It takes only two things to keep people in chains:

.

The ignorance of the oppressed

and the treachery of their leaders.

——————————————————————————————————————————————————————————————————————————————————————————–

If you ever have wondered what we mean by the “Big Lie,” you need wonder no more. Here it is, as demonstrated by Jacob L. (Jack) Lew, former U.S. Treasury Secretary.

Remember, as you read this, we’re not talking about ignorance. We’re talking about outright lying. A Treasury Secretary knows how the U.S. financial system operates. Lew surely does. But he repeatedly misstates the facts, i.e. lies.

Former Treasury Secretary Lew Says Tax Cuts Will Leave the U.S. Broke

Marcus Bensasson, Bloomberg, January 2, 2018Jack Lew said the Trump administration’s decision to add a significant amount of debt through last year’s tax legislation is leaving the country broke.

Immediately we see lie #1: The United States cannot be “broke,” if being “broke” means being unable to pay its bills.

The United States, unlike you, and me, and unlike the cities, counties, and states — the United States uniquely is Monetarily Sovereign. It has the unlimited ability to create its sovereign currency, the U.S. dollar.

The U.S. government cannot run short of dollars. Period.

Yes, I know. Back in 2009, GOP Speaker of the House John Boehner lied:

“We’re broke. America’s broke. All year long, our friends on the other side of the aisle have been on a massive spending spree that our nation can’t afford.

“Our Democrat friends want to raise the debt limit next week by $1.8 trillion. Instead, let’s stop the madness and vote no.”

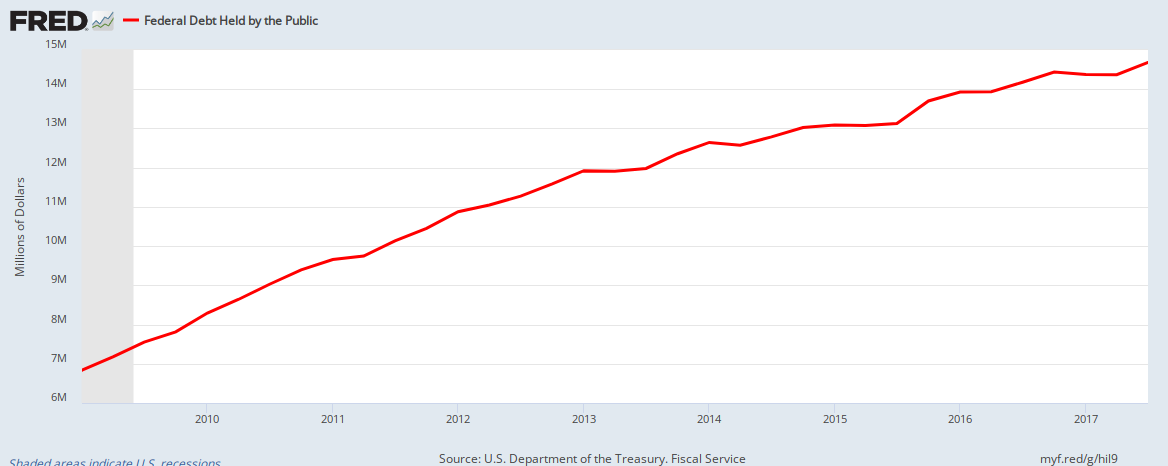

That was eight years ago, when the federal debt was under $8 Trillion.

Today, the federal debt has almost doubled, to $15 Trillion, and guess what: We still aren’t “broke.” We continue to pay all our bills, and oh yes, the GOP has voted to add $1.5 trillion more to the federal debt — and we won’t be “broke” then, either.

It was a lie, a Big Lie when Boehner said it, and it’s a Big Lie today when Lew says it.

You who are regular readers of this blog may remember, Federal Debt: A “ticking time bomb” (November 2009), and “From ‘ticking time bomb’ to ‘looming collapse.’”

Both articles detailed the ongoing references, beginning in 1940 (!), to the federal debt as a “ticking time bomb.” Well, that phony 78-year-old “time bomb” still is ticking:

“It’s a ticking time bomb in terms of the debt,” Lew said in a Bloomberg Radio interview withTom Keene and Jonathan Ferro. “You cannot run a fiscal policy by spending trillions of dollars you don’t have at a time that the economy is doing well.”

For 78 years, the debt-nuts have warned us about imminent disaster. Seventy-eight years of being wrong, wrong, wrong. How many more years of lies will be required for the public to catch on?

Not only is the “time bomb” analogy a lie, but so is the “dollars you don’t have” phrase a lie. I challenge Mr. Lew to tell us how many dollars the U.S. federal government “has.”

The answer would be either none or infinite, depending on how one wishes to count, for the government has the unlimited ability to create dollars, ad hoc, every time it pays a bill.

(If you owned a dollar-printing press, how much money would you have?)

Having chosen to make tax policy without including Democrats in any of the conversation, now the administration probably can’t rally Republicans in Congress to do the basic business of government, such as making sure the country doesn’t default on debt and children don’t get thrown off health insurance, he said.

IF (big “if”) the Republicans don’t want the U.S. to default on its debt, all they need do is simply to pay the bills. The government does this every day, by sending instructions to each creditor’s bank, instructing the bank to increase the numbers in the creditor’s checking account.

So long as the federal government doesn’t run short of instructions, the country won’t default on its debt.

And as for throwing children off health insurance, all the GOP Congress needs to do is to vote to pay for health care. Simple and obvious, but the GOP prefers to claim that our Monetarily Sovereign nation is “broke.”

“The next shoe to drop is going to be an attack on the most vulnerable in our society,” Lew said. “How are we going to pay for the deficit caused by the tax cut?

We are going to see proposals to cut health insurance for poor people, to take basic food support away from poor people, to attack Medicare and Social Security.

One could not have made up a more cynical strategy.”

Mr. Lew, who are you trying to kid? “Cutting health insurance for poor people, and taking basic food support away from poor people” is exactly what the GOP wants to do.

That is the way the GOP satisfies its rich base — by widening the Gap between the rich and the rest.

Widen the Gap. That, in three short words, is the entire GOP platform. It is what their wealthy backers want.

So Lew, a Democrat, carries water for the Republicans, proving again that political liars come in all stripes.

“What we’ve seen is a tax cut that spends money we don’t have to have very concentrated benefits for global corporations and the top 1 percent, and it’s leaving us broke,” according to Lew.

Oh, shut up, Lew. Please, just shut up.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Although Jack Lew lied repeatedly, he is an amateur compared to Trump. See nine pages of Trump’s lies, here:

LikeLike