Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

=====================================================================

Up is now down; black is now white; big is now small.

Stimulus 2008: Mr. Obama called on Congress and the Bush administration to pass an economic stimulus package.

He said it was an “urgent priority” to extend unemployment insurance benefits for workers who could not find jobs in the bleak economy. He also said he would give aid to states, create new jobs and move forward with his tax-cut plans for middle-class families.

So, in 2008, “stimulus” and “create new jobs” required more federal deficit spending.

Stimulus 2009: The $787 billion economic stimulus package was approved by Congress in February, 2009. The package was designed to quickly jumpstart economic growth, and save between 900,000-2.3 million jobs. The package allocated funds as follows:

$288 billion in tax cuts.

$224 billion in extended unemployment benefits, education and health care.

$275 billion for job creation using federal contracts, grants and loans.

In 2009, “stimulus” still required more federal deficit spending.

Stimulus 2010: Most of the growth present in the US economy is coming from the money injected into our capitalist system by the Government. This is why so many people are asking if we will get another stimulus check in 2010? So here’s what we know so far: There will be a $250 stimulus check for Social Security (SS)

Yes, in 2010, “stimulus” still required more federal deficit spending.

Stimulus 2011: President Obama unveiled a stimulus plan Thursday night that he says will boost hiring and provide a jolt to the stalled economy if it becomes law.

A mix of $253 billion in tax cuts and $194 billion in new spending, the total bill for the plan is $447 billion.

Consistently in 2011, “stimulus” still required more federal deficit spending

Stimulus 2012: Putting pressure on Congress to approve parts of his latest economic stimulus plan, President Obama urged Americans Saturday to push lawmakers to approve his multibillion-dollar “to-do list” for creating jobs.

“Each of the ideas on this list will help create jobs and build a stronger economy right now,” Mr. Obama said. The president’s list includes an expanded program to help homeowners refinance their mortgages, a proposal to give small businesses tax breaks for hiring more workers, a program that would help veterans find jobs, and an extension of tax credits for clean-energy companies.

All told, the proposals on the president’s list could cost up to $34.7 billion:

In 2012, “stimulus” still required more federal deficit spending.

But wait! Up is now down; black is now white; big is now small:

Stimulus 2013: President Obama unveiled a 10-year budget blueprint Wednesday that calls for nearly $300 billion in new spending on jobs, public works and expanded pre-school education and nearly $800 billion in new taxes, including an extra 94 cents a pack on cigarettes.

But the president’s spending plan would also cut more than $1 trillion from programs across the federal government — for the first time targeting Social Security benefits.

“Our economy is poised for progress, as long as Washington doesn’t get in the way,” Obama said. He said his budget represents “a fiscally responsible blueprint for middle-class jobs and growth.”

The plan reduces the deficit and makes necessary investments “because we can do both,” he said. “We can grow our economy, and shrink our deficits.” He added: “The numbers work. There’s not a lot of smoke and mirrors in here.”

I have a question: How many millions of Americans now wrongly believe we grow the economy by taking money out of the economy, when in the previous five years, they correctly believed growth required adding money into the economy?

And by the way, exactly how do we “grow our economy, and shrink our deficits” at the same time? Smoke and mirrors?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY

Sure, less deficits…

Initial solution – years and years of continued deficits

1) economy crumbling

2) employment way high

3) the income gap bigger than ever

Can anyone guess what the solution is?

1) It’s not letting banks eat the losses for taking unduerisk.

2) It’s not letting home owners lose their homes for buying a home they could not afford.

3) It’s not removing protections for the 3% of union members and public employees extracting the blood of the 96%.

4) It’s not forcing our elected officials at the local, state and federal level to spend withinOUR means.

No, the solution is the same solution that has been tried time and time and time again. It’s to issue more debt which will purchase items which would have been otherwise been purchased by the already destroyed, beaten tax payer. Not the union member, not the blood suckers, not the politicians, not the rich, the 96% of the real workers will pay for it. I keep asking, what happens dr mitchell, when there is nothing else to rob?

