Robert Murphy of The Mises Wire reviewed Stephanie Kelton’s book, The Deficit Myth.

Predictably, he panned it, because the Mises folks have languished in the “fiscal austerity” netherworld for many years.

Essentially, Mises wants you to believe there is no difference between Monetary Sovereignty and monetary non-sovereignty, and the growing federal debt is unsustainable, and if federal deficit spending is not stopped, the economy is doomed.

They have been saying the same things for more years than I have been alive (in other words, a long, long time). Their philosophy continues to ignore the reality that in the past 80 years the federal debt has grown an astounding 55,000% and we have not experienced the disasters Mises continually predicts.

On the contrary, our economy is the strongest it ever has been, or will be as soon as we find the vaccine or cure for COVID-19.

So Mises has been wrong, wrong, wrong, like the cult leader who continually predicts the end of the world, and never is dissuaded by the fact that the world continues to exist.

Economics is the place where reality competes with theory, and theory wins.

What follows are some excerpts from Mises’s Robert Murphy’s critique, and my own comments. He quotes Kelton:

‘When a country issues its own nonconvertible (fiat) currency and only borrows in its own currency, that country has attained monetary sovereignty.

‘Countries with monetary sovereignty, then, don’t have to manage their budgets as a household would.

‘Countries with a “high degree of monetary sovereignty” include “the US, Japan, the UK, Australia, Canada, and many more” (Kelton 2020, p. 19). (And notice that even these countries weren’t “sovereign” back in the days of the gold standard, because they had to be careful in issuing currency lest they run out of gold.)

‘In contrast, countries like Greece and France today are not monetarily sovereign, because they no longer issue the drachma and franc but instead adopted the euro as their currency.”

All of the above is absolutely correct, though Robert Murphy doesn’t believe it.

The insistence on countries issuing debt in their own currency helps to explain away awkward cases such as Venezuela, which is suffering from hyperinflation and yet has the ability to issue its own currency.

The answer (from an MMT perspective) is that Venezuela had a large proportion of its foreign-held debt denominated in US dollars, rather than the bolivar, and hence the Venezuelan government couldn’t simply print its way out of the hole.

In contrast, goes the MMT argument, the US government owes its debts in US dollars, and so never need worry about a fiscal crisis.

The above is partly correct, but incomplete and misleading.

As regular readers of this blog know, inflation is caused by shortages, usually scarcities of food and/or oil.

Merely being Monetarily Sovereign does not eliminate the problem of inflation, if the government doesn’t use its sovereignty to eliminate the shortages.

Here is an excerpt from:

Explainer: Causes of Hyperinflation in Venezuela

Posted on September 12, 2018 by Mathew Emmanuel PinedaWhen revenues from oil dried out due to the volatility of the global oil market, the country was affected not only because it was dependent on oil exports but also because it already had socioeconomic vulnerabilities.

Supplies of essential commodities essentially ran out because the country was unable to import them due to lack of foreign currency reserves and it was not definitely capable of producing such because of its one-dimensional and oil-dependent economic structure.

Venezuela is not an “awkward case” as Murphy tries to claim, but rather a typical case of a government so crooked, that it ransacked its economy, and no one trusted its money, both of which led to the scarcity of food, oil, and other “essential commodities.”

It was an example of a government that on the surface may have seemed to be Monetarily Sovereign, but in truth, was not sovereign at all.

Now back to Murphy’s article:

At this stage of the argument, the obvious retort for any postpubescent reader will be, “But what about inflation?!” And here’s where the critic of MMT needs to be careful.

Kelton repeatedly stresses throughout her book that printing money is not a source of unlimited real wealth.

She understands and warns her readers that if the federal government prints too many dollars in a vain attempt to fund too many programs, then the economy will hit its genuine resource constraint, resulting in rapidly rising prices.

As Kelton puts it: Can we just print our way to prosperity? Absolutely not! MMT is not a free lunch. There are very real limits, and failing to identify—and respect—those limits could bring great harm.

MMT is about distinguishing the real limits from the self-imposed constraints that we have the power to change.

Here, Murphy is correct, Kelton is wrong, and Mosler says something completely different.

As I explained in the previous post (“What causes inflation? No, it’s not ‘money printing.'”) inflation never is caused by “too many dollars.”

Inflation always is caused by shortages of essential commodities, most commonly food and oil.

The “too many dollars” myth has infected the science of economics for many years. It reminds one of how the myth that stress was a primary cause of stomach ulcers infected medicine.

To use the Mark Twain quote Kelton herself often uses, “What gets us into trouble is not what we don’t know. It’s what we know for sure that just ain’t so.”

Economics knows for sure that “too many dollars” causes inflation, though it just ain’t so, which we will demonstrate.

Warren’s Mosler’s law states: “There is no financial crisis so deep that a sufficiently large fiscal deficit cannot deal with it.” Clearly, Mosler was not handcuffed by the “too many dollars” myth.

Back to Murphy’s article:

In other words, when someone like Alexandria Ocasio-Cortez proposes a Green New Deal, from an MMT perspective the relevant questions are not, “Can the Congress afford such an expensive project? Will it drown us in red ink? Are we saddling our grandchildren with a huge credit card bill?”

If we approve this spending, will the new demand largely absorb workers from the ranks of the unemployed? Or will it siphon workers away from existing jobs by bidding up wages?”

“Expensive” is not a problem for an entity with the unlimited ability to create its own sovereign currency. “Red ink” does not exist for an entity that in reality, does not borrow. (It only accepts deposits into Treasury Security accounts, and does not touch the money in those accounts.)

And as for the least knowledgable of all: “Huge credit card bill,” the government does not have a credit card. It pays for everything by creating dollars ad hoc.

These “slack in the economy,” “enough workers,” and “siphon workers away” notions are seldom a concern in the real world.

During WWII, when millions upon millions of working men and women suddenly — in the space of a year or two, were either drafted into the military or took jobs manufacturing for the war effort, inflation-inducing shortages appeared.

It hasn’t happened again.

The keyword is “suddenly.” Outside of wartime, the effect of government initiatives occurs slowly, and the economy adapts.

Consider, for instance, the Ten Steps to Prosperity (below).

Steps #2 and #4 might move some workers to new jobs. But they will greatly enrich the middle- and lower-income groups, closing the gap between the rich and the rest.

The rest of the Steps will require money creation, but will not be related to “slack in the economy,” “enough workers,” and “siphon workers away.” gvStep 1., Eliminate FICA, will increase the federal deficit, but will not strain the economy in any way.

On the contrary, it will boost the economy by increasing consumers’ ability to buy.

To the Mises folks though, this is a problem.

The fundamental problem with Kelton’s vision: regardless of what happens to the “price level,” monetary inflation transfers real resources away from the private sector and into the hands of political officials.

If a government project is deemed unaffordable according to conventional accounting, then it should also be denied funding via the printing press.

To clarify, the word “inflation” does not mean higher prices, at least not to Mises people. No, that is “price inflation.” To Mises, the word, “inflation” merely means there is more money in the economy.

So whenever the government spends even $1, Mises claims we have “inflation,” and that somehow that “‘inflation’ transfers real resources away from the private sector and into the hands of political officials.”

Consider, for instance, Medicare benefits. When the government pays for your medical bills, Mises believes “real resources” are transferred away from you.

What are those real resources that you lose by receiving Medicare benefits? No one knows.

Or when the federal government builds a highway or supports NASA, or pays for medical research, somehow you supposedly are losing “real resources.” What they are remains a mystery.

And then we come to this comment, “If a government project is deemed unaffordable according to conventional accounting, then it should also be denied funding via the printing press.”

What that means is, if a national highway is not a toll road it should not be built. If the private sector will not support a trip to the moon or other types of research that have no profit potential, they should not be funded.

Or, if the military cannot be supported via some version of “conventional accounting” it simply should not be supported.

Does anyone really believe that?

Government cannot be in any way a fountain of resources; all that it spends, all that it distributes in largesse, it must first acquire in revenue, i.e., it must first extract from the “private sector.”

The great bulk of the revenues of government, the very nub of its power and its essence, is taxation, to which we turn in the next section.

Another method is inflation, the creation of new money, which we shall discuss further below. A third method is borrowing from the public.

Here again, Murphy doesn’t seem to understand federal financing. He claims that in order to spend, it first must acquire the dollars from the public.

But where did the public get those dollars?

In 1792, the U.S. government first created laws from thin air, and those laws created U.S. dollars, millions of them, also from thin air. Prior to then, no one in the private sector had any dollars.

Ever since, the federal government has continued to create dollars from thin air — which Murphy acknowledges with his “the creation of new money” comment.

And finally, the U.S. government does not borrow. Why would it, since it has given itself the unlimited ability to create dollars?

What Murphy and Mises don’t understand is, the U.S. dollar was created by laws passed by Congress.

The dollar is nothing more than a legal entity, not a physical entity.

Not only was it created by laws, which like all laws, were created from thin air, but the dollar’s value was set by laws, and its value has been changed many times– by laws — all of which were created from thin air.

In short, Congress created the laws that created the U.S. dollar, and those laws give the government the unlimited ability to create as many dollars as it wishes any time it wishes.

Why would the government have to borrow what it can create instantly, from thin air? Answer: It doesn’t. This is what the Mises people don’t say.

After explaining that government spending programs merely return resources to the private sector that had previously been taken from it, the economist will inform the public that there are three methods by which this taking occurs: taxation, borrowing, and inflation.

The economist will often add that government borrowing can be considered merely deferred taxation, while inflation is merely hidden taxation.

“The economist,” whoever that might be, is wrong on three counts. Federal spending does not “return resources.” Federal dollars are created from thin air. And federal dollars pay for the creation of new resources.

Taxation by a Monetarily Sovereign entity does not supply that entity with dollars. In fact, federal tax dollars are destroyed upon receipt.

The instant they arrive at any federal agency, they cease to exist as part of any measure of money supply. They simply disappear.

This contrasts with taxation by monetarily non-sovereign entities, which does supply those entities with dollars. Those dollars are held in banks, and remain part of the M1 money supply measure.

Sadly, Murphy and Mises do not understand the fundamental differences between Monetary Sovereignty and monetary non-sovereignty.

So they criticize Monetary Sovereignty based on what they believe about monetary non-sovereignty.

As for his comment, “inflation is merely hidden taxation,” he now suddenly uses “inflation” to mean price increases, rather than dollar supply increases. Confusion reigns.

And by the way, taxation and inflation are not the same things at all. Though both take real dollars from the private sector, taxation is directed by the government for a special purpose and inflation is not.

The fundamental purpose of federal taxation is to direct the economy by rewarding what is wanted and discouraging what is not wanted.

Federal taxation, unlike state/local taxation, does not provide dollars to the federal government, an entity that already has the unlimited ability to create dollars.

Federal taxation also serves the purpose of convincing the populace and apparently the Mises people, that taxation funds federal spending. It doesn’t.

The (federal) printing press allows the government to get away with spending that the public would never agree to explicitly pay for through straightforward tax hikes.

Except for the “minor” detail that while state/local taxes do fund state/local spending, federal taxes do not fund federal spending, Mises doesn’t understand the difference, which was the whole point of Kelton’s book.

Suppose that prices would have fallen in the absence of government money printing. In this case, everybody holding dollar assets would have seen their real wealth go up because of the price deflation.

If the government merely prints enough new dollars to keep prices stable, it’s still the case that those original dollar holders end up poorer relative to what otherwise would have happened.

Except for the other “minor” detail that in the absence of government money creation, we will have deflation. And deflation discourages buying, thus causing recessions and depressions.

With deflation, consumers wait until “tomorrow” to make purchases, which hurts businesses and increases unemployment, which further takes money from consumers, in a destructive downward spiral.

Ask any of the euro nations that being monetarily non-sovereign, have had to institute austerity, i.e reduced government spending. They will tell you in colorful detail about the horrors of what Murphy recommends.

Of all the economists in the world, I suspect only the Mises economists favor deflation.

MMT theorists claim that if there is still some “slack” in the economy, in the sense of unemployed workers and factories operating below capacity, then a burst of monetary inflation can put those idle resources to work.

Even though the rising prices lead to redistribution, if total output is higher, then per capita output must be higher too. So, on average, the people still benefit from the inflation, right?

But, if there is “slack” in the economy, why would spending cause inflation? It wouldn’t. But then, which “inflation” is Murphy referring to? Hard to tell.

After WWII, there always has been “slack” in the economy (i.e. unemployed workers and factories operating below capacity), so federal spending never can be the cause of inflation.

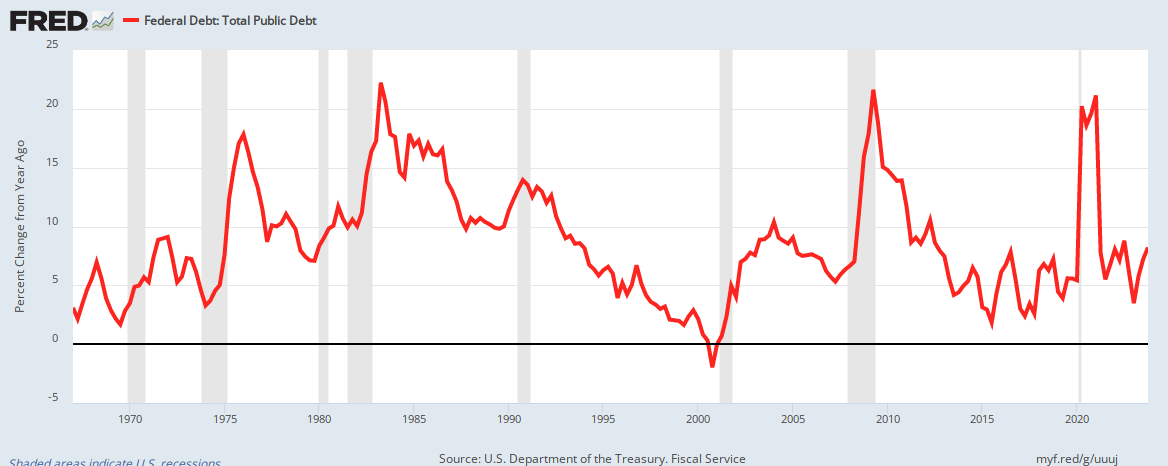

And finally, to put the myth to bed, please look at this graph:

GRAPH 1.

Using 1970 as a basis, federal debt has risen massively, while inflation has been moderate.

If federal spending caused inflation one would expect the two lines to be essentially parallel. That widening gap between the red and blue lines represent the massive spending that did not lead to inflation.

On this score, we simply have a disagreement about how the economy works, and in this dispute I think the Austrians are right while the MMTers are wrong.

Uh, except very few economists agree with the Austrians, whose main thesis is that federal austerity benefits the populace. The opposite is true. Ask Greece. Ask France. Ask America, as you shortly will see (below).

History shows that austerity causes recessions and depressions, which serve only to widen the Gap between the rich and the rest.

According to Mises’s theory of the business cycle, “idle capacity” in the economy doesn’t just fall out of the sky, but is instead the result of the malinvestments made during the preceding boom.

NO, it’s not “malinvestments. It’s investing for the future. Only a bad businessman (or a Mises economist) would wait until he reaches full capacity to begin investing in additional capacity.

