Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

We have entered “debt-ceiling” season, where Congress and the President spend endless hours arguing about whether the limit should be increased, and if so, how much.

Number of requests for increase

Depending on who is doing the research, it is said that the US has raised its debt ceiling (in some form or other) at least 90 times in the 20th century.

The debt ceiling has been raised 74 times since March 1962, including 18 times under Ronald Reagan, eight times under Bill Clinton, seven times under George W. Bush, and five times under Barack Obama.

Congress has raised the debt ceiling 14 times from 2001-2013. The debt ceiling was raised a total of 7 times (total increase of $5,365 billion) during Pres. Bush’s eight-year term and it has been raised 7 times (as of 10/2013 a total increase of $5,385 billion) under Pres. Obama’s term as of 2013 (five years in office).

The debt ceiling has been raised an average of once a year, for about a century. Every single time we have bumped up against the debt ceiling, it has been raised. Every time.

So, remind me again. If it always is raised: What is the real reason we have a debt ceiling?

The debt ceiling has nothing to do with future spending. Congress and the President determine future spending.

The debt ceiling is a device to prevent paying our legitimate bills for past spending.

Failure to raise the debt ceiling, first would cause a shutdown of the federal government, and shortly thereafter would cause an unprecedented U.S. default.

Not only would we become “Deadbeat America,” but our entire economy — indeed the entire world’s economy — would crash, making the 2008 recession look like a picnic.

So remind me again: What is the real reason we have a debt ceiling?

Congress and the President are aware of the dangers inherent in a debt ceiling. But like spoiled children, they continually stomp their feet and play a game of “chicken,” gambling with America’s and the world’s future, in an attempt to get their own way on their favorite issues.

The debt ceiling has nothing to do with financial prudence or with spending or with taxes or abortion or immigration or Medicare or gay rights or with our military power or whether the Cubs ever will win a World Series.

The debt ceiling exists only because of a bunch of ruthless, vindictive people, whose pay will continue even during a depression — people who could not care less about you, me or anyone else on earth — people who demand, “Give me what I want or I’ll destroy your life and the lives of your friends and loved ones and of the whole world.”

So that is the real reason we have a the debt ceiling: Bastard power.

Don’t believe me? Contact your Senators and Representatives, and ask them why we have a debt ceiling.

You’ll be able to fertilize your garden with their answers.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

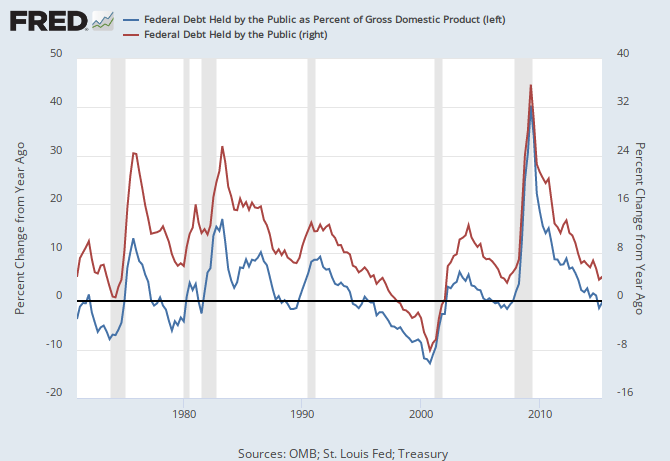

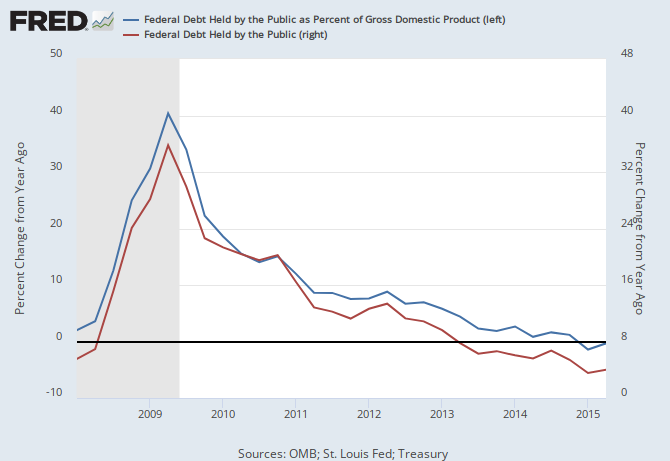

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY