It takes only two things to keep people in chains:

.

The ignorance of the oppressed

and the treachery of their leaders.

——————————————————————————————————————————————————————————————————————————————————————————–

The words are “debt” and “deficit.”

In our personal lives, we wish to avoid them, so we easily are gulled into believing the federal government should avoid them too.

Your Deficit and Debt

If you continually run a deficit, i.e. if your income is less than your spending, eventually you will need to borrow, at which time you will accumulate debt. And this debt will be a financial burden on you, because you must use future income to service it and pay it off.

The same is true of your city, your county, your state, and your business. All are monetarily non-sovereign. None of you has a sovereign currency.

Your income, your deficit, and your debt all are denominated in U.S. dollars (or some other currency), which is the sovereign currency of the U.S. federal government.

You can run short of this currency, because it is not yours to create. That is the characteristic of a monetarily non-sovereign entity.

The Federal Government’s Deficit and Debt

The federal government’s finances are totally different from yours, and from your city’s, county’s, state’s, and business’s. The federal government is Monetarily Sovereign.

The federal government has the unlimited ability to create its sovereign currency, the dollar.

Originally, the government created, from thin air, the laws that created the original dollars, also from thin air.

Today, the federal government continues to create laws from thin air, and those laws allow the government to continue creating dollars, which it does, ad hoc, every time it pays a bill.

It is functionally impossible for the federal government, unintentionally, to run short of dollars. It creates them in unlimited amounts as needed.

For that reason, the federal government has no functional need to borrow. The so-called federal “debt” is not borrowing in the usual sense, but rather it is the federal government acceptance of deposits into Treasury security (T-security) accounts, which are quite similar to your interest-paying bank savings accounts.

When you “lend” to the federal government, you actually instuct your bank to debit your checking account and to deposit the dollars into your T-security account, where they remain until your T-security matures, and the dollars, plus interest, are returned to you.

The dollars remain in your account, because the federal government has neither need for, nor use of, them.

That is why federal spending increases the money supply (however defined). It creates brand new dollars when it pays its bills.

The Federal Deficit

The federal deficit is the difference between federal spending and federal revenues. Current law requires the federal government to issue T-securities in an amount corresponding to federal deficits.

These laws were created when the federal government was on gold and silver standards. Back then, the federal government arbitrarily restricted its own money-creation abilities to match the values of gold or silver. Running short of gold and silver meant new dollars could not be created, which required borrowing dollars.

Now, being off any metal standard, borrowing no longer is necessary. The federal government does not need to issue Treasury securities. In fact, during times when the federal Treasury lacks buyers for its securities, it has another federal agency, the Federal Reserve buy them.

Wait! If the federal government does not need income, why does it continue to borrow and tax?

Why Does The Government Issue T-securities?

As said, U.S. government does not need income. Even if all tax revenue and every other sort of revenue fell to $0, the federal government could continue spending, forever.

But T-securities have some value to the federal government and to the world.

- They provide America and the world with a safe place to invest U.S. dollars, which reduces world financial risk and market gyrations.

- This safety provides demand for U.S. dollars, which benefits America’s businesses.

- T-securities assist the Federal Reserve in setting interest rates, which help control inflation.

Why Does The Federal Government Levy Taxes?

The federal government (unlike state and local governments) has no need for tax dollars. So why levy taxes?

- To some degree, taxes reduce inflation, by removing dollars from the economy. Though this is the effect of federal taxation, it is not how the federal government uses taxes. Federal taxes are too political, too slow, and too blunt an instrument for effective inflation control.

- Progressive taxes help reduce the Gap between the rich and the rest.

- To encourage or discourage certain actions. “Sin” taxes on alcohol and smoking are examples.

Do Deficits Cause Inflation?

Yes — and no.

Inflation is far more than just the Supply of Money. Inflation even is far more than the Demand for Money / the Supply of Money.

Inflation is the complex result of the current and predicted Demand and Supply of money vs. the Demand and Supply of goods and services.

In the past few decades, money Supply has not been an important determinant of inflation. That honor goes to oil.

Worldwide, and in America, the single most important determinant of inflation is the Supply and Demand for oil, which affects the Supply and Demand for goods and services.

Here are two pictures worth more than 1000 words;

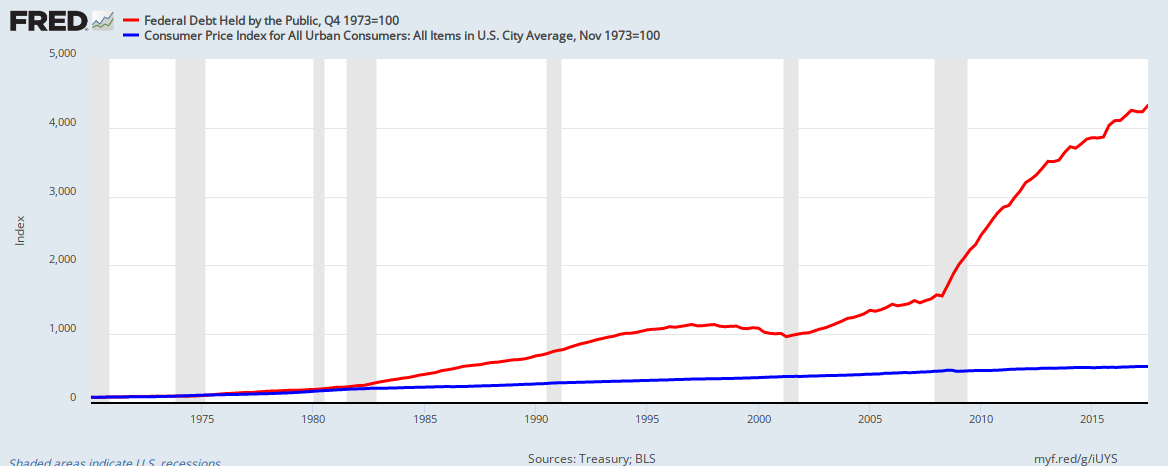

While federal money creation (as indicated by Federal Debt Held By The Public) has risen massively, since 1971 (the year in which the U.S. went off a gold standard), the consumer price index has risen moderately.

Or, looking at the same figures another way:

It would be difficult to imagine more dissimilar graph lines than the debt and inflation lines. During periods of highest debt growth, inflation declined. Contrary to popular wisdom, massive federal deficit spending has been very weakly related to inflation — if at all.

The Trade Deficit

There is another sort of deficit that the public doesn’t understand: The trade deficit.

Because the phrase “trade deficit” contains the word “deficit,” it easily is manipulated

Trump’s Duties On Steel And Aluminum

As with many things Trump, his statements are meant to take advantage of the public’s ignorance of federal finance.

On March 5, 2018, Trump said,

“We lost, over the last number of years, $800 billion a year. Not a half a million dollars, not 12 cents. We lost $800 billion a year on trade. Not going to happen. We got to get it back.”

Not only are his numbers wrong, but the entire concept is wrong. Let’s say you gave your son $25 to go your local grocery store and spend $25 on various products./customer-paying-cashier-in-grocery-store-158315205-575720495f9b5892e808de01.jpg)

Your family now has run a “trade deficit” with your local grocery store. Your son gave them $25 and they gave him groceries. Here are some questions about that transaction:

- How much did your family “lose” in that trade deficit.

- Should you demand that the grocery store buy $25 worth of goods and services from you so that you will have a balanced trade budget?

- Will you impose an import tax on the items your son buys from the grocery store, so they will be more expensive to him?

Nations generally are not injured by people in one nation buying what people in another nation sell (i.e. trade deficits). The sole exceptions might be if:

- Vital domestic industries are damaged by overseas competion.

- Vital security products might be unobtainable during a war.

In today’s world economy, these exceptions are quite rare. If domestic industries are not competitive, they probably are unsuitable for local production. And war-specific materials seldom (never?) are available only from one place.

In short, a trade deficit is not the negative some populist politicians make it out to be. In the instant case, steel and aluminum are imported from many nations, and their lower cost or physical superiority are of great benefit to the American public.

The notion that these products can compete with domestic products, despite a massive shipping disadvantage, says much about domestic production incompetence. Raising the prices of these products (via duties), will hurt American industry and workers.

If the federal government wished to aid American steel and aluminum producers, it more productively could pay them money. Giving them X dollars per ton would aid the domestic producers — and the federal government could afford it without any cost to taxpayers.

The federal government, being Monetarily Sovereign, can afford anything without any cost to taxpayers.

In summary, the words “debt” and “deficit” often are misused as pejoratives, when in fact, they are assets to the economy:

- The federal government is Monetarily Sovereign. It never can run short of its own sovereign currency, the dollar. It does not need to levy taxes or to borrow to obtain the dollars it produces freely.

- Federal “debt” is nothing more than the total of dollars deposited in T-securities accounts.

- Millions of dollars in federal debt is paid off every day, simply by transferring dollars from those T-security accounts back to the checking accounts of the T-security owners. This involves no financial burden on the federal goverment or on federal taxpayers.

- The federal “debt,” which results from federal “deficits,” is pro-growth, because federal deficits add dollars to the economy.

- Trade “deficits” are an even exchange of money for goods and services. These exchanges are equally beneficial to both buyer and seller. No one “loses” by these exchanges.

- Trade deficits result when consumers of one nation purchase products of other nations either because these products are less costly or of better quality, than the same products produced domestically. This availability of cheaper or superior products benefits consumers.

Superior products entering the U.S. benefits the America. Dollars entering the U.S. do not benefit the U.S., because the U.S. already has the unlimited ability to create new dollars.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Excellent post, thank you. I have a very hard time trying to explain the concept of trade deficits to friends and colleagues. For monetarily sovereign nations, imports are an economic benefit and exports an economic cost. When we import, we exchange fiat dollars for high value finished goods, which helps to drive lower costs and higher quality for American consumers through competition.

When we export goods, we exchange our limited resources (labor, materials, energy, etc.) for something that we have an unlimited supply of: our own fiat dollars. The real problem is not trade deficits per se, the problem is a lack of appropriate federal policy response to compensate for when workers or whole industries are displaced due to offshoring of jobs. While tariffs are one policy response, they are certainly not the best one.

As you stated, if steel and aluminum industries are vital to national security, then the government should subsidize those industries as China does, which would benefit everyone, rather than pass higher costs onto it citizens through trade tariffs.

LikeLike

Your friends and colleagues are confused by the word, “deficit,” which in their minds, always is a bad thing.

Ask them this: “If you owned a printing press, and legally could print as many dollar bills as you wished, and you could exchange those dollar bills for cars, boats, airplanes, homes and vacations, would you prefer to reverse the process so that you gave your cars, boats, etc. and in turn received the dollar bills you already could print? Is that the kind of deal you would want?”

LikeLike