Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Politicians of a certain political stripe tend to brand any federal spending as “socialism” and “redistribution.”

Social Security, Medicare, Medicaid and Food stamps all are “Socialism and redistribution.” Any other aid to the poor and middle classes is Socialism and redistribution.

Those two words, “socialism” and “redistribution” have become the epithets du jour.

As to socialism, there are many kinds, but those who use the word seldom know any of them. For all kinds of socialism, the word does not simply mean government spending.

If it did, every government in history could be called “socialist,” since all spend money.

Rather “socialism” means government ownership and management of production. So the next time someone tells you a certain government project is socialism, ask him for the definition of “socialism,” then watch him stumble.

So called “socialized medicine” is not socialized medicine. Truly “socialized” medicine would be a system in which the government owned all the hospitals and employed all the doctors, nurses and other health-care providers.

I doubt many in America advocate socialized medicine.

The term ignorantly is used to describe “single payer” programs. Medicare is an example. Medicare is not socialized medicine any more than the Supreme Court is “socialized” law, though the government pays the justice’s salaries. Nor is Congress “socialized” legislation. Nor have we had a “socialized” military, or a “socialized” White House.

Government spending is not socialism. (It also is not communism, fascism or any other “ism.” It simply is spending.)

Now, having stepped on the obtuseness of the “socialism” epithet, let’s examine “redistribution”.

Every time you, your city, county or state spends a dollar, there is some measure of “redistribution.” You had a dollar; you spend it; now the store has your dollar. That dollar has been redistributed.

State, county and local taxes are redistributed via state, county and local spending.

Ironically, when the federal government spends a dollar, no redistribution occurs. The federal government creates new dollars by spending. So although federal spending causes “distribution,” it is not an example of RE-distribution.

(Some may object that federal taxing AND spending together comprise redistribution, but that would not strictly be correct. There is no relationship between federal taxing and federal spending. Federal taxing destroys dollars; federal spending creates new dollars. Different dollars.)

Semantic arguments aside, the right-wing objects to any program from which the gap between the rich and the rest is narrowed. They sneer at narrowing of the gap as “redistribution.”

To prevent the poor and middle class from coming closer to the rich, right-wingers define redistribution as a process whereby indolent slobs, who rather than becoming educated or working for a living, prefer to commit crimes in a drug-induced stupor, while collecting easy money from the government.

Never mind that the vast majority of Americans are poor or middle class, and by portraying these folks in negative terms, the right wing essentially portrays America in those same terms.

Such is right-wing patriotism.

New York Times

WHITE HOUSE MEMO

Don’t Dare Call the Health Law ‘Redistribution’

By John Harwood

Published: November 23, 2013Rebecca M. Blank was a top candidate in 2011 to lead President Obama’s Council of Economic Advisers, but then the White House turned up something politically dangerous.

“A commitment to economic justice necessarily implies a commitment to the redistribution of economic resources, so that the poor and the dispossessed are more fully included in the economic system,” Ms. Blank, a noted poverty researcher, wrote in 1992. With advisers wary of airing those views in a nomination fight, Mr. Obama passed over Ms. Blank.

“Redistribution is a loaded word that conjures up all sorts of unfairness in people’s minds,” said William M. Daley, who was Mr. Obama’s chief of staff at the time. Republicans wield it “as a hammer” against Democrats, he said, adding, “It’s a word that, in the political world, you just don’t use.”

Despite the fact that, compared with the rich, the average poor and middle class labor harder and longer, and lead more difficult, less healthy lives, and have less bright futures, this is not thought to be “unfair.”

To the right wing, “unfairness” means closing that income/wealth gap. Even the poor and middle class have been brainwashed to believe such nonsense.

These days the word (“redistribution”) has been hidden away to make the Affordable Care Act more palatable to the public and less a target for Republicans, who have long accused Democrats of seeking “socialized medicine.”

