Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

When is a “hole” a “bump”?

‘Cadillac tax’ repeal threatened by fight over how to fill $90 billion budget hole

By Tom Howell Jr., http://www.washingtontimes.com, October 6th, 2015Everyone from Democratic presidential front-runner Hillary Rodham Clinton to Rep. Paul Ryan, Wisconsin Republican, wants to scrap the “Cadillac tax” on generous health care plans — a rare bipartisan push to tweak Obamacare — but there is little consensus on how to fill the $90 billion budget hole that a repeal would leave.

Slated to go into effect in 2018, the tax will apply to expensive health care plans — the kinds that labor unions often negotiate for their members. That gives Democrats an incentive to support a repeal.

Sen. Bernard Sanders, the Vermont independent, says a surtax on the wealthiest Americans should do the trick.

Hillary Clinton says her overall health care plans, which would expand Obamacare, would produce enough savings to “more than cover” the repeal.

Mr. Ryan, who heads the House Ways and Means Committee, wants to go the other direction by trimming Obamacare and using the savings to pay for the repeal.

“There’s no consensus on how to pay for it, and it’s a pretty big piece of change,” said Timothy Jost, a law professor at Washington and Lee University in Virginia.

Democrats included the levy in the Affordable Care Act as a way to extract billions of dollars to pay for other benefits in Obamacare.

“Repealing this provision of the ACA would hurt our economy by increasing the deficit, raising health care cost growth and cutting workers’ paychecks,” a White House official said.

Note to Paul Ryan, Bernie Sanders, Hillary Clinton, Timothy Jost, Democrats, Republicans and the White House: FEDERAL TAXES DO NOT PAY FOR FEDERAL SPENDING.

The federal government, being Monetarily Sovereign, pays for all federal spending, ad hoc, by instructing banks to increase the balances in creditors’ checking accounts.

The sole financial effect of federal taxation is to reduce the supply of money in the economy.

Cutting federal taxes by $90 billion would be a $90 stimulus to the economy. In other words, an economic “bump.”

Mrs. Clinton said the health care reforms she will roll out to build on Obamacare would pay for repeal.

Meanwhile, Mr. Sanders’ campaign said a less than 1 percent tax on Americans making more than $1 million per year would cover the lost revenue.

Republicans on the committee say scrapping the law’s individual mandate to hold insurance will result in massive savings because fewer people will seek taxpayer subsidies on Obamacare’s exchanges — a windfall that would be enough to pay for repealing the Cadillac tax and the law’s 2.3 percent levy on medical device sales.

No, no and no. There is no need to “pay for” a reduction in federal taxes, or to “cover lost revenue.” The federal government neither needs nor uses tax dollars for anything. Even if all federal taxes fell to $0, the U.S. government could continue creating dollars and paying bills, forever.

The proper name for a $90 billion tax cut is “economic stimulus.” It leaves more dollars in the pockets of consumers, who then have the power to save or spend those dollars to increase sales and profits of businesses.

So why the budget gamesmanship? The 1% rich, who own the politicians, do not want the 99% rest of us to increase our power.

They want to keep their ruling power. They want to increase the Gap.

So they tell us that giving us a financial bump really puts us in a financial hole. It’s the Big Lie, again.

In 1971, we went off the gold standard straightjacket, to allow the federal government unlimited stimulus flexability — the unlimited ability to pay its bills without raising taxes.

The bought-and-paid-for politicians pretend it never happened.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

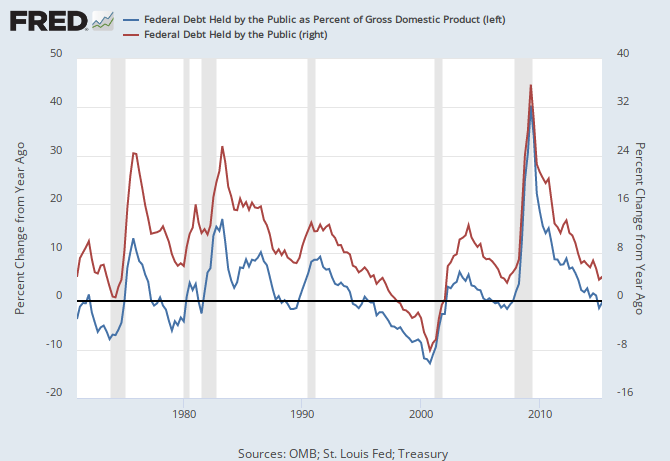

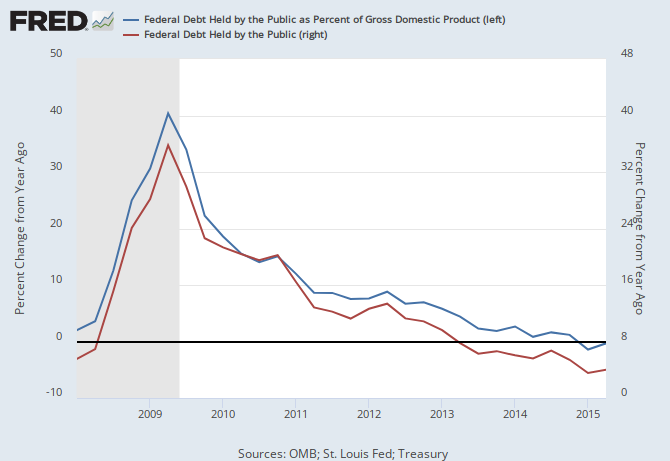

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Economics is not like physical science where energy arriving at point A must have come from somewhere else since energy can’t be created or destroyed.

But money can! Money is not part of the real world. We made it up. It can’t run out. The financial world of MS can’t be depleted or exhausted. The MS gas tank is as big or small as we want it to be. But the 21st century will need a very big gas tank to run the economic engine successfully, lest we want to continue sputtering down the same old bumpy road.

LikeLike