Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the Gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

============================================================================

It’s common knowledge that:

1. Japan’s economic growth is too low, and

2. Its debt is too high, and

3. Japan can’t stimulate its economy by “printing” money, since that would cause inflation or hyperinflation.

Japan’s debt looks like this: 1,000,000,000,000,000 yen

John Schwartz — New York Times — 11 Aug 2013A quadrillion is a million billion. Measuring any currency in quadrillions brings to mind the hyperinflation of Germany between the wars, or Zimbabwe in the last decade.

Clearly, with a debt that high, Japan must be teetering on the edge of hyper-inflation. True?

Not exactly hyper-inflation. Is this a problem?

First, a quick backstory: Deflation is said to be bad for an economy, because it encourages people not to buy.

Today, they wait for prices to fall tomorrow, then tomorrow, they wait for prices to fall the next day. This continual waiting for prices to fall inhibits growth in Gross Domestic Product.

(Would you be more or less likely to buy a house today, if you expected house prices to be lower next month?)

So nations try for a small amount of inflation — usually in the neighborhood of 2%-3% — to stimulate buying today, but not so high as to be an excessive burden.

Inflation generally is micromanaged via interest rates. The Value of money (inflation) is in part, based on Supply and Demand. Demand is, in part, based on Risk and Reward, and the Reward for owning money is interest.

The higher the interest, the greater the Demand for money (i.e. accounts that pay interest), so raising interest rates increases the Value of money. When central banks sense inflation may rise too high, they raise interest rates to increase Demand, which increases the Value of money, thus fighting inflation.

So, Japan’s inflation, after years of deflation, might be a bit higher than desired — a situation that easily could be modified by raising interest rates.

But that relatively small amount of easily-modified inflation is far less a problem than is slow economic growth.

Japan’s Economy Shrinks the Most Since 2011 Quake on Tax

By Keiko Ujikane Aug 12, 2014 9:56 PM CT BloombergJapan’s economy contracted the most since the record earthquake three years ago as consumption and investment plunged after an April sales-tax increase aimed at curbing the world’s biggest debt burden.

Gross domestic product shrank an annualized 6.8 percent in the three months through June, the Cabinet Office said.

Household consumption plummeted at an annualized pace of 19.2 percent from the previous quarter, while private investment sank 9.7 percent, highlighting the damage to demand by the 3 percentage point increase in the levy.

A bit more backstory: Central Government Deficit = Economy’s Income + Balance of Payments This means, the net (after taxes) dollars created by the central government go into the nation’s economy or go abroad.

By definition, a growing economy requires a growing supply of money: Gross Domestic Product = Government Spending + Non-government Spending + Net Exports

This equation merely says that GDP is a money measure, and the less money available in an economy, the less GDP can grow.

But, central government taxes remove money from the economy, and sales taxes are among the worst kind of taxes, because they directly take money from consumers, who then are forced to spend less (Non-government Spending).

Japan’s government is Monetarily Sovereign. It has the unlimited ability to create it’s sovereign currency, the yen. It never can run short of yen to pay its bills.

The only constraint on yen creation is inflation, which can be controlled by interest rates.

So when Japan tries to stimulate its economy via increased government spending, while at the same time, increasing sales taxes, it is, in essence, giving the anemic patient a blood transfusion, while at the same time, applying leeches.

Given its absolute control over what is a moderate inflation, you may find it difficult to understand why Japan has applied leeches to its anemic economy — other than the following speculation:

Sales taxes are highly regressive, falling primarily on the lower and middle income groups. For that reason, sales taxes widen the Gap between the rich and the rest.

The Gap is what makes people rich. Without the gap, no one would be rich, and the wider the Gap, the richer they are. So the rich want, more than anything, for the Gap to widen.

Japan’s politicians, like American politicians and indeed, politicians the world over, are bribed by the rich (via campaign contributions and promises of lucrative employment later), to widen that Gap.

From a purely economics standpoint, there is no logical reason for Japan to have increased its sales taxes. They long ago proved the debt is no problem. The data is right there in front of our eyes.

