Here is what economic ignorance causes.

The Post-Coronavirus Unemployment Crisis Could Last for Years, Economists Say

Economists expect the U.S. to suffer its largest-ever contraction this quarter and the unemployment rate to soar to a post-Depression record, followed by a recovery that will be moderate and drawn out.

All economists? Some economists? A few economists?

The recovery may be “moderate and drawn out” only because the federal response has been moderate and drawn out.

The stock market alone lost $1.4 trillion in just one week. This doesn’t count all the other weeks this year, and it doesn’t count all the business and personal losses.

And Congress and the President think $2 trillion will prevent a depression?? Really?

Gross domestic product will plummet an annualized 25% from April through June after a smaller setback in the first quarter and the jobless rate will hit 12.6%, the highest since the 1940s, according to the median forecasts in Bloomberg’s monthly survey of 69 economists.

Gross Domestic Product (GDP) = Federal Spending +Non-federal Spending +Net Exports.

Therefore, the more the federal government spends, the faster will GDP grow.

Add a trillion dollars in federal spending and GDP will rise by a trillion dollars. Straight algebra.

Federal spending also stimulates non-federal (private sector) spending, which further increases GDP.

Sadly, our federal government does not acknowledge it is a Monetary Sovereign. It has the unlimited ability to create U.S. dollars at no cost.

Instead, it follows the right-wing, Tea Party / Libertarian formula of spending the least it can, under the circumstances, because of irrational fears about deficits and “big” government.

Then to exacerbate the problem, the politicians continue with petty, political arguments about precisely where each dollar is to go.

The downturn looks likely to be deemed as the first recession since 2007-2009 by U.S. business-cycle arbiter National Bureau of Economic Research. The second half of the year will see a resumption of growth, according to the survey, though economists say the deck is stacked against a snap-back.

The Fed is expected to keep interest rates near zero until the first half of 2022.

The low-interest-rate myth continues. The popular belief is that low interest rates are economically stimulative because they make borrowing cheaper.

But low interest rates have a negative side: They reduce the amount of interest the federal government pays on its Treasury Securities, i.e. the amount of interest money the government pumps into the economy. This reduction directly cuts GDP.

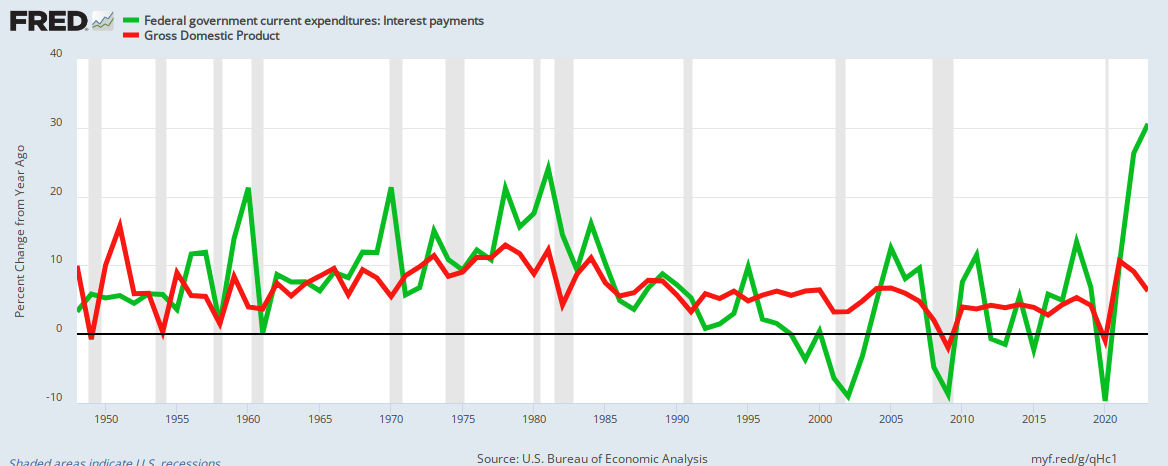

As the above graph demonstrates, high interest rates correlate with high GDP growth and low rates correlate with low GDP growth.

As interest rates trended up, through 1980, the GDP growth trended up. Then, as interest rates trended down, the GDP growth rate trended down.

The above graph is similar to the previous graph except it shows total interest paid rather than interest rates. The result essentially is the same.

On average, the more interest the federal government pays, the more GDP grows.

“Even if the economy starts to re-open in mid-May, more than 20 million Americans will have lost their job with the economy likely having contracted around 13% peak-to-trough, more than three times deeper than the global financial crisis,” James Knightley, chief international economist at ING Financial Markets, wrote with his forecast submission.

“It will be a gradual re-opening of the economy, so a return to ‘business as usual’ is many months away.

Throw in crippling financial losses and a legacy of defaults and it means we estimate U.S. economic output won’t return” to the late-2019 peak until mid-2022 at the earliest, Knightley said.

People “lose their jobs” because companies cannot afford to maintain payroll. As the companies run short of money, their people run short of money. When consumers run short of money, they buy less, so more companies run short of money, in a self-strengthening helix descending to depression.

To cut the helix, the government must give (not lend) money to businesses and to consumers.

“Crippling financial losses and a legacy of defaults” are symptoms of a lack of money.

See the commonality? The overarching problem facing the economy is a shortage of money — which the federal government could solve with sufficient deficit spending.

The U.S. federal government has a massive built-in advantage, that if used properly, would eliminate recessions and depressions. Unlike state and local governments and unlike euro-nation governments, the U.S. government is Monetarily Sovereign.

It has the unlimited ability to create U.S. dollars and to give those dollars any value it chooses.

There is no excuse for a company to fire people because it has run short of payroll dollars if the government simply will provide per-employee financial support.

There is no excuse for “crippling financial losses” if the government will pump dollars into the economy.

We are at war with our financial enemies: Recession and depression. The U.S. government has an ultimate weapon to use against these enemies: Monetary Sovereignty.

Instead, it chooses to fight with sticks and stones — little sticks and tiny stones. And it leaves the battle to the monetarily non-sovereign states, counties, and cities. The army has departed the battlefield, leaving the women and children to fight empty-handed.

The government is in a war against the enemies, recession

As a result, we will lose the war, and the American people will suffer.

Needlessly.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

“:he more the federal government spends, the faster will GDP grow”

Only spending into the production-and-consumption economy – spending into the FIRE economy never shows in GDP.

LikeLike

Really? So that house I bought doesn’t count?

LikeLike

I believe just the imputed rental expense of your house goes into GDP. Am I wrong abut that?

LikeLike

See #12: https://en.wikipedia.org/wiki/Gross_domestic_product#/media/File:GDP_Categories_-_United_States.png

Construction of the new house is counted. After that, the imputed rental expense is counted.

LikeLike

Check St. Louis Federal Reserve website. Plenty of charts depicting FIRE and GDP.

LikeLike

Thank you Steve,

The variable is time. Today, that variable is quite short.

LikeLike

My understanding is that GDP captures the “flow” of money through the economy (ie, revenue & expenses) not the “stock” (ie, assets & liabilities), so government spending that bails our banks or subsidizes industries is never seen by GDP. If that’s incorrect, I’d like to know it.

LikeLike

Ed, you are correct. Transfer payments are not counted, at least not directly. It’s only when the transfer payment dollars are used for purchasing that they are counted.

LikeLike

“Add a trillion dollars in federal spending and GDP will rise by a trillion dollars. Straight algebra.”

The algebra only works when there are idle resources. Once you’re at the economy’s capacity, any further government spending draws real resources away from the private sector. But we almost always operate below capacity so we should print money and spend up to that point.

“Federal spending also stimulates non-federal (private sector) spending, which further increases GDP.”

Yes, true again but only if their are idle resources (which is most of the time). Here is William Vickrey on that:

“The current reality is that on the contrary, the expenditure of the borrowed funds (unlike the expenditure of tax revenues) will generate added disposable income, enhance the demand for the products of private industry, and make private investment more profitable.

