Regular readers of this blog have seen this before. Periodically, we reference the latest ignorant claim that the federal debt is a “ticking time bomb” ready to destroy America and the world.

The most recent reference to the ticking time bomb of federal debt came yesterday:

‘The world’s largest Ponzi scheme’: Peter Schiff just blasted the US debt ceiling drama. Here are 3 assets he trusts amid major market uncertainty

Story by Bethan Moorcraft

A ticking time bomb in the U.S. economy is running perilously close to detonation.With the U.S. reaching its debt limit of $31.4 trillion on Jan. 19, Treasury Secretary Janet Yellen urged lawmakers to increase or suspend the debt ceiling.

The first reference we found came in 1940 when the federal debt was about $40 Billion. Previous reviews can be found here and here.

Today, the federal debt zips past $25 Trillion, and still, the time bomb hasn’t exploded. We were confronted with our latest entry, dated February 5, 2023, which we placed at the bottom of the list.

It just proves the debt heads have learned nothing in 84 years and counting.

We still have the media, the economists, and the politicians whining, moaning, complaining, and warning about the impending disaster that never seems to happen.

Whether by ignorance or intent, these folks want the federal government to stop deficit spending on such benefits as Medicare and other healthcare, Social Security, all the poverty aids, education aids, and every type of scientific research and development, national parks, infrastructure — well just about everything that makes American life beautiful.

Oh, and they also want you to pay more taxes.

The only thing that seems to have some immunity is the military. Everyone loves the military because that’s patriotic. Right? Oh, and any benefits to the rich will remain intact, because the rich pay the politicians via “campaign contributions.” (aka “bribes.”)

The complaints come from people who do not understand, or don’t want you to understand, the differences between federal government financing (Monetary Sovereignty) and all other financings (monetary non-sovereignty).

A Monetarily Sovereign entity (the U.S., Canada, Australia, et al) never can run short of its own sovereign currency. So, for instance, the U.S. can pay any financial obligations denominated in U.S. dollars.

A monetarily non-sovereign entity (you, me, cities, counties, states, euro nations like France and Greece) have no sovereign currency, so they can and do run short of the money to pay their debts.

Those who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty do not understand economics. You should believe their opinions on federal debt about as much as you believe their opinions about quantum chromodynamics.

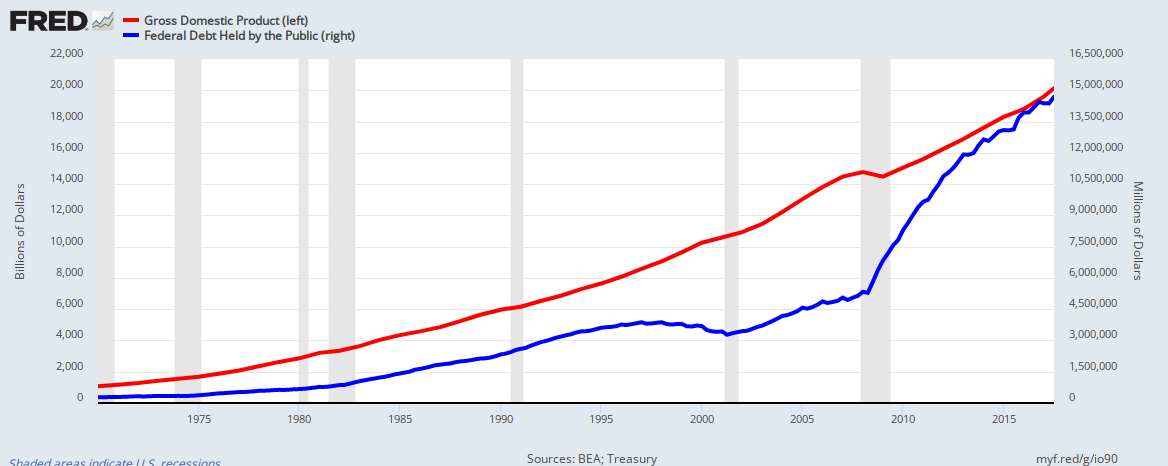

Here is a picture of how the federal debt has grown. Keep in mind that every year it has been called a “ticking time” bomb” by debt-nuts. and every year they are proven wrong.

Here’s the partial list of debt head, sky-is-falling, warnings. Try not to laugh (or cry) at the repeated Henny Penny wrongheadedness.

————————//—————————

September 1940, the federal budget was a “ticking time-bomb which can eventually destroy the American system,” said Robert M. Hanes, president of the American Bankers Association.

By 1960: the debt was “threatening the country’s fiscal future,” said Secretary of Commerce, Frederick H. Mueller. (“The enormous cost of various Federal programs is a time-bomb threatening the country’s fiscal future, Secretary of Commerce Frederick H. Mueller warned here yesterday.”)

