Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………………………………………………………………………………..

This blog frequently refers to the “Big Lie,” the lie that says our Monetarily Sovereign federal government uses taxes to pay its bills.

Based on the Big Lie, politicians and others tell you the federal deficit and debt are “unsustainable,” “dangerous,” and a “ticking time bomb” — all lies.

And these lies lead to the lies that FICA must be increased, while Medicare, Social Security, and other social benefits must be decreased. The politicians say it because the rich want them to say it, and the rich want it, because those lies widen the Gap between the rich and the rest.

In various posts, we have addressed the specifics of many lies emanating from the Big Lie, but seldom have we seen them expressed in such concise fashion as in the following:

Trump’s Economic Plan is a Betrayal of the People Who Voted for Him

“President-elect Donald Trump’s race to enact the biggest tax cuts since the 1980s went under a caution flag Monday as Senate Majority Leader Mitch McConnell warned he considers current levels of U.S. debt “dangerous” and said he wants any tax overhaul to avoid adding to the deficit.

“‘I think this level of national debt is dangerous and unacceptable,’ McConnell said, adding he hopes Congress doesn’t lose sight of that when it acts next year. ‘My preference on tax reform is that it be revenue neutral,’ he said…

“The Committee for a Responsible Federal Budget, a nonpartisan think tank, has projected that Trump’s plans would increase the debt by $5.3 trillion over a decade, with deficits already over $600 billion a year and rising on autopilot…

“‘What I hope we will clearly avoid, and I’m confident we will, is a trillion-dollar stimulus,’ he said. ‘Take you back to 2009. We borrowed $1 trillion and nobody could find that it did much of anything. So we need to do this carefully and correctly and the issue of how to pay for it needs to be dealt with responsibly.'”

Let’s analyze this abominable series of lies:

Lie #1. “Current levels of U.S. debt (are) dangerous.”

Why? What is dangerous about the U.S. debt? Will the federal government run short of dollars to pay its debts? No. The U.S. cannot run short of its own sovereign currency.

Has the massive “debt” increase caused the much-feared, overblown threat of hyperinflation? No. Inflation has been running below the Fed’s target rate. In fact, the U.S. never has had hyperinflation.

Lie #2. Tax reform(should) be revenue neutral

No it shouldn’t. This is a restatement of the notorious “Balanced Budget Amendment” argument, in which somehow the U.S. economy is expected to grow without a growing supply of dollars. There is no known economic mechanism for that to happen.

Every depression and most recessions have come on the heels of reduced deficit growth.

Lie #3. The Committee for a Responsible Federal Budget, (is a) a nonpartisan think tank

While the CRFB does not self-identify as Republican, it strongly leans to the right, and it is highly partisan for one goal: Widening the Gap between the rich and the rest.

The CRFB invariably favors cuts to social programs along with increases in FICA.

Lie #4. Trump’s plans would increase the debt by $5.3 trillion over a decade

Whether or not the figures turn out to be correct, this is a lie by inference. The CRFB loves to quote large numbers, implying that somehow these numbers are bad. However, if you go to the CRFB website you will not find a single analysis telling you why the numbers are bad.

Because there are no reasons, the CFRB hopes you simply will believe the lie without substantiation.

Lies #5 and #6. We borrowed $1 trillion and nobody could find that it did much of anything.

These are the most outrageous lies of all.

The U.S. doesn’t “borrow.” The Federal Reserve Bank accepts deposits in T-security accounts. The intentionally misleading word “debt,” when applied to T-securities, should be changed to “deposits.”

“Nobody could find that it did much of anything” except the deficit spending is what brought us out of the worst recession since the Great Depression of the 1930s.

Mitch McConnell and his fellow liars have learned that if one repeats a lie often enough, and if many other people repeat the same lie, the populace will believe it, no matter how obvious the lie is.

Most people are aware the federal government cannot run short of its own sovereign currency. And most people also are aware that despite massive deficit spending, the Fed’s primary concern has been the lack of inflation.

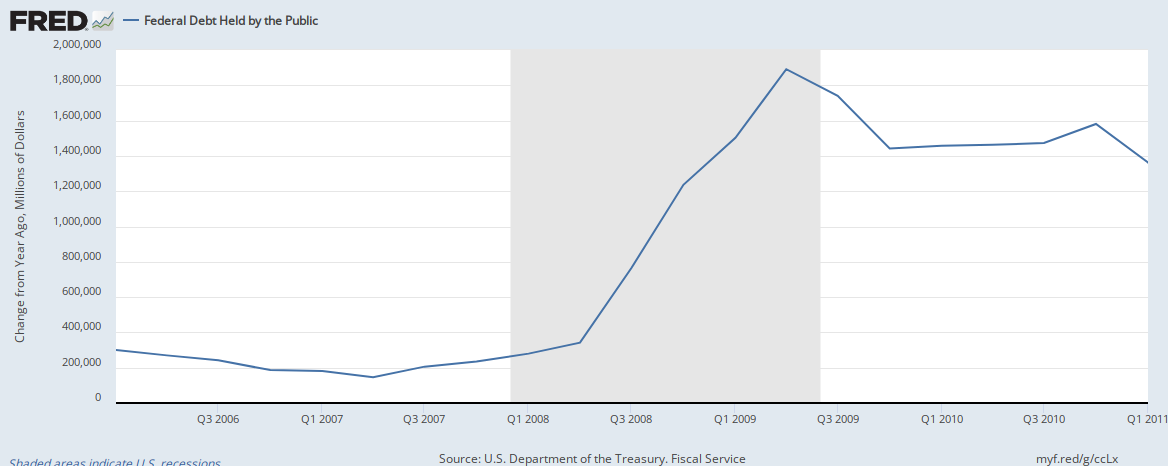

Finally, most people are aware of what the above graph tells them: The sharp increase in stimulus spending (i.e. deficits) brought us out of the recession and into almost a decade of economic growth and reduced unemployment.

The rich have bribed McConnell and his fellow politicians to lie. But they haven’t bribed you to believe their lies.

So why would you?

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the rich and the rest.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE AN ANNUAL ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA, AND/OR EVERY STATE, A PER CAPITA ECONOMIC BONUS (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONEFive reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE CORPORATE TAXES

Corporations themselves exist only as legalities. They don’t pay taxes or pay for anything else. They are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the government (the later having no use for those dollars).

Any tax on corporations reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all corporate taxes come around and reappear as deductions from your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and corporate taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

‘Mitch McConnell and his fellow liars have learned that if one repeats a lie often enough,’

32 years long enough? You bet, Dinosaur McConnell made the listing of doomsayers on your classic post from Nov’09:

https://mythfighter.com/2009/11/24/federal-debt-a-ticking-time-bomb/

‘January 12, 1985, Lexington Herald-Leader (KY):The federal deficit is “a ticking time bomb, and it’s about to blow up,” U.S. Sen. Mitch McConnell, a Louisville Republican, said yesterday.’

Now, about that fuse…

LikeLike

The prophet said, “The world is about to end. Give me all your possessions, and go up the mountain.”

So the people believe him and give him all their possessions, and go up the mountain.

But the world does not end, so they come back down. Now they have no possessions; they are destitute, and the prophet has all the possessions.

So the people work and slave and sweat and strain, and after one year, they have created new possessions.

So the prophet again tells them, “The world is about to end. Give me all your possessions and go up the mountain.”

Again they believe him, and again the world does not end, and again the people are destitute and left without possessions.

And this happens every year, and every year the people believe the prophet. And every year their possessions are taken away. But the people never learn.

So who is at fault for the people’s destitution: The prophet or the people who never learn?

LikeLike