Mises theory merely demonstrates how poorly he understood the realities of business.

So if we follow Kelton’s advice and crank up the printing press in an attempt to put those unemployed resources back to work, it will simply set in motion another unsustainable boom/bust cycle.

Except that the “busts” have come when federal deficit spending was cut.

The following graph shows annual changes in federal debt (red line) and recessions (vertical gray bars).

GRAPH 2.

As one plainly can see, recessions tend to be caused by periods of reduced federal debt growth; recessions (“busts”) are cured by increased federal debt growth.

This graph is exactly the opposite of what one would expect if federal debt growth set in motion a boom/bust cycle.

And then, of course, there’s this table, which Kelton included in her book, and which I have included many times on this site:

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

If Murphy’s and Mises’s hypothesis was correct, one would expect federal debt reductions to lead to booms rather than to depressions.

In summary, the fundamental “insight” of MMT—namely, that governments issuing fiat currencies need only fear price inflation, not insolvency—is something that other economists have acknowledged for decades.

Oops, suddenly Kelton’s thesis, which until now has been “wrong,” suddenly “is something that other economists have acknowledged for decades.”

Where the MMTers do say something different is when they claim that printing money only carries an opportunity cost when the economy is at full employment. But on this point, the MMTers—like their more orthodox cousins the Keynesians—are simply wrong.

That’s the big argument?? Mises agrees with MMT on everything except that there is an economic cost to money creation when there is full employment — which has not happened in America since 1945!

So his long, long article, disparaging MMT, only applies when we are at “full employment,” which almost never happens?

Apparently, Mises suggests that the nation endure slow growth, even recessions and depressions for year upon year, to avoid the extremely rare occurrence of spending during a full-employment period causing inflation??

That is like suggesting that leeches be applied to everyone to avoid the extremely rare time when everyone has too much blood.

For her part, Kelton criticizes certain nonmonetarily sovereign governments for particular actions, such as joining a currency union, but she doesn’t ask the basic question: Once an MMT economist explains its benefits, why doesn’t every government on earth follow the criteria for becoming a monetary sovereign?

Uh, could it be because they don’t listen to MMT, but instead listen to Mises, and that is the reason Kelton wrote her book??

Indeed, why don’t all of us as individuals issue our own paper notes and only borrow from lenders in our own personal currencies?

Posed in this way, these questions have obvious answers. The reason Greece adopted the euro, and why Venezuela borrows so much in US dollar–denominated debt, and the reason I use dollars rather than conducting transactions in RPMs, is that the rest of the financial community is very leery of the Greek drachma, the Venezuelan bolivar, or the Murphyian RPM note.

Perhaps Murphy thinks he really has caught Kelton with this “unanswerable question.” After all, he is correct, with regard to the Murphyian note. No one would trust it.

The fact is that any entity can issue its own currency, with the only condition being that people accept it.

Murphy doesn’t realize it, but every time he writes a check, that check is part of a process that temporarily creates money, so long as the recipient accepts it.

Any entity can be Monetarily Sovereign if whatever they deem to be their sovereign currency has reasonably wide acceptance.

The question Murphy avoids asking is, “Why do Bulgaria, Croatia, the Czech Republic, Denmark, Hungary, Poland, Romania, Sweden, and the United Kingdom not use the euro, and instead retain their monetary sovereignty?”

The people of Greece, France, Portugal, and others have suffered terribly because their surrender of their Monetary Sovereignty has forced them to institute the very austerity that Mises favors, the very austerity responsible for recessions and depressions, every time it is implemented.

Consequently, the Greek and Venezualan governments, as well as me personally, all subordinated our technical freedom to be “monetary sovereigns” and violated one or more of Kelton’s criteria.

And the price you and they all paid: You and they can go broke. Monetarily Sovereign countries cannot.

The Greek government knew its economy would receive more investment, and that it would be able to borrow on cheaper terms, if it abandoned the drachma and adopted the euro.

Is this a joke? The Greek government lurches from one financial disaster to the next. It cannot service its debt without repeated concessions from its lenders. “Borrow on cheaper terms?” Greece barely can borrow at all.

Now that we’ve covered this basic terrain, I have a follow-up question for the MMT camp: What would it take for a government to lose its monetary sovereignty?

In other words, of those governments that are currently monetary sovereigns, what would have to happen in order for the governments to start borrowing in foreign currencies, or for them to tie their own currency to a redemption pledge, or even abandon their own currency and embrace one issued by a foreign entity?

Here again the answer is clear: a government that engaged too recklessly in monetary inflation—thus leading investors to shun that particular “sovereign” currency—would be forced to pursue one or more of these concessions in order to remain part of the global financial community.

Ironically, current monetary sovereigns would run the risk of forfeiting their coveted status if they actually followed Stephanie Kelton’s policy advice.

In answer to the question, a nation would have to have be so corrupt and inept that lenders would refuse to accept the nation’s sovereign currency.

Zimbabwe is an example. At one time it was Monetarily Sovereign. But its corrupt and inept government stole farmland from white farmers, and gave it to black people who didn’t know how to farm.

The predictable result: Severe food shortages, which predictably led to hyperinflation. A Mises economist probably would claim that “money printing” caused the inflation, but the cause was food shortages. Currency-printing was the inept response

Ironically, the inflation might have been cured if the Zimbabwe government had used its Monetary Sovereignty to pay for farmers’ training, and to help them grow more food, while also buying food from abroad and distributing it freely.

In that case, government spending would have cured inflation.

Meanwhile, China, Canada, Mexico, Australia, and Japan, as well as the above-mentioned nine EU nations have prospered by not surrendering their Monetary Sovereignty.

None of them can go broke, and they have no need to impose austerity on their people.

A bedrock claim of the MMT camp is that unlike you, me, and Walmart, the US Treasury doesn’t need to have money before spending it.

Which has been the exact circumstance since 1792, when the U.S. government created, and immediately began spending dollars — before having any tax revenue.

When I write a personal check for $100 to Jim Smith, who also uses my bank, we could explain what happens like this: “Murphy instructed Bank of America to simply add 100 digital dollars to the account of Jim Smith.”

Notice that this description is exactly the same thing that Kelton said about the Treasury buying military hardware.

Correct. When Murphy, you, or I write a check, it constitutes instructions to the creditor’s bank to add dollars to the creditor’s bank account. At the moment the bank follows those instructions dollars (M1) are added to the economy.

Sadly, when that check clears, your bank then deducts dollars from your checking account, and dollars are subtracted from the economy.

One of the fundamental differences between a Monetarily Sovereign entity and a monetarily non-sovereign entity, is that the former needs no income, while the latter does need income.

That is a difference Murphy does not mention.

Now of course, I can’t spend an unlimited amount of dollars, since I’m a currency user, not a monetary sovereign.

That is the whole point. Though Murphy doesn’t realize it, he just agreed with Kelton.

The only difference between my situation and the US Treasury’s is that I actually have bounced checks and online payments before, whereas the US Treasury hasn’t.

The US Treasury hasn’t because it has the unlimited ability to create dollars, just as Murphy admitted in the previous paragraph.

Indeed, the Treasury itself sure acts as if it needed revenue before it can spend.

That’s why the Treasury secretary engages in all sorts of fancy maneuvers—such as postponing contributions to government employees’ retirement plans—whenever there’s a debt ceiling standoff and Uncle Sam hits a cash crunch.

Murphy completely misunderstands what is happening.

Monetary Sovereignty is created by a nation’s own laws. Depending on how the nation arbitrarily writes its laws, the nation can be more sovereign, less sovereign, or not sovereign at all.

For example, when the U.S. was on a gold standard it was less Monetarily Sovereign than it is today. The gold requirement restricted the government’s ability to create dollars.

The gold requirement was based on arbitrary laws passed by Congress.

Similarly, when Congress passes a new debt ceiling (there have been something like a hundred of them), at that moment, the government is less sovereign than if there were no ceiling.

But as soon as the government hits the debt ceiling, Congress simply increases it, to maintain U.S. sovereignty.

If ever Congress arbitrarily decided that the debt ceiling was permanent, the U.S. would become monetarily non-sovereign, at which time we would enter a “Mises depression.”

Yet, to reiterate, so far the Treasury has never tried to spend money that it didn’t already have sitting in its checking account.

Because the Fed adds dollars from thin air.

Question for Murphy: Where do all the dollars come from? If like some people (erroneously) believe, those dollars are borrowed, where did the lending dollars come from?

Here is how the federal government creates dollars:

To pay a creditor, the government sends instructions, in the form of a check or wire, to the creditor’s bank, instructing the bank to increase the numbers in the creditor’s checking account.

At the instant the bank obeys, dollars are created.

Then the instructions are sent to the Federal Reserve, which simply approves them.

So what about that “checking account” to which Murphy refers. Like all accounting, it is just numbers — numbers over which Congress and the Fed have total control.

If Congress and the Fed said, “From now on, the numbers in the checking account will read “$10 million,” or “ $100 million,” that is exactly what they would read.

$100 million,” that is exactly what they would read.

A Monetary Sovereign doesn’t need to “get” money from anywhere.

It merely creates laws that create money, just as the U.S. did in 1792, and just as it has every day since.

Does Murphy really believe the federal government has only $5 million, as he claims?

If I ever meet Murphy, I will ask him one question: “How much money does the U.S. federal government have?”

He won’t be able to answer. No one can, because the government has infinite money. There is no money measure — M1, M2, M3, etc. — that includes money the federal government has.

This year alone, the federal government will run a $3 trillion deficit — that’s $3 trillion more than it collects in taxes.

Does any sane person think that an entity having only $5 million in the bank actually could spend $3 trillion more than it collects that year? And the next year. And the next. Ad infinitum?

No, the federal government has infinite dollars. In that regard, the U.S. government is similar to the Bank in the board game Monopoly™ .

.

According to the rules, the Bank “never goes broke.” If the Bank runs out of money, the Banker may issue as much as needed by writing on any ordinary paper.

The federal government operates in the same way. According to the laws (“rules”), the federal government never runs out of money. It may issue more simply by pressing a computer key.

never runs out of money. It may issue more simply by pressing a computer key.

Amazingly, even though their system claims to explain how money works, the MMTers apparently don’t know the simple difference between money and debt.

Borrowing money per se doesn’t create money.

WRONG! Not only does borrowing create money, but borrowers create most of the money in the world — far more than the governments create.

When you lend someone, say $1,000, the borrower receives $1,000 and you receive the borrower’s note, which you add to your accounts receivable. By definition, accounts receivable is the money owed to you.

So that $1,000 loan creates another $1,000.

By contrast to lending, giving creates no money. When you give someone $1,000 they receive $1,000 and you receive nothing. Their gain is your loss.

So, that $1,000 gift creates zero money.

Every form of money also is a form of debt. There is no money that is not debt,

Here’s another way I can demonstrate that Kelton’s discussion is obviously missing something: if Kelton were right and the US national debt were a tally of how many dollars on net the government has “spent into existence,” then when Andrew Jackson paid off the national debt, the American people would have had no money—the last dollar would have been destroyed.

Oh, dear. The federal government is not the only dollar creator. It isn’t even the largest dollar creator.

Bank lending is the world’s largest dollar creator. When you take out a bank mortgage, the bank merely increases the balance in your checking account. This creates money — usually far more dollars than the bank owns.

That is why banks are able to lend far more than their capital.

Bringing the federal debt down to zero doesn’t eliminate all money; it only eliminates money spent by the federal government.

Now, if by some method, all debt, public and private, were eliminated then all money would be eliminated — yet another thing Murphy doesn’t understand.

In response to these claims, I make a simple point: you can’t spend Japanese government bonds in the grocery store.

That’s why money and debt are different things. You can’t pay your rent or buy groceries with government bonds.

This ignores the concept of liquidity. Some forms of money are far more liquid than others. The liquid kind are the ones spent in grocery stores.

What you spend in grocery stores is called “a medium of exchange.” But some money is not a medium of exchange. Some money is just a store of value.

Consider the money measure called “M3.”

The M3 classification is a measure of an economy’s money supply. It emphasizes money as a store-of-value more so than as a medium of exchange — hence the inclusion of less-liquid assets in M3.

M3 includes large time deposits, institutional money market funds, short-term repurchase agreements and larger liquid assets.

You can’t buy from a grocery store with repurchase agreements, but they are money.

Printed currency actually is debt. The printed dollar is a title to an interest-free debt of the U.S. federal government. What does the government owe the holder of a $5 dollar bill?

Answer: Five dollars. Dollars are not physical. The merely are numbers — accounting notations — and that is what the government owes you.

Like all debt, money has collateral. What is the collateral for that five dollar debt?

Answer: At one time it was a varying amount of gold, depending on current law, plus the full faith and credit of the U.S. government.

Today, the collateral for dollars only is the full faith and credit of the U.S. government.

That is why Murphy cannot issue his own currency. There is no law prohibiting it. But his full faith and credit are not impressive enough for broad acceptance.

That said, it would be perfectly legal for him to print up a bunch of “Murphybucks” and try to spend them at his local store. In fact, the University of Missouri does exactly that with its “RooBucks program.

“Roo Bucks can be used at UMKC dining locations and vending machines, the University Bookstore, printing at computer labs and the University Libraries, and at several Off-Campus locations.”

Give it a try, Mr. Murphy. Who knows? It might work.

Even if the central bank creates a new $10 million and simply hands it to Jim Smith for free, it hasn’t made the community $10 million richer—except in the nominal sense in which we could all be “millionaires” with this practice.

Mere money creation doesn’t make any more houses or cars or acres of arable farmland available. Printing new money doesn’t make the community richer.

At best it’s a wash with redistribution, and in fact in practice it makes the community poorer by distorting the ability of prices to guide economic decisions.

Murphy’s sophistry aside, money creation pays for “more houses or cars or acres of arable farmland.” That is why rich people own more houses, cars, and acres of arable farmland. They have more money.

Again, Murphy equates money-creation with price inflation, the falsity of which we have demonstrated with GRAPH 1. (above).

Or is this the Mises (intentional?) confusion between dollar inflation (more dollars) and price inflation (higher prices).

The fundamental disconnect between MMT (and Monetary Sovereignty) vs. Mises, is that Mises does not really understand that money is not a physical object with physical supply limitations.

Money is nothing more than accounting subject to laws. A Monetarily Sovereign nation can do anything it wishes with money, simply by passing laws.

To the degree that laws are created from thin air, so is money.

All of Murphy’s objections have to do with either his not understanding current law or disagreeing with current law.

He simply fails to understand that a Monetarily Sovereign entity can create money, destroy money and/or give money any value (vs. goods, services or other forms of money) it wishes.

It can create inflation (which is difficult as Japan has learned), prevent inflation, create and cure recessions, or do anything else it wishes involving money, simply by passing laws.

Example: The creator of the Monopoly™. game not only arbitrarily decided how many dollars the Bank and the players should have, but he also arbitrarily decided how many dollars each house, each piece of property, and each penalty was worth.

That God-like ability over dollars is owned by the federal government, too. That is the meaning of Monetary Sovereignty.

Rodger Malcolm Mitchell

Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell …………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

3. Social Security for all or a reverse income tax

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10.Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY