Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

A message to Mr. & Mrs. Average American:

Folks, admit it. The government and the media and the compliant economists have sold you on the false notion that you, as a taxpayer, pay for federal spending.

(Sure you pay for your city’s spending, and your county’s spending and your state’s spending. But you don’t pay for federal spending.)

And when the federal government receives dollars from the private sector (that’s you), you buy into the silly idea that private sector taxpayers are being paid, rather than understanding that private sector taxpayers actually are paying.

And because you believe in such nonsense, the following article, based totally on bull manure, was designed to make you feel good, although it should make you feel angry, cheated, deceived and conned.

Washington Times

Fannie, Freddie close to paying off taxpayer bailout bill

Treasury reaps revenue from 2 mortgage giants

Ooooh, wonderful. The Treasury, which has the unlimited power to create dollars, is reaping revenue it doesn’t need. Great!

Hmmm, I wonder where those dollars are coming from.

Fannie Mae and Freddie Mac announced Thursday that they will return another $39 billion in dividends to the U.S. Treasury next month, bringing them close to fully repaying the taxpayers who rescued them.

Fannie Mae said it plans an $8.6 billion dividend that will bring its total payments to the Treasury in the past two years to $114 billion — $3 billion shy of its total $117 billion bailout — while Freddie Mac said a payment of $30.4 billion in dividends will more than complete the repayment of its $71 billion bailout.

Do you, as a taxpayer, feel richer now? Have you received your share of that nearly $200 billion?

It would come to about $600 for every man, woman and child in America. Check your mailbox and see if your share has arrived.

Not there? Of course not. Here’s why:

First, consider where Fannie’s and Freddie’s dividends come from. They come from you, the private sector. They are part of your mortgage payment to your bank (which sold your Mortgage to Fannie or Freddie).

Those $200 billion dollars, which were part of America’s money supply, are now being sent to the Treasury, where they no longer will be part of America’s money supply.

So, exactly how does taking dollars from the private sector, and sending them to the Treasury, put dollars in taxpayers’ pockets. Well it doesn’t, of course.

In fact it does the opposite. Those payments from Fannie and Freddie represent dollars taken from taxpayers.

The bought-and-paid-for politicians and the rich-owned media, and the rich-supported university economists all want you to believe government spending costs you money, and taxes (and other dollars going to the Treasury) save you money. That is to convince you the government should spend less and tax you more.

Further dividends from both mortgage giants at the beginning of next year almost certainly will make taxpayers whole and turn their rescue operations into once-unimaginable cash cows for the government.

The bull manure is spread extra thick here. In Washington Post doublespeak, a “cash cow for the government” somehow benefits you, the taxpayer, while in fact it is nothing less than dollars taken from your pocket.

I have some really terrible news for you: You are not the federal government. You are not Monetarily Sovereign. The federal government is, and being Monetarily Sovereign, it creates unlimited dollars at will. The federal government has an infinite supply of dollars.

By contrast, you do not create dollars at will, and when you send your dollars to the Treasury, you get poorer. Are you shocked?

The large dividend payments to be reaped by the Treasury also highlight the important role the two mortgage giants have played in helping to sharply reduce the federal budget deficit in the past year to less than half of its $1.4 trillion peak during the crisis.

We have seen that payments from Fannie and Freddie take dollars from the economy, which hurts the economy. And now we are told (correctly) that those payments reduce the federal deficit.

So, think about it: If the payments hurt the economy and they reduce the deficit, then reducing the deficit must hurt the economy. Bingo!

Yes, that is exactly what reducing the deficit (also known as adding fewer dollars to the economy) does. It causes recessions. It causes depressions. It makes you, the taxpayer, poorer.

And all this time, you’ve been told that reducing the deficit is a good thing, when in fact it’s a bad thing. Now doesn’t that make you feel like a chump?

Only the bailout of General Motors Co. remains as a significant loss for taxpayers, although the Treasury is expected to recoup another big chunk of the $50 billion in funds it paid two of Detroit’s Big Three automakers.

You have just been treated to perfect doublespeak bull manure. Here’s a translation of the above Washington Post sentence:

“Only the bailout of General Motors Co. remains as a significant PROFIT for taxpayers, although the TAXPAYERS are expected to LOSE another big chunk of the $50 billion in funds THE TREASURY paid two of Detroit’s Big Three automakers.”

The mortgage giants owe their profitability to the robust recovery in the housing market and refinancing boom in the past two years, which dramatically lifted sales and prices and sharply increased the fees they earn for packaging individual mortgages into mortgage-backed securities.

Right. Fannie and Freddie earn fees from the private sector (aka “taxpayers”) and give those fees to the Treasury, which has no use for them. The dollars disappear from the economy.

And now, for the cherry on the sundae:

President Obama and congressional leaders all say they want to phase out Fannie and Freddie, and turn over most of their functions to the private sector. But the sizable dividend payments pose a temptation for lawmakers who are still groping for ways to reduce huge budget deficits.

The very rich have bribed Congress (via campaign contributions and promises of lucrative employment later) to widen the gap between the rich and the rest.

The best way to widen the gap is to reduce federal spending (most of which benefits the “rest”) and to increase taxes on the rest (FICA, sales taxes, “broadening the tax base.”)

Those dividends from Fannie and Freddie steal dollars from mortgage holders, which on balance, widens the gap.

That’s why Congress has been reluctant to allow the private sector to earn the dividends Fannie and Freddie now earn.

What will change Congress’s minds? When the rich-owned banks are given the lucrative Fannie and Freddie franchise. When that happens, there will be bad news and good news:

The bad news: The rich will get richer, compared with the rest, i.e. the gap will continue to widen.

The good news: At least the dollars will remain in the economy rather than wastefully going to the Treasury, which destroys them because it has no need for them.

Either way, you have been, and will continue to be, screwed, and all because you believe your tax dollars pay for federal spending.

Oh, and please send me your address. I have some costume jewelry I’d like to sell you.

(Maybe I should put an ad in the Washington Times. You think?)

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

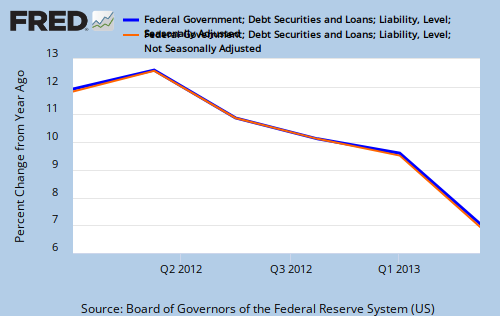

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY