Federal finances are different from your personal finances. They also are different from city, county, and state finances. And they are different from business finances.

How different?

- The U.S. federal government cannot unintentionally run short of its own sovereign currency, the U.S. dollar.

- The federal government does not use or need tax income, in order to pay its bills.

- The federal government cannot become insolvent, no matter how high its financial responsibilities.

Who says so?

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Alan Greenspan: “Central banks can issue currency, a non-interest-bearing claim on the government, effectively without limit. A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e.,unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.

In short, even if all federal tax collections were $0, the federal government could continue paying its bills, forever.

Yet the AARP, repeatedly spreads the false idea that federal finances are like personal finances and so, Social Security can run short of dollars.

Here are excerpts from their latest “informational article” with regard to Social Security:

12 Top Things to Know About Social Security

Understanding the program that helps secure your future

by Kenneth Terrell, AARP Bulletin, November 20181. Social Security is not going bankrupt

At the moment, you could say the opposite; the Social Security trust funds are near an all-time high. “The program really is in good shape right now,” says David Certner, AARP’s legislative policy director. “But we know it has a long-term financial challenge.”

Here’s why: For decades, Social Security collected more money than it paid out in benefits. The surplus money collected from payroll taxes each year got invested in Treasury securities; today, the trust fund reserves are worth about $2.89 trillion.

But as the birth rate has fallen and more boomers retire, the ratio of workers to Social Security recipients is changing. This year is a tipping point: The program will need to dip into its reserves to pay full benefits from this point forward, absent any change to the program.

It’s now forecast that the trust fund reserves could be exhausted in 2034. “The longer we wait to fix Social Security funding, the more the cost will be paid by the younger generations, either on the tax side or the benefits side,” says Kathleen Romig, a Social Security analyst at the nonpartisan Center on Budget and Policy Priorities.

The above is the classic “Social Security finances are like your finances” myth. But, the federal government does not pay its bills out of “trust funds” as the term ordinarily is used:

From the Bureau of the Fiscal Service, U.S. Department of the Treasury: The Federal Government uses the term “trust fund” differently than the way in which it is commonly used.

In common usage, the term is used to refer to a private fund that has a beneficiary who owns the trust’s income and may also own the trust’s assets.

A custodian or trustee manages the assets on behalf of the beneficiary according to the terms of the trust agreement, as established by a trustor.

Neither the trustee nor the beneficiary can change the terms of the trust agreement; only the trustor can change the terms of the agreement.

In contrast, the Federal Government owns and manages the assets and the earnings of most Federal trust funds and can unilaterally change the law to raise or lower future trust fund collections and payments or change the purpose for which the collections are used.

Although AARP speaks about the Social Security “trust fund” having a “financial challenge” and reserves “could be exhausted,” the truth is that the federal government has 100% control over the “fund.”

It has the unlimited power to add dollars, deduct dollars, or do anything else it wishes. It could eliminate the “trust fund” and the FICA tax completely, and still continue to pay Social Security benefits.

2. Congress probably will not take up Social Security reform anytime soon

Several members of Congress have proposed legislation to address the program’s long-term funding issues.

But given the deep political divides on Capitol Hill, it’s unlikely that Congress will make any effort to reform Social Security until there’s the possibility of bipartisan support.

There are concerns that the tax-cut legislation passed in late 2017 could lead some lawmakers to look for places where they might cut spending. “The stage has been set by the tax bill to take another run at Social Security, Medicare and Medicaid,” says Max Richtman, CEO of the National Committee to Preserve Social Security and Medicare.

Here, the myth is that taxes, especially FICA, pay for Social Security benefits. Though state and local taxes do fund state and local spending, federal taxes pay for nothing.

In fact, federal taxes are destroyed upon receipt at the U.S. Treasury. and all payments are made with new dollars created ad hoc.

3. Some ideas to reform funding are starting to take shape

One proposal is to either raise or eliminate the wage cap on how much income is subject to the Social Security payroll tax. In 2019, that cap will be $132,900, which means that any amount a worker earns beyond that is not taxed.

Remove that cap, and higher-income earners would contribute far more to the system.

Other options lawmakers might consider include either raising the percentage rate of the payroll tax or raising the age for full retirement benefits.

All of the above options are completely unnecessary. None of them would add even one cent to the federal government’s ability to fund Social Security benefits.

4. Lawmakers do not raid the trust fund

Another common myth about Social Security is that Congress and the president use trust fund assets to pay for other federal expenses, such as education, defense or economic programs.

That’s not accurate. The money remaining after the Social Security Administration (SSA) has paid benefits and other expenses is invested directly into U.S. Treasury securities.

The government can use the money from those securities, but it has to pay the money back with interest.

Via fictional bookkeeping, the government arbitrarily increases and decreases balances in “trust fund” accounts and Treasury Security accounts.

None of this affects, even to the slightest, the federal government’s ability to fund Social Security benefits.

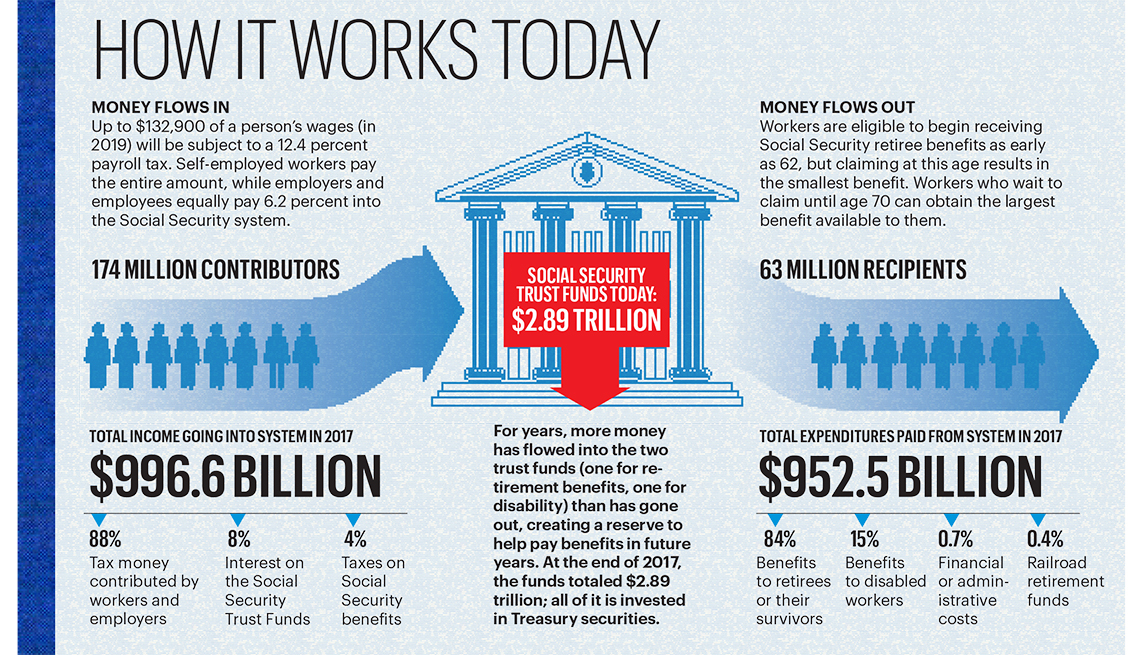

Then, we are treated to the following graph, which would apply to a personal trust fund, but is entirely fictional when describing federal finances.

The dollars “flowing in” are tax dollars destroyed upon receipt. The dollars flowing out are brand, new dollars, created ad hoc by the government. There is no connection between what “flows in” and what “flows out.”

The remainder of the “Twelve things to know” deal with specific rules, not the health of the “trust fund.”

In Summary, Social Security is a federal agency. Because the U.S. government is Monetarily Sovereign, and so cannot run short of its own sovereign currency, the U.S. dollar, no agency of the federal government can run short of dollars unless Congress and the President will it to.

The federal government does not need to “raise or eliminate the FICA wage cap.” Nor does it need to “raise the percentage rate of the payroll tax .” Nor does it need to “raise the age for full retirement benefits.”

None of these acts will improve Social Security’s solvency, which is infinite .

The federal government doesn’t want you to understand the above, lest you demand more benefits. Why doesn’t the government want you to have more benefits?

Because of Gap Psychology. You can read more about that, here.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. Eliminate FICA2. Federally funded medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

“….the U.S. government is Monetarily Sovereign, and so cannot run short of its own sovereign currency,…”

Monetary Sovereignty taught me this: WE can run short of physical stuff like oxygen, water, electricity, aluminum, milk, etc. But legal is infinite, and money, under control, is legally infinite.

Money isn’t physical.. What it “buys” is physical. You can touch paper, metal and plastic. You can’t touch money or feel money or see money or model anything legal or illegal. Legal and illegal are merely politically agreed upon abstractions enforced by pain, i.e., jail and fines.

Hard to believe but true, and until we understand that we will continue to think and see and feel the way society wants us to. (Society also is wrong.)

Amen

LikeLike

There is a classic exchange between former Fed Chairman Alan Greenspan and Paul Ryan on YouTube regarding Social Security “solvency” from a 2005 Budget Committee hearing, where Greenspan comes right out and states: “I wouldn’t say the pay-as-you-go benefits are insecure in the sense that there is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody”. He goes on to state that the real limitation is will there be enough real resources available for retirees to spend that money. Required watching for anyone worried about Social Security “solvency”.

LikeLiked by 1 person

Inflations and hyper-inflations are caused by shortages of goods, usually shortages of food, and sometimes, shortages of energy. But the notion that the U.S. can be short of “real resources,” despite plenty of money to pay for them, us utter poppycock.

LikeLiked by 1 person

I don’t think Greenspan was suggesting that the US would run short of resources due Social Security benefit payouts per se, I believe he was merely stating there are in fact real resource limitations on the government’s unlimited ability to spend. In a broader context, I believe Greenspan was also suggesting that the conversation among lawmakers regarding SS benefits shouldn’t be about affordability or “solvency”, but rather what is the overall socioeconomic impact of the benefits that are paid.

From an economist’s (mostly theoretical) viewpoint, the concern of SS benefits is the impact on the balance of consumption vs. productive output, considering retirees (like the idle rich) are primarily consumers, not producers, in the economy. At what level of benefit does that balance become problematic is subject to debate, but I would agree we are currently no where near that limit, and in fact wealth and income inequality, driven in part by the current meager benefit levels, are of much greater concern.

LikeLike

I agree with you, with one very small caveat. I don’t recall seeing any debate about the limit to productive output. It generally has come down to a general statement that “there must be some limit.” Actually, no one can possibly identify that limit, because innovation is limitless.

LikeLiked by 1 person

True, since we don’t know the limits of innovation, we can’t possibly know the limits of long term productive output. That is why I described the concern as “mostly theoretical”. I would also argue the reason we don’t debate the limits of productive output is precisely because of the ongoing focus on deficit and debt reduction that has generally led to persistent slack in the economy, making it a non-issue under the current terms of the debate. Additionally, it would seem that this persistent slack is at least partly responsible for the lack of productivity growth since 2004 despite advances in technology.

https://www.mckinsey.com/featured-insights/employment-and-growth/new-insights-into-the-slowdown-in-us-productivity-growth

LikeLike

There’s two problems here–reality and legality. In reality there is no debt. The law of conservation of energy states nothing can disappear or be created, only changed in form.

Everything is reusable, recyleable or replaceable by another form that works better, eg. solar/wind power rather than petroleum or uranium. Brain-power is always at work increasing efficiency and reducing inputs– more from less.

Nature cannot go broke.

Obviously, society isn’t using a reality-based economic system. Pre-industrial society saw scarcity and failure as the norm. That’s where we got “survival of the fittest” and “not enough to go around.”

Now we have automation and potential abundance and universal success. But we can’t have it both ways: backward, preindustrial, scarcity thinking versus the reality of technology and abundance. (Has anyone ever seen a picture of the scarcity model in any econ textbook?)

The quickest way out of this mess: put monetary sovereignty to the task of removing the Gap, i.e., getting to first base. But until MS is thoroughly accepted, we’re stuck at home on the verge of striking out. The invisible .01 percent and their visible political puppets will have to step aside and allow evolution to normalize wealth. It’s going to be utopia or dystopia.

LikeLike