I don’t think you know what revolution is sir… revolutions are not the product of lazy, blood sucking leeches. It’s the product of oppressed people, stolen of their freedom (gun control), and their purchasing power (deficits).

LikeLike

Got it. Guns are freedom and adding dollars to the economy reduces purchasing power. Why didn’t I think of that?

LikeLike

A reader asked me, “If Obama is bribed by the .1% to widen the wealth gap, why did he want more deficit spending in 2008, 2009, 2010, 2011 and 2012, only to do a complete U-turn in 2013.”

The answer should be evident. Before 2013, he was running for office. He wanted the economy to improve. He needed to pump dollars into the economy to grow GDP and reduce unemployment.

Now that he no longer is running for office, he doesn’t care about the economy or the suffering people.

He cares only about the people who will build his big Obama presidential library, the people who will hire him (and Michelle) for mega-bucks speaking engagements, the people who will support his daughters if they decide to run for office or want jobs.

(Think multi-millionaire Bill Clinton and family. His daughter Chelsea now is “open” to running for office, and so is her mother-in-law. Bill increased the debt his first term and decreased it his second term in office, causing a recession, and the rich have rewarded him ever since.)

It is well understood in Chicago and Washington that if you take care of the rich boys while you’re in office, they’ll take care of you when you leave.

Obama learned this well when he was here in Chicago, getting along by going along. It’s the Chicago way.

LikeLike

Wow Rodger. Outstanding research. Superb writing.

Best blog on the Internet!

You ask, “How many millions of Americans now wrongly believe we grow the economy by taking money out of the economy, when in the previous five years, they correctly believed growth required adding money into the economy?”

How many Americans? Almost all of them. A third want a reduced deficit because they lean to the right. Another third want a reduced deficit because people like Paul Krugman and Bernie Sanders want a reduced a deficit. A final third want a reduced deficit because they are apathetic, and they think what the media tell them to think.

MMT morons want a reduced deficit because they think Obama is innocent and means well, but is simply “misguided.” Today at the NEP blog, Bill Black wrote a post claiming that Obama pushes for austerity because Obama gets advice from Jack Lew. This is support for Obama, who wants a reduced deficit. Even people like Ralph Nader want a reduced deficit, since they want financial transaction taxes, plus increased taxes on the rich and on corporations.

Thus, everyone wants a reduced deficit. Right, left, middle, rich and poor, they all demand it. Welcome to collective suicide.

Rodger asks, “By the way, exactly how do we ‘grow our economy, and shrink our deficits’ at the same time? Smoke and mirrors?”

Simple. Shrinking the deficit grows the economy by increasing the wealth and power of Wall Street and the 1%. This expands the financial economy at the expense of the real economy, but according to the rich-owned media, the two economies are one and the same. Therefore, the more we die, the more we are in a “recovery.” Circles are square, pigs have wings, and 0 + 0 = 3. This is “common sense,” backed up by Harvard Ph.Ds. Anyone who questions it is a terrorist.

(Just ask “Flash.”)

LikeLike

Malcolm, a few suggested manifesto tweaks for you;

Free Education up to 25, including job training for all, this would take the sting out of bad feeling towards academic education and stimulate general/vocational training.

Per capita public education spending pegged to mean private education spending.

Performance related pay for politicians incomes/pensions directly related to mean incomes for their jurisdiction.

National pensions/living wages pegged to mean income/productivity.

LikeLike

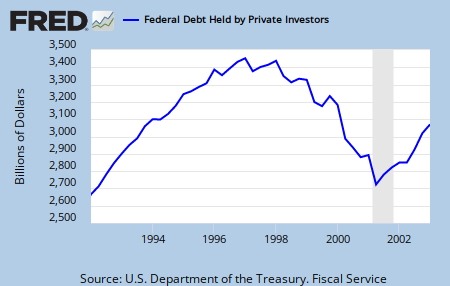

Excellent graphs. The battle over the 2014 budget

The lower the lines, the more certain we are of recession and depression, and the worse the recession and depression will be.

LikeLike

RANDOM NOTE

“As the U.S. economy perks up, and federal budget deficits shrink, there will be less pressure on Washington for fiscal belt-tightening.”

~ Wall Street Journal op-ed

The above sentence would be valid if we changed the first word to “IF.”

The stronger the economy, the less politicians demand austerity. On the flipside, the weaker the economy, the more politicians demand austerity, in order to make it weaker still. The worse the anemia, the more they pile on leeches. In Europe, the more destruction caused by the euro, the more politicians claim that the euro is preventing destruction.

It’s part of society’s collective madness. We saw it in the 1930s. We are seeing it now. We are headed for a Dark Age and / or a World War.

http://blogs.wsj.com/economics/2013/04/11/budget-deficit-is-shrinking/

++++++++++++++++++++++++++++++++++++++

WANT A BETTER JOB? TRY THIS

Hey kids, would you like to be a professor of economics at a top university? Would you like to have pompous titles like John Cochrane, AQR Capital Management Distinguished Service Professor of Finance at the University of Chicago Booth School of Business, research associate of the National Bureau of Economic Research, adjunct scholar at the Cato Institute, and blah-blah-blah?

Yeah? Then all you need to do is spout GARBAGE like this…

John Cochrane: “Inflation results when the government prints more dollars than the government eventually soaks up in tax payments.”

(WRONG! Inflation is less associated with the supply of money than with the demand for money. Also, energy prices play a role in causing inflation. Also, when politicians impose austerity, the public must get private loans from banks, which causes a debt-price spiral, i.e. inflation. Consider higher education. The higher the college tuitions, the more the student loan debt. The more the debt, the higher the tuition prices. Meanwhile, deficit spending is counter-inflationary. The more money people have, the more power they have as consumers. This causes business to compete for sales, which pushes prices down.)

John Cochrane: “In the near-term, the government can soak up dollars by issuing bonds, which are backed with a promise of higher taxes to pay for the interest in the future.”

(WRONG! T-securities are not backed by taxes, since taxes do not create T-securities, nor pay interest on them. Instead, T-securities are backed by the “full faith and credit of the United States” – that is, by the federal government’s ability to create as much money as needed forever. It’s called Monetary Sovereignty. Learn it. Know it. Live it. )

John Cochrane: “If investors start to believe that the U.S. isn’t going to raise taxes to pay off that interest, then they won’t buy bonds. “

(WRONG! Tax revenue has nothing to do with T-securities. At present, when we consider inflation, some T-securities pay less than zero interest. Nonetheless, investors put their money in T-securities for periods ranging from 30 days to 30 years, because Monetary Sovereignty makes T-securities secure.)

…and so on. The more garbage you spew, the more “brilliant” you are.

To be a respected “genius,” you must rationalize austerity with every word. More austerity! Always more! The more you defend poverty and the wealth gap, the more the corporate media will call you “brilliant,” and the more the public will agree that you are an “authority.”

Just be sure to refer to the wealth gap as “debt reduction,” or “deficit reduction,” or “fiscal responsibility” or “fiscal consolidation.”

And be sure to use meaningless charts and graphs that no one understands, including you.

Cochrane’s garbage is here…

http://www.nationalaffairs.com/publications/detail/inflation-and-debt

++++++++++++++++++++++++++++++++++++++

IT’S DEFICIT DOVE SEASON

(Grab your shotguns!)

Question: If everyone rejects the facts of Monetary Sovereignty, then what should we do? Should we let deficit hawks promote austerity unchallenged, so that the resulting depression proves they are all liars? Or should we support deficit doves who say we need austerity, but not right now?

MMT morons favor Option #2. They call themselves “deficit owls,” yet they support deficit doves like Paul Krugman.

Unfortunately, deficit doves confuse the public, thereby strengthening the deficit hawks.

Therefore, I say blast them both.

For example, a Washington Post op-ed challenges eight claims for deficit reduction, but it advances other lies that cause confusion, and thus legitimize deficit reduction. (“Why Do People Hate Deficits?”)

