Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Mr. Stephan Faris wrote an article for BloombergBusinesweek titled, “How Poland Became Europe’s Most Dynamic Economy”

First he provided a bit of background for an economic mystery:

With much of Europe still struggling to recover from the impact of the 2008 financial crisis, Poland stands out as an unlikely island of economic success.

In 2009, when the gross domestic product of the European Union contracted by 4.5 percent, Poland was the only country in the union to see its economy grow, by 1.6 percent.

The EU economy as a whole remains smaller than it was at the beginning of 2009 and isn’t expected to recover its losses until the end of next year. In that same period, Poland is projected to enjoy a cumulative growth of more than 16 percent.

Then he provided the reasons for this mystery:

(Poland) has a large internal economy, a business-friendly political class. Its leaders pushed through a set of painful but ultimately effective reforms. The country benefited from an infusion of foreign assistance at the precise moment other EU members were getting clobbered by the financial crisis.

Price controls were lifted, government wages were capped, trade was liberalized, and the Polish currency, the zloty, was made convertible. The policies left millions out of work but freed Poland to begin to recover from decades of mismanagement. The economy got a further boost with the country’s entry into the EU in 2004.

The foundation of Poland’s relative success is not its “business-friendly political class,” the lifting of price controls, the capping of wages or the liberalizing of trade.

The clue to Poland’s success lies that one word: “Zloty.”

Poland kept its own currency, rather than adopting the euro. Poland kept the single most valuable asset any nation can have: It’s Monetary Sovereignty.

“While other countries followed policies of austerity, government spending in Poland actually went up,” says Gavin Rae, a professor at Kozminski University in Warsaw and author of Poland’s Return to Capitalism.”

Bingo! Those “other countries” had to adopt austerity. As monetarily non-sovereign users of the euro, they were unable to create money to pay debt. Poland, being Monetarily Sovereign, had the power to create all the money it needed, at any time.

Poland’s combination of increased spending and tax cuts was half again as large in per capita terms as the U.S.’s $800 billion American Recovery and Reinvestment Act of 2009.

All across Poland, large cities and small towns underwent much-needed makeovers. In addition to new stadiums, everything from rail stations to city squares to airports were upgraded.

Even as subsidies from the EU fueled its growth, Poland has benefited from remaining outside the common currency. Measured in euros, the value of Polish exports dropped 15.5 percent from 2008 to 2009—but in zloty terms it grew 4.4 percent.

When a nation is Monetarily Sovereign, it not only can control its money supply, but also its money value (i.e. inflation). Poland can do what euro users cannot do.

Poland also must address some long-deferred fiscal challenges. The government is pushing up against the constitutional debt limit and is desperate for funds. “They’ve done a lot of creative accounting to keep the deficit down,” says Andrew Kureth, editor-in-chief of the Warsaw Business Journal.

Uh oh! Just as in the U.S., Polish politicians are determined to pull defeat from the jaws of victory. In Poland, as here, the debt hawks fight against the money creation that has grown their economy and is necessary to continue growing their economy.

While Poland was smart enough to keep its sovereign currency, it voluntarily is surrendering some of its Monetary Sovereignty via its own legislation — just as in the U.S.

Growth next year is projected to be 2.5 percent, driven in part by a recovery in parts of the EU, especially Germany, the destination of more than 25 percent of Polish exports.

The EU budget for 2014-2020 was the first in the union’s history that saw cuts in total spending, but the money allocated to Poland rose nonetheless.

Because of a mix of factors—including its size and proximity to Germany, Poland is eligible for €105.8 billion, making it once again the biggest beneficiary among member states.

Let’s think about this. The euro nations suffer because of cuts in government spending, aka “austerity.” Poland grows because it receives money from exports, from the EU and from government spending.

Hmmm . . . What can that mean? Could it mean a growing economy requires a growing supply of money? Could it mean reductions in the money supply are recessive?

Could it mean deficit cutting is absolutely the most stupid thing a Monetarily Sovereign nation ever does?

Yes, it means all of those things.

It’s not clear whether Poland understands the reasons for its relative success. Its limit on government debt casts doubt on its understanding of Monetary Sovereignty. But keeping the zloty gives reason for optimism.

At least Poland has retained the power to increase its money supply dramatically, something Greece, France, Italy et al cannot do.

Contrast that with the U.S. Congress, the Tea Party and all those Americans who claim the finances of our Monetarily Sovereign federal government are the same as the finances of the monetarily non-sovereign states, counties, cities, businesses and people.

American leaders continue struggling to impoverish America by cutting federal deficit spending. Sadly, Polish leaders soon may do the same.

