It takes only two things to keep people in chains:

The ignorance of the oppressed

and the treachery of their leaders.

——————————————————————————————————————————————————————————————————————————————————————————–

Warning: This is going to be dead simple — 2nd grade, child’s picture-book simple.

Why do businesses spend precious dollars — billions, in fact — on Advertising, Sales, and Research & Development?

The primary purpose of Advertising and Sales is to attract and maintain customers. The primary purpose of Research & Development is to create products and services that will attract and maintain customers.

In short, businesses rely on customers. Gaining and serving customers is how businesses profit and grow. That’s Business 101.

So, if the U.S. government wants to help America’s business profit and grow what should it do?

Right: The government should help American business attract and maintain customers.

And who are the customers for America’s business? For the vast majority of America’s businesses, their customers are the middle- and lower income 99%.

Yes, the upper 1% buy things. Like the 99%, they buy food, clothing, and shelter. They also buy diamonds, yachts, and private airplanes.

But the purchases by the richest 1% add up to only a minuscule fraction of what the 99% spend. The 99% are the primary customers of America’s business.

The best way to help America’s business grow is to help customers of American business buy.

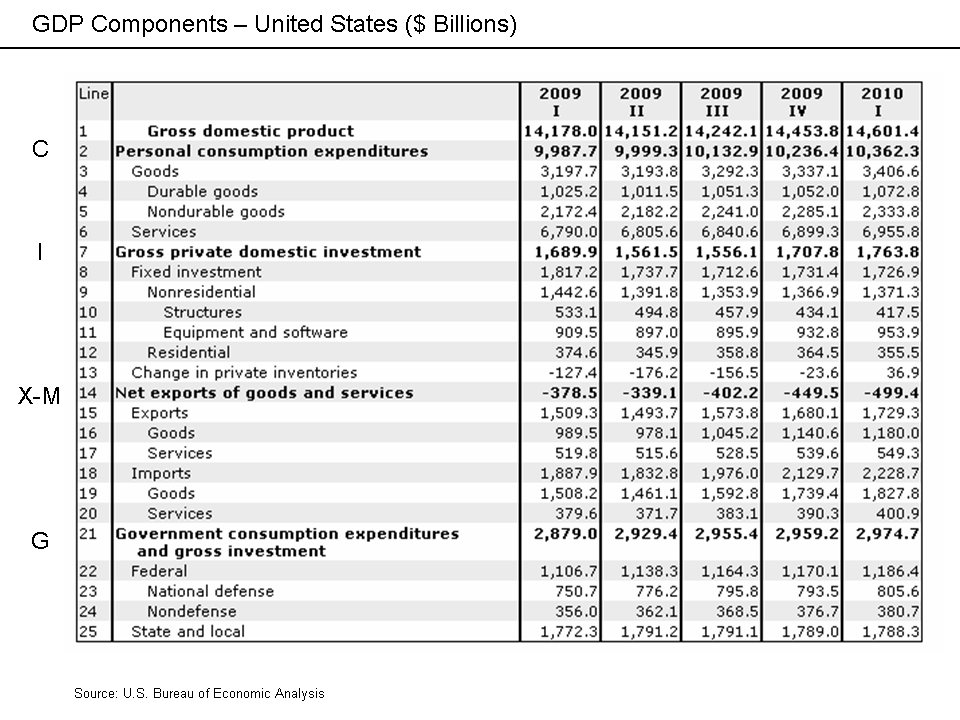

The most common measure of our economy is Gross Domestic Product (GDP). The formula for GDP is:

GDP = Federal Spending + Non-federal Spending + Net Spending on Exports

In short, U.S. GDP measures the spending on American-produced products and services. And again, who does the vast majority of spending in America? The lower 99% income groups. They are the primary customers for America’s business.

How can the federal government help the lower 99% increase their spending?

The federal government can help the lower 99% increase their spending by helping them to have more spending money.

This is known as: Trickle-up Economics

Give the 99% a billion dollars and they will buy goods and services, thus stimulating the entire economy. They will stimulate America’s business.

But, give the richest 1% a billion dollars, and they will buy stock, increasing the prices of stocks and their own wealth, all to distance themselves from the 99%.

Trump’s Tax Promises Undercut by CEO Plans to Help Investors

By Toluse Olorunnipa, November 29, 2017, 4:00 AM ESTMajor companies including Cisco Systems Inc., Pfizer Inc. and Coca-Cola Co. say they’ll turn over most gains from proposed corporate tax cuts to their shareholders.

Robert Bradway, chief executive of Amgen Inc., said in an Oct. 25 earnings call that the company has been “actively returning capital in the form of growing dividend and buyback and I’d expect us to continue that.”

Executives including Coca-Cola CEO James Quincey, Pfizer Chief Financial Officer Frank D’Amelio and Cisco CFO Kelly Kramer have recently made similar statements.

“We’ll be able to get much more aggressive on the share buyback” after a tax cut, Kramer said in a Nov. 16 interview.

The biggest moral problem facing the world is the wide and widening Gap between the rich and the rest. Enriching the 99% helps solve that problem.

And the biggest economic problem facing the world also is the wide and widening Gap between the rich and the rest. Enriching the 99% helps solve that problem, too.

The moral and the economic problems can be addressed by providing the 99% with more money — something governments are exquisitely designed to do.

Governments can budget spending that enriches the 99% and also can pass laws that protect the 99%. This too, is Trickle-up Economics.

There are those among the rich, who advocate “trickle-down economics — the notion that if the government supports the rich, or supports business directly, then increased spending by the rich and business will “trickle down” to the rest of America.

It is utter nonsense. It is a lie meant to justify enriching the rich and widening the Gap between the rich and the rest.

When the rich and businesses spend, it is to benefit themselves. When they hire, they pay the lowest wages possible and they hire the least number of people they can.

The rich and businesses actually do their best to avoid trickle-down effects.

The rich do not care whether the 99% have adequate food, clothing, housing, education, etc. Obviously, there are exceptions, but the rich as a group, care only that the 99% serve and stay distant (See: Gap Psychology.)

The Ten Steps to Prosperity (below) are based on Trickle-up Economics. They are designed to encourage business customers to buy goods and services. They do for all businesses what Marketing and R&D do for individual businesses.

Trickle-up Economics grows the economy by creating a solid base of newly enriched customers. Rather than rewarding the rich and their businesses for doing nothing, the Ten Steps rewards businesses by doing exactly what businesses pay Marketing and R&D to do: Attract customers’ dollars.

Talk to your federal Senators and Representatives, and demand Trickle-up Economics — aid to the 99% who are the customers of business — for the sake of yourself, your family and friends, and for America.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Despite the fact that you who are not in the 1% richest Americans, and you lower 99% income Americans are the ones who support the Gross Domestic Product (GDP), you get no respect from the Republicans:

He’s referring to you, the 99%, who “are just spending every darn penny they have, whether it’s on booze or women or movies.”

When I see photos of people cheering Donald Trump, and when I see what the Republicans tried to do with ACA, and what they now are doing with tax “reform,” I only can shake my head in wonderment.

As the maxim that leads this post says, “It takes only two things to keep people in chains:

The ignorance of the oppressed

and the treachery of their leaders.”

===============================================================================================================================================

The Republican tax cuts won’t trickle down, CEO writes in scathing op-ed

“I can tell you what no other CEO wants to tell you,” Todd Carmichael, co-founder and CEO of La Colombe Coffee Roasters in Philadelphia writes in an op-ed in The Philadelphia Inquirer: “A half-trillion dollars of corporate tax giveaways proposed by the GOP aren’t going to do a thing for the middle class, or create a single job.

Because what every CEO knows but won’t tell you is this: A tax break for their company simply means a fatter bottom line. Not jobs. Not investment.”

CEOs have “a powerful fiduciary duty to return all profits to shareholders — not to the employees, or the suppliers, or the community and certainly not to the unemployed or left behind,” he explained. “Profit goes to shareholders (and the CEO) and not to the employees.”

LikeLike

Not only simple but stupid.

If it were that easy, then why not just hand people all the goods and services? Why bother having to “give” people money?

Have you ever thought that your plan may discourage producers? Why work when the government is handing out for free and why produce when there is nothing to be made. Have you not seeing what happened in Cuba and all the communist countries?

You yourself don’t believe your own crap. Amazing that your level of devotion for communism is greater than your honesty.

LikeLike

You’re back and still have learned nothing. Your comments apply to every government program — Social Security, Medicare, Medicaid, Highways, the Military, aids to education, food & drug inspection, the courts — all can be dismissed as “communism.”

Do not respond until you answer this question: What is the purpose of government?

LikeLike

Very well-said as usual, Rodger! Right on the money, pun intended of course. Meanwhile, the 0.1% and their sycophantic lackeys keep spreading the trickle-down myth to pull the wool over the eyes of the 99%, many of whom are unfortunately none the wiser even after nearly 40 years of this failed social experiment. Edward Conard (think “canard”), the Bain of our existence as I like to call him, is one of the latest of such pseudo-intellectual armchair-philosophizing hucksters, and he is already out with his second book of lies.

LikeLike