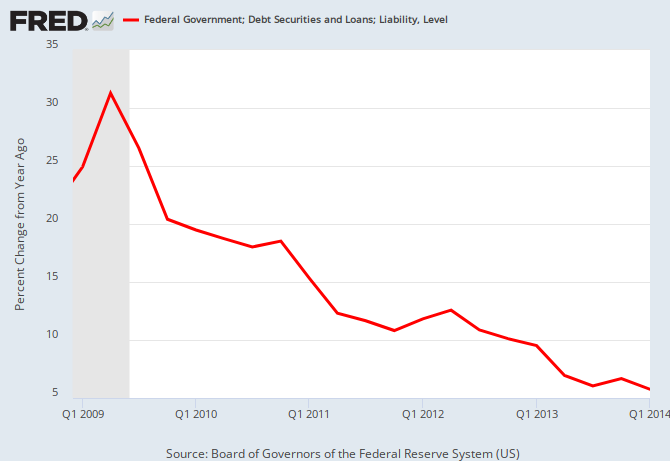

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Hold on Roger,

On September 18, Scotland will vote on a referendum to declare independence from Great Britain. The current debate, if there is a yes vote, is whether or not to keep the British Pound Sterling.

Nevertheless, in the last five months I have traveled though nine European countries. Having a common currency in the Euro does facilitates international travel.

LikeLike

The euro (not just European) nations would be far better off if they were Monetarily Sovereign, and just used the U.S. dollar as their “common currency,” as most of them always had done.

LikeLike

The gap that keeps the rich rich and the poor poor has another face–the gap between understanding and not understanding monetary sovereignty. The more people understand MS the greater will be the likelihood of escape from eternal debt-nation and social detonation. Why? Because once everyone understands the (rich) emperor has no clothes, then, like the tea party seeking and supporting their own people, the politicians who must finally acquiesce to MS, if they want to be elected, will be sought out by like thinking and prodding citizens. These politicians will not need a ton of money like the others; they will be supported by an evolving zeitgeist of MS people tired of all the lies.

The 1% can keep moving the goal post, but the 99% can put a stop to it once it becomes obvious all the thick headed naysayers have NO solution except to continue denying MS, like fist pounding liars who refuse to stop lying and admit they’re wrong.

There is no Easter Bunny and there is no unsustainable debt and no need of poverty. FED Chairman Ben Bernanke said to CBS reporter Scott Pelley ” As long as we can find enough electrons we can find enough money.”

LikeLike