The debt hawks are to economics as the creationists are to biology. Those, who do not understand Monetary Sovereignty, do not understand economics. If you understand the following, simple statement, you are ahead of most economists, politicians and media writers in America: Our government, being Monetarily Sovereign, has the unlimited ability to create the dollars to pay its bills.

==========================================================================================================================================

Some have asked what is the difference between Monetary Sovereignty (MS) and Modern Monetary Theory (MMT). Others use the terms interchangeably.

Actually, while both share many features, there are differences. Both understand that the U.S. federal government is Monetarily Sovereign, while euro nations, and U.S. states counties and cities are monetarily non-sovereign. Monetarily Sovereign governments uniquely:

–Have the unlimited ability to credit bank accounts (pay bills), including their own

–Neither need nor use taxes or borrowed funds to support spending

–Rely on continually increased deficits, rather than on exports, to support economic growth

And, there are additional similarities, related to, and/or derived from, the above.

Two differences should be noted, one not particularly important and one quite important. Of lesser importance: MMT says the purpose of taxes is to create demand for money. The requirement that taxpayers use dollars creates the need for taxpayers to accept dollars as payment for debts.

MS doesn’t deny that taxes help create demand for dollars, though other factors may be sufficient. Perhaps the most important factors are: Dollars are legal tender and dollars are commonly used and accepted by the vast majority of Americans and the world (which does not pay U.S. taxes).

Yet, even were the MMT position to be correct, it is clear that federal taxes are not necessary for demand purposes, as there are adequate state and local taxes, all of which are paid in dollars, making the point moot. After some discussion, I believe MMT now accepts the position that federal taxes are not necessary to create demand for dollars.

The more important difference between MS and MMT is the handling of inflation. MS suggests increasing interest rates when inflation threatens. MMT holds that increasing interest rates exacerbates inflation by increasing costs, and that the correct prevention/cure for inflation is to reduce federal deficits, with higher taxes and/or with reduced federal spending.

MS says:

1. Deficits have not been related to inflation for at least 40 years. Instead, inflation has been related to oil prices. Since deficits have not been the cause, reducing deficits is not the cure.

2. Reduced federal deficits lead to recessions and depressions, meaning the MMT approach leaves a poor choice between inflation and recession, or a very difficult balancing act between the two.

3. Reducing federal deficits cannot be done quickly or incrementally. The questions surrounding which taxes to raise or which spending to cut are slow, difficult, cumbersome and politically charged, as witness the repeated battles over the debt ceiling. Deficit control is ill suited to inflation fighting, which needs fast, incremental action.

4. Interest is a minor cost for most businesses, and an increase in interest rates represents a minuscule increase in business costs – not enough to affect pricing significantly.

5. Money is a commodity, the value of which is determined by supply and demand. Demand is determined by risk and reward. The reward for owning money is interest, so when interest rates increase, investment tends to flow to money (i.e. bonds, CDs, money markets), increasing the value of money. When interest rates fall, investment tends to flow to non-money (stocks, real estate), reducing the value of money. Increased money value is the prevention/cure for inflation.

There isn’t definitive evidence supporting either the MMT or MS position, though there are some hints. There actually is something of a parallel between higher Fed Funds rates and higher inflation, which at first glance might support the MMT position.

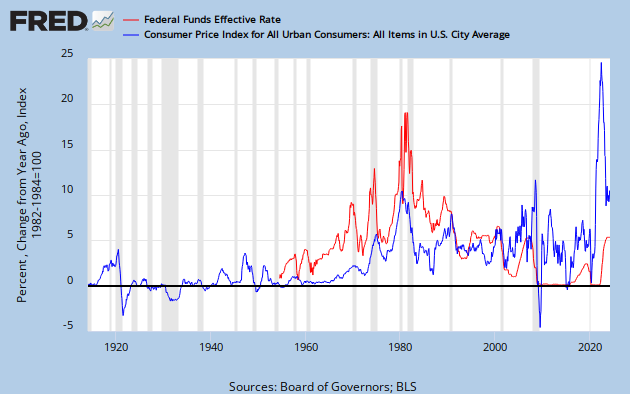

However, because the Fed raises interest rates in anticipation of inflation, this parallel is to be expected. Timing is key. If high rates fight inflation, one would expect to see rates rise as inflation rises, with the highest rates followed by reductions in inflation. The above graph seems to show a Fed raising interest rates in anticipation of inflation, then reducing rates as inflation moderates.

