Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

This is a study in contrasts.

The U.S. government invented its sovereign currency, the dollar. It authored from thin air, all the laws that made the dollar possible and continue to make the dollar what it is, today.

With its unlimited ability to change those laws at will, the government has 100% control over the dollar.

The government creates as many dollars as it wishes, simply by paying bills. It destroys as many dollars as it wishes, simply by taxing. It can change its laws to give the dollar any value it wishes, thereby preventing or causing inflation or deflation.

Having given itself these legal powers, the U.S. government does not need to ask anyone for dollars — not you, not me, not China, not Europe, not any banks.

The U.S. government does not need to tax or to borrow dollars. The government is the absolute sovereign over the dollar. There is nothing the U.S. government cannot afford. By its own lawmaking powers, it is Monetarily Sovereign.

In contrast, the dollar is not the State of Vermont’s sovereign currency. Vermont needs to tax and borrow dollars or it could run short of dollars. Vermont has no more control over the dollar than it has over the euro, the yen or the renminbi. All are “alien” currencies for Vermont.

Like you and me and like every busines and every state, county and village in America, Vermont is monetarily non-sovereign.

Which is why the following is both amazing and discouraging:

The Washington Times

Vermont plans launch of ‘universal’ health care system: It’s a ‘right and not a privilege’

By Associated Press(Vermont) has a planned 2017 launch of the nation’s first universal health care system, a sort of modified Medicare-for-all that has long been a dream for many liberals.

The plan is especially ambitious in the current atmosphere surrounding health care in the United States. Republicans in Congress balk at the federal health overhaul years after it was signed into law. States are still negotiating their terms for implementing it.

(The plan) combines universal coverage with new cost controls in an effort to move away from a system in which the more procedures doctors and hospitals perform, the more they get paid, to one in which providers have a set budget to care for a set number of patients.

The result will be health care that’s “a right and not a privilege,” Gov. Peter Shumlin said.

He said he expects a payroll tax to be a main source of funding, giving for the first time a look at how he expects the plan to be paid for.

Think about it. The United States government, having the legal ability to create unlimited dollars and the further ability to give those dollars any value it wishes, does not provide its citizens with universal health care.

But little Vermont, with limited resources, amazingly will try to do just that.

Several times in recent years, hundreds of people have rallied in Montpelier for a campaign advocating that health care is a human right.

Vermont’s small size also is often credited with helping preserve its communitarian spirit. People in its towns know one another and are willing to help in times of need.

Compare that with America at large, where one party leadership, sneers at the poor and sick and uninsured as “leeches” and “sloths” who “always are looking for a handout,” while the other party leadership claims this Monetarily Sovereign nation “cannot afford” to provide health care for its people.

Will Vermont succeed? The problem it faces is money, a huge problem indeed. Universal health care is expensive, and a monetarily non-sovereign’s ability to pay is limited. But the Governor and the people of Vermont are trying, because they recognize their human duty, to care for their fellow citizens.

By contrast, that convoluted, complex, tangled labyrinth known as the Affordable Care Act (nee Heritagecare, nee Romneycare, now Obamacare), covers some people more and some people less, with deductions for all sorts of contingencies — that plan — not Medicare for All — is the best the President of the United States, given unlimited resources, can propose.

Discouraging.

Why are the Americans in Vermont different from Americans as a whole? They aren’t. The difference is in their leadership.

Vermont is led by a group of courageous, compassionate giants, whose primary concern is the well-being of their fellow human beings. America is led by a group of frightened, means-spirited, little people, whose primary concern is their wealthy contributors, their own future incomes and a future Presidential Library.

Would that Governor Peter Shumlin were President, and not that other guy. How great this nation could become.

It’s a study in contrasts.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

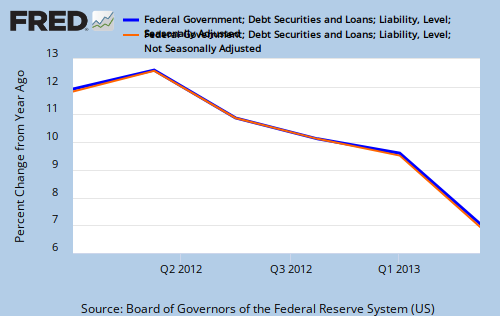

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

If Gov. Shumlin were to be president he would be tooo great a threat to vested interests and would probably suffer the same fate as JFK who wanted nothing to do with Vietnam. The people will vote and the money finds the shooter(s).

LikeLike

totally agree with tetrahedron above.

there’s no way the .001% would allow such a person to become president.

that’s assuming, of course, that he even agrees with the legislation he just signed into law.

i say that, b/c i’ve heard that “romneycare,” which was the supposed inspiration for “obamacare” was not originally something that then-governor romney supported, but it was the democrat-led massachussetts state legislature that forced his hand.

i also heard that obama originally wanted single-payer, but that congress forced him to back off that, as well.

though i understand the point you’re trying to make, i still say that you, rodger, put way too much importance on the president and, in this case, the governor. just as the governor is not the dictator of the state, the president is not the dictator of the country.

neither one of them has the power, unilaterally, to decide whether or not the state or the country gets single-payer. that’s up to the state legislature or congress. if the president or governor wants it, but the legislative body doesn’t, then he doesn’t get it.

if they want it, but he doesn’t, they can always override his veto.

and, of course, if they really don’t like him, they can have him fired.

JFK wanted to make major changes in the US and the world, and though, nominally, he was the most powerful man in the country, if not the world, he still got his brains blown out (literally!) right in front of his wife’s face, on national TV, at high-noon.

LikeLike

“It can change its laws to give the dollar any value it wishes”

Against what standard are you measuring the value of the dollar, and by what laws would it be set? And if this power exists, why has it not been used to stabilize the value of the dollar, which everyone says they want? (Except the Fed, of course, which wants 2% annual inflation, deliberately reducing the dollar’s value by 75% in a person’s lifetime, presumably because they don’t believe they can safely stabilize it.)

LikeLike

Currency exchange value.

Additionally, with interest rate control, the government can affect the demand for dollars, which increases or decreases the value of the dollar.

The value of the dollar is as stable as the government wants it to be. The theory is that 2% inflation stimulates the economy, by making people buy now, rather than later.

It’s as close to deflation as the Fed wishes to come. Deflation is felt to be recessionary, because it makes people delay buying until prices are lower.

LikeLike

So, peg the dollar at 1.3 Euro, or 100 Yen? Or some basket of foreign currencies? That policy gives up the ability to create dollars as needed for the economy. With fixed exchange rates, dollars are created and destroyed as necessary to maintain the peg. Domestic price levels will be determined by fluctuations in those other currencies. Attempts to control inflation with interest rates will be counter-productive. Raising rates to try to control inflation will cause the markets to buy dollars, tending to drive the value up. Issuing more dollars to maintain the peg will only exacerbate the inflation problem.

LikeLike

“Raising rates to try to control inflation will cause the markets to buy dollars, tending to drive the value up.”

Exactly. Think it out. A rising value of the dollar is anti-inflation.

“Issuing more dollars to maintain the peg will only exacerbate the inflation problem.”

While issuing dollars can be inflationary, (It hasn’t been for at least 40 years), that is not how pegs are maintained.

This is not a unique occurrence. Mexico and England both devalued their currencies, as have many other nations.

“That policy gives up the ability to create dollars as needed for the economy.”

I can’t imagine why.

LikeLike

But your policy is to not allow the dollar to rise. When others buy, you must sell. It may be inflationary or not, it depends on how much the others want to buy. Not on how you want to run your economy. But raising interest rates cannot increase the currency exchange value of the dollar (damping inflation) unless you abandon your peg.

How pegs are maintained is by standing offers to buy and sell at fixed prices in unlimited quantity, just like Central Banks maintain interest rates.

Yes, on fixed exchange rate systems there are devaluations. But that means the fixed exchange rate policy has failed. The country cannot maintain the exchange value of its currency while exercising discretion in managing its economy. The quantity of dollars created under fixed exchange rates is determined by the FX market, not by government discretion.

One of the key assumptions underlying MMT’s policy proposals is a floating exchange rate. The willingness to let the currency exchange value freely float is what allows the government to spend and tax as it pleases, and allows its central bank to set whatever interest rate it pleases. If the government constrains itself to a fixed exchange rate, it loses that policy space.

LikeLike

Typically, a revaluation finds a new level, shortly after which the currency again floats. The British pound and the Mexican peso are examples. Both were devalued, and since have floated near the new level.

At any rate, revaluation is an extreme measure, and not the day-to-day method for affecting the value of a currency.

I merely was showing the range of options available to a Monetarily Sovereign government. Monetarily non-sovereign government do not have the power to revalue currencies.

The Fed successfully has used interest rate control to keep inflation in the 2%-3% range.

LikeLike

So, apparently neither England nor Mexico, monetarily sovereign, could “change its laws to give the [pound/peso] any value it wishes”

And following devaluation, the currency does not float, it is pegged at the new level. Devaluation is a concept applicable only to fixed exchange rates, not floating exchange rates.

LikeLike

The people of Vermont obviously can afford to pay for all the health care consumed in Vermont. They are doing it today. Doing it though government only redistributes the cost a little differently. The problem that will arise depends on the details of how the providers are compensated.

People with serious illnesses requiring expensive treatments, such as cancer, or requiring organ transplants, may move to Vermont if they cannot afford insurance premiums and deductibles. Providers who treat such patients may move out of Vermont if the State does not pay enough to cover their costs. Cancer Centers of America probably has a per patient cost that is 100X the average, maybe more. If they are compensated at the average rate, they will close their Vermont facility in a heartbeat and Vermont cancer patients will go elsewhere or go untreated. If they are guaranteed fair compensation, they will open additional facilities in Vermont, attracting more cancer patients, with predictable effects on the State budget.

There are similar dynamics going on now between the US and Canada, and the US and Mexico. Since it is much easier to move between New Hampshire and Vermont than between Canada and Vermont, the effects will be swifter and greater.

LikeLike

“The people of Vermont obviously can afford to pay for all the health care consumed in Vermont.”