The right wing, by controlling the media, the politicians and the mainstream economists, has been so effective in using “redistribution” as a pejorative, one cannot even utter the word without adverse consequences.

But the redistribution of wealth has always been a central feature of the law and lies at the heart of the insurance market disruptions driving political attacks this fall.

“Americans want a fair and fixed insurance market,” said Jonathan Gruber, a health economist at the Massachusetts Institute of Technology who advised Mr. Obama’s team as it designed the law. “You cannot have that without some redistribution away from a small number of people.”

And therein lies the problem, for even Mr. Gruber buys into the Big Lie, the belief that taxes pay for federal spending, which if true, would mean that the rich are paying for the poor. But in a Monetarily Sovereign government, taxes do not pay for spending.

Mr. Obama’s advisers set out to pass the law in 2009 fully aware that fears among middle-class voters sank President Bill Clinton’s health initiative 16 years earlier. So they designed the legislation to minimize the number of people likely to be hurt.

That was a perfect example of the brainwashing. To “minimize the number of people likely to be hurt,” the federal government should institute a fully paid, comprehensive Medicare for every man, woman and child in America.

Instead of a sweeping change to a government-run “single-payer” system favored by Democratic liberals, members of the administration sought to preserve the existing system of employer-provided health insurance while covering the uninsured through the expansion of Medicaid and changes to the individual insurance market.

Sadly, there seem to be no “Democratic liberals.” Obama is a right winger, who may seem liberal only by comparison with the extreme right wingers of the Republican party.

When Mr. Obama ran for president in 2008, Republicans tried to wound him by accusing him of waging “class warfare” to achieve wealth redistribution. That fall, the Republican presidential nominee, Senator John McCain, derided Mr. Obama as the “redistributor in chief.”

“Class warfare” and “redistributor in chief” meant Obama wished to reduce the GINI ratio, which unfortunately, he seems not to.

Mr. Obama survived that episode and other instances when Republicans deployed old recordings of him using the word “redistribution” as evidence that he was a closet socialist.

Again, misuse and stigmatizing of the word “socialist.”

The president promised stability: “If you like your current insurance, you will keep your current insurance.”

Hiding in plain sight behind that pledge — visible to health policy experts but not the general public — was the redistribution required to extend health coverage to those who had been either locked out or priced out of the market.”

Again, fundamental misunderstanding on two levels:

1. Since taxes do not pay for federal spending, there should be no redistribution in the ACA.

2. Redistribution, if it occurred, would narrow the GINI ratio, and therefore benefit America.

The law, for example, banned rate discrimination against women, which insurance companies called “gender rating” to account for their higher health costs. But that raised the relative burden borne by men. The law also limited how much more insurers can charge older Americans, who use more health care over all. But that raised the relative burden on younger people.

And the law required insurers to offer coverage to Americans with pre-existing conditions, which eased costs for less healthy people but raised prices for others who had been charged lower rates because of their good health.

The “redistribution” is not between rich and poor, but rather among select demographic groups — which would be unnecessary in a “Medicare for All” program. The government simply would pay for health care, regardless of age of prior condition.

Ironically, that private insurance redistribution is made necessary by the right-wing’s focus on the reduction of deficit spending, making fully funded Medicare for All impossible.

David Axelrod, the president’s longtime strategist said, “we’ve created a sense that everyone can expect to win — nobody has to sacrifice.”

Which would be true in a federally funded, “Medicare for All” scenario.

Mr. Axelrod argued that widening income inequality has, to some Americans at least, changed the meaning of redistribution. “The whole redistribution argument has shifted in the country because there’s a sense that a lot of redistribution has been to the top and not the bottom.”

Bingo! That is exactly what has happened. The rich, who argue most against redistribution, have been, in fact the beneficiaries of tax laws and a bribed Congress and President, who have legislated the huge increase in income/wealth redistribution to the top.

“Understand this is not a redistribution argument,” the president told his audience [18 months ago]. “This is not about taking from rich people to give to poor people. This is about us together making investments in our country so everybody’s got a fair shot.”