(Unfortunately, the picture is blurred by the Fed’s use of interest rates not just to cure inflation but in a misguided attempt to stimulate the economy.)

In any event, the Fed’s following of the raise-rates-to-prevent/cure-inflation prescription seems to have been successful. Despite massive deficits in the past, particularly during and after the Reagan administration, and despite significant increases in the price of oil (the prime driver for inflation) the Fed has been able to keep inflation close to its 2%-3% annual goal. Tax policy has not been involved.

Though substantial reductions in deficits could cut inflation (by causing recessions or depressions), I’ve encountered no good arguments this would be a wise strategy. Recessions and depressions are a poor solution for inflation.

I do see historical evidence that interest rate control has been an effective means for inflation control.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. It’s been 40 years since the U.S. became Monetarily Sovereign, and neither Congress, nor the President, nor the Fed, nor the vast majority of economists and economics bloggers, nor the preponderance of the media, nor the most famous educational institutions, nor the Nobel committee, nor the International Monetary Fund have yet acquired even the slightest notion of what that means.

Remember that the next time you’re tempted to ask a dopey teenager, “What were you thinking?” He’s liable to respond, “Pretty much what your generation was thinking when it screwed up the economy.”

MONETARY SOVEREIGNTY

When speaking of sector balances, specifically savings and investment, where savings is a drain and investment is an addition, does savings include CDs, bonds and money markets and investment include stocks and real estate? Or is savings strictly T’s and savings accounts?

If the economy overheats, interest rates will compete with a stock market rally. How high can you raise interest rates to match a bear market?

I do see your point about a significant lag in adjusting tax rates and government spending.

The interest rate approach is quicker, but seems to be a tough balancing act as well,

Bear with me, i”m still learning. Thanks!

LikeLike

I see no difference between saving and investing.

You probably mean a “bull” market, and there is no upper limit to interest rates.

Rodger Malcolm Mitchell

LikeLike

I may have extracted a major (probably not) concession from Warren Mosler. In the comments area of his latest blog post, I asked him, “… didn’t high interest rates help to cause the economic boom of the 90s?”

His response: “didn’t hurt!”

What I glean from that is perhaps he newly believes that not all interest rate hikes cause a recession.

LikeLike

I believe Warren thinks interest rate increases cause inflation, not recession. Your question to him could have been, “Didn’t high interest rates help cure the inflation of the late 70’s and 1980?”

Rodger Malcolm Mitchell

LikeLike

In his book, he writes:

“I didn’t see any deflationary consequences from[Volcker’s] ‘tight’ monetary policy. Instead, it was the deregulation of natural gas in 1978 that allowed natural gas prices to rise, and therefore, natural gas wells to be uncapped. U.S. electric utility companies then switched fuels from high-priced oil to what was still lower-priced natural gas. OPEC reacted to this supply response by rapidly cutting production in an attempt to keep prices from falling below $30 per oil barrel. Production was cut by over 15 million barrels a day, but it wasn’t enough, and they drowned in the sea of excess world oil production as electric utilities continued to move to other fuels.”

LikeLike

Tyler, as I often have said, the single most important factor affecting inflation is oil prices. Whether high interest rates helped pull down inflation is a matter of much debate between Warren and me. Warren thinks high interest rates actually cause inflation.

Examine this graph of the period in question. Both high rates and oil prices are working here. The one thing I do not see is high rates causing inflation.

LikeLike

I agree with you, Rodger.

I’d like to see the Fed’s dual mandate abolished and returned to its single mandate of preventing inflation. Bernanke’s record, for all its flaws, has been one of keeping inflation low.

LikeLike

worst possible thing for budding social movement teams to do?

Divide & conquer yourself … without waiting for divide & conquer strategies from orthodox opponents.

It’s called policy & political suicide.

Audiences ignore teams that argue in public, and turn on one another.

First rule of social species …. “Support your collaborators in public (and argue strategy details in private)”

LikeLike

Where is “in private”?

