Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

================================================================================================================================================================================

Despite the Republicans’ endless attempts to cripple Medicare, it remains one of our greatest federal programs.

Yes, it’s inadequate. It should cover fully every man, woman and child in America.

And yes, it pays doctors and other providers too little, encouraging some to refuse acceptance, while reducing the incentive to become a doctor.

And yes, there absolutely is no reason for a Monetarily Sovereign government to collect FICA, supposedly to “pay for” Medicare, when FICA does no such thing. All FICA does is widen the gap between the rich and the rest.

But even with those shortcomings, Medicare helps millions of Americans survive potentially bankrupting health problems.

For those who claim everything is better if done by the private sector, Medicare does what no private insurance company does. It accepts even those people having an adverse health history and for patients, it is a no-hassle benefits program. The doctors and the hospitals submit everything.

Single-payer is a great concept.

One problem with Medicare: Parts A and B don’t cover everything. You are left with deductible costs that can be prohibitive, especially for long-term diseases like cancer, congenital problems, Altzheimer’s, etc.

Why doesn’t Medicare pay for everything?

There are two (bad) reasons: One is the false belief that if people pay nothing, they will overuse medical care. Not only is this utter nonsense, but it is a non-problem, even if it occurs.

If the federal government were to pay for unnecessary medical procedures, that simply would stimulate the economy.

Two is the false belief that taxes pay for Medicare, so costs must be held down. As previously mentioned, FICA does not fund Medicare. In fact, contrary to popular belief, federal taxes don’t fund anything. The federal government creates dollars ad hoc, by spending.

Because of the big holes in Medicare coverage, many people invest in Medigap policies, through private insurance companies. These policies pay some or all of what Medicare fails to pay. And here again, the federal government has done what the private sector could not and would not do.

The government has standardized coverages. With a few exceptions, there are ten Medigap plans, “A” through “N” (no “E,” “H,” “I” or “J”) which private insurance companies are allowed to offer and — this is the big idea — each plan is standardized.

Every company’s “A” plan is the same as every other company’s “A” plan. (In some cases, companies my offer additional benefits, but no fewer than the standard). All “B’s” are the same; all “Cs” the same, etc.

Why is this important? Because, all you need do is select the plan and then find the cheapest premium. You don’t have to filter through thousands of pages of benefits, benefit exceptions, fine print and other tricks usually found in private insurance contracts.

Just select the plan and the lowest premium.

Done.

And here is where you probably are doing it wrong:

I. Most people select Plan “F,” when plan “G” is cheaper and offers the same coverage, with one exception: On Plan “G” you have to pay an additional $147 as a Medicare Part B deductible.

But the annual premium savings for Plan “G” generally are far greater than that $147, so most people would come out way ahead by buying Plan “G.”

II. Very few people select the least expensive insurance company.

Remember: Once you have decided on your plan (“A” through “N”), you only need to decide on an insurance company, and that decision is based solely on cost. Simply pick the cheapest one. It’s that easy.

Every state has a different roster of companies. In my state, 21 companies offer Medigap policies; only one can be the cheapest. All the others are more costly.

So who is wasting money buying unnecessarily expensive policies in my state? Virtually everyone.

Our biggest provider is Blue Cross, Blue Shield. It is not the cheapest. In fact, it is among the more expensive. Why does anyone buy a BCBS Medigap policy?

They believe BCBS is “better” somehow. (It isn’t. By law, the BCBS policy is essentially identical with all other policies in the same category.)

Think of all those millions of people who are not buying the cheapest Medigap policy (in each category). Are you one of them?

More importantly, if you are not buying the cheapest policy, will you now do a bit of research to find and purchase the cheapest policy?

Odds are, you won’t. If you are typical, you will continue to believe — despite all facts — your insurance company is “better” than the one with the lowest premiums, and you’ll stay right where you are.

People hate to change their minds and people hate to accept the possibility they have been wrong. I was one of those, who simply was too lazy to investigate, and I thought that in some unknown way, my insurance company was more reliable, safer or easier than a company offering cheaper rates — especially if I never had heard of that cheaper company.

When it comes to Medigap, the best company is the cheapest company. It’s just that simple.

I admit it. I was wrong. (And lazy.) That’s one of the penalties of being human.

It also, by the way, is the fundamental reason why people don’t accept Monetary Sovereignty. It’s too simple.

The notion that the federal government never can run short of its own sovereign currency, and can pay for anything without collecting taxes, and can do so without causing the dreaded Weimar/Zimbabwe hyper-inflation — that notion is just too simple.

It falls afoul of the “too-good-too-be-true” and the “no-such-thing-as-a-free-lunch” rules.

So people who would benefit mightily, if the government eliminated FICA and offered free, comprehensive Medicare for everyone, reject the idea. And they don’t just reject it, but they reject it angrily and with lots of insults directed at anyone who suggests it.

They would much rather hold to their irrational beliefs that federal deficits and debts are too high. So they pay, pay, pay more, more, more and receive less, less, less.

Now my question is: If you purchase a Medigap policy, which insurance company will you use?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

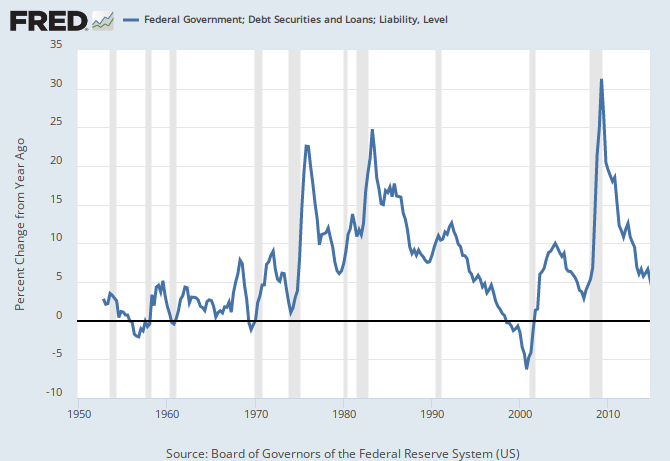

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

If you purchase a Medigap policy, which insurance company will you use? The company with the least expensive premium! (Thanks sir.)

LikeLike

Excellent.

LikeLike