If you are a hammer, every problem is a nail, and if you are a banker, every problem is a monetary problem.

In a series of papers and speeches in the early millennium years ( 2011, Causes, Consequences, and Our Economic Future), Federal Reserve Governor Ben Bernanke outlined what the Fed might do when faced with near-zero interest rates.

A distinguished historian of the Great Depression, Dr. Bernanke’s main concern was to ensure that ‘it’ never happened again, and the critical element of his program was to avert a repeat of the damaging deflation of the early 1930s.

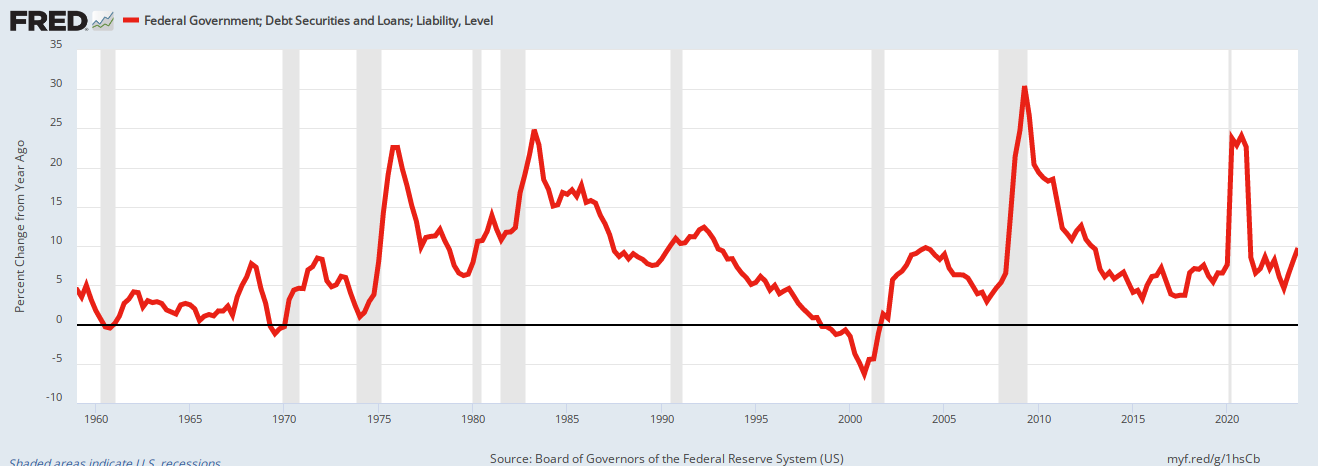

We’ll interrupt Martin Hutchinson’s paper by reminding you that almost every recession and depression in U.S. history has been associated with reduced federal deficit spending.

These recessions and depressions were cured by increased federal deficit spending.

We have depressions when the federal government takes dollars from the economy (i.e., runs a surplus).

Fact: U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

The way to keep recessions and depressions from happening again is continually to increase federal deficit spending on domestic goods and services, which grows the economy.

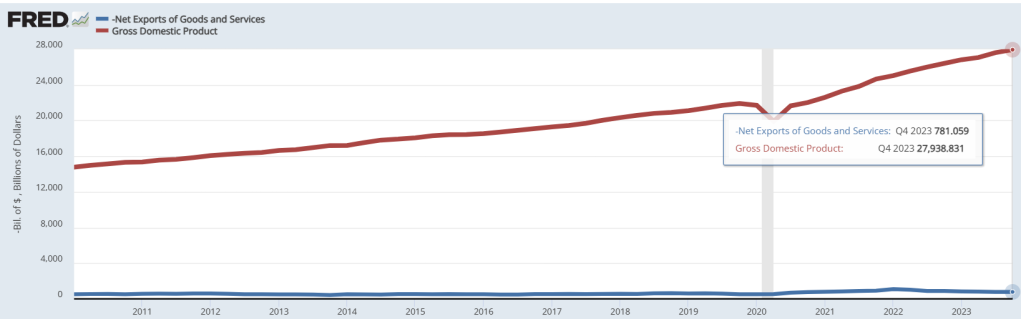

GDP = Federal Spending + Nonfederal Spending + Net Exports

The policies themselves boil down to the Fed throwing everything it has into a desperate battle to avert falling prices – an attack on deflation.