As long as there are plenty of idle resources lying around, and monetary authorities behave sensibly, (instead of trying to counter the supposedly inflationary effect of the deficit) those with a prospect for profitable investment can be enabled to obtain financing.

Under these circumstances, each additional dollar of deficit will in the medium long run induce two or more additional dollars of private investment. The capital created is an increment to someone’s wealth and ipso facto someone’s saving.

“Supply creates its own demand” fails as soon as some of the income generated by the supply is saved, but investment does create its own saving, and more.

Any crowding out that may occur is the result, not of underlying economic reality, but of inappropriate restrictive reactions on the part of a monetary authority in response to the deficit.”

LikeLike

Mostly correct.

When Vickrey refers to “the expenditure of tax revenues” he should specify which tax revenues. State and local governments do spend tax revenues. The federal government does not. It destroys all tax revenues, and all other income, and creates new spending dollars.

Supply creates demand, and demand creates supply. Saving creates both. “Crowding out,” when referring to borrowing, is a mythical bogeyman, whose existence can be found in economic picture books of fiction, but never in the real world. Same with the federal government “spending taxpayers’ money.”

LikeLiked by 1 person

Yes, agreed.

Government deficits are self-financing. The government spends first and borrows back its own spending. Government spending adds reserves and government bond sales drain reserves. As such, there in no financial crowding out. MMT goes a step further and says that bond sales are not even necessary and the government should let the interest rate fall to zero.

“It destroys all tax revenues”

At one time, they actually burned them. This from an article by Randell Wray as regards the American colonial currency:

“A redemption tax of 10,327£VA was collected, of which 2,527£VA was in specie that was explicitly set aside in a dedicated account to be used to redeem notes brought to the treasury. The rest of the tax payments were burnt, implying that those tax payments were made in notes. Therefore, 76 percent of this tax was paid in notes, and 24 percent was paid in specie.”

Link to Wray’s article: https://www.nakedcapitalism.com/2016/02/randy-wray-american-colonial-currency-debt-free-money-part-4.html

LikeLike

Ahmed, years ago I gave a talk to one of Randy’s classes at UMKC. At the time, I had not heard of MMT, so I thought I was being so very controversial. I was shocked to learn that the students all agreed with me!

Since then I have moved a bit from MMT, since I disagree with their focus on a Jobs Guarantee. I still “pen pal” with Stephanie Kelton and to a lesser extent, Warren Mosler.

T-bond sales are not used for federal funding. One purpose of T-bonds (notes, bills) is to help the Fed control inflation via interest rate control.

A second purpose is to provide a safe stopping place for unused dollars, which stabilizes the U.S. dollar.

The third purpose is to make the citizenry belief federal finances are, like personal finances, and so borrowing is necessary. (aka “The Big Lie.”) This tamps down demands for government assistance, which the rich do not want the poor to have.

LikeLike

You had to know this clown would be one of the first: https://triblive.com/opinion/john-stossel-bankrupting-america/

LikeLike

Yes, his comments about economics are so wrong they are comical at best and tragic at worst, so he covers the complete entertainment gamut.

LikeLike

Steve,

I noticed he mentioned Zimbabwe. Had he read Rodger’s articles, he would know that inflation causes money printing, not the other way around.

First Zimbabwe has a negative supply shock when they started land reforms distributing large white-owned farms in small plots to black farmers. That caused the inflation in food prices, then the money printed started. Zimbabwe would have had inflation even if it hadn’t printed any money.

LikeLike

Correct. Every hyperinflation in history began with a scarcity, usually a scarcity of food or energy. Scarcity causes inflation.

In response to the inflation, the government “prints” (produces) currency, thereby creating the illusion that the currency creation caused the hyperinflation.

The solution to hyperinflations is to eliminate the scarcity, which a Monetarily Sovereign government can do by purchasing from abroad or funding production at home. This involves, ironically, money creation.

Thus the solution to inflation involves money “printing,” but directed properly.

LikeLike