Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

We all should very happy. Washington has moved away from angry, Tea Party, take-no-prisoners, destroy-America-to-save-it rhetoric, and now is in compromise mode.

Ryan pleads with conservatives as budget deal heads to Senate

Republicans plan to use debt ceiling fight as a bargaining chip in 2014

By Jacqueline Klimas-The Washington Times Sunday, December 15, 2013As the bipartisan budget deal moves to the Senate, where it faces opposition from some Republicans, Rep. Paul Ryan is telling those on the right that the compromise is good for core conservative values.

(“Bipartisan” is a much-loved word these days, as supposedly it stands for something good, though no one knows what.)

O.K., so it’s not exactly the friendliest of compromises, but at least it’s better than all that fighting. At least something will get done. Right?

“Look at the details, I say to those who are criticizing it. This is keeping our principle intact: no tax increases, net deficit reduction, permanent spending cuts in place of the across-the-board approach,” Mr. Ryan said on “Fox News Sunday.”

The Wisconsin Republican joined Sen. Patty Murray, Washington Democrat, last week to announce the two-year, $1.012 trillion plan, which would alleviate some of the sequester cuts and reduce the deficit by $23 billion over 10 years.

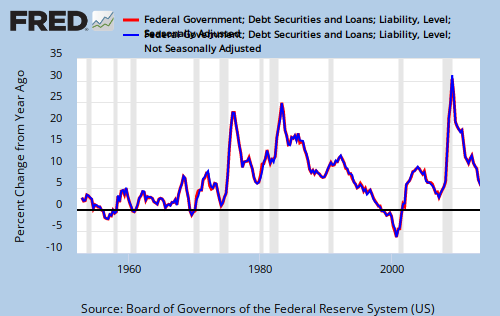

In August of this year, we published The Recession Clock. It showed two graphs and asked four questions:

1. What does the federal government do in the years leading up to recessions? (Answer: Cut growth in deficit spending)

2. What does the government do that cures recessions? (Answer: Increase deficit spending growth)

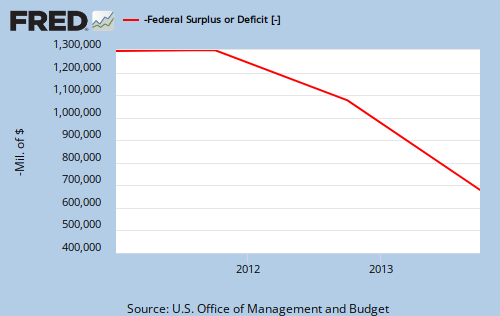

3. What is the government doing now? (For a clearer picture, here is a closeup of the most recent past):

4. Why is the government cutting deficit spending growth, despite overwhelming evidence this causes recessions? (Because of the false premises that the federal government can run short of dollars, or by creating dollars, could cause inflation.)

Now the Republicans and the Democrats, in the spirit of collegiality, plan to compromise. They will reduce the deficit. The Republicans want to kill us by shooting, and the Democrats want to kill us by poisoning. The compromise is all about how best to kill the lower and middle income groups.

So we head toward another recession, which will impact the poor far more than it impacts the rich (as recessions always do). It will be a wholly avoidable, entirely unnecessary recession. For our Monetarily Sovereign nation, the deficit is no burden. Your children will not pay the federal debt.

The federal deficit is the economy’s surplus. The deficit stimulates economic growth. (GDP = Federal Spending + Non-federal Spending + Net Exports)

On average, the U.S. negative balance of trade is $40 billion per month. We import $40 billion more each month than we export. Month after month, $40 billion flows out of America.

This means, that just to break even, i.e. for Net Exports to = $0, the federal government needs to run a $40 billion monthly deficit — a $360 billion annual deficit.

What is our current deficit?

Six hundred billion . . . and dropping fast.

So, the “compromise” is a cousin to President Obama’s rightfully scorned “grand bargain.” Like the “grand bargain,” the “compormise” will continue to reduce the deficit with massive cuts to spending.

What exactly will be cut? I don’t yet know. But this is absolutely, positively certain: The cutting will affect the lower and middle income groups far more than the top .1%

The rich will get richer. The poor will get poorer. The middle will fade away. The politicians will prance and preen and congratulate themselves on how they made a bipartisan deal to save America (i.e. save their rich donors).

And the public, will buy into the myth that helping the poor makes them lazy “takers”, unmotivated and deserving of their suffering, while the rich are hard working, beneficial “makers,” deserving of their wealth, and even deserving of thanks for allowing the little people enough to keep alive.

It’s a lie, a Big Lie. The poor are not lazy. They are not sloths looking for handouts. Their lives are hard and unrewarding. Their hopes are diminished. It’s a daily effort just to get by. It’s a Big Lie promulgated by the rich.

And as for those “makers,” the presidents and top executives of General Motors or A.T.&T. or General Electric or Exxon or Apple — they haven’t made anything or hired anyone. It’s the corporation that does the making and the hiring.

The executives themselves were hired by the corporations to do jobs, for which they are well rewarded. These executives, these well-paid employees, are the ultimate takers, receiving massive benefits from the toil and sweat of their subordinates, and from the government.

It’s not the rich executives who pull 100 boxcars filled with freight. It’s the engine. All the executives do is pull the levers and watch the scenery. Is their job so much harder than yours, that they should be paid 10, 100, 1000 times more than what you earn?

Unless you’re among the very rich, cutting the deficit hurts you. It widens the gap between you and the rich. That is what the rich want, and to effect it, they gave you the Big Lie.

If you’ve bought the Big Lie, you and your children will spend the rest of your lives paying for it.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

All your general comments are true, but this deal does not reduce deficits, it increases them compared to current law. The details of the deal are at http://budget.house.gov/uploadedfiles/bba2013summary.pdf

For 2014, spending is $45B higher than current law, and for 2015 $18B higher. That’s the $63B of “sequester relief”. The $85B of spending cuts and user fees is spread out over the ten years, with $28B in 2022 and 2023. Until then, the budget effects are a little under $6B each year.

The net is about $39B of increased spending this year, and $12B more next year. After that, the deal expires and there will have to be another deal, or Congress will have to pass a regular budget or a continuing resolution.

Review the math: when you cut $6B, it’s “$60B over 10 years”. When you spend $45B in a year, it’s $45B. Not $450B over 10 years. “Deficit reduction” = 15 (60 – 45).

Portraying this deal as deficit reduction is dishonest. A few of the Republicans recognize that and object on philosophical grounds. But most will support it even though the Tea Party doesn’t like it, because it leaves Obamacare as the only remaining big issue, and that is to their political advantage.

LikeLike

Your operative words were, “. . . according to current law.” That’s the whole idea.

First ridiculously cut deficits. Then moderate the cut so that people feel things “aren’t so bad.” It’s all hocus pocus.

Not only must deficits increase, but they must increase by an increasing amount if we are to avoid recessions.

See: http://research.stlouisfed.org/fredgraph.png?g=q4o

LikeLike

True, but this is a baby step in the right direction, not the wrong direction. And they lie about it.

LikeLike

Perhaps you’re right, but I can’t get too enthusiastic about one step in a “down-two-steps, up-one-step” series, especially when we already are too far down.

LikeLike

John, I know I give you a hard time occasionally due to some of, what I perceive to be, your strange fox news-like political scandal-gate commentary displaying your obvious dislike of D’s; but its comments like this that make me appreciate you anyway. I’m always appreciative of people who make an effort to get the numbers right.

You are obviously right that this budget is an “improvement” from the what would otherwise happen.

Its very sad that things are so hopeless, I’m forced to acknowledge an improvement from -10 to -9.5.

I wouldn’t be so sure that Obamacare is going to be the big advantage you seem to believe it is. The ACA either redistributes (to the extent that capital gains and other taxes plus some medicare spending cuts) from relatively wealthier to less so people, or simply gives away via Govt spending many billions of dollars. Regular people deserve those free or redistribtuted dollars, and I wouldn’t want to be the one betting against the popularity of a program that gives middle and lower income people “free money”.

LikeLike

The Medicaid expansion and the subsidies help the poor, but for middle class people with private insurance and no pre-existing conditions the premiums and deductibles are quite a bit higher, and people who will change from highly subsidized employer plans to private are going to have some enormous sticker shock.

Plus, the web site was the easy part. The tip of the iceberg. 90% of the IT involved is in the back end systems: the billing, eligibility, and provider payments, and those are not even finished yet. Even if that goes totally smoothly, which is practically impossible, the Rs think the cost and the lies will still be enough for them to make hay. Maybe they’re wrong?

LikeLike

Rodger,

Off topic but important: one of the news services reported that Brazil is in “big trouble” because of its “excessive” deficit spending with its own $R (the Real). Comments?

LikeLike

Think about it. How could a Monetarily Sovereign nation, which has the unlimited ability to create its own currency, be in “big trouble” because of deficit spending?

What you read is the same old media BS that equates sovereign finances with personal finances. Not a day goes by in America, without at least a dozen of the media claiming the government should reduce its deficit.

They are bribed (i.e. owned) by the 1% to say that.

LikeLike

“Capitalism” is dead. There is only hucksterism.

All the lies promulgated by the rich and their toadies are the opposite of the truth. All of them.

CLAIM: The US government is broke

REALITY: The US government has infinite money

CLAIM: Deficit reduction helps the economy

REALITY: Deficit reduction causes recessions.

CLAIM: The lower classes are “takers.”

REALITY: The richer you are, the more you are a “taker” who gets a free lunch.

…and so on. I can think of hundreds of examples.

REALITY: the rich and their toadies are parasites. The masses are their host.

All parasites tell lies in order to enslave the host. Sadly, the human host defends the lies with its life. For example, all wars of imperialist agression are based on lies, but there are always plenty of average people to go fight them. They murder and die, and they make themselves poorer, so that rich people can become richer.

No matter how many times the parasites lie, the host always believes them.

Perhaps the rich are correct: “If God did not want them sheared, he would not have made them sheep.”

LikeLike

This tells it all:

LikeLike

There will not be another hostage. They abandoned that strategy last time, because Obama is willing to suspend Social Security payments and able to blame Republicans for it. It is only an opportunity to do another “deal”, another something-for-everyone compromise.

Someone needs to convince Obama that he can and should “mint the coin”. Then the debt ceiling issue goes away.

LikeLike

Regarding the silly debate in Washington about raising the “debt limit,” it was never a big deal during the 40 years when Democrats controlled the US House (1955-95). In fact, the Democrats completely did away with the “debt ceiling” debate in 1979, thereby sparing us from the lies and the posturing for the next 16 years.

In 1995 when the Republicans finally gained a majority of seats in Congress, they brought back the “debt ceiling” debate via their “Contract With America.”

Now the nonsense happens with every new budget.

This was not a Republican victory. It was a Democrat betrayal. Already in 1992 the “New Democrats” (e.g. Bill Clinton) were pushing to bring back the “debt limit” charade, so that both parties could impose endless austerity on the masses. Bill Clinton also ran for President on the vow to “end welfare as we know it.”

The masses loved this. The USA was in a recession, and Bill Clinton told America ,”I feel your pain.” Clinton and the “New Democrats” would ease your pain by casting you into austerity.

In 1995 the “New Democrats” passed NAFTA. In 1996 they eliminated the Aid to Families with Dependent Children program (which had been in effect since 1935). By 1997 they were moving to cut the US budget deficit to zero — but the resulting depression was masked by the dot-com bubble, and later by the housing bubble.

Today the rich and the bankers no longer need bubbles. They play in the Wall Street casino, knowing the US government will always bail them out, and that the Fed will always spend $85 billion per month to juice the markets.

And so, everything will continue to get worse until the masses quit acting so stupid and selfish. (Which may be never.)

LikeLike

Why there is any “compromise” at all:

Note to golferjohn: So much for the “baby step in the right direction.” Call it a strategic step to win the war.

LikeLike

Yes, that’s what I said. Gingrich called it terrible policy but great political strategy.

LikeLike

This “budget deal” has two basic functions: maintain austerity, and make sure it does not affect military contractors.

[1] MILITARY: In 2011 the Obama regime vowed to cut $1.2 trillion in discretionary social spending (mostly education). Half of those cuts were supposed to affect military contractors, but those cuts were deferred until March 2013 (the “sequester”).

In 2012 politicians slightly toned down their hysterical demands for more austerity, because there was a mid-term election for Congress. After the November 2012 elections, both Republicans and Democrats rushed to the ‘fiscal cliff’ deal of January 2, 2013, in which they ended the 2% FICA “tax holiday” for workers, while they further lowered taxes on the rich. Once again, all cuts to military contractors were deferred to a later date.

Beginning March 1, 2013 the ‘sequester’ cuts fell on non-defense spending. All cuts to military contractors were shielded and offset in various ways by Obama and the Congress. Indeed, the House Budget and Senate budget proposals for FY 2014 both call for increasing Pentagon spending.