LikeLike

Every single 1% increase in interest rates brings about over $100 Billion in new fiscal spending through the interest spending channel. If securities outstanding were $30 Trillion than it would more than $200 Billion in new spending.

The effects of interest rate increases are dependent on the outstanding level of interest bearing Govt securities and thus fiscal policy.

In other words, there can be no one rule of thumb that governs interest rate and inflation interactions since its all interdependent.

RMM, Zimbabwe had 900% interest rates and still hyperinflation. Are you saying that they simply needed to have 1800% interest rates to stop the inflation?

LikeLike

Timing is the key.

LikeLike

that is not an answer. Your entire position wrt inflation and interest rates is suspect due to this debt level dynamic, and your answer is “timing is the key”?

LikeLike

I meant for you to read the paragraph that including, “Timing is key.”

Anyway, you say my position is suspect because Zimbabwe had hyperinflation and high interest rates?? No other evidence counts? Just Zimbabwe?

You forgot Weimar Republic and Argentina, the other two nations endlessly mentioned by MS deniers.

And by the way, what do you think my position is?

LikeLike

clearly, your position is that interest rate increases stop inflation. Which in turn means you believe that higher interest rates are a more powerful deflationary force than the inflation inherent in the increases in fiscal spending that results from higher interest rates.

Problem is the inflationary force of a given interest rate increase is dependent on the level of outstanding securities. Something your position ignores completely.

What are the fiscal differences between a 5% increase in interest rates when securities outstanding are 10% of current GDP ($1.5T) vs 100% ($15T)?

LikeLike

Auburn,

Increasing interest rates increases the Demand for, and thus the Value of, the dollar.

This mitigates against inflation. Because inflation is a complex phenomenon, the amount of mitigation depends on many factors.

For the past 40 years, the most important factor has been the price of oil, which itself is a complex phenomenon, depending on several factors — Supply, Demand and fiat determination.

LikeLike

“Increasing interest rates increases the Demand for, and thus the Value of, the dollar.”

Increasing interest rates increases the # of Dollars, thus lowering the Value of, the dollar

“This mitigates against inflation. Because inflation is a complex phenomenon, the amount of mitigation depends on many factors.”

This mitigates against deflation. Because deflation is a complex phenomenon, the amount of mitigation depends on many factors (like the deflationary force of increasing the “value” of a dollar)

“For the past 40 years, the most important factor has been the price of oil, which itself is a complex phenomenon, depending on several factors — Supply, Demand and fiat determination.”

Exactly. And yet you still think interest rate increases are the way to combat inflation even though there is no relevant historical data that confirms this view.

LikeLike

It is true, to a very slight extent, that increasing interest rates increases the number of dollars, by requiring the government to pay more interest. However the effect is quite small compared with the increase in Demand.

Lowering interest rates weakens a currency, which mitigates against deflation, and in fact, is one way nations use to combat deflation.

It’s well accepted in economics that increasing interest rates “strengthens” (i.e. increases the exchange value) of a currency. Arguing against that is arguing against accepted economics, which would require that you provide contrary evidence.

It’s the method the fed successfully has used to control inflation to its target rate for the past 40 years, and beyond. You might wish to read the above post.

LikeLike

Hi Mr. Mitchell

I’d like to go back to the other point of disagreement:

“Yet, even were the MMT position to be correct, it is clear that federal taxes are not necessary for demand purposes, as there are adequate state and local taxes, all of which are paid in dollars, making the point moot. After some discussion, I believe MMT now accepts the position that federal taxes are not necessary to create demand for dollars.”

I don’t think you are saying that state and local taxes act as a proxy for federal taxes (if federal taxation did not exist)–this is just delegation …

I have only been able to find this from the MMT folks:

Click to access wp_778.pdf

see bottom of pg 9 and pg 10 (adobe pg 10 and 11):

“… But to be clear, MMT does not argue that taxes are necessary to drive a currency or money—critics conflate the logical argument that taxes are sufficient by jumping to the conclusion that MMT believes there can be no other possibility. In truth, MMT is agnostic as it waits for a logical argument or historical evidence in support of the belief of critics that there is an alternative to taxes (and other obligations). We have not seen any plausible

alternative. …”

Are there other MMT sources you can cite who have stated that federal taxation is not necessary to create demand for dollars?

Thanks very much.

