Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

Quoting from the previous post:

Austerity, aka deficit reduction, stems from the belief that a government’s income pays for government spending. This is belief is correct for monetarily non-sovereign entities: Cities, counties, states, businesses and people.

You and I need outside sources of income in order to spend. So do our local governments. We all are monetarily non-sovereign.

By contrast, Monetarily Sovereign entities, such as: U.S., UK, Canada, China, Japan et al, do not need outside sources of income.

A Monetarily Sovereign entity is sovereign over its own sovereign currency, and so, has the unlimited ability to create its currency. A Monetarily Sovereign entity never can run short of its own currency, and never needs to ask anyone for its own currency.

So, a Monetarily Sovereign entity never needs to tax or borrow, in order to obtain its own sovereign currency. It is sovereign.

That is a fundamental economic truth, though all our politicians, most notably the Tea Republicians, refuse to acknowledge it. Debt and deficit limitation is the set of actions responsible for our unnecessarily slow recovery.

And now we come to poor, euro-smashed Europe, with its twin problems: The euro and austerity:

Divisions Grow as a Downturn Rocks Europe

NY Times, By LIZ ALDERMAN and ALISON SMALEAUG. 29, 2014Germany, the Continent’s economic engine, contracted in the second three months of the year, while the bloc of 18 European Union nations that use the euro failed to grow at all.

While the per capita Gross Domestic Product of the U.S. has risen following the Great Recession, the euro nation’s recovery not only has stalled, but has declined for the past two years.

The eurozone is in the midst of what is known as “a recession” — headed toward a full-fledged depression.

United States = Solid Line (left); Euro Area = Dotted Line (right)

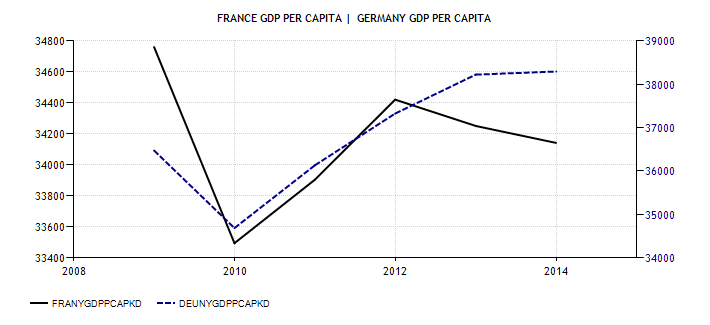

The decline has not been fairly distributed among nations, of course. But even the mighty Germany now has leveled off and begun its fall.

France = Solid Line (left); Germany = Dotted Line (right)

Why has the U.S. grown (albiet too slowly, because of deficit reduction) while the eurozone has faltered? Monetary non-sovereignty.

When the eurozone nations adopted the euro, they surrendered the single most valuable asset any nation can have: Its Monetary Sovereignty, i.e., the unlimited ability to create its own sovereign currency, and thereby pay any debt denominated in that currency.

The monetarily non-sovereign eurozone nations need endless deficit reduction to avoid debt defaults, while the Monetarily Sovereign U.S. does not need deficit reduction and never will default on dollar-denominated debts. Having the unlimited ability to create dollars prevents default (despite John Boehner’s famous lie, “Let’s be honest. We’re broke.”)

One result of less austerity in the U.S.: Our unemployment rate is falling much faster:

The U.S. = Solid Line (left); The Euro Area = Dotted Line (right)

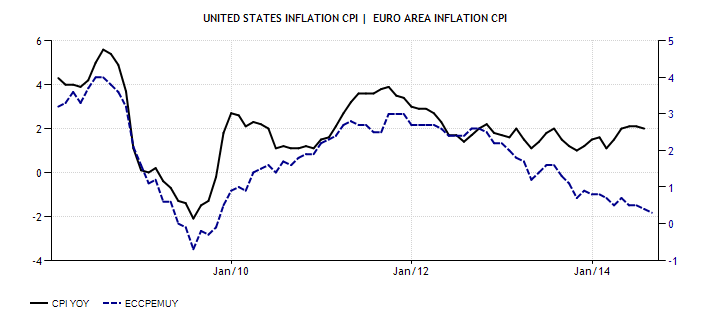

Yet another effect of monetarily non-sovereign austerity: Dreaded deflation. While the inflation rate in the U.S. remains very close to the Fed’s target rate of 2.5%, the eurozone’s lack of money has sent it into a deflationary slump.

The U.S. = Solid Line (left); The Euro Area = Dotted Line (right)

Deflation is felt to be anti growth, because it encourages consumers to delay spending until prices fall further. If you know products will be cheaper tomorrow, you’ll wait until tomorrow before purchasing. This delay evolves to “no-purchase-at-all,” which impacts GDP.

The eurozone provides the perfect test of deficit reduction (austerity). The test demonstrates how deficit reduction leads to recessions and depressions:

U.S. depressions tend to come on the heels of federal surpluses.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