This all boils down to the simplest of all economic equations:

Austerity = Poverty

On wonders how long it will take, and how many examples will be required, before the voting public begins to understand it.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

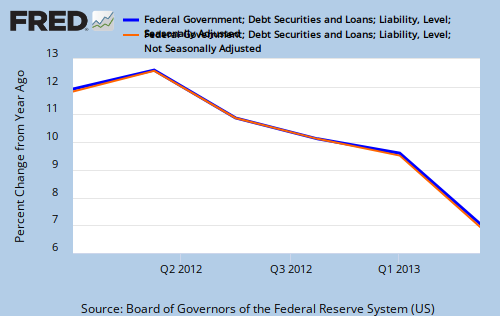

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Very insightful, Rodger! Begs the question how are the 24(?) non-EU European countries faring economically versus the “Union”?

LikeLike

Good question and subject for a bit of research.

The following 23 nations use the euro: Andorra, Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Kosovo, Luxembourg, Malta, Monaco, Montenegro, Netherlands, Portugal, San Marino, Slovakia, Slovenia, Spain, Vatican City

The following 10 nations are in the EU, but do not use the euro: Bulgaria, Czech Republic, Denmark, Hungary, Latvia, Lithuania, Poland, Romania, Sweden, United Kingdom

Meanwhile, just glancing at the larger euro nations, my sense is that only Germany is doing well, and they have grown because of exports, which have been facilitated by low wages to its citizens — a somewhat dubious measure for success.

And such larger nations as Greece, Italy, France, Ireland and Spain seem to be doing poorly.

On the non-euro side, the UK, Poland and Denmark seem to be doing well. Sweden was the weakest of the larger nations, but still growing.

Based on observation, the non-euro nations seem to be doing much better (Who could be a sick as Greece and Spain?), but if you would like to do the research that would be instructive.

A good source is at: http://www.tradingeconomics.com/

LikeLike

Appreciate the reply, Rodger! You’re an astounding analytical resource!

Generous with time and talent. Hope you realize the extent of the effect you’ve already had and continue having on we — ‘The Finally Enlightened’!

LikeLike

Thanks.

Pass the word on Monetary Sovereignty (but be prepared to be called an “idiot.” It comes with the territory.)

LikeLike

Dear Rodger! Classing your disciples as ‘Idiots’ is no way to further our cause! Why haven’t you made a ‘YouTube’, say 3/5 episode series about your MS brain child? If you’re as persuasive in persona as written word, a renaissance in U.S. econ thinking is at stake!

Why not do it? Recall, there’s lots of ways to air your incredible views than this web site!

LikeLike

If recent graduates finding it necessary to move in with parents because housing costs, I’m speaking of rentals not purchasing which is completely out of range except for the already well-off, if very low wages, not sufficient even for the purchase of decent shoes and clothing, is the meaning of a thriving economy, then by all means Poland is a big success story. The above is not B.S. conjecture or propaganda from the mouths of the already wealthy or bureaucratic peddlers of misinformation. It is fact spoken from two young graduate engineers who have recently immigrated and are employed by my company. It’s a story is playing itself out worldwide, whether in so-called monetary sovereigns or non-sovereigns. Poland is not an example of a success story by any means.

LikeLike

Rodger:

Have to agree with Chasfa. What good is rising gdp and a climbing stock market, and housing sales and less unemployment if you still have slums in every city in the world? No economy is a success until poverty is stricken. The glass is still half empty…………. everywhere!

Also agree w/ Dan B about the YouTube thing. MS has to hit the big time where it’ll be noticed as an “interesting new challenging concept” sort of like the 3-D printer and micro-loans and the octa-drone that will be delivering Amazon’s light weight goods in the future (aired on 60 Minutes Dec. 1.) MS has to be presented to the general public. It must go viral and with that it will be argued fiercely and the winner will get his hand raised after the contest.

The best MMT/MS minds will have to be teamed up to take on the resistance that will no doubt come from the status quo power structure who will try to shoot it down with the usual household budget, econ 101 tripe. Good ideas grow; the truth can’t be stopped. MS has to fish or cut bait on the national scene.

LikeLike

On the other hand,A protest by about 300,000 Ukrainians angered by their government’s decision to freeze integration with the West turned violent Sunday, when a group of demonstrators besieged the president’s office and police drove them back with truncheons, tear gas and flash grenades. Dozens of people were injured.

Independence Square, in the biggest show of anger over President Viktor Yanukovych’s refusal to sign a political and economic agreement with the European Union.

Yanukovych has been smarter than 300,000 rioting Ukrainians!

LikeLike