Here’s a summary…

CLAIM 1: It’s unconscionable to load so much debt on to our grandkids.

The Washington Post author correctly notes that Americans own two-thirds of the national debt. Thus, their grandkids will inherit the wealth from interest payments. However the author fails to mention that the national debt is a national asset on deposit, since it is the amount of T-securities purchased. (The government does not need to sell the securities in the first place.) From this he makes the additional error of claiming that “Higher debt burdens might mean tax increases or spending cuts for your grandkids, but it could mean more moolah from bonds, too, and more money to programs like Social Security and Medicare with trust funds.”

See? By falsely claiming that the sale of T-securities necessitate higher taxes, and that interest from T-securities helps pay for Social Security and Medicare, the author defends the lies that politicians use to justify austerity.

Shoot that deficit dove!

CLAIM 2: We’ll be in debt to the Chinese! Think of the national security risks!

The Washington Post author says the idea that the national debt is a national security threat is rejected by the Defense Department, the Heritage Foundation, and just about everyone in between. WRONG! Many government bureaucrats claim that, “The greatest national security threat to the United States is our national debt.” The big ratings agencies say it. The Defense Department issues regular bulletins saying it. Adm. Mike Mullen said it when he was Chairman of the Joint Chiefs of Staff (2007-2011). To deny that they say it is to cause confusion, which supports austerity.

From there the author piles on additional errors, e.g. “The nightmare scenario is a massive sell-off of U.S. debt. But that would hurt China much more than it would the U.S.”

WRONG! It wouldn’t hurt us at all. The Treasury sells securities by choice, not by necessity. We could pay off the entire national debt today, effortlessly, with no inflationary effects. The Washington Post author conceals this.

Shoot that deficit dove!

CLAIM #3: We’re broke! America is going to be bankrupt!

The author correctly says the U.S. Treasury never need default on any of its debts, since we control our own currency. But then he piles on more garbage again: “If we owe debts and DON’T HAVE THE TAX REVENUE TO PAY THEM, we can always just print the money and hand it over.”

Oops…the all-purpose “taxes pay for government” lie.

Folks, if you do not fully understand Monetary Sovereignty, then you will promote austerity, no matter what you say, and no matter how well-intentioned you are. Paul Krugman is an example.

Shoot that deficit dove!

CLAIM #4: Deficits will give us inflation!

The Washington Post author correctly notes that there is no demonstrable correlation between deficit size and inflation rates, especially in developed nations. But then comes the garbage (again): “At some point, deficits get large enough that it’s worth worrying about inflation getting out of control. But we’re just not there yet.”

At some point? What point? Why are deficits a problem tomorrow, but not today? By failing to note that the government’s surplus is our deficit, you support austerity by default.

Shoot that deficit dove!

CLAIM #5: Every dollar lent to the U.S. government is a dollar not lent to private companies.

Here the Wa-Po author addresses the “crowding out” lie — i.e. the bullshit claim that if people buy T-securities, then people won’t buy corporate stocks or bonds, or other types of bonds. The author claims (falsely) that yes, this is a potential problem with deficits, but it isn’t a problem right now. This deficit dove drivel supports deficit hawks who rightly say, “If it’s a problem tomorrow, then why isn’t it a problem today?”

Shoot that deficit dove!

CLAIM #6: Countries with debt over 90 percent of GDP enter a danger zone.

The debt-to-GDP ratio is meaningless for nations that have Monetary Sovereignty, but the Washington Post author cannot admit this, since he is a deficit dove. Instead, he debunks the 90 percent figure by saying it is an arbitrary notion invented by Harvard economists Ken Rogoff and Carmen Reinhart in their paper “Growth in a Time of Debt.”

The Wa-Po author fails to mention that in this paper, and in the book, “This Time Is Different: Eight Centuries of Financial Folly,” Rogoff and Reinhart only use examples of nations that had no Monetary Sovereignty, and no free-floating non-convertible currency. Thus, the Rogoff – Reinhart claims are garbage.

