Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

We have entered “debt-ceiling” season, where Congress and the President spend endless hours arguing about whether the limit should be increased, and if so, how much.

Number of requests for increase

Depending on who is doing the research, it is said that the US has raised its debt ceiling (in some form or other) at least 90 times in the 20th century.

The debt ceiling has been raised 74 times since March 1962, including 18 times under Ronald Reagan, eight times under Bill Clinton, seven times under George W. Bush, and five times under Barack Obama.

Congress has raised the debt ceiling 14 times from 2001-2013. The debt ceiling was raised a total of 7 times (total increase of $5,365 billion) during Pres. Bush’s eight-year term and it has been raised 7 times (as of 10/2013 a total increase of $5,385 billion) under Pres. Obama’s term as of 2013 (five years in office).

The debt ceiling has been raised an average of once a year, for about a century. Every single time we have bumped up against the debt ceiling, it has been raised. Every time.

So, remind me again. If it always is raised: What is the real reason we have a debt ceiling?

The debt ceiling has nothing to do with future spending. Congress and the President determine future spending.

The debt ceiling is a device to prevent paying our legitimate bills for past spending.

Failure to raise the debt ceiling, first would cause a shutdown of the federal government, and shortly thereafter would cause an unprecedented U.S. default.

Not only would we become “Deadbeat America,” but our entire economy — indeed the entire world’s economy — would crash, making the 2008 recession look like a picnic.

So remind me again: What is the real reason we have a debt ceiling?

Congress and the President are aware of the dangers inherent in a debt ceiling. But like spoiled children, they continually stomp their feet and play a game of “chicken,” gambling with America’s and the world’s future, in an attempt to get their own way on their favorite issues.

The debt ceiling has nothing to do with financial prudence or with spending or with taxes or abortion or immigration or Medicare or gay rights or with our military power or whether the Cubs ever will win a World Series.

The debt ceiling exists only because of a bunch of ruthless, vindictive people, whose pay will continue even during a depression — people who could not care less about you, me or anyone else on earth — people who demand, “Give me what I want or I’ll destroy your life and the lives of your friends and loved ones and of the whole world.”

So that is the real reason we have a the debt ceiling: Bastard power.

Don’t believe me? Contact your Senators and Representatives, and ask them why we have a debt ceiling.

You’ll be able to fertilize your garden with their answers.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

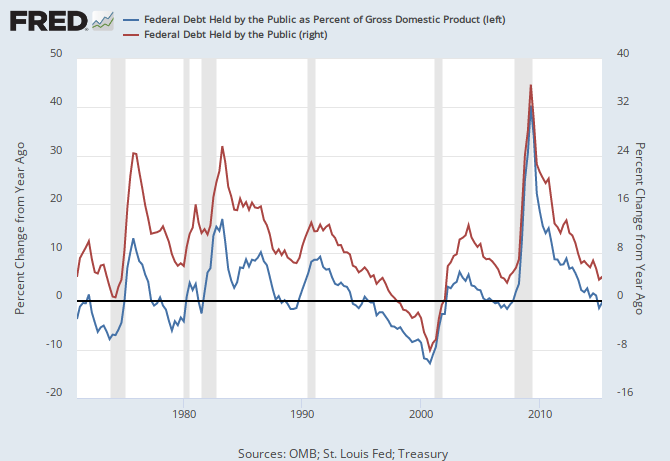

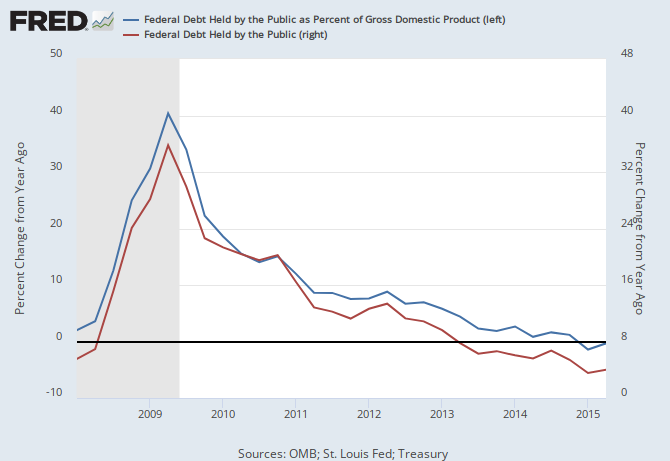

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

“Recessions come after the blue line drops below zero.”

Er, what kind of science is this. Look at the graph into the 1990s. That’s arbitrary. The US has a large trade deficit, so wouldn’t it make more sense to put the line at the level of the trade deficit if you want to see if the domestic private sector can net save.

“Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.”

The deficit is an irrelevant accounting abstraction.

4.3 trillion in Federal spending is not something to pay attention to? The highest spending in five years.

Personal Consumption Expenditures since the third quarter last year, when oil started to tank, are up nearly $300 billion and Gross Private Domestic Investment is up $35 billion (non-residential up $22 billion).

So, what the hell are you talking about?

LikeLike

It was an observation. I was not referring to net saving.

Look at the graph beginning in 1970. There were six recessions since then, and in each case, the blue line fell below 0% before we had a recession. A 6-time coincidence?

The point is: Deficits are not an “accounting abstraction.” Federal Deficit = Federal Spending – Taxes. Nothing abstract, there.

You can have massive increases in Federal Spending and have decreased deficits, if taxes increase.

Deficits add dollars to the economy. Deficit reduction reduces the number of dollars added to the economy.

Surpluses (like trade deficits) reduce the absolute number of dollars in the economy. There is nothing “abstract” about that, either.

ly is shrinking. Deficit spending is stimulative and more deficit spending is more stimulative.

The most popular measure of the economy is:

GDP=Federal Spending + Non-federal Spending + Net Exports.

You can have increases in private spending and still have decreased GDP (because other factors decreased).

You can argue all you wish, but it happens that there is a highly repeated mathematical correlation between federal deficit spending decreases and recessions.

Since we went off the gold standard (1972), reductions in deficit spending always have led to recessions, and all recessions have been cured by increases in deficit spending.

Even the Great Depression was cured by the increases in WWII deficit spending.

If you disagree, you should provide data to show why there has been no relationship between deficit reductions and recessions.

LikeLike

“The deficit is an irrelevant accounting abstraction.

4.3 trillion in Federal spending is not something to pay attention to? The highest spending in five years.”-mrkemail2

Apparently mrkemail2 spends too much time on Mike Norman Economics. Norman himself has been proclaiming for months now that top line government spending and NOT the deficit is the only indicator that matters.

Oops…

“There is a massive Treasury shortage because of the austerity, debt ceiling, and the huge reduction in the deficit. We talked about the liquidity crisis that hit the banking system a few weeks ago. The Fed had to inject nearly $700 billion of Treasuries into the market in a single week because of a shortage.

Look at these tables. Last fiscal year (just concluded, Sep 30) the Treasury redeemed $60.4 trillion of Treasuries while it issued $60.8 trillion. That was a mere, $400 billion of net new supply.”-Mike Norman, Mike Norman Economics Blog, October 21, 2015

LikeLike

Very simply, federal spending adds dollars to the economy and federal taxing subtracts dollars from the economy.

Not sure why one would be important and the other not important, as both affect the money supply.

LikeLike

Error note: You have ceiling being raised during Obama Admin five times in one para and seven times in the next. Otherwise, great informative post, as usual.

LikeLike

Right. Good catch. The author misstated somewhat.

The ceiling was raised 5 times and suspended twice more. A suspension constitutes an increase, though not the same as an increase.

An increase is: “Here is how much you are allowed to borrow to pay the bills.”

A suspension is: “Borrow as much as you need to pay the bills.”

Of course, the word “borrow” is inaccurate, in that the federal government does not borrow its own sovereign currency.

When investors deposit dollars into T-security accounts at the Federal Reserve Bank, that misleadingly is termed “borrowing.” Unlike with real borrowing, the Fed doesn’t use the dollars. But, by law, it is required to accept deposits no less than the total of all deficits.

LikeLike

The debt ceiling as we know it has only been around a few decades. It is the current implementation of the power given to Congress in Article I Section 8 to borrow money on the credit of the United States.

Before WWI, the Congress authorized each issuance of bonds separately, typically within the law authorizing the related spending. In essence, there was an operating budget, more or less balanced, and a capital budget funded by borrowing of specific amounts for specific purposes.

For WWI, they didn’t know how much would be required, so they passed the first “debt ceiling” sort of law, authorizing a total amount of debt without specifying how the money was to be spent.

Since then there have been a few variations of debt ceiling laws. For a time, the debt ceiling was raised by merely amending the old law. Capital spending is no longer accompanied by a separate authority to borrow the required amount, it is covered by the blanket authority of the debt ceiling law. And so is whatever operating budget amount that is in excess of tax receipts. The concept of operating and capital budgets are now totally alien in Washington.

Of course, Congress could avoid separate authorization of borrowing – separate from the appropriations and tax laws – by either declaring it redundant and repealing the debt ceiling law, or passing a debt ceiling law with an absurdly high limit.

LikeLike

Or better, by acknowledging that the federal government is Monetarily Sovereign, so the usual, double-entry accounting rules regarding Income/Expenses don’t apply.

The federal government neither needs nor uses Income, and could operate forever very nicely, thank you, with zero Income.

LikeLike