With the specter of looming deflation, they also suggest that this is not a time to worry about inflation. To quote one eminent authority, using another evocative analogy, “Fear of inflation, when viewed in the context of a possible global depression, is like worrying about getting the measles when one is in danger of getting the plague.”

New conventional wisdom has thus evolved, which maintains that the current major threat is deflation rather than inflation and insists that this threat must be countered by all possible means.

Keep in mind that the paper was written in 2011.

On the contrary, we would argue that this view and its associated policies are fundamentally misconceived; they are also irresponsible and potentially highly dangerous.

First, they miss the main point as a response to the crisis (and to avert worse to come). Resolving the crisis does not require ‘stimulus’ – fiscal or monetary; nor does it require bailouts or near-zero interest rates.

Instead, the crisis can only be resolved by an appropriately radical restructuring of the balance sheets of the major financial institutions.

There it is, the hammer/nail analogy. The author believes deflation is caused by something lacking in major financial institutions’ balance sheets.

Think about it. Deflation is falling prices. What makes prices fall? It’s not “major financial institution balance sheets.” It’s reduced overall demand for goods and services.

And what reduces the overall demand for goods and services? Lack of money.

Deflation is the opposite of inflation, and what causes inflation? What causes the price of anything to rise? Supply that is less than demand for that thing.

What causes all prices to rise. More less supply than demand for critical products, notably oil and/or food.

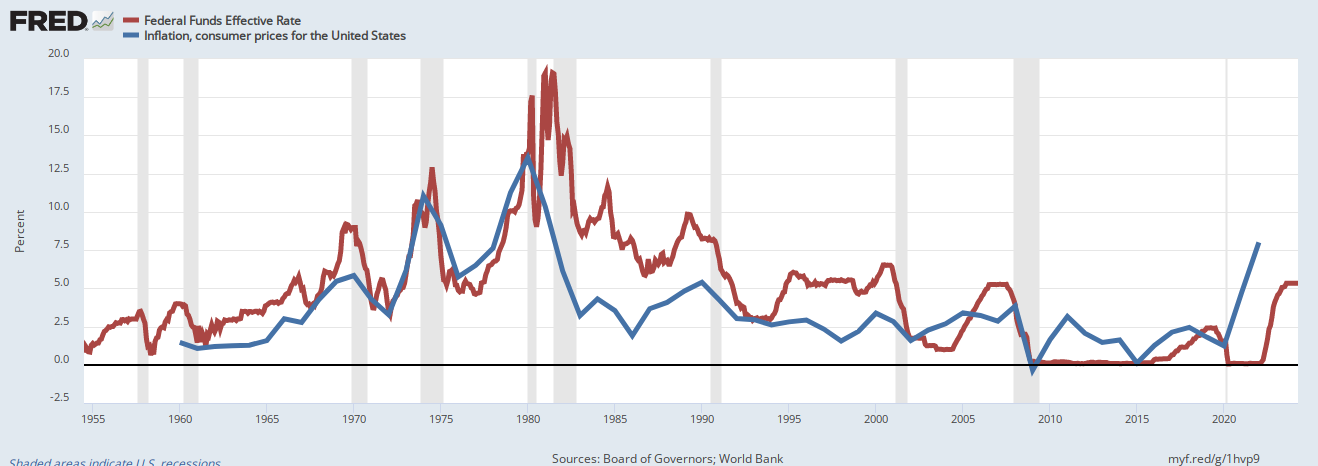

Increases in oil prices are driven by oil scarcity, which parallels inflation.

If you want to know inflation, don’t refer to “major financial institution balance sheets.” Refer to oil prices. (Oil prices, and to a lesser degree, food prices = inflation.) Notice anything missing from that equation?

Interest rates.

The Fed raised interest rates to fight inflation. The theory is that raising interest rates “cools” the economy by — by doing what? By making things more expensive.

Houses, cars, transportation- every industry- sees increased costs from higher interest rates, which are passed on to consumers.

Strangely, the Fed (and most economists, politicians, and the media) believe that making things more expensive by raising interest rates is an excellent way to fight inflation. Does that make any sense?

In essence, the Fed tries to cure anemia by applying leeches.

Yes, raising interest rates increases the exchange value of the U.S. dollar because people need dollars to purchase U.S. bonds, notes, and bills. So, as interest rates rise, the demand for dollars increases.

But that primarily affects imports and exports — making imports cheaper.

However, net imports (blue line, calculated as the inverse of net exports) are only a tiny fraction of our economy (GDP – red line).