Rather than “redistribution,” our Monetarily Sovereign government can make it “fair distribution,” where nothing is taken from the rich, but more is given to the middle and the poor.

Closing the gap is the course of action, fairest and most beneficial to America — but that would be mis-termed, “socialism” and “redistribution.”

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

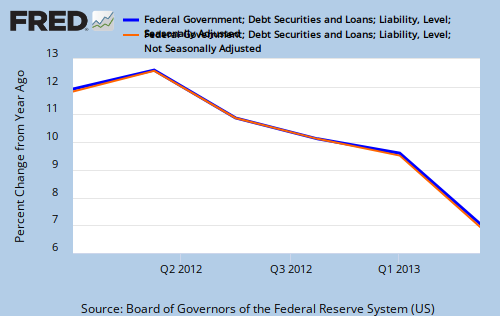

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Don’t be afraid of me Roger, I’m just a dumb poster. My response to Tetra was not up to your standards?

Anyway, here is the definition of socialism as per Google:

a political and economic theory of social organization that advocates that the means of production, distribution, and exchange should be owned or regulated by the community as a whole.

Notice the word “regulate” in there. What that means is that, aside from an all out ownership of the means of production, the government can dictate who is licensed to produce certain things, who can distribute the things (again, licensed) the government says you can distribute. The Fed (a quasi government entity) manipulates money markets, the government subsidies education, it subsidizes medicine, it subsidizes food, it subsidizes housing, what else is left?

To say that government spending does not equate to redistribution is like saying rain is not wet. And technically, it isn’t when it’s up in the sky. When it hits earth, well, I think we know the story. When the government spends a dollar that did not previously exist, it removes purchasing power from other dollars in existence. Otherwise Mr Roger, what is counterfeiting and why is it illegal? So it’s not “ironic”, it’s theft Roger.

I would quality as a middle income person by regular measure and I would never, ever, ever agree that government spending improves the lives of people like me. I’ve seen it first hand, going to the supermarket for a bag of groceries while welfare recipients are pulling to carts is not what I would call fun. Not when you have a few mouths to feed. And that, Roger, is what the middle class is going through these days. The middle class is either too busy working their asses off and too stressed to read and become well versed on the economy and how the government’s action is screwing them. Instead, they go vote for socialist fools like Obama. What improves my quality of life is my labor and the labor of others. If we all contribute something, we are all better off. If the majority of us just consumes what the other part produces, well – what do you think will happen to the quality of life of the working part? Is it any wonder that the working part is overworked? Is this too hard to understand Roger or are we just lying flat out?

The last time I checked, the government is the people. So it ain’t the government that will pay for it, it’s the people. It’s the people who will suffer the consequences of higher prices elsewhere. Your analysis fails to identify the issue because you don’t focus on the source of the problem. Medical costs are high because the same government you defend, is hell bent on maintaining a monopoly in place (that’s it Roger). Yes, we have a monopoly in place that is sucking the blood dry out of people like us. Medicine is the single biggest issue for Americans, yet nobody, nobody gives a damn.

So why aren’t we asking for the government to kill that monopoly? Instead, the political fanaticism was stronger, and so you defended Obamacare. I’m surprised you haven’t blamed that one on the tea party too.

I’m not sure what media you watch, but aside from Fox, all other outlets (and there are many of them) are fanatic socialists.

You know why you decide to lie, I will point it out as long as I can find access to a computer. And I don’t care if you post it or not, at least I know you saw this post. Do the right thing for once.

LikeLike

I reject comments that I deem too lengthy, off subject or simply foolish. If you wish to write at length, you might publish a book or your own blog.

Incidentally, by your measure, every government in history is socialist and redistributing — but then, you object to redistributing “too much” to the poor and not redistributing “enough” to you.

Finally, if you believe the poor have it better than you do, you owe it to your family to quit your job and go on welfare.

LikeLike

‘When the government spends a dollar that did not previously exist, it removes purchasing power from other dollars in existence.’

Notyellen, it is imperative you realize the several factors that REQUIRE the net creation of dollars by the federal government:

1. Savings desires of the private sector

2. The requirement to pay federal taxes

3. Current account balance deficit

4. Population increases

5. Inflation (if less than 2%, typically the economy CANNOT grow)

The 0.001% bribes Congress and the president, who continue to place useless restraints on government monetary operations in order to give more profit-making power to the financial sector. Private banks create 97% of $US out of thin air. Since that money is debt-based, when it is repaid, that money DISAPPEARS from the economy.

With private income stagnate (as it has been since the 70’s, in real terms), an economy MUST have an accelerating private debt to grow. This is unsustainable. How can an accelerating level of private debt be paid with stagnate incomes? There is a limit to how much citizens and businesses can borrow. The US is STILL ~300% of GDP in private debt. We’ve gone as far as we can go. Now we are trying to pay down our debt (lately it is accelerating again), and because of where our money comes from (debt-based private bank issued $), paying down debt REDUCES the money supply in tandem.

The federal government of course cannot run out of money. We have the productive capacity to handle much higher aggregate demand and there is NOT a single business that would claim they are “maxed out” in terms of how much they wish to produce. Economic production is still about 80% of capacity. So, stimulating the economy with higher deficits will NOT cause undue inflation.

LikeLike

Private banks create 97% of $US out of thin air. Since that money is debt-based, when it is repaid, that money DISAPPEARS from the economy.

The first sentence is absolutely correct. The second, you will find upon proper research, is not an accurate one.

LikeLike

Actually, the federal government has created 20% ($11 trillion) of the $56 trillion in existence. See: http://research.stlouisfed.org/fredgraph.png?g=pnF

LikeLike

‘I would quality as a middle income person by regular measure and I would never, ever, ever agree that government spending improves the lives of people like me.’

Typical anarcho-capitalist thinking. No concern or AWARENESS about what occurs in the aggregate. None whatsoever.

LikeLike

When the government spends a dollar that did not previously exist, it removes purchasing power from other dollars in existence.

NO. NO. NO. No. No! Notyellen, I know you honestly believe what you say. That’s why I rated your comment up. You think it is plain common sense. But this statement, expressing a near universal view, one that the media and academia incessantly repeats is in fact, INSANE RAVING.

Once you realize how crazy it is, you understand MS= MMT etc. It’s the things you think are obviously true that are the problem. They aren’t! That;s the problem. You mix good sense with such lunacies. MMT, “Keynesian” economics incorporates the good and true things you have said above, but rejects the crazy lies. This is not an easy thing to do! As Keynes said Economics “is an easy subject, at which very few excel.”

They’re crazy things that can be occasionally true, like a stopped watch telling the correct time. The mainstream crazily generalizes from such stopped watch statements to conclude that these crazy statements are always true.

LikeLike

“Closing the gap is the course of action, fairest and most beneficial to America — but that would be mis-termed, “socialism” and “redistribution.”

Socialism? We’ve been socialist since the New Deal. Capitalism couldn’t make it without socialist non competitive underwriting in the form of government defense contracts to keep us free from the bogeyman and megacorp in the black. Capitalism died in 1929; socialism/communism died in 1989. We now have a synthesis.

Sooner or later the ultra wealthy will realize more is to be gained from closing the gap. What the government spends to stimulate the 99% will end up in the 1% ‘s pocket. Win-win.

LikeLike

Ethnocultural sovereignty is the complementary opposite of monetary sovereignty.

LikeLike

The Ethnocultural Sovereignty Amendment

I. No citizen shall be denied or deprived of the natural right to an ethnoracial kinship group identity.

II. No citizen shall be denied or deprived of the natural right to membership in an ethnoracial kinship group (ethnorace).

III. No ethnorace shall be denied or deprived of the natural right to ethnocultural sovereignty.

IV. No ethnorace shall be denied or deprived of the democratic right to proportional political representation.

V. The English and Spanish languages are the official languages of the United States of America.

LikeLike

Tax revenues represent transfer of already existing money stemming from a variety of money flows, as I see it. You incessantly state “taxes do not pay for federal spending”, from what evidence do you derive your conclusion? Do not construe this to be argumentative, sir, yet I’ve read and reread a good number of your commentaries and I am having a hard time finding that?

LikeLike

One of the differences between the Monetarily Sovereign federal government and a monetarily non-sovereign state government is that when federal tax dollars are collected, they are destroyed. They disappear from the money supply.

When state taxes are collected, they remain in the money supply (as bank demand deposits or time deposits — M2 and M3.)

Because federal taxes disappear from the money supply, they are not “transferred” anywhere. They do not go to the Treasury or anywhere else. They simply are destroyed.

Being destroyed, they do not pay for federal spending. When the federal government spends, it instructs creditors’ banks to mark up creditors’ checking accounts.

Even if taxes were $0, the federal government endlessly could send these instructions to banks, and banks, not knowing or caring about federal taxes, would follow these instructions.

At no point in the process is federal government spending limited by taxing. Two completely separate functions.

Speaking of “destroyed,” dollars are created and destroyed by two entities:

1. The government creates dollars by spending and destroys dollars by taxing.

2. Banks created dollars by lending and destroy dollars when loans are repaid.

LikeLike

I respectfully disagree with your assessment. If our government was acting as a true monetary sovereign then you might be correct. I’ve yet to see the evidence, though I do see opinions consistently.

LikeLike

You are correct that there are multiple degrees of Monetary Sovereignty. In one sense, the U.S. government always has been sovereign over the dollar, even when it was on a gold standard.

However, it was less sovereign than it is now. Clearly, it is far more Monetarily Sovereign than are Illinois and Greece.

That said, it’s hard to know specifically with what you disagree.

LikeLike

@chasfa, this points to an issue that I’m unclear about. When the US “sells”? $85B of T-bonds to the Fed every month (QE), isn’t that amount of money created by the Fed to “buy” those bonds? If so, doesn’t that place the creation and control of money in the at-least-semi-private domain?

Roger, could you clear this up for me? Perhaps another way of asking this is, “Why should the US borrow money at ANY time from ANYONE if it is indeed Monetarily Sovereign? Why not change this by, for example, enacting HR2990, the National Employment Emergency Defense (NEED) Act of 2011 that would replace Federal Reserve currency with a US National currency?

LikeLike

There is a move in India to remove all taxation and balance the economy by deficits only. The balance for India is

{ DEFICITS – NET IMPORTS = NET PRIVATE SAVINGS}

It is only deficits that matter. Federal taxation is not required except to improve income inequality if it is extreme to start with.

Use deficits to fund everything people need. Simply wait for businesses to produce profits and keep increasing deficits to match.

from

http://www.rediff.com/business/interview/abolish-income-corporate-taxes-to-boost-growth-says-swamy/20131113.htm

It might come to pass. I hope it does. It will demonstrate economics of monetary sovereignty. After all, India invented the number zero and zero tax is very tasty.

India already has many socially useful items funded by deficits and zero tax adds to the innovation.The economy will be half socialist and half free enterprize.

Roder, will this work smoothly?

LikeLike

Unfortunately, Mr. Swamy still believes the government needs income. He wants the government to auction things and to impose a transaction tax.

He doesn’t understand Monetary Sovereignty.

LikeLike

Pshak,

I’m sure the same definition applies to other nations, I just don’t think it’s as simple though. I do not think savings, in wealth/capital sense, equals deficit dollars. Otherwise, why would you need more yen to buy the same goods you could buy in dollars in the US?

LikeLike

Justa simple stupid question. If the Feds do not need “tax money”, why tax?

Who would appose 0% federal income taxes, the rich,the poor?

