Words matter.

When you hear about the U.S. federal “debt,” or “deficits,” you probably visualize something akin to personal debt or deficits, corporate debt/deficits, or local government debt/deficits.

And when hear about federal “borrowing,” you probably visualize borrowing similar to personal, corporate, or local government borrowing.

If that’s what you’d visualize, you would be wrong.

Federal finances are nothing at all like personal, corporate, or local government finances.

The difference begins with the fact that the U.S. government is uniquely Monetarily Sovereign.

In the beginning of our nation, the federal government created laws from thin air. Some of those laws created the U.S. dollar from thin air– as many dollars as the government wished.

And those laws gave those dollars whatever value the government wished.

That is what being sovereign over the dollar means: Total, 100% control over the laws that have total 100% over all aspects of the dollar. In real effect, the federal government is God of the Dollar

Throughout the history of America, the U.S. federal government has continued to create as many dollars as it wished at whatever values it wished.

These values arbitrarily were changed many times, and even today the federal government creates dollars at will, just by pressing computer keys, and controls their value.

Neither you, nor any corporation, nor any local/state government has this ability with respect to U.S. dollars. You are monetarily non-sovereign.

The federal government’s unique and unlimited ability to create dollars and arbitrarily to control their value means.

- Unlike you, businesses, and local governments, the federal government never unwillingly can run short of dollars.

- Unlike you, businesses. and local governments, the federal government neither needs nor uses income.

Imagine that you own a dollar-creating machine that allows you legally to create any number of dollars you wished. You could press keys that create, a million dollars, or a billion, or a trillion, trillion, trillion dollars.

Would you need any other source of income?

Would you need any other source of income?

Think logically: Would you ever need to borrow dollars?

Would you ever need to levy taxes on anyone, to acquire dollars?

Would you ever have any difficulty paying for anything?

And, in fact, the federal government does not borrow dollars. It levies taxes, but not to acquire dollars. And it can pay for anything at the touch of a computer key.

Federal taxes do not provide the federal government with spending money. The purpose of federal taxation is to control the economy by taxing what the government wishes to discourage, and by giving tax breaks to what the government wishes to encourage.

Even if all federal taxing ended, and tax collections equaled $0, the federal government could continue spending, forever.

BORROWING AND THE “DEBT”

The federal government never borrows.

Some people claim that T-securities — T-bills, T-notes, T-bonds — represent borrowing. That claim is wrong.

You, and businesses, and state/local governments borrow to acquire dollars you do not have, or to acquire dollars at a lower cost than you can earn by investing. When you buy a house or a car, you may finance the purchase if you don’t own enough dollars to cover the cost, or if the interest you would pay is less than you could earn with those dollars.

But the federal government has the ability to create infinite dollars at essentially zero cost. It has no reason to borrow.

So why does the government sell T-securities?

The purposes of T-securities are:

A. To provide safe, interest-paying “parking places” for unused dollars. This safety helps to stabilize the value of the dollar.

B. To help the Fed control interest rates, which is one of the methods by which the government controls the value of the dollar, i.e. controls inflation.

When you purchase a T-bill, note, or bond, you actually open a T-security account and deposit your dollars into your T-security account.

This account is comparable to a bank, safe-deposit box. The federal government never touches the dollars in your T-security account.

There, your dollars stay, earning interest, until maturity, at which time all the dollars in your account are returned to you.

The so-called federal “debt” is the total of the dollars in all T-security accounts. To pay off the “debt,” the federal government merely returns those dollars to the account holders. No tax dollars or future taxpayers are involved.

Contrary to what you repeatedly are told, your children and grandchildren will not pay off the “debt.” No one will. Paying off the “debt” merely involves the return of existing dollars.

Thus, the “debt,” no matter how large, never is a burden on the federal government, nor on taxpayers, nor on the economy.

In this regard, there is the mistaken belief that the federal government should borrow when interest rates are low, because that would constitute a reduced repayment burden. This belief is laughably wrong because:

- The federal government does not borrow and is not a debtor liable for the federal debt.

- The federal government sets interest rates at any level it wishes, and can do so, instantly.

- The federal government has the infinite ability to pay for anything.

- The interest the federal government pays constitutes growth dollars for a healthy economy.

THE “DEFICIT”

The federal “deficit” is the net amount that the federal government invests in the economy each year.

It is the difference between the number of dollars the government spends into the economy vs. the number of dollars the government takes out of the economy via taxation.

It would be far more accurate to replace “deficit” with “federal investment.”

The single most common measure of the economy is Gross Domestic Product (GDP), one formula for which is:

GDP = Federal Spending + Non-federal Spending + Net Exports.

All three terms, Federal Spending, Non-federal Spending, and Net Exports, add growth dollars to the economy. By formula, it is impossible for GDP to grow without growth dollars, and the primary, long-term source of growth dollars is the federal government.

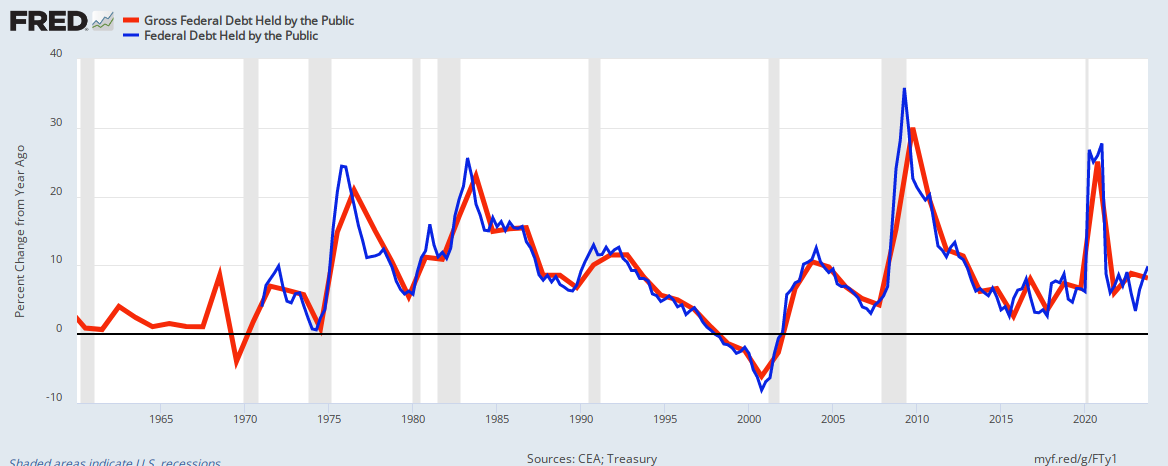

Virtually every recession and depression in U.S. history has resulted from insufficient “deficit” growth, i.e. insufficient federal investment into the economy.

Depressions follow federal surpluses (i.e. complete elimination of net federal investment in the economy.)

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

To avoid recessions and depressions, the federal government consistently must invest new dollars into the economy. Although this investment commonly is known by the pejorative terms, “deficits” and “debt,” it should be called “economic investment.”

The U.S. federal government, being Monetarily Sovereign, and thus having the infinite ability to create its own sovereign currency, the U.S. dollar, never should reduce its annual investment in the economy. For a healthy economy, the so-called “deficit” and “debt” always should increase.

INFLATION

Contrary to common claims, inflation never is caused by “too much” federal deficit spending.

All inflations are caused by shortages of key goods and services, usually shortages of food or energy.

In fact, the best cure for inflations is additional “deficit” spending to increase the supply of the scarce goods and services. Example:

The notorious Zimbabwe hyperinflation began when the Zimbabwe government took farmland from farmers and gave it to people who did not know how to farm.

The resultant food shortage caused inflation, which could have been cured by additional government investment to assist the new farmers (via education and equipment) and to obtain food from overseas and distribute it to the populace.

Instead, the Zimbabwe government simply printed currency, which gave the illusion that government money-creation caused inflation. In reality, the scarcity of food caused inflation.

Scarcities cause prices to rise. All inflations are caused by scarcities.

Cure the scarcities and you cure the inflation.

GOLD

Let us discuss one more common myths in economics: When the U.S. dollar was “backed” by gold, this helped stabilize the dollar and encouraged trust in the dollar.

The term “back” is another word for “collateral,” which is “something pledged as security for repayment of a loan, to be forfeited in the event of a default.”

The reality: Gold never collateralized the U.S. dollar — not during the times when the U.S. was on various gold standards, and not today. Never.

The notion of “backing” comes from the belief that if something happened to reduce the value of the dollar, the holder of a dollar always could turn to gold.

This notion is utter nonsense.

During gold standard times, the U.S. government arbitrarily determined the exchange rate between the dollar and gold.

The U,S. Coinage Act of 1792 arbitrarily fixed the exchange rate at one dollar to 24.75 grains of fine Gold and 371.25 grains of fine Silver.

In 1862, Congress passed the Legal Tender Act. Paper currency was guaranteed only by the full faith and credit of the United States and could not be redeemed for Gold.

In 1875, Congress passed the Specie Payment Resumption Act, in which paper currency again could be redeemed for Gold.

In 1913, the Federal Reserve was allowed to print paper currency with 40% of the currency’s value to be reserved in Gold.

In 1933, gold had to be turned over to the government at $20.67 per ounce.

In 1934, the government arbitrarily set a new gold price of $35 per ounce

In 1971, dollars no longer could be redeemed for gold. Paper currency was ensured only by the full faith and credit of the United States.

Clearly, gold cannot “back” the dollar whilen the federal government has the unlimited ability to change the exchange value of gold at will. What kind of collateral is it that cannot be relied upon?

It would be akin to your house being collateral for your mortgage, but at any time, you could substitute a different house to back your mortgage.

So what does collateralize the U.S. dollar? The same thing that always has “backed” the dollar, from the day it first was created: The full faith and credit of the U.S. government. Period.

Every form of money, including the U.S. dollar, is a debt of the money issuer, and every debt requires collateral. The U.S. dollar is a debt of the federal government. The collateral for federal debt is “full faith and credit,” which involves certain, specific, and valuable guarantees:

A. – The government will accept only U.S. currency in payment of debts to the government

B. – The government unfailingly will pay all its dollar debts with U.S. dollars and will not default

C. – The government will force all your domestic creditors to accept U.S. dollars, if you offer them, to satisfy your debt.

D. – The government will not require domestic creditors to accept any other money

E. – The government will take action to protect the value of the dollar.

F. – The government will maintain a market for U.S. currency

G. – The government will continue to use U.S. currency and will not change to another currency.

H. – All forms of U.S. currency will be reciprocal, that is five $1 bills always will equal one $5 bill and vice versa.

IN SUMMARY

Federal “deficits” actually are the net annual investments in economic growth by the federal government. The economy cannot grow without money growth; insufficient money growth results in recessions, and federal surpluses result in depressions.

Federal “debt” is the total of government investments, which equals, by law, the total of deposits into T-security accounts. The federal government pays off those T-security accounts by returning the money to the account holders, and not with tax dollars. Thus, no one is liable today or in the future for paying off the “debt.”

Inflation is caused by shortages of key goods and services, not by “excessive” federal deficit spending.

All money is a debt of the money issuer. All debt requires collateral. Gold never has been the collateral for the U.S. dollar. The collateral for the U.S. dollar is, and always has been, the full faith and credit of the U. S. government.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

To be precise and completely accurate the volume of money is only a tertiary cause of inflation, and MMTers will be disappointed to see “normal” 2-4% inflation continuing after their fiscal deficits are enlarged. The inflation will not be because of the increased deficits, but merely because the primary cause of “normal” inflation is the fact that there is no present regulatory way to prevent commercial decision makers from committing the economic vice of raising their prices. That is what the 50% discount/rebate policy at retail sale and my suggested regime of 100% taxation of any revenue garnered by price rises despite the HUGE savings created by the other policies of the new monetary and financial paradigm…would create in spades. The new paradigm would also politically enable many of the 10 changes you correctly want to see occur.

LikeLiked by 1 person

Hi Rodger,

What about wage inflation? I know you say it’s always a shortage of goods and services that cause inflation but Is there a shortage of workers?

” A string of papers by economists in the 1960s and 1970s, when inflation was thought to be a constant threat, argued that once households expect inflation to be high for the foreseeable future, they will demand higher wages.Jun 20, 2022″

Thanks, penny

LikeLike

Yes, there is a shortage of workers. https://finance.yahoo.com/news/labor-shortage-given-employees-big-174152148.html

LikeLike