By 1983: “The debt probably will explode in the third quarter of 1984,” said Fred Napolitano, former president of the National Association of Home Builders.

In 1984: AFL-CIO President Lane Kirkland said. “It’s a time bomb ticking away.”

In 1985: “The federal deficit is ‘a ticking time bomb, and it’s about to blow up,” U.S. Sen. Mitch McConnell. (Remember him?)

Later in 1985: Los Angeles Times: “We labeled the deficit a ‘ticking time bomb’ that threatens to permanently undermine the strength and vitality of the American economy.”

In 1987: Richmond Times-Dispatch – Richmond, VA: “100TH CONGRESS FACING U.S. DEFICIT’ TIME BOMB'”

Later in 1987: The Dallas Morning News: “A fiscal time bomb is slowly ticking that, if not defused, could explode into a financial crisis within the next few years for the federal government.”

In 1989: FORTUNE Magazine: “A TIME BOMB FOR U.S. TAXPAYERS“

In 1992: The Pantagraph – Bloomington, Illinois: “I have seen where politicians in Washington have expressed little or no concern about this ticking time bomb they have helped to create, that being the enormous federal budget deficit, approaching $4 trillion.“

Later in 1992: Ross Perot: “Our great nation is sitting right on top of a ticking time bomb. We have a national debt of $4 trillion.”

In 1995: Kansas City Star: “Concerned citizens. . . regard the national debt as a ticking time bomb poised to explode with devastating consequences at some future date.”

In 2003: Porter Stansberry, for the Daily Reckoning: “Generation debt is a ticking time bomb . . . with about ten years left on the clock.”

In 2004: Bradenton Herald: “A NATION AT RISK: TWIN DEFICIT A TICKING TIME BOMB“

In 2005: Providence Journal: “Some lawmakers see the Medicare drug benefit for what it is: a ticking time bomb.”

In 2006: NewsMax.com, “We have to worry about the deficit . . . when we combine it with the trade deficit we have a real ticking time bomb in our economy,” said Mrs. Clinton.

In 2007: USA Today: “Like a ticking time bomb, the national debt is an explosion waiting to happen.“

In 2010: Heritage Foundation: “Why the National Debt is a Ticking Time Bomb. Interest rates on government bonds are virtually guaranteed to jump over the next few years.

In 2010: Reason Alert: “. . . the time bomb that’s ticking under the federal budget like a Guy Fawkes’ powder keg.”

In 2011: Washington Post, Lori Montgomery:”. . . defuse the biggest budgetary time bombs that are set to explode.”

June 19, 2013: Chamber of Commerce: Safety net spending is a ‘time bomb’, By Jim Tankersley: The U.S. Chamber of Commerce is worried that not enough Americans are worried about social safety net spending. The nation’s largest business lobbying group launched a renewed effort Wednesday to reduce projected federal spending on safety-net programs, labeling them a “ticking time bomb” that, left unchanged, “will bankrupt this nation.”

In 2014: CBN News: “The United States of Debt: A Ticking Time Bomb“

On June 18, 2015: The ticking economic time bomb that presidential candidates are ignoring: Fortune Magazine, Shawn Tully,

On February 10, 2016, The Daily Bell: “Obama’s $4.1 Trillion Budget Is Latest Sign of America’s Looming Collapse”

On January 23, 2017: Trump’s ‘Debt Bomb‘: Deficit May Grow, Defense Budget May Not, By Sydney J. Freedberg, Jr.

On January 27, 2017: America’s “debt bomb is going to explode.” That’s according to financial strategist Peter Schiff. Schiff said that while low interest rates had helped keep a lid on U.S. debt, it couldn’t be contained for much longer. Interest rates and inflation are rising, creditors will demand higher premiums, and the country is headed “off the edge of a cliff.”

On April 28, 2017: Debt in the U.S. Fuel for Growth or Ticking Time Bomb?, American Institute for Economic Research, by Max Gulker, PhD – Senior Research Fellow, Theodore Cangeros

February 16, 2018 America’s Debt Bomb By Andrew Soergel, Senior Reporter: Conservatives and deficit hawks are hurling criticism at Washington for deepening America’s debt hole.

April 18, 2018 By Alan Greenspan and John R. Kasich: “Time is running short, and America’s debt time bomb continues to tick.”

January 10, 2019, Unfunded Govt. Liabilities — Our Ticking Time Bomb. By Myra Adams, Tick, tick, tick goes the time bomb of national doom.

January 18, 2019; 2019 Is Gold’s Year To Shine (And The Ticking U.S. Debt Time-Bomb) By Gavin Wendt

[The following were added after the original publishing of this article]

April 10, 2019, The National Debt: America’s Ticking Time Bomb. TIL Journal. Entire nations can go bankrupt. One prominent example was the *nation of Greece which was threatened with insolvency, a decade ago. Greece survived the economic crisis because the European Union and the IMF bailed the nation out.

July 11, 2019: National debt is a ‘ticking time bomb ‘: Sen. Mike Lee

SEP 12, 2019, Our national ticking time bomb, By BILL YEARGIN

SPECIAL TO THE SUN SENTINEL | At some point, investors will become concerned about lending to a debt-riddled U.S., which will result in having to offer higher interest rates to attract the money. Even with rates low today, interest expense is the federal government’s third-highest expenditure following the elderly and military. The U.S. already borrows all the money it uses to pay its interest expense, sort of like a Ponzi scheme. Lack of investor confidence will only make this problem worse.

JANUARY 06, 2020, National debt is a time bomb, BY MARK MANSPERGER, Tri City Herald | The increase in the U.S. deficit last year was about $1.1 trillion, bringing our total national debt to more than $23 trillion! This fiscal year, the deficit is forecasted to be even higher, and when the economy eventually slows down, our annual deficits could be pushing $2 trillion a year! This is financial madness. there’s not going to be a drastic cut in federal expenditures — that is, until we go broke — nor are we going to “grow our way” out of this predicament. Therefore, to gain control of this looming debt, we’re going to have to raise taxes.

February 14, 2020, OMG! It’s February 14, 2020, and the national debt is still a ticking time bomb! The national debt: A ticking time bomb? America is “headed toward a crisis,” said Tiana Lowe in WashingonExaminer.com. The Treasury Department reported last week that the federal deficit swelled to more than $1 trillion in 2019 for the first time since 2012. Even more alarming was the report from the bipartisan Congressional Budget Office (CBO) predicting that $1 trillion deficits will continue for the next 10 years, eventually reaching $1.7 trillion in 2030

April 26, 2020, ‘Catastrophic’: Why government debt is a ticking time bomb, Stephen Koukoulas, Yahoo Finance [Re. Monetarily Sovereign Australia’s debt.]

August 29, 2020, LOS ANGELES, California: America’s mountain of debt is a ticking time bomb The United States not only looks ill, but also dead broke. To offset the pandemic-induced “Great Cessation,” the U.S. Federal Reserve and Congress have marshalled staggering sums of stimulus spending out of fear that the economy would otherwise plunge to 1930s soup kitchen levels. Assuming that America eventually defeats COVID-19 and does not devolve into a Terminator-like dystopia, how will it avoid the approaching fiscal cliff and national bankruptcy?

April 16, 2021, NATIONAL POLICY: ECONOMY AND TAXES / MARK ALEXANDER /

The National Debt Clock: A Ticking Time Bomb: At the moment, our national debt exceeds $28 TRILLION — about 80% held as public debt and the rest as intragovernmental debt. That is $225,000 per taxpayer. Federal annual spending this year is almost $8 trillion, and more than half of that is deficit spending — piling on the national debt.

June 17, 2022 Time Bomb On National Debt Is Counting Down Faster Thanks To Fed’s Rate Hike, Tim Brown /

We are now staring down the barrel of the end of the U.S. economy based on fiat money, printed out of thin air but charged back to the people at ridiculous interest rates. Now, the national debt is approaching $31 trillion, which is $12 trillion more than when Donald Trump took office in 2017 and more than half of that debt was tacked on in his final year. Then we’ve had the disastrous year and a half of Joe Biden. Now, the Fed is now hiking its rates and that spells even more trouble for the national debt and the economy at large.

December 4, 2022 America’s ticking time bomb: $66 trillion in debt that could crash the economy

By Stephen Moore, The national debt is $31 trillion when including Social Security’s and Medicare’s unfunded liabilities. Wake up, America.That ticking sound you’re hearing is the American debt time bomb that with each passing day is getting precariously close to detonating and crashing the US economy.

January 13, 2023. A ticking time bomb in the U.S. economy is running perilously close to detonation. Long considered a harbinger of bad luck, Friday, Jan. 13 came with a warning for Congress that the country could default on its debt as soon as June. With the U.S. reaching its debt limit of $31.4 trillion on Jan. 19, Treasury Secretary Janet Yellen urged lawmakers to increase or suspend the debt ceiling.

February 5 2023 ‘The world’s largest Ponzi scheme’: Peter Schiff just blasted the US debt ceiling drama. Here are 3 assets he trusts amid major market uncertainty Story by Bethan Moorcraft, A ticking time bomb in the U.S. economy is running perilously close to detonation. With the U.S. reaching its debt limit of $31.4 trillion on Jan. 19, Treasury Secretary Janet Yellen urged lawmakers to increase or suspend the debt ceiling.

———————–//———————–

If, year after year for 84years, you keep predicting something is imminent, yet it never happens, at what point do you reexamine your beliefs?

Apparently never, for the debt heads.

Truly pitiful.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: Ten Steps To Prosperity:

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

It takes only two things to keep people in chains:

It takes only two things to keep people in chains: