Economics involves many questions, of course, but is there one question that is key? Is there one question, the answer to which opens the door to the entire study of economics?

After some thought, I believe such a question exists, and I will reveal my nomination here. You may disagree with my choice, and if so, I’d be glad to know yours, or if you feel no question is that important.

First, a bit of:

BACKGROUND

In the first eleven billion years of the universe’s existence, and the first 4 billion years of the earth’s existence, there was no such thing as the United States or the U.S. dollar.

But beginning in the 1700’s AD, men created a variety of laws. The laws were completely arbitrary and created from thin air, as all laws are. And as is true for all laws, these laws had no physical existence. They merely were concepts.

The laws could be spoken, handwritten, typed, printed, mimeographed, texted, Emailed, or delivered in any number of ways, but the laws themselves had no physical existence. They merely were an amalgam of ideas, concepts, and beliefs.

Some of those laws, which were created, from thin air, produced the political entity known as “the United States of America.” and some of those laws created, also from thin air, the U.S. dollar.

Those laws arbitrarily created millions of dollars, and arbitrarily created the value of those dollars, with regard to arbitrary amounts of silver and gold.

And now for the question that I believe to be the most important question in economics:

How Many Laws Can The U.S. Federal Government Create?

I suggest that the answer to this question is: “Infinite.”

Now “infinite” is a very big number. It is bigger than the number of glasses of water in all the oceans on earth. It is bigger than the number of stars in the sky. Infinite is bigger than the number of atoms in the known universe.

How is it possible for humans to create here on earth, something that is bigger than the oceans, stars, and the universe’s atoms? The reason is that water, stars, and atoms are physical objects, but laws have no physical existence.

Like creating numbers, the ability to create laws is limitless. You cannot see, hear, feel, taste, or smell a number or a law. You can sense representations of numbers and laws, but the numbers and laws themselves merely are concepts.

Similarly, the dollars created by laws, have no physical existence. You can see representations of dollars — dollar bills, bank statements, savings account passbooks, T-bill records, etc. — but you cannot see, hear, feel, taste, or smell a dollar. It is just a number in a balance sheet.

When you go to a store to make a purchase, you pay by presenting your credit card. Invisible dollars are taken from that card and sent to the card issuer, who in turn, sends invisible dollars to the store. Soon thereafter, invisible dollars will be taken from your checking account and sent to the credit card company, which will deposit these invisible dollars into its balance sheets.

All the while, invisible dollars will flow to and from the Federal Reserve, tidying things up. And it all will be done in thin air, with nothing but the occasional atom moving.

Because the U.S. dollar was created by U.S. laws, and because the federal government has the infinite ability to create U.S. laws, and because neither laws nor dollars have any physical existence:

I. Dollars are created by laws. The U.S. federal government has the infinite ability to create laws, so it has the infinite ability to create U.S. dollars.

We’re not even talking about an infinite ability to “print” dollars. Those printed green paper things you carry in your wallet are not dollars. They are representations of, or titles to, dollars. The real dollars are just numbers in numerous records and balance sheets all over the world.

Because the U.S. government has the infinite ability to create the laws that create dollars, and so has the infinite ability to create dollars, the government never unintentionally can run short of dollars.

And because the government has the infinite ability to create U.S. dollars:

II. The U.S. government has no need to collect U.S. dollars from anyone or anywhere.

This means the government has no need to borrow or to tax. It does not need to ask you for dollars. It does not need to ask China for dollars. It does not need to ask anyone for dollars. The federal government creates from thin air all the dollars it uses.

Even if all federal tax collections fell to zero, the federal government could continue spending forever. Not only that, but:

III. All the tax dollars you send to the federal government are destroyed upon receipt.

The amount of money that exists in the United States is divided into “M”classifications such as MZM, M0, M1, M2, and M3, according to the type and size of the account in which the instrument is kept.

The money supply reflects the different types of liquidity each type of money has in the economy. It is broken up into different categories of liquidity or spendability.

The tax dollars you, and everyone else sends to the federal government generally come from checking accounts, which are part of the money supply measure called “M1.”

When you pay taxes, you take money from your M1 checking account and send them to the Treasury where they cease to be part of any money supply measure. Effectively, your tax dollars are destroyed.

The reason is clear. Because the federal government has the unlimited ability to create dollars, it would make no sense to try to measure its money supply, which is infinite. If, say, you send $1,000 to the federal government, $1,000 + infinity = infinity. No difference.

That is why no one ever can answer the question, “How much money does the federal government have?” The only accurate answer is “Infinite.”

The Monopoly Example

If you ever have played the board game Monopoly, you know that it usually is played with four players, plus a Bank. The function of the Bank is to distribute Monopoly dollars to, and to collect Monopoly dollars from, the players, according to the rules.

But, one rule of Monopoly is that the Bank never can run short of dollars. If you were to open the game box to discover all the printed dollar certificates were missing, what would you do in order to play the game?

One approach would be to take a sheet of paper and divide it into four columns, one column for each player.

At the top of each column you would print each player’s name, and below each name, a starting amount of money.

The illustration at the right shows that each player begins with 5,000 Monopoly dollars.

Then as each player spends and receives money, the amounts below that player’s name are changed.

Many of those dollars go to, and come from, the Bank, but the bank has no column because the Bank has infinite dollars.

In the game, when you pay dollars to the “Community Chest,” the dollars are supposed to go to the Bank, and when you receive $200 for passing “GO,” the dollars are supposed to come from the Bank.

Although the rules specify that tax dollars and other dollars go to the Bank, the above example shows that they really are destroyed upon receipt. The Bank has no column. There is no way to determine how many dollars the Bank has. It has infinite dollars.

In the real world, the federal government operates just like the Monopoly Bank: It collects dollars from the public, and it distributes dollars to the public. But once dollars are received by the Treasury, they disappear.

Though the Treasury keeps internal records, there is no way to determine how many dollars the government has. It has infinite dollars.

Since the federal government has no use for tax dollars, why does the federal government collect tax dollars?

There are three reasons: One real, one mythical, and one secret.

- The real reason the government collects tax dollars is to control the economy. It taxes what it wishes to discourage and it gives tax breaks to what it wishes to reward or encourage. That is why there are so many tax breaks for the rich people who control the government.

- The mythical reason the federal government collects tax dollars — a reason espoused by many economists — is to create demand for dollars with which to pay taxes. The demand for such cryptocurrencies as Bitcoin, Ethereum, and Litecoin, which are not supported by taxes, debunks this reason.

- The secret reason the federal government collects taxes is to help make you believe dollars are scarce to the government. This belief keeps you from demanding more benefits like expanded Social Security, Medicare for All, poverty aids, free college for all, and an end to the FICA tax.

The rich people and rich companies are rich only because of the Gap between them and those who are not as rich. If there were no Gap, we all would be the same. No one would be rich. And the wider the Gap, the richer are the rich.

The rich always want to be richer. This is known as “Gap Psychology,” the desire to widen the income/wealth/power Gap below, and to narrow it above.

Widening the Gap below can involve either gaining more for oneself or preventing those below from gaining. Either will make one richer.

To make themselves richer, the rich bribe the key sources of your information. They bribe the politicians (via political contributions and promises of lucrative employment later). They bribe the media (via ownership and advertising dollars). They bribe the economists (via university contributions and “think tank” employment).

All these sources of information combine to tell you the Big Lie, that in order for you to receive more federal benefits, taxes must be increased.

That misinformation provides an excuse for the current battles against President Biden’s “Build Back Better” Act, which first was proposed at a $3.5 trillion level, and since has been cut in half because of the Big Lie.

The pretext was that this proposal must be “paid for” with taxes. But, as you now know, taxes do not fund federal spending.

The federal government pays for everything by merely sending instructions (checks and wires) to creditors’ banks, instructing the banks to increase the balances in creditors’ checking accounts.

When the banks do as instructed, this creates more M1 dollars, the same kind of dollars you send to the federal government as taxes.

Since the federal government has no need to ask anyone for dollars, why does it borrow dollars?

The U.S. federal government never borrows dollars. The acceptance of deposits into Treasury Security accounts (T-bills, T-notes, T-bills) is wrongly called “borrowing” and federal “debt.” It neither is borrowing nor debt.

The closest parallel to a T-security account is a safe deposit box.

When you put dollars into your safe deposit box, your bank never touches those dollars, and your bank doesn’t owe you those dollars.

They neither are loans to your bank nor are they debts of your bank.

The bank “pays you back” simply by allowing you to take back whatever dollars are in your box.

Similarly, when you make a deposit into your T-security account, the federal government never touches those dollars. The government “pays you back” by allowing you to take back whatever dollars are in your account.

Since the federal government has no need to ask anyone for dollars, why does it provide for deposits into T-security accounts? There are two real reasons and one secret reason:

- The first real reason is to help the Federal Reserve to control interest rates. These accounts pay interest, the rates for which begin with Federal Reserve decisions regarding the state of the economy.

- The second real reason is to provide a safe, interest-paying place for people, businesses, and nations to “park” unused dollars.

- The secret reason is again to help make you believe the federal government is so deeply “in debt” it cannot afford to help narrow the Gap between the rich and the rest.

The federal government has no need to ask anyone for dollars, and has the infinite power to spend. But, doesn’t too much government spending cause inflation?

Remember that way back in the 1780s, the federal government created as many dollars as it wished and gave those dollars whatever value it wished — and it did all this by passing laws.

The federal government still has the unlimited power to:

- Pass laws

- Create dollars, and

- Control the value of dollars.

Over the years, the government has used all three of those powers. While nos. 1 and 2 already have been explained, you may be curious about how the government controls the value of dollars. It has two primary tools:

- When the government raises interest rates, more people will want to obtain more dollars to invest in interest-paying bonds, and this increased demand for U.S. dollars increases their value.

- Government fiat. When the U.S. was on various silver and gold standards, the government merely would pass laws saying that a dollar could be exchanged for specific amounts of gold or silver. The U.S. Constitution gives Congress the power “To coin Money, regulate the Value thereof.” The government, by fiat, can change the exchange rate between dollars and other currencies. This is known as “devaluation” and “revaluation.”

That said, the primary driver of inflation is not interest rates, or federal fiat, or federal deficit spending, or so-called federal “debt.” The primary driver of inflation is shortages.

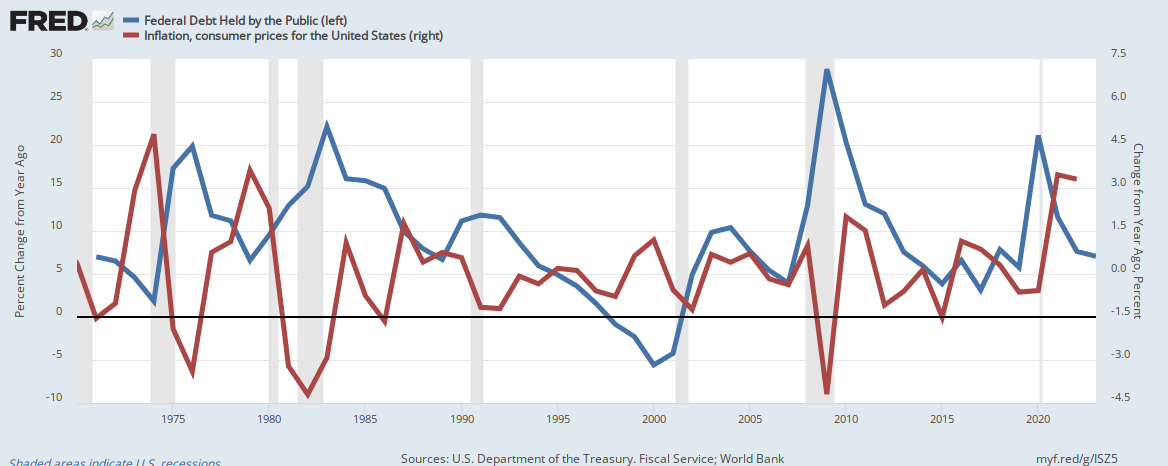

If the “federal deficit spending” myth were true, an increase in federal deficit spending should correspond to an increase in prices.

There is no historical relationship between changes in federal deficit spending (blue line) and changes in inflation (red line). Federal deficits do not cause inflations.

IV. The driver of inflation never is federal deficit spending, but rather the scarcity of key goods and services.

Like all inflations through history, today’s inflation is caused by shortages of energy, food, computer chips, supply chain resources, and labor.

Some of these are related to global warming and some are related to COVID. Many are related to inefficient government.

Contrary to popular wisdom, today’s inflation could be controlled via increased federal spending to eliminate the shortages. Federal spending to increase oil and gas drilling, renewable energy production, farmer aids, computer chip production, shipping, and the elimination of taxes that discourage employment (i.e. FICA), would reduce inflation.

Also notice in the above graph that:

V. Recessions begin with reductions in federal deficit growth and are cured by increases in federal deficit growth.

This should surprise no one because economic growth requires money growth. The most common measure of economic growth is Gross Domestic Product (GDP) a formula for which is:

GDP=Federal Spending + Non-federal Spending + Net Exports.

All three factors on the right-hand side of the equation are related to an increased dollar supply.

What happens when the federal “debt” (i.e., the net total of deficits) decreases?

1804-1812: U. S. Federal “Debt” reduced 48%. Depression began 1807.

1817-1821: U. S. Federal “Debt” reduced 29%. Depression began 1819.

1823-1836: U. S. Federal “Debt” reduced 99%. Depression began 1837.

1852-1857: U. S. Federal “Debt” reduced 59%. Depression began 1857.

1867-1873: U. S. Federal “Debt” reduced 27%. Depression began 1873.

1880-1893: U. S. Federal “Debt” reduced 57%. Depression began 1893.

1920-1930: U. S. Federal “Debt” reduced 36%. Depression began 1929.

1997-2001: U. S. Federal “Debt” reduced 15%. Recession began 2001.

Again, this should surprise no one. Just as a growing economy requires a growing supply of money, reducing federal “debt” (i.e. running federal surpluses) takes dollars from the economy and sends them to the Treasury, where they are destroyed..

By definition, GDP is reduced when dollars are taken from the economy.

Fortunately, the U.S. federal government has the ability to create infinite U.S. dollars and to control their value, i.e. prevent excessive inflation.

So, the federal government has the ability to fund Medicare for All, Social Security for All and college for all who want it. Further, the government has the financial ability to eliminate the grossly recessive employment taxes (FICA) and to help the states, counties, and cities to reduce their tax burdens.

Given this infinite power, the federal government is left with one final question: Is there a limit? We know the government has the power, but is there a limit as to how much of this power the government should use?

The problem has two parts: Financial and political.

Financially, is there a dollar limit, beyond which federal deficit spending actually harms the economy rather than benefitting it?

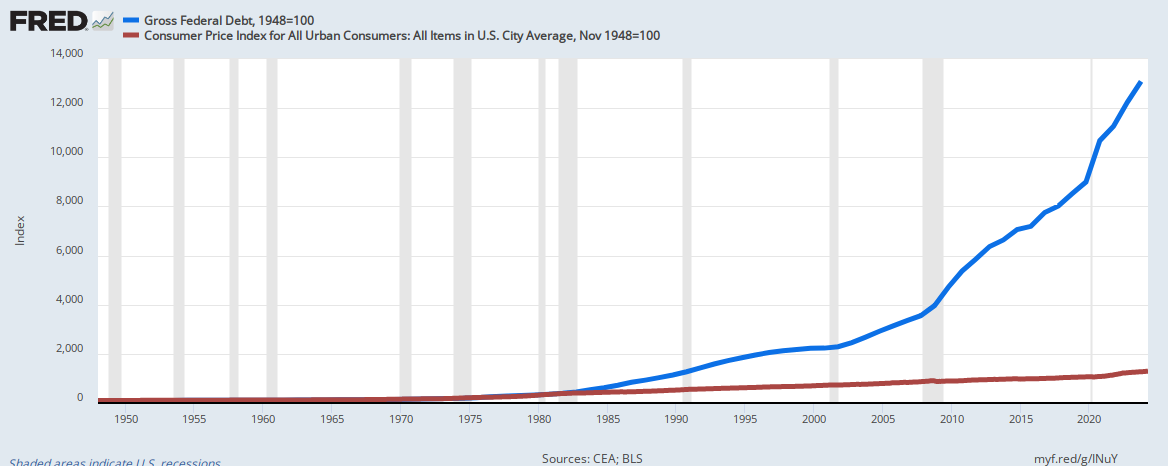

There may be, but no evidence exists for any limit. As the following graph shows, federal “debt” (blue line) has increased massively, while inflation (red line) has followed a comparatively modest, even trajectory.

If federal deficit spending caused inflations, the blue line (federal deficits) and the red line (inflation) would be parallel.

Claims that future federal deficit spending, in any given amount, will cause inflation are based on intuition and guesswork and not on historical precedent.

Politically, is there a point beyond which federal deficit spending gives the federal government “too much power”?Libertarians think so.

In fact, Libertarians can be trusted to object to any amount of federal deficit spending, or even any amount of federal spending at all. They think people should be “free” to pay for unaffordable health care, education, infrastructure, housing, schooling, sustenance, and retirement.

Others think local governments should do what the federal government does because, in their belief, local governments know what local people want, and after all, aren’t we all “local” people?

Sadly, while the federal government, being Monetarily Sovereign, has infinite funds, monetarily non-sovereign local governments do not. They must levy burdensome taxes in order to spend.

The question of “too much federal power” often is answered in a general sense, but when specifics are broached, the answers are not clear. I, for one, have no idea what “too much” federal power is, except when it impinges on what I personally view as a personal privilege.

Outlawing recreational drugs, liquor, abortions, certain marriages, and certain books fall into that category. Mandating vaccination to protect our species does not. But that’s just my view.

Power begets criminality, but on balance I suspect local government tend to be less honest than does the federal government for one reason: The media do a better job of investigating and shining light on federal government than on local governments, where media have less investigative power and less influence.

SUMMARY

The most important question in economics is: How Many Laws Can The U.S. Federal Government Create? The answer is “infinite.” Since U.S. dollars are created by laws, the U.S. government can create infinite dollars and can give these dollars any value it chooses.

Thus, the U.S. government has no need to collect U.S. dollars from anyone or anywhere. All the tax dollars you send to the federal government are destroyed upon receipt.

Economic growth requires money growth, which requires federal deficit growth. The insufficiency of federal deficit growth leads to recessions and depressions, which can be cured only by federal deficit growth.

The driver of inflation never is federal deficit spending, but rather the scarcity of key goods and services. Inflations actually can be prevented and cured by increased federal deficit spending to cure shortages. To date, despite massive federal deficits, particularly in the past decade, we never have reached the level of “too much federal spending.”

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

Economics (money) is probably the most cruel of the “sciences”. This is due to acceptance of scarcity as its model; a model that went out with mass production, but kept in force by those who benefit the most. Ironically, those same beneficiaries can’t succeed w/o federal socialism working behind the scenery to keep them afloat, thanks to FDR’s New Deal legislation.

But humanity is in a legal trap. The only way out may be disintegration of the system, but w/o hurting anyone or at least keeping it to a minimum. I can’t see money becoming abundant since it’s a scarcity item. Making it abundant makes it worth – less and would take all the glee out for the controlling rich. But I can see how MS may play the part of a transitional device, gradually releasing wealth to all until, finally, people mature to total responsibility.

Looks to me that we’re headed for do-or-die volunteerism, and the rule of Natural law & Behavior in accord with the “guts” of established science, technology, and distribution. Like a garden, we’ll gladly care for it, because, it cares for us. But we’ve yet to realize this due to domination by too many insects.

LikeLike

Would You Manage 70 Children And A 15-Ton Vehicle For $18 An Hour? https://fivethirtyeight.com/features/would-you-manage-70-children-and-a-15-ton-vehicle-for-18-an-hour/?

LikeLike

Yet another problem that could be solved by federal funding of education rather than by local (i.e. taxpayer) funding.

You can thank those who fear federal deficit spending for this.

Think of all the world’s problems that are related to money shortages, and then think of the fact that money is a human creation, not a limited resource, and you only can shake your head at the misery we intentionally cause ourselves.

LikeLike

When was the last time dim bulb Summers was right about anything? https://www.interest.co.nz/business/113186/james-k-galbraith-attributes-supply-chain-problem-us-system-was-built-efficiency

LikeLiked by 1 person

Uh, never?

I wish I could say Summers is useless, but he isn’t. He is harmful. But he must have a great gift of gab to get his high-level jobs.

LikeLike

Refresh my memory: Were his pair of famous uncles ever quite as harmful in practice?

“Samuelson’s family included many well-known economists, including brother Robert Summers, sister-in-law Anita Summers, brother-in-law Kenneth Arrow and nephew Larry Summers.”

Nepotism opened doors for that nitwit.

LikeLike