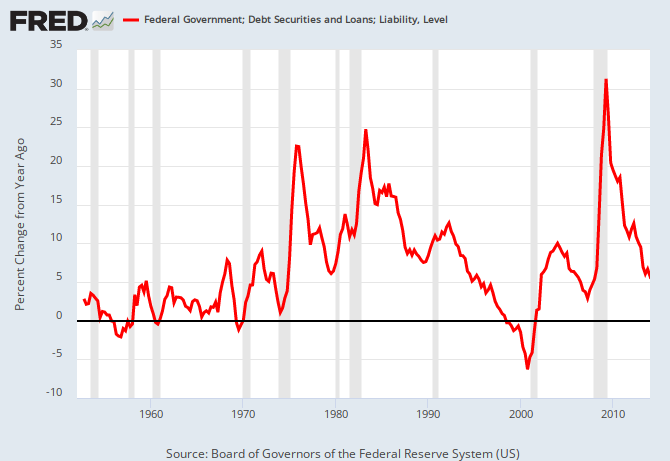

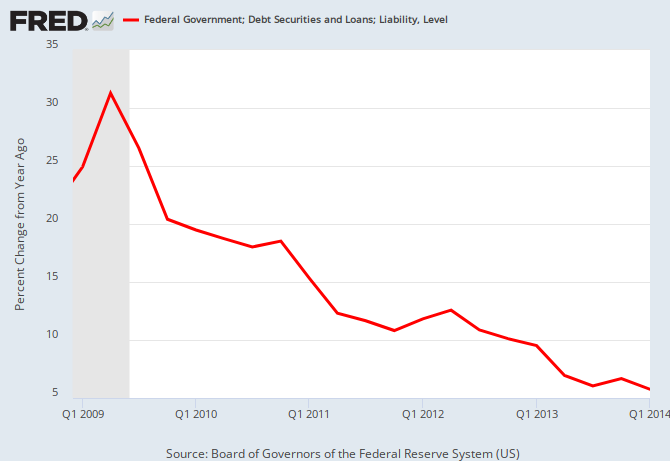

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.Recessions tend to come on the heels of reductions in federal debt/money growth (See graph, below), while debt/money growth has increased when recessions were resolving. Taxes reduce debt/money growth. No government can tax itself into prosperity, but many government’s tax themselves into recession.

Deficit reduction causes economic destruction. But deficit reduction often is necessary for monetarily non-sovereign governments, which cannot create the money to pay their bills. Long term, such governments can survive only if they have money coming in from outside their borders.

The euro nations need the EU (which, by the way, is Monetarily Sovereign) to give (not lend) them continual infusions of euros. Similarly, the U.S. states (which are monetarily non-sovereign) need continual infusions of dollars.

For a euro nation, the additional euros can come from a positive balance of payments — importing more euros than exporting. But few euro nations can be net exporters. They need help from the EU.

Again similarly, the U.S. states either must be net dollar importers (via tourism or sales of goods and services) or they must receive dollar infusions from the federal government — federal deficit spending.

Counties and cities, also being monetarily non-sovereign, need continual infusions from their states. The obvious implication is that states must run deficits to support their cities and counties, and in turn, states must be supported by federal deficits.

Bottom line: Barring uncontrollable inflation (which the U.S. never has experienced) austerity, i.e. deficit reduction, always is harmful to an economy. Anyone who tells you the U.S. federal deficit and debt are too large either is ignorant of economics or is a liar. Those are the only two options.

As for the euro nations, they either need to re-adopt their own sovereign currencies, or join politically into something resembling a United States of Europe, in which the EU gives (not lends) euros to member nations as needed.

Perhaps things to get much worse, before the euro nations have the willpower and the desire to implement one of these solutions. After all, reductions in government spending negatively affect the lower income people far more than the upper income people. That is why the upper .1% income/wealth/power group loves austerity: Austerity widens the Gap between the rich and the rest.

Being bribed and controlled by the very rich, the EU and the International Monetary Fund consistently advocate for deficit reduction and Gap widening.

In fact, one may safely assume that Gap widening has been the fundamental purpose of the euro, all along.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

If the EU gives (not lends) euros to member nations as needed, this will, as I’ve pointed out before, send a message of “complete affordability” just as scarcity, limit, and monetary non-sovereignty sends the opposite traditionally accepted message.

The whole idea of MS is ironically its Achilles Heal. The 1% fear loss of control and power over the minions. In the final analysis it may take continued austerity to elevate our problems to such a degree that we induce failure and collapse. Then, faced with no other choice, society will be forced to have to find functional finance as the only solution. Emerge by means of emergency. The solution MAY be the elevation of the problem.

LikeLike

Are you suggesting that the economy should get so bad, it collapses, which leads to a narrowing of the Gap between the rich and the rest?

I doubt that solution.

Look around you at all the bad economies, from North Korea, to Gaza to Haiti to many of the African nations. There the economies are in shambles, but the rich lead luxurious lives and maintain power, while the rest lead lives of misery.

It can take generations or even centuries, for the poor to acquire enough willpower to rise up against the rich. Meanwhile the poor suffer.

Much better to narrow the Gap via the “10 Steps to Prosperity.”

I do not subscribe to the philosophy, “Things have to get worse before they get better.”

LikeLike

I feel there are other forces at work besides the poor getting poorer, powerlessness, unemployment, crooked politicians, the gap and inflation.

There are external, unprecedented consequences like major flooding, wind, sinkholes, earthquakes, species disappearance, asymmetrical weather patterns, infrastructure collapse etc. that will prove extremely costly, forcing a functional economic policy in order to cope, whether the rich like it or not. My guess is their control and influence will dissolve under these extreme conditions simply because they have no influence over them. One way or another Nature and evolution will have the final say, not the 1%.

I agree completely with the 10 Steps but there has to be “activation.” The 10 Steps won’t just suddenly happen on their own or because the rich decide it’s time to step aside; they’ll only respond to unprecedented force, if not by people then by Nature.

Things don’t have to get worse before they get better, but it seems we have to make all the wrong moves (including no moves– procrastination) before we know the right one. It’s boiling down to the Old West’s “the quick and the dead.”

Whether by design or coincidence, our “leaders” are getting their feet put to the fire from the increasing disorder that we see thanks to the internet.

LikeLike