Some can; some cannot. But you are correct in the overall. Vermont is monetarily non-sovereign, so yes, all government costs are paid by Taxes and by net Exports.

A Monetarily Sovereign government would not have to charge anyone anything, and could pay providers “fair” compensation.

That is why it is such a pity that the U.S. doesn’t do it, and Vermont feels the need to.

LikeLike

“The Fed successfully has used interest rate control to keep inflation in the 2%-3% range.”

In what universe?

http://stats.bls.gov/cpi/home.htm#data

Since 1914, the average price level each year has been 2-3% higher than the average price level in the previous year just 17 times in 99 tries. Even going back just to 1971, it has happened 12 times in 41 tries, 29%.

The average for 99 years was 3.34% with a standard deviation of 4.89 !!! The low was -10.5%, the high 18%.

Since 1971, after 58 years of practice, they have missed the target by a wider margin, averaging 4.36% inflation, but they are more consistent, the standard deviation is only 2.98 and the range is only -0.4 to 13.5

I suppose since they were successful 17 times your statement is literally true (once would be enough to make it so), but it is not a record to be proud of, and one has to wonder if it is any better than a random occurrence.

LikeLike

This universe:

LikeLike

Looks about the same as the BLS data. 12 for 41, with spectacular failures in both directions.

LikeLike

For the past 30 years, inflation rose above 5% once, and generally was in the 2%-3% range. Some years it rose above, only to fall below. 2.5% seems to be about the median.

Not sure what your point is, but the above graph didn’t happen by accident. The U.S. is a monster economy, affected by an even bigger economy — the world — with all sorts of wars, recessions, inflations, etc., etc. happening.

Given all of that, a median of 2.5% seems pretty good.

LikeLike

No, it was generally outside the 2-3% range. 18 times out of 30. The median was 3.0, average 2.94. And it’s the best 30 years out of the 100 for hitting their target. You couldn’t have cherry-picked any better subset of the data. Maybe they are learning. Or maybe it’s those other things you mention, not the Fed or the laws at all.

LikeLike

Golfer:

You said, “. . . apparently neither England nor Mexico, monetarily sovereign, could ‘change its laws to give the [pound/peso] any value it wishes’”

Actually, in 1949 the British government devalued the pound to exactly $2.80.

Mexico devalued the peso to half its value sometime in the 1990’s (don’t recall the specifics).

Subsequently, the dollar peg for both currencies disappeared and both now float free.

Today a floating dollar is worth .619738 floating pounds and 12.8783 floating pesos.

If you are claiming that governments didn’t use the full power of their Monetary Sovereignty to control the value of their currencies, you are right. Not using the full power of Monetary Sovereignty is the primary complaint of this entire blog.

The U.S. still has debt limits, austerity, FICA, other federal taxes and T-securities. All are evidence that the U.S. leadership does not wish to recognize our Monetary Sovereignty.

Otherwise, we would have no debt limits, no FICA or other federal taxes, and no T-securities — and no one would be talking about Social Security and Medicare running out of dollars.

Keep in mind that a Monetarily Sovereign currency is the sole invention of a sovereign government, created by the laws of that government. By changing its laws, the government can do anything it wishes with the currency.

Tomorrow, if the U.S. government chose, it could make pumpkin seeds the official currency of the nation.

I recall at one time, Mexico had an inflation, so the government arbitrarily stripped three zeros from the peso, and Presto!, they created a nuevo peso. That is something monetarily non-sovereign governments cannot do.

LikeLike

Yes, in 1949 exchange rates were fixed, not floating. Britain devalued the pound, not because $2.80 was the value they wanted, but because they were forced to do so. They could no longer maintain the peg at $5.00, they were running out of dollars and gold to buy pounds with. And there is no law they could have passed that would have maintained the value at $5.00

LikeLike

The Fed’s desire to stimulate the economy at any rate of inflation is, to me, the same as saying ” we are going to rob the poor and exacerbate their (our ) problems.” I’m not an economist but I have to say we need a way to stimulate the economy without inflation. Otherwise it’s legalized theft that can only help the rich who have the wherewithal to take advantage of price increases.

There’s a lot of stuff about the widening gap here. Inflation does just that and should in my opinion be resisted. Any models out there that can successfully enforce the Fed’s mandate to within 0% inflation? Or is inflation = stimul-US (the rich) some sort of universal law of macroeconomics?

LikeLike

The MMT JG (Job Guarantee) would set an anchor price for unskilled labor, which would propagate (plus skill-based differentials) to all labor, and, at least in theory, prevent any persistent increase in the general level of prices.

But there are things outside the control of the market price mechanism, where the law of supply doesn’t work. Two are very important because their cost is an unavoidable part of the cost of nearly everything else: oil and land. Oil’s price is controlled by the Saudis, who are the marginal producer and set the supply curve wherever they like. They’re not making any more land, so that increases in population increase the demand for land with no response on the supply side to contain the price increases. Control of oil is gradually slipping away from the Saudis, but it seems to me that as long as population continues to increase, the general price level will increase as well, because of the need for more and more land that is harder and harder to reach and develop. Water could be another one, if technology doesn’t save us there.

LikeLike