Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Thank you for your leadership, Mr. President

September 19, 2013 2:01 pm

JPMorgan hit with $920m in fines over ‘whale’ trade

By Tom Braithwaite and Kara Scannell in New York and Daniel Schäfer in LondonUS and UK authorities hit JPMorgan Chase with $920m in fines on Thursday for wrongdoing related to the “London whale” trading losses.

Wow! $920 million sure sounds like a lot of money

Jamie Dimon, chief executive, initially referred to the position as a “tempest in a teapot” in an April 2012 earnings call before revealing large losses.

In the same call, Doug Braunstein, then chief financial officer, said the positions in question were “fully transparent to the regulators [who] … get information on those positions on a regular and recurring basis as part of our normalised reporting”.

But an investigation by a powerful US Senate committee found that the Office of Comptroller of the Currency, the bank’s primary regulator, was not aware of the specific positions.

John McCain, the committee’s leading Republican, accused bank executives of “deception”.

Wow, again. The top management was derelict in its duty and lied to Congress. I wonder who’s going to jail.

But Mr Dimon and his top lieutenants, avoided specific criticism in the four regulatory actions.

Not only are Dimon and his top honchos not going to jail, they are not even prosecuted. In fact, they aren’t even criticized.

So is anyone going to jail for one of the biggest crimes in history?

Last month, when prosecutors charged two former London-based traders with hiding hundreds of millions of dollars in losses, US attorney Preet Bharara said the criminal investigation was continuing.

President Obama, having been bribed (via campaign contributions and promises of lucrative employment later) by the big banks, has decided that fishing for minnows is sufficient punishment for the big banks.

Daily Beast

Goldman & JP Are Still Tops—But Dimon Takes a Pay CutEarnings reports show that the two big banks did great this year, even if JPMorgan CEO Jamie Dimon had to cut his pay in half to $11.5 million.

Oooh, the pain, the punishment. He’s down to $11.5 million, not counting the huge perks of his office. (All those with a free private plane, chauffeur-driven car and generous stock options, please raise your hands.)

At least JP Morgan paid that big $920 million fine.

JPMorgan reported that it took in $99.9 billion in revenue and $21.3 billion in net income in 2012. In total JPMorgan’s 2012 revenue was 12 percent higher than the year before.

The “big” fine was less than 1% of revenue — a rounding error — and less than 5% of profits. Clearly, those rich bankers and Congress have learned their lessons, and things like this never will happen again.

Big Bank Lobbyists Help Write Bank Regulation Bills for Congress

Tuesday, May 28, 2013Lobbyists from Wall Street’s biggest banks are dominating the writing of new legislation to weaken the Dodd-Frank financial reform law passed in 2010 to correct some of the abuses that led to the Crash of 2008 and the Great Recession.

The banks are paying for the privilege, donating more than $1.3 million to key members of Congress (70% of it to Republicans) in the first quarter of 2013, according to the Center for Responsive Politics.

Dodd-Frank was weak to begin with, and didn’t come close to solving the problems that caused the Great Recession. But the banksters want to weaken it even more!

Not only are the politicians whores, but they are cheap whores, charging a lousy $1.3 million to save the banks many billions. Jamie Dimon could have paid the whole thing out of his one month’s salary, not counting airplane. (Actually, his airplane costs alone could have paid for the bribes.)

This is what passes for governance in post- “Citizens United” America.

Thank you for your leadership Mr. President. When you leave office, enjoy your big Obama Library and your lucrative speaking gigs, while the rest of us starve.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

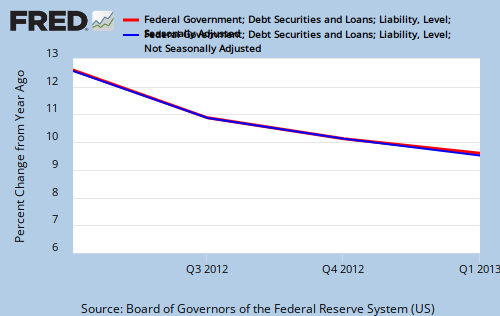

THE RECESSION CLOCK

As the lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Rodger,

Let a “blind” computer that’s programmed to know the crime and the punishment, thus decide the punishment. Period. Whatever it spits out cannot be overridden. Would that slow down white collar crime or overload the jail cells? Think about it.

LikeLike

this is slightly off-topic, but i bring it to your attention, rodger, b/c it’s in your home state:

LikeLike

1. http://www.bloomberg.com/news/2012-06-18/dear-mr-dimon-is-your-bank-getting-corporate-welfare-.html

2. http://finance.yahoo.com/q/ks?s=JPM+Key+Statistics

LikeLike