But the real data is the Gap, and that is what the Japanese rich have bought.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

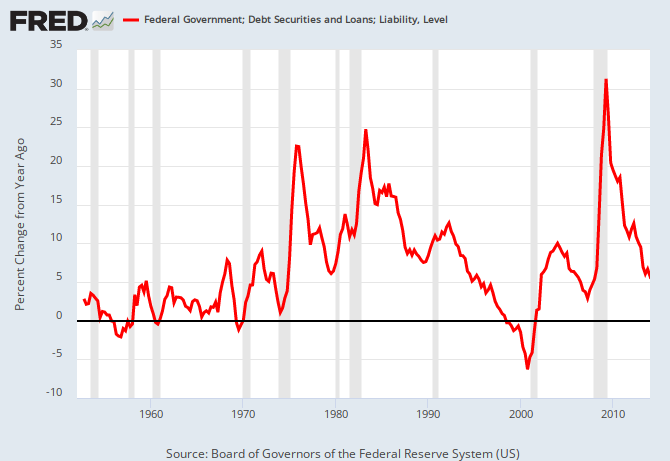

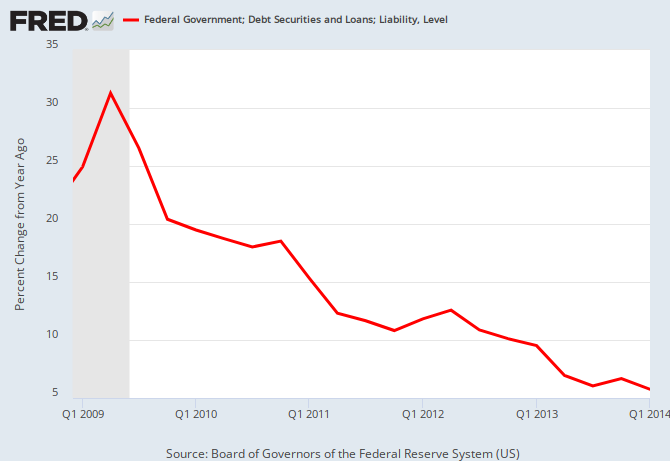

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

[1] Bloomberg claims that the April increase in Japan’s national sales tax was “aimed at curbing the world’s biggest debt burden.”

LIES!

The US and Japanese governments have no “debt burden” whatsoever, since they both have Monetary Sovereignty. The tax increase was aimed at further widening the gap between the rich and the rest.

In the next sentence, Bloomberg admits that Japan’s real economy is in a depression. Household spending has plunged, wages have dropped for 23 months in a row, and thirty-right percent of the labor force can only find part-time jobs. Bloomberg implies that all this suffering is necessary to “curb the world’s biggest debt burden.” LIES!

[2] Rodger writes: “When Japan tries to stimulate its economy via increased government spending, while at the same time, increasing sales taxes, it is, in essence, giving the anemic patient a blood transfusion, while at the same time applying leeches.”

True, but there is no increase in government spending for Japan’s real economy (except for weapons makers and military-related industries.)

Instead, the Bank of Japan (i.e. central bank) is engaging in QE, which the media refers to as “stimulus spending.” QE only stimulates the financial economy, and does so at the expense of the real economy.

[3] The farther that Japan shifts to the right in fiscal terms, the farther Japan also shifts to the right in political terms. Japanese politicians talk of the “need to cut entitlements,” while they demand a larger and more aggressive military force.

Excessive military spending is part of austerity, which itself serves to widen the gap between the rich and the rest. However, corporate media outlets claim that Japan’s increasing military spending is to counter the “rise of China.” That is nonsense. China has the world’s largest army in terms of manpower. And China has had nuclear weapons for the last 50 years. China has dwarfed Japan militarily for decades. But now Japan’s right-wing government must suddenly “counter the Chinese threat.” That is, Japan’s masses must have more austerity.

Japan’s ultra-right-wing Prime Minister Shinzo Abe (a clone of England’s David Cameron) wants to privatize the Government Pension Investment Fund (GPIF), and shove it in the stock market. George W. Bush wanted to do the same thing with Social Security but Bush had to back off when Lehman Brothers collapsed and the Wall Street tanked.

Now Abe wants to put the security of Japan’s elderly at risk to boost profits for his plutocrat owners. Mr. Abe also wants to eliminate overtime pay. He wants to make it easier for corporate bosses to fire workers. He wants to allow low-paid foreign workers to care for children and the elderly in a series of “special economic zones” that are exempt from labor laws, such as the minimum wage.

Meanwhile big corporations in Japan are sitting on a record amount of cash, which they use to buy back their stock from the market. This is done to improve shareholder returns by increasing the value of the remaining shares outstanding. When the value of the stock goes up, so do their bonuses and compensation of the corporate bosses.

Japan has austerity mania just like every other nation.

LikeLike

Well said.

LikeLike

RMM, A little knit picking to make your day. Title of this entry should read “These data are….” Data is the plural of datum. Data can also become information. http://dictionary.reference.com/browse/data

But the real data (information) is the gap, and that is what the Japanese rich have bought.

LikeLike

Thanks.

LikeLike

Ah ha, that should be nitpicking.

LikeLike

As quatloosx was saying: Study: New jobs pay 23% less than those lost during the Great Recession

LikeLike

In the mood for some more cartoons? Here’s three of them. The theme is student loans…

LikeLike

And the excuses begin….

“Deflation is said to be bad for an economy, because it encourages people not to buy.” RMM

Really? So if you are hungry you wait until a few weeks to eat? If you need a car to get to work, around, etc… you will wait another month? If you don’t have clothes to wear you wait until next year and walk around naked?

No RMM… it’s a lie, a myth.

The issue in Japan is pretty easy to understand – the country has embraced fraud as a way of life. Inflation has remained low – how good is low inflation when real wages are dropping?

This year they’ve been trying to create the proverbial free lunch and just got smacked in the face. The money is getting created and stolen by the folks in government and banks. And that’s exactly what will happen when you embrace fraud. Stop the excuses Rodger, I told you I would be back to tell you.

LikeLike

Not sure what “excuses” you think you have discovered, but . . .

If you knew the price of homes would be lower next month, you would not wait a month to buy a home??

If you knew the price of cars would be lower next month, you would not wait a month to buy a car??

If you knew the local department store was going to have a big sale next week, you wouldn’t wait until next week, before buying??

Yes, you might not go without food, but Cosco’s entire business model is based on people delaying the purchase of food and clothing until they can go to the Cosco and stock up.

Based on your previous comments, perhaps your answer is, “Yes, I wouldn’t wait.” But sane people would.

In fact the reverse also is true, with much of the demand for homes having been based on the belief that home prices always would rise. It also is the basis for the demand for stocks.

Absolute rule: When people know prices will be lower tomorrow, they will delay purchasing until tomorrow, if they are able. To deny it smacks of intentional ignorance.

By the way, your final paragraph is nonsensical, as usual. First, you demean the notion of money being a “free lunch” (I assume this means you think the government cannot create it at will.)

Then you talk about the “money getting created . . . by the . . . government and the banks.”

So make up your mind. Can the government and banks create money or not?

Oh heck, you don’t know. Why would I even ask?

LikeLike

You buy things when you NEED them Rodger. Does that make any sense?

LikeLike

The government can create money any time – who doesn’t know that?

What you fail to admit is that that is counterfeiting – theft – fraud. That is why Japan is collapsing.. That is why the middle class of a few years ago are now poor people on welfare programs. That’s why the middle class continues to disappear.

The people don’t need “free” things, they have 2 freaking hands to work and produce – and can hold their own. What they do need is a government that does not foment fraud – a government that prefers fraud over responsibility. You cannot have it both ways Rodger – either you are a fraudster or you are a kind loving person.

If you steal from the someone, even if you are giving it to a poor person, how can anyone take you honestly? Irrespective of what you say, you are included in the fraudster camp.

LikeLike

Truly sad. I understand your name.

LikeLike

Government seigniorage is fraud, theft, and counterfeiting?

Wow. Hats off to Marvin the Monkey.

Here’s a special cartoon to show my gratitude…

LikeLike

== Off topic ==

AUSTERITY IN AUSTRALIA

As austerity mania continues to ravage the planet, Australian politicians continue their frantic campaign of catching-up with the rest of the corrupt world.

Today Australia’s Treasurer Joe Hockey said he may be forced to take “emergency action” and deliver a severe increase in austerity if structural budget reforms are not made.

“Structural budget reforms” means austerity, whose sole purpose is to widen the gap between the rich and the rest. Such “reforms” include things like increased co-pays for Medicare, cuts to welfare, cuts to education assistance, a new fuel excise tax, and so on.

The poor spend a higher proportion of their incomes on fuel, but Joe Hockey says his new fuel tax will not hurt the poor, since the poor don’t have cars, and they don’t drive very far anyway. Mr. Hockey ignores the fact that higher fuel taxes on trucks, trains, planes, tractors, farm combines, and so on will cause food to become more expensive in supermarkets. Bus fares, taxi fares, and passenger train fares will also go up. Heating oil will become more expensive in the winter. City taxes will be increased to pay for fire trucks, garbage trucks, police cars, police helicopters, and so on.

In short, when energy prices go up (in this cause because of a gratuitous tax) the prices of everything else in society go up.

Joe Hockey says the masses must have more austerity because (Monetarily Sovereign) Australia has a “national debt crisis.” He also says that Medicare is “not sustainable.”

(NOTE: Hockey is half-Palestinian, which made him a social outsider when he was growing up. In order to become a powerful insider, he learned to champion the rich at the expense of the rest. His magic wand is the Big Lie. Also, note how austerians in every country use the same lies, e.g. “not sustainable.”)

Joe Hockey says of his demand for increased austerity, ”I am warning the people of Australia that if we do not take action now, we are going to end up paying up $3 billion a month in interest alone.”

This is more lies, since the Reserve Bank of Australia creates money out of thin air to pay interest on T-securities. No one in Australia will ever have to pay one cent on the so-called “national debt.”

Fortunately for Mr. Hockey and his lies, the masses like to suffer. They like to hear that their federal government has a “national debt crisis,” since this gives them ammunition for hating their chosen target, whether it be immigrants, Aborigines, Jews, Muslims, or whatever.

http://www.smh.com.au/federal-politics/political-news/joe-hockey-threatens-emergency-austerity-action-if-budget-measures-are-rejected-20140813-3dm4o.html

By the way, Joe Hockey tells the middle class and the poor that he will attack the rich too. For example, Hockey has proposed a 2% “deficit levy” payable on incomes of $180,000 or more. The levy would be applied for one year, and would suck $2.5 billion out of the Australian economy. The details are vague (intentionally so), but of course no tax on the rich will ever pass.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

OF BANKERS AND WITCHES

John Bruton was Ireland’s prime minister from 1994-1997. He is now chairman of IFSC Ireland, which promotes the Irish financial services sector at the expense of the real economy. He says that nowhere in the world have (fraudulent criminal) bankers had anything to do with austerity. He says that “Populations are blaming austerity on bankers like people in the 17th century blamed witches.”

John Bruton also warned that the (Monetarily Sovereign) U.S. government will be forced to default on its Medicare and Social security commitments.

He spewed his lies at a function held in his honor at the exclusive 21 Club in New York.

John Bruton, 67, ceased being Ireland’s prime minister 17 years ago. You’d think that when these maggots leave office, we should no longer have to put up with their stench – but no. They keep crawling back until the day they die.

http://www.independent.ie/irish-news/politics/john-bruton-populations-are-blaming-austerity-on-bankers-like-people-in-the-17th-century-blamed-witches-30495871.html

LikeLike

My only problem with the Fed’s idea of purposely inducing inflation is it’s proportionately higher impact on the 99%, especially the poor. This is a sustained program of continual legal theft all in the name of GDP growth. The fact that this is more beneficial to the rich than everyone else tells me the Fed is not a public but a private concern, and “federal” is an intentionally misleading façade.

For the past century everything, including electricity, has been getting less expensive to manufacture due to scientific advancements in being able to do more and more with ever less inputs involving lighter, stronger, cheaper materials techniques and methods.

Major greedy international corporations (not small competitive businesses who are forced to play catch up) are very likely behind inflation by way of their collusion. But this goes undetected by the public due to their a-greed upon plan to advance prices one by one separated by large time intervals rather than all at once where the conspiracy would obviously be exposed.

The Fed is likely an arm of the .1%, and the policy of induced inflation by the Fed is merely a disguise for what is secretly going on at the transnational mega-corporate level, i.e., a program of universal cash theft guaranteed both secretly and publicly by sustained “Federal” policy in favor of large stock holders who love inflation and don’t have to lift a finger to earn a living.

LikeLike