Thus, on balance, raising interest rates increases prices. The Fed does exactly the wrong thing in its fight against inflation.

Not only is there an obvious and present danger of returning inflation, but there is also a genuine danger that the Federal Reserve will become insolvent and victim of its own policy failures.

Here, the author displays an astounding ignorance of Monetary Sovereignty.

It is impossible for any agency of the U.S. federal government, including the Federal Reserve, to become insolvent unless, for some reason, that is what Congress and the President want.

Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

These words should be embedded into the brains of every economist, politician, and media writer: “WE SIMPLY USE THE COMPUTER TO MARK UP THE SIZE OF THE ACCOUNT.”

That is how the federal government creates dollars, which is why the federal government has the infinite ability to create dollars to pay its obligations.

There is no limit on the computer. Send the federal government with a $100 invoice or a $100 trillion invoice, and both could be paid instantly, simply by “using the computer to mark up the account.”

The failure to understand this fact has caused most of the world’s financial problems: Hunger, homelessness, lack of health care, lack of education, poor infrastructure, and delays in scientific innovation. The list goes on and on.

There are so many things the federal government could but doesn’t pay for because of the mistaken belief in unaffordability.

(Since 2006, we have had) an ‘accommodating’ monetary policy and this interpretation has been confirmed by strongly negative interest rates since the summer of 2008.

In the short term, this monetary growth will likely have a limited impact on inflation while the economy remains in deep recession with substantial under-utilization of resources.

Near zero (negative real) interest rates continued well after the “deep recession,” and there was still no inflation. The reason can be seen in the oil/inflation graph above.

However, once credit markets begin to ease and confidence returns, monetary velocity will return to normal levels, possibly quite rapidly. We should expect inflation to rise again and perhaps proliferate when this happens.

We didn’t have high inflation because oil was not in short supply. We had inflation only when COVID made oil (and scores of other products and services) scarce.

As always, the bankers view inflation as a monetary problem and wish to apply monetary solutions. But inflation is a goods and services supply problem which requires a goods and services supply solution.

In 1979, there will come a point where the existing policies will be seen to have failed, and the Fed will reluctantly reverse policy – presumably under a new Chairman. The Fed will then sharply raise interest rates and force monetary growth down, and the economy will undergo another painful recession.

The Fed’s monetary bent makes for the belief that recessionary action is needed to prevent/cure inflation.

We then get into a careful balancing act in which the Fed tries to set “just enough” recessionary interest rates to cure inflation but not enough to cause a recession.

The scenario reminds one of a child sitting in the back seat of a car, thinking he is steering the vehicle.

The Fed (child) thinks it’s “steering the car,” while in the front seat, the real steering is being done by the (parent) President and Congress.

Increased federal spending to cure oil shortages and other goods and services shortages would cure inflation while preventing recession.

Ultimately, the “child” happily believes he has steered safely, while the “parent” smiles and tells the child what a wonderful job he did.

If the Fed then sticks with such a policy – as it did under Volcker – then it will gradually but painfully grind inflationary forces out of the system; if it gives up, as earlier in the 1970s, then inflation will return again, only to need further harsh monetary medicine further down the road. Welcome back, stagflation.

We didn’t have the predicted stagflation because oil supplies increased, reducing inflation. Meanwhile, the government spent enough to prevent stagnation, though declining deficits ultimately led to the 1990 recession.

Long before all that, higher interest rates would follow naturally from higher inflation expectations and the massive borrowing requirements of the US federal government.

The U.S. federal government does not borrow dollars. Not now. Not ever. Why would it, given its infinite ability to “use the computer to mark up the account,” as Bernanke said.

Former Fed Chair Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

The author thinks Treasury bonds, notes, and bills are “borrowing” because those terms describe private sector borrowing.

But Treasury bonds, notes, and bills are accounts owned by depositors, not by the government. The accounts resemble safe deposit boxes, the contents of which are owned by account holders, not by the bank.

Upon maturity, the contents of T-security accounts simply are returned to the owners, having never been touched by the federal government. No government money is involved.

The purpose of T-securities is not to provide spending funds to the government. The government has infinite spending funds. Instead, the purposes are:

- To provide a safe storage place for unused dollars. This stabilizes the dollar.

- To help the Fed control interest rates.

The dollar’s value is determined by relative inflation rates: if the US inflates more than its trading partners – as seems likely – then the dollar must eventually fall.

The Fed’s manipulation of interest rates determines the dollar’s exchange value. The Fed decides what the rate will be. Raising rates increases demand for the dollar, which increases its value.

As described earlier, this exacerbates inflation by raising the price of goods.

The fundamental determinant of inflation is the supply of crucial goods and services, predominantly oil and food.

But there are also substantial speculative dollar holdings. As of May 2009, approximately $3.3 trillion of the $ 6.9 trillion of Treasury securities outstanding were held by foreigners, of which $ 2.3 trillion were held by foreign central banks.

As the dollar falls, foreign holders of Treasuries are likely to begin selling. These holdings represent a dangerous overhang, the unraveling of which could cause a sharp decline in the dollar’s value once foreign exchange markets start to correct themselves; thus, the ingredients are already in place for a major dollar crisis.

If every single holder of Treasury bonds, notes, and bills sold their holdings, the bonds, notes, and bills would continue to exist, only in different hands.

The Fed could continue to control interest rates by fiat or open market purchases (aka “quantitative easing”). There would be no crisis.

It’s like asking what would happen if every safe deposit box holder sold the contents of his box. The answer: A lot of new people would own those contents.

The bleak prognosis just described amounts to a return to the miseries of stagflation.

This happens when the Fed tries to cure inflation by raising interest rates. The higher interest rates exacerbate inflation and stagnate the economy.

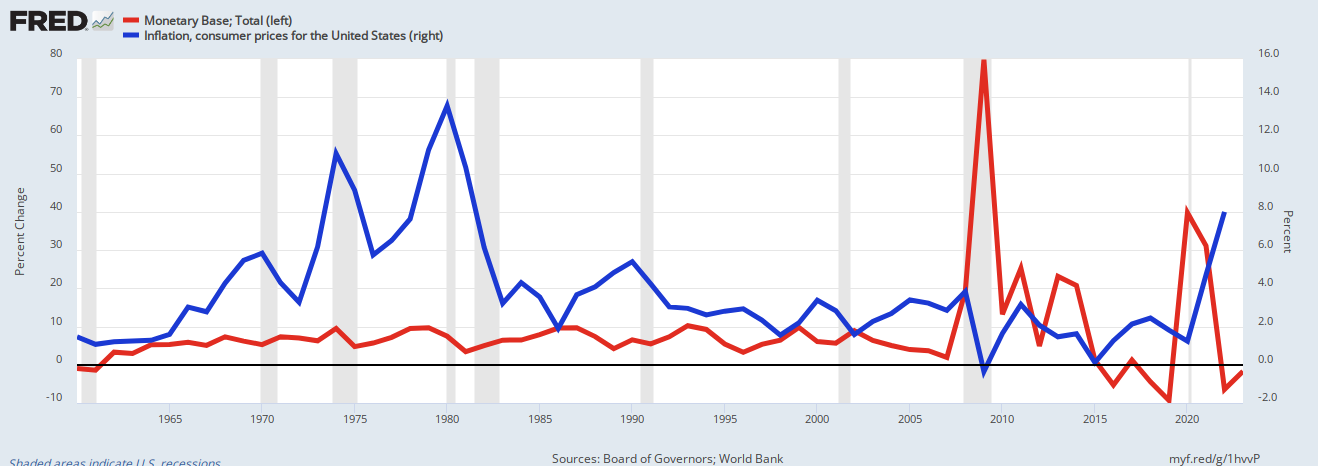

In principle, of course, such an outcome can be averted (or at least ameliorated) if the Fed moves quickly to claw back the growth in the base before its inflationary potential is fully unleashed.

Still, in practice, this would be very difficult to do.

Here, the author claims that growth in the monetary base causes inflation. See the following graph:

As usual, the bankers erroneously believe that inflation is a money supply problem when, in fact, it is a goods/services supply problem.

Traditionally, almost the only assets held by the Fed were US Treasury securities: loans to commercial banks were negligible, and the Fed did not lend at all to other institutions. All this has now completely changed.

The Fed’s equity cushion is now down to just 1.9% of its assets from 3.9% a year before.

The Fed’s equity cushion — the amount of losses the Fed could absorb without defaulting on debts — is infinite. Not 1.9%, not 3.8%, but infinite.

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

The Fed’s leverage ratio has gone up from just under 25 to about over 50 as the quality of its assets has markedly deteriorated.