LikeLike

In discussions with Randy and with Warren Mosler, they have acknowledged that state and local taxes would be sufficient to drive demand.

Although I question whether any taxes are necessary to drive demand for dollars, I don’t take a strong position on this, mostly because I think the point is moot. It’s an argument without evidence and without a point.

Yes, I imagine there are Americans who don’t pay taxes, but still want dollars, but this isn’t proof.

I do take a strong position that federal taxes are unnecessary, because the monetarily non-sovereign needs of states and local governments require taxes.

Therefore (and this is the point), the i>federal government could eliminate all federal taxes, and not fear that demand for dollars would disappear.

On a practical basis, this means the federal government could, and should, reduce taxes while increasing spending, particularly on programs that benefit the 99.9% income/power groups — up to the point where interest rate control is insufficient to control inflation.

LikeLike

Here in Australia, the conservative federal government, as part of the process of trying to sell it’s austerity budget, has suggested that the Australian states be allowed to levy their own taxes directly. (States currently receive constitutionally forced grants from the federal government, which I believe is a better system:

http://en.wikipedia.org/wiki/South_Australia_v_Commonwealth

)

I would view the return of state taxation as a disaster here and the start of an internal race to the bottom,

Coming back to your point, I like to think of it as follows: whether states tax directly (like the USA) or indirectly (like Australia), they act as proxies for federal taxation, when the federal government is not imposing it’s own tax.

I agree that the currency would become useless without taxation imposed by some governmental entity within a country’s sovereign borders.

I also agree with you that the federal government should reduce taxation on the 99.9% and increase expenditure. The point of constitutional government is to broadly advance civilization, not to curtail it.

LikeLike

Good article overall. I would point out one caveat though. Inflation is a two-headed dragon, and interest is a razor-sharp, double-edged sword that can both increase and decrease inflation, depending on which KIND of inflation. If the inflation is of the textbook “demand-pull” variety, then yes, the classic inflation-fighting effect of raising rates (at least if raised higher than the inflation rate so the “real cost of money” is positive) would predominate, even if only by choking the flow of money to slow its velocity. But if the inflation (or anticipation thereof) is of the “cost-push” variety (such as increased costs caused by a sharp increase in oil prices, or perhaps a significant sales tax or VAT hike), then raising interest rates is like pouring gasoline on a fire since increased borrowing (and fuel, tax, and other) costs faced by businesses ultimately get passed onto consumers in the form of higher prices. So MMT and MS can both be correct. Caveat lector.

As for recessions, 10 out of the past 11 recessions were preceded by a sharp increase in oil prices. And 11 out of 11 were preceded by a sharp increase in interest rates. Coincidence? Probably not. But again, there is also the *effective* money supply to consider as well: all 11 or the past 11 recessions, and in fact, basically every recession and depression in history, was preceded by fiscal tightening as well (i.e. sharp and significant deficit reduction, or in the case of depressions, fiscal surpluses), which of course shrinks the *effective* money supply more than just about anything the FERAL Reserve can typically do.

Of course, the Great Depression was preceded by a sharp tightening of both fiscal and monetary policy (budget surpluses and high interest rates), and that tightness persisted which deepened and prolonged the Depression causing totally unnecessary pain to so many people. That is, until we got off the gold standard and devalued the dollar, cut interest rates, and ran deficits again from 1933-1936. And the Recession of 1937 was caused by a premature tightening of both fiscal and monetary policy as well, which killed off the fairly decent recovery until WWII broke out and we began running very high deficits again.

What has been occurring since the end of 2015, and especially since the start of 2017, has been an increase in deficit spending *and* and increase in interest rates. This is the first time in decades that fiscal and monetary policy have moved in opposite directions at the same time. And even though interest rates are relatively low by historical standards, the “natural” or “neutral” rate of interest is also much lower nowadays as well (due to “secular stagnation”, which the Economic Policy Institute defines as “a chronic shortage of aggregate demand constraining economic growth”), and the FERAL Reserve is also doing “quantitative tightening” (QT), the opposite of QE, which makes monetary policy even tighter still than the nominal interest rate would suggest. And now oil prices are also rising as we speak. Two factors in one direction and one factor in the opposite direction–which will win out is the question?

LikeLike