In short, spending on military contractors was never “sequestered” at all.

Nevertheless, during the last six months, I have seen endless articles in which people like Chuck Hagel whined and moaned that the sequester cuts may eventually hurt military contractors.

Now the Ryan-Murray budget deal will make sure that military contractors never suffer any cuts at all. The same day the House passed the budget deal, it also passed the National Defense Authorization Act, which increased Pentagon spending for FY 2014.

[2] AUSTeRITY: The Ryan-Murray budget deal ensures the continuation of austerity (i.e. the ever-widening gap between the rich and the rest, and between the financial economy and the real economy).

Since the mid-term 2014 Congressional election season is about to begin, politicians are once more toning down their demands for more austerity. Austerity will continue, but at a piecemeal rate. In Feb 2014 there will be further cuts to Food Stamps (at least $8 billion), plus cuts to federal worker pensions. The Ryan-Murray budget deal will increase federal “fees” by $26 billion. Of that, $6 billion will come in the form of raising federal employees’ pension contributions, and another $6 billion by cutting cost of living increases for military pensions. Another $12.6 billion will come from raising federal taxes on airline travel.

(Taxes the federal government does not need or use.)

The Ryan-Murray deal also ensures that on December 28, 2013, some 1.3 million workers will lose their unemployment benefits. Another 1.9 million who were projected to continue benefits in 2014 will also now lose them.

After the elections are over in November 2014, politicians will resume screaming for STILL MORE austerity.

LikeLike

Interstate lotteries are another tactic the federal government uses to impose austerity.

Here’s how…

The “Mega Millions” lottery jackpot for 17 Dec 2013 was estimated to be $636 million.

Assuming there was a winner, the lump sum amount was $341.2 million.

Of that $341.2 million, the federal government deducts 39.6% and destroys it. (Last year the feds deducted only 35%.)

That $135 million was in the economy, but it was sucked out of the economy via the sale of lottery tickets. Then it was destroyed.

Each lottery prize that is subject to federal taxes sucks more money out of the economy. And since the masses are increasingly desperate, they increasingly play lottery games, which increasingly makes the depression worse.

What a waste.

LikeLike

This is totally a fallacy.

So someone won 636 million from the lottery. I will assume that the 636 million (plus some other administrative fee and profit kept by the states) was collected from individuals playing into the game. Let’s say that the entire 636 million was spent on smaller items, at a 10% tax rate.

572 million in goods/services and 64 million to taxes (10% tax)

381 million to winner and 255 million to taxes (40% tax)

In both cases funds would either be RE-spent by people or the government. No change at all.

The Fed debits the funds from the bank of first deposit and credits the Federal Government’s account at the Fed. The government will later spend these funds.

Whether the US government calls the first 64 million or 255 million spent as those received from taxes collected from millions of tax payers or the lottery winner, it’s a mute point. The bottom line here is that the people can no longer spend purchase goods/services worth 64 or 255 million – but the government does. I thought Roger stated that this was all a balance sheet – are we now taking this argument back?

What is outside of the balance sheet is new credit creation. The credit created by either the government or banks. These are funds coming into existence – outside of taxes. If you think that this is somehow “good” for you – you are complicit to the ongoing theft. If you do, than I have a hole bunch of Bapoy bucks I need to get rid of – send over all the goods and services you can get and I will reward you with Bapoy bucks. This is how laughable that idea is.

LikeLike

“The government will later spend these funds.”

The $636 million originated with the private sector. From the $636 million, the federal government deducts about 1/3 for taxes. The balance goes to the winner.

The tax money disappears from the money supply. QUATLOOSX is correct. The private sector loses money with every lottery win.

The federal government does not spend taxes or any other incoming funds.. Those are destroyed upon receipt and no longer are part of the money supply.

By the way, state and local governments do spend taxes and incoming funds. Those are deposited in private-sector banks, and remain part of the money supply.

Those who do not understand the difference between Monetary Sovereignty and monetary non-sovereignty do not understand economics.

LikeLike

Good links:

http://www.dailykos.com/story/2013/12/18/1263706/-Rep-Jack-Kingston-Poor-kids-should-work-if-they-want-to-eat-school-lunches?detail=email

http://www.dailykos.com/story/2013/12/19/1263522/-Income-inequality-in-six-panels?detail=email

http://www.nationalmemo.com/who-is-really-waging-war-on-christmas-look-in-the-mirror-right-wing-scrooges/

LikeLike