As Lawrence H. White put it in a recent paper, “The Fed now looks increasingly like a very highly leveraged hedge fund” (White, 2008, p. 11).

The risk to the Fed is zero. Unlike a hedge fund, the Fed has infinite dollars. It can always “use the computer to mark up the size of the account.”

Amazingly, the author and others of similar ilk simply do not understand the basics of Monetary Sovereignty. The Fed cannot become insolvent.

The only alternative would be sterilizing the monetary base growth through (increased) reserve requirements.

This would, however, choke off the lending that the entire bank recapitalization exercise is intended to revitalize, and, as with selling off the recent Fed acquisitions, this would seriously counter the current stimulus measures.

Such a measure also has ominous historical overtones: the doubling of reserve requirements by the Fed in 1936-37 is commonly held to have been the principal factor behind the 1937-38 recession, itself deeper than any since World War II.

It is virtually inconceivable that the Bernanke Fed would risk a repeat of that debacle. Thus, sterilization would appear, to all intents and purposes, to be out of the question.

Aside from being totally unnecessary, this “sterilization” suggestion leads to another question: Why do banks have reserve requirements. Answer: To protect depositors from bank failures.

And that leads to the real question. Why do we have private banking? The federal government spends so much time, effort, and money to regulate the banks and to protect the public, that all banks are at least partially run by the regulators.

Why not have the government simply run all banks? Eliminate the profit motive, and banking would be cheaper and safer. See Private Banks, America’s Worst Criminals.

Suppose the Fed starts to print money to cover its losses. In that case, there is a real danger of a vicious cycle taking off in which monetizing the Fed’s losses leads to higher inflation, higher interest rates, more losses, and even more significant inflation.

That would be true if inflation were a money supply problem. But as we have seen, inflation is a goods/service supply problem, not a money supply problem.

Recent US experience is also consistent with the last false deflation scare when then-Governor Bernanke persuaded Alan Greenspan in 2002 that the US was (then also) in imminent danger of deflation.

The Fed responded by pulling interest rates down to about 1% and holding them at that level for a year.

The resulting expansionary monetary policy then fed an unprecedented roller coaster of a boom-bust cycle that ended in the collapse of stock and property markets, the specter of renewed inflation, the destruction of much of the financial system, and a sharp economic downturn.

I believe the author is talking about the 2008 recession, which was not caused by low-interest rates but rather by real estate speculation involving mortgage-backed securities and bad loans. The Fed failed to stop banks and other lenders from giving mortgages to people with bad credit risk.

Low-interest rates were not at fault. On the contrary, when the Fed raised rates, mortgage payments rose beyond borrowers’ ability to pay, so they defaulted. The rising rates precipitated the crash of real estate mortgages and other loans.

Does the Fed draw the lesson that aggressive monetary policy is ultimately destabilizing? Not at all. Instead, it embarks on an even more activist monetary policy that lays the seeds of an even bigger boom-bust cycle.

By “aggressive monetary policy,” the author means lowering interest rates. Also called “expansionary monetary policy.”

The Fed is thus repeating the same mistakes it made in the mid-90s and then again in the early years of the new millennium – but on a grander scale.

And, in the meantime, there is also that little matter of inflation in the pipeline to worry about …

The Fed’s mistakes are based on erroneous beliefs. The facts are:

- Our Monetarily Sovereign federal government and its agencies have unlimited spending money.

- Federal taxes and borrowing do not fund federal spending. To pay its bills, the federal government creates new dollars, ad hoc. All federal tax dollars are destroyed upon receipt by the Treasury.

- Treasury bonds, notes, and bills (i.e., federal “debt”) are not federal borrowing, The accounts remain the property of the depositors.

- The Fed does not control inflation by raising interest rates. Higher rates exacerbate inflation.

- Federal deficit spending does not cause inflation. Inflations are caused by critical goods and services shortages, usually oil and/or food. Federal deficit spending cures inflations when the spending cures the shortages that caused the inflation.

- Ongoing economic growth requires ongoing increases in federal deficit spending.

- Decreases in federal deficit spending lead to inflations and depressions.

- Ongoing federal deficit spending is infinitely sustainable.

Economic growth is controlled by Congress and the President via federal spending, primarily via spending to eliminate shortages of critical goods and services. Raising interest rates is recessionary and does not control inflation.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

Government’s Sole Purpose is to Improve and Protect People’s Lives.

MONETARY SOVEREIGNTY