Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

As “austerity,” also known as “deficit reduction,” eats America from the inside, we can look to the euro nations to see our future.

Once Europe was wealthy. Then came the euro, which required each nation to surrender its single, most valuable asset: Their Monetary Sovereignty.

SPAIN faces staggering losses as it accepts the reality of the housing bust

By Matt PhillipsThe size of Spain’s banking crisis required a bigger, politically unpalatable bailout from the European policy makers writing the checks.

It’s a recipe for decades of terrible economic conditions. But that seems to be what Europe is cooking up.

The “unpalatable bailout” includes more loans to a nation unable to pay even its current debts, plus austerity: The American Tea/Republican Party’s guaranteed formula for economic disaster.

FRANCE’s ‘AA’ Hollande pays price for kowtowing to EMU deflation madness

By Ambrose Evans-PritchardFrance’s heroic fiscal squeeze of 1.8pc of GDP last year – in order to comply with EMU demands – was at best self-defeating, and arguably destructive. All France got was a double-dip recession. Some 370,000 people have lost their jobs.

There is a near religious belief in Berlin – evangelised by Brussels, and the EMU gang of five – that any let up in austerity, any recourse to stimulus, let alone a new deal, is a gift to shirkers who want to dodge reform.

The EMU gang of five claims that applying leeches is the way to cure anemia — the same believe the U.S. Congress and the President foist on America.

GREECE‘s debt inspectors back amid austerity anger

Inspectors from Greece’s bailout creditors have restarted talks on spending reforms that the government is resisting, with Greek officials ruling out any further blanket wage and pension cuts.

The sides are at odds over the size of a 2014 budget gap and whether a plan to cover it will require more austerity measures.

Greek officials insist no additional austerity measures can be implemented, arguing they would be unproductive in an economy that is contracting for a sixth year and with unemployment near 28 percent.

Conservative Prime Minister Antonis Samaras late Monday said Greece was fulfilling its bailout commitments and would cover budget gaps without new blanket pay cuts for wage earners and pensioners.

Austerity = pay cuts for the populace. It’s inevitable, because deficit reduction reduces the economy’s money supply. Less money = less business = fewer jobs = less pay = more poverty.

ITALY signals end of eurozone recession

By Mark ThompsonItaly provided further evidence Tuesday that the eurozone’s prolonged recession may already be over, after data showed its economy shrank by (only) 0.2% quarter-over-quarter, confirming the eurozone’s third-biggest economy has now been stuck in recession for two full years — a post-war record.

An easing of the austerity agenda by Italy’s coalition government, including the cancellation of a planned VAT hike and removal of a property tax on first homes, may already be contributing to a recovery in household spending.

For the Eurozone, success is when the economy shrinks less than expected. And while reducing austerity “may contribute to a recovery,” austerity has been implemented as the cure for recession.

While recognizing that reducing austerity “contributes to a recovery,” the leaders maintain that deficit reduction is beneficial.

But, of course, the euro nations, being monetarily non-sovereign,

cannot create money at will, and so are stuck with austerity. By contrast, the U.S. is Monetarily Sovereign, can create dollars at will, and never needs to cut deficits.

Yet we cut deficits, inflicting grievous harm on ourselves, for no good reason.

IRELAND’s economy forecast to grow 1.7 per cent in 2014

Olli Rehn says the European economy has reach a “turning point”, but it is too early to declare victory.Gross public debt as a percentage of GDP is expected to decrease from 124.4 per cent in 2013, to 120.8 per cent in 2014 and to 119.1 per cent in 2015.

Olli Rehn, Commission Vice-President for Economic and Monetary Affairs and the Euro said “There are increasing signs that the European economy has reached a turning point.

(Unemployment is expected to decrease to 12.3 per cent in 2014 and to 11.7 per cent in 2015.)

That 12.3% unemployment is well above the level the U.S. economy reached during the darkest days of the Great Recession. For the euro nations, 12.3% unemployment is a happy “turning point.”

This “turning point” will be short lived, as a money shortage will make economic growth impossible.

CYPRUS reeling 6 months after EU rescue

By Alanna Petroff, September 26, 201325% pay cuts. 40% increase in unemployment.

Six months after Cyprus became the fourth eurozone country to need a bailout, the Mediterranean island’s economy is shrinking rapidly as austerity measures bite, sending unemployment through the roof.

Austerity measures have also been introduced to satisfy bailout conditions, with lawmakers implementing tax hikes and steep salary cuts in the public sector.

“There’s no bright future. Day by day, things get worse.”

The beat goes on. While “austerity,” which is just a synonym for deficit reduction, has ravaged Europe, we in America are subject to — that’s right — austerity.

The question has not been whether to inflict austerity on ourselves, but how much. The Democrats want a little deficit cutting, the Tea/Repulicans want a lot.

Both parties administer repeated doses of the proven-to-be-deadly, deficit-cut poison, while assuring us this will cure our ills.

By definition, a large economy has more money than does a small economy. Therefore, a growing economy requires a growing money supply. QED

The euro nations, being monetarily non-sovereign, do not have a sovereign currency. They cannot create euros at will, so debts are a heavy burden. To survive, long term, they need to acquire euros from beyond their borders.

The only successful euro nations are those with a positive balance of payments. But mathematically, all nations cannot have a positive balance of payments.

The haves take euros from the have-nots. Half of Europe is destined to starve now; the other half destined to starve later.

By contrast, the U.S. is Monetarily Sovereign, so has the unlimited ability to create its sovereign currency, the dollar. Debt never can be a burden.

Because the U.S. cannot run short of dollars, it never needs to ask anyone else for dollars — not you, not me, not China. But, U.S. politicians, media and mainstream professors pretend the U.S. is like the euro nations.

They brainwash the public into believing the U.S. can run short of its sovereign currency. The Tea/Republicans speak of small government, as though the government that provides thousands of benefits to America, actually is a burden on us.

But it is not the government that is a burden. Rather, it is unnecessary taxes — unnecessary because the government can create unlimited dollars — that are the burden.

The Tea/Republicans opt for lower benefits and higher taxes on the middle classes and the poor, so to reduce the deficit (i.e reduce money creation).

It would be easy to ascribe effort to ignorance, and for the American public, that would be true. The public is economically ignorant, relying on its leaders for guidance.

But for the political, media and academic leaders, ignorance is not the problem. They know exactly what they are doing.

The politicians have been bribed by the rich, via political contributions and promises of lucrative employment, later.

The media are owned by the rich.

The universities, and their employees, respond to what their rich donors want.

Because most federal spending benefits the poor more than the rich, it narrows the gap between the rich and the rest. But the rich want the gap widened. It is what makes them rich.

So the rich push America toward the euro disaster, and claim this is prudent.

While the European people drown because of deficit reduction, the American people willingly adopt the same destructive, deficit reduction.

And get angry when you warn them they are marching over a cliff.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

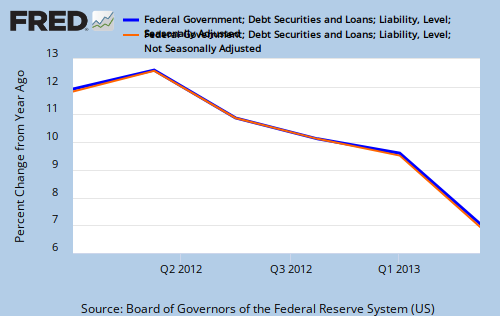

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Great essay, Rodger. Shared.

LikeLike

Thanks, Dan.

LikeLike

Rodger,

You are right.

Austerity is a loser for the American people.

Prosperity is not created by cutting everything.

LikeLike

Agree! Well done, Rodger!

LikeLike

Tea party = Teahadists

LikeLike

Can you quantify what is a good rate of growth for the money supply? Is it 5% or 10% or 15? And why?

LikeLike

Notyellen,

There is no specific number. It’s like asking how many points a basketball team needs.

The money supply needs to grow enough to prevent recessions, i.e. a real GDP growth above 2.5% annually.

LikeLike

I think a basketball game is a very good analogy – just not in the way you are using it.

Even though most teams want to win – they are resigned to the fact that you win some and you lose some. The key is not to win all the games, but to win more than your competitors – and win consistently. You can win a basketball game with either a low score or a high score. In the world, the other players are simply the other countries.

Your position; however, is completely different than the foundations of a basketball game… Your proposal is that there is only one single player (although it’s clear the US competes against other countries) and it should never lose a game. While every player is trying the same medicine (currency weakness/devaluation, supposedly for competitive advantage) for the last decades, could it be that the opposite is what we need to improve the lives of our population relative to the other players?This strategy (currency devaluation) what is it that has caused a lost of over 80% of the dollar’s purchasing power since 1970..

LikeLike

Just visited Pres James Madison’s former home, in Montpelier Station, VA, and got to review some of our Constitutional history again.

The reminder:

Madison was given 400+ books by Jefferson & Franklin, and told to review why ancient republics always failed.

After exhaustive study for 6 months, Madison’s reply was that it wasn’t size, but the inevitable rise of factions in growing populations that doomed their gov’s.

So, they came up with “The Virginai Plan,” to make a novel gov with something having more checks & balances than any Parliamentary system.

Good try, but IMMEDIATELY overtaken by the pace of history. Madison himself immediately became a part of the “Federalist” faction, just to get the Constitution enacted. He then tried to distance himself from political parties.

It was too late. Everything the Constitution tried to implement was immediately cut undermined, by the inevitable push for disconnected people to find NOVEK ways to form factions.

Political gangs undermine the very concept and practice of representative governance and democracy.

Would it help, to redesign our Constitution once again? And maybe outlaw anything except a hierarchy of regional representation …. without political gangs transporting factionalism across state borders?

LikeLike

roger, i’ve heard something like this before, i.e. that those founding fathers who, later on, were elected presidents immediately began using their new-found power to subvert the very Constitution they themselves wrote years earlier.

“…maybe outlaw anything except a hierarchy of regional representation…”

once you have to use the words “hierarchy” and “regional” then you’re talking about “factionalism.”

also, where are you gonna find some, uh, “factional-less” individuals who would presumably be tasked with doing the outlawing?

LikeLike

The only rational thing to do, EVER, Yuu, is to make a suggestion. Of course there’s always more work to be done, to organize on an even larger scale.

That’s the price we pay for living.

It’s a nice problem to have.

Madison et al made a gallant effort to protect their new nation from the disorganizing effects of factionalisim – aka, disorganation.

It’s up to us to take up the challenge where they left off, and add further refinements.

This is like bitching that the methods used to tune an 8-cylinder engine aren’t adequate for a 12 or 16 cylinder engine.

Cry me a river!

Just suggest what methods DO help with the new scale of tuning tasks.

Any more compaints from Yuu? Just place them in the bo marked “whining”

LikeLike

Unethical politicians exist in every single nation, it’s not luck that the US has breezed past other nations and went from an underdog to become the only super power. The country has shifted to a more social-focused policy, as back as the early 1900s. The same proponents of those social policies now blame capitalism and even the constitution for their own failed attempts.

Do we ever stop to think why capitalism/constitution was fairer 30, 50, 80 years ago? Why were real incomes higher? Why were most families able to afford a home, a car, an education, health care and food, even with less technological advances and lower productivity? Why were there less people under the poverty line?

Did the constitution and capitalism decide that it would no longer be fair at a certain point in history after being around for 200 years? If there is anything that has held the political thugs in check it’s the constitution. If as a society, we allow the constitution be changed – we are in for another holocaust.

I find comfort in that there is as much probability of these proponents changing the constitution as pigs flying.

LikeLike

As soon as the Constitution was even discussed, Madison himself presented ~11 Amendments, 9 or so of which became the Bill of Rights.

We’ve had a few more Amendments since. LIfe is warfare, and the rule of warfare is to CONTINUOUSLY increase the quality of distributed decision-making, by continuously upgrading methods as demands increase.

Only Luddites sit still, unchanged, and thereby become extinct.

LikeLike

Not arguing about how many changes the document went through initially. My point above is that, today, the constitution is EXTREMELY hard to change, and it is this way on purpose. It’s not me saying this,see this…

The constitution provides a foundation on which the powers of government rest, a balance of powers, across various institutions. Most importantly, it outlines the rights that the creator (not it says creator, not government) has endowed upon the American people.

Your position is that we should change the constitution to ignore powers across these institutions so that an idea you and a few others see beneficial to pass. I would think the majority would support and push for it if it was.

Before making assumptions, I would suggest thinking of what can go wrong with that scenario. Maybe we will get lucky and get 1000 straight good guys/gals and live will be awesome.. But, perhaps we are not so lucky, like 90% of the world is today, who have to live with their bad leavers and starve or cause a major war (i.e. Venezuela, Cuba). Perhaps Germany’s Hitler would be a good starting point.

This is exactly what the constitution was designed to stop and, although I am not happy with the direction of the country today, I am extremely happy for it.

LikeLike

Agreed that care is needed. Our Founders made serious efforts to improve all they say. If we don’t do OUR best to Select Wisely, someone else will drive Natural Selection for us.

No one said it’s easy. Just saying that there’s no reward for not trying to continuously “make a more perfect union.”

LikeLike

“But the rich want the gap widened. It is what makes them rich.”

You can only stretch a rubber band so far before it breaks. The gap is not infinitely extendable. Even the rich must know this. And without the rest of us how are they to sell their wares; then they too fall. The rich MUST know this is an interconnected system. So I can’t really buy into the idea that the rich want the gap to widen. It is suicidal on a world scale.

I think the rich are simply stuck in a mindset of completely selfish myopia. They don’t see the forest for the trees. In short, they are not at all system-wise or system trained. They are not comprehensive; they are simply monetary specialists.

The trick, if there is one, is to design a model that will assure the 1% of their magnificently high income without destroying the middle class. I.E. bring the bottom/middle up without touching the top.

Given the choice of more gap and total peril OR less gap and keep your high income, the rich will adopt the model that produces the latter. This the nature of the crossroads were arriving at, imo, and MS/MMT will have to be involved in the decision-making because, short of inflation, MS is infinitely extendable.

LikeLike

dunno, tetra–i do think the .001% are “stuck in a mindset of completely selfish myopia.” and i do not see how it could possibly be suicidal for THEM on a world scale.

i fear we are being ushered into a period of permanent austerity and right now they are powerful and technologically advanced enough to maintain control over the world’s population so long as they can maintain a mass media complex sufficiently large enough to distract the public and then get the government(s) to maintain a sufficiently large enough “goon squad” to terrorize those who are not so easily distracted.

LikeLike

Yuu seems sufficiently paranoid, Rodger, I’d say, to always second your pre-eminately brilliant though at times, rant-ringing views…….

LikeLike

tetra, so far that has not proven to be true:

LikeLike

Thanks for the links. You said “so far” but I wonder how much further ‘so far’ can go. So far can only go so far then snap and nobody knows when that’s going to happen. I don’t think it’ll be an all at once snap, but here and there leading to perhaps a critical mass reaction. The economy is after all interconnected, no?

This is my point. The “gap” is anti-interconnection. The system is rubbing against itself.

LikeLike

Rodger,

I missed something somewhere…what’s gini stand for? ( hope it’s not slang for an Italian, which I am 🙂

LikeLike

See: https://mythfighter.com/2013/08/22/welcome-to-slavery-in-america-lincoln-never-imagined-this/

LikeLike

Reasonably good comments from Jamie Galbraith. https://www.youtube.com/watch?v=qD3XMyNmfeY

LikeLike