Why not use “a means to raise revenue for Congressional spending (someone that is not allowed to ‘print’) by other means.Maybe one that may be ‘fair and equitable? Hint : “Actually, the federal government has created 20% ($11 trillion) of the $56 trillion in existence. See: http://research.stlouisfed.org/fredgraph.png?g=pnF“, RMM. Isn’t that $45 trillion that is raising more than $45 trillion in REAL revenue from the people and being turned over to the Private For Profit Banks (they call it Interest Income, Justaluckyfool calls it ‘profit from thin air by charging the people to use their own money’)?

LikeLike

Right. The federal government does not need to tax. Federal taxation is a relic of the gold standard days, when taxing was necessary.

LikeLike

Do taxes in the US reduce the debt? I’m of the opinion that the only way to extinguish money is to use it to reduce debt.

LikeLike

Federal taxes reduce the deficit directly, and indirectly reduce the debt.

The federal debt merely is the total of T-security accounts at the Fed — acounts which are not directly affected by taxes.

It would be possible to have deficit without debt and debt without deficits. Each is functionally independent.

LikeLike

It would be a major “LIGHT BULB” going on in the heads of everyone on the planet if government quit taxing and admitted MS to be our future policy revenue model. (Though I’d spell it rev anew).

Money from thin electrons is going to have to be the reality as that is precisely what most of the current-cy is: electric current. Since money/debt doesn’t exist naturally in the universe, we have to make it abundantly and quickly available in order to conduct the economy by using nature’s highly abundant and speedy electrons as stand ins for money. (try doing it with paper and metal alone and armored cars. It would be like trying to multiply and divide with Roman Numerals).

The quantum leap, no matter how gradual, from household budget thinking to Modern Monetary Mechanics, will be a very interesting feat, much more astounding than the discovery that light has speed or the Sun really doesn’t rise or set.

LikeLike

@tetraheadron720, the model that makes sense to me is that money has evolved from being a scarce commodity (salt, beads, silver, gold, etc.), to being an information system – electron based.

I agree with Roger’s observation that money is a “scale” that measures, much like cm, inches, miles measure distance, and each monetary system has it’s own dimensions (yuan, yen, dollars, pounds, euros, etc). But it’s not clear to me what those dimensions actually measure. I have a hazy idea that money, as an information system, measures an entities’ (person, corporation, government, etc) claim on productivity, or at least it should.

And yet we live with the 500+ year old neo-Malthusian model of scarcity, when, since c. 1970, we have economically turned the corner to be able to provide survival and security needs for every human on earth.

LikeLike

Jeff,

Agree on the ” we live with the 500+ year old neo-Malthusian model of scarcity” in contrast to 21st century automation/mass produced plenitude. Part of our problem is this HUGE disparity and social media’s making us aware of it. People keep asking ‘what the hell is going on here?’ Are we wealthiest nation on earth and if so what’s the problem? The connection between the monetary/financial system and the industrial system are waaay out of proportion.

I don’t think any currency really measures anything in the sense of a tape measure or pair of machinist calipers, i.e., reality. I think currency is a ‘Me-assured’ relationship-connection to goods, a way to justify getting our hands on the output.

A scientifically designed economy has been considered by others throughout history, but falls flat when trying to determine the actual worth of labor –white or blue collar. Engineers can calculate horsepower, watts, kilowatts, ergs, etc, per unit of industrial output; that is, the total amount of energy involved per unit of time per widget, then tie that to the local cost of a kilowatt hour and Bingo you have a cost figure and a basis for pricing. But what, scientifically, is any working or unemployed human’s time/energy worth?

Maybe one day an engineered economy will emerge, never say never, but I think MS will have to come into the picture as a “first stage” transition to get away from econ 101’s scarcity based funda -mental inadequacy view of today’s reality. If there’s a second stage, it could be an evolved engineered economy adopted world around. But definitely many decades off …if at all.

LikeLike