However the Washington Post author cannot be this honest, for them he could not be a deficit dove.

Shoot that deficit dove!

CLAIM #7: Deficit-spending in good times makes it harder to do so in bad ones.

Here the Washington Post author goes wildly astray, saying that this is, “The best argument for keeping deficits low or nonexistent.”

He says, “During recessions, governments almost by necessity must run deficits. Tax revenue tanks, payments through programs like food stamps increase, and so forth. So you want room to run deficits of an appropriate size to stave off the recession. That’s easier to do when investors are willing to lend you money, and insofar as behaving in a fiscally prudent manner keeps them interested, it’s valuable.”

Garbage! The author claims that “fiscal responsibility” in good times means the government can borrow more in bad times (i.e. run larger deficits during recessions).

No! The US government does not need to borrow at all. Ever. It sells T-securities by choice, not necessity. Hence, the size of the deficit has nothing to do with investors’ decision to buy T-securities. The size is decided by politicians. It is a function of politics (i.e. power games). Previous deficits are irrelevant.

However the Washington Post author claims that deficits are a problem (only not right now).

Shoot that deficit dove!

CLAIM #8: Not balancing the budget means borrowing more, which adds to the national debt.

The author says this is not a problem, since interest rates are very low. Again he conceals the fact that the U.S. government sells T-securities by choice. He also says that low interest rates cause a reduction in the national debt (i.e. fewer sales of T-securities). Nonsense of course. Interest rates are very low, yet the “national debt” keeps growing (i.e. the purchase of T-securities).

Shoot that deficit dove!

Naturally Paul Krugman loves this article.

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/04/08/why-do-people-hate-deficits/

Speaking of Krugman, he says, “This whole deficit fever has been based on bad logic and weak evidence.”

No Krugman, It is based on deficit hawks on one side, and you on the other.

ALL OF YOU are liars.

LikeLike

Thanks Mark. Seems you should have your own blog. But wait! No need. TheMS/Mythfighter Blog and the MR Blog. Two, two blogs in one! You couldn’t ask for more. Thanks again dude.

LikeLike

Steve did you see this? No surprise. Over the last two weeks, the Cyprus economy has died so fast that depositors must now surrender another € 6 billion ($7.8 billion) of their own money, in addition to the € 7 billion ($ 9.1 billion) they already had stolen from them. The “haircut” is a scalping. (Again, no surprise.)

In these last two weeks, the bill for the “bailout” of Cyprus banks has risen from € 17.5 billion to €23 billion – and keeps accelerating. €23 billion is more than an entire year’s output from the Cypriot economy. Cyprus is in the debt / austerity death spiral. (So is Portugal, whose debt is 124% of GDP and rising.)

Cypriot president Nicos Anastasiades asked for more debt, but the Germans said they would only give him € 10 billion in new debt. Cyprus must rob its own depositors for the rwmaining € 7 billion (whoops, now € 13 billion, and climbing).

Yannakis Omirou, president of the Cypriot parliament’s president, says the Troika has “served poison” to Cyprus. Yet Mr. Omirou clings to the poison, which is the euro currency.

Thus, if peripheral nations want to keep using the euro, they must get future “bailouts” from their own depositors. If their depositors have nothing left to steal, but their nation has juicy natural resources, then in some cases the Troika will stretch out the terms of the loans another seven years, which means higher interest payments overall.

Portugal’s prime minister Pedro Coelho remains absolutely committed to the euro currency, and to austerity for his people. (Germans love him.) Meanwhile “opposition” politicians claim they want an end to austerity, but they also want to keep the euro, which is like using liquor to cure alcoholism. None of them want to be crossed off the Troika bankers’ Christmas card list.

NOTE: In 2011 the Troika bankers used their computer keyboards to create a € 78 billion debt bomb out of nothing, and drop it on Portugal. Portuguese politicians promised to impose more and more austerity on their people, but last week Portugal’s Constitutional Court ruled that several austerity measures in the 2013 budget were unlawful. Troika bankers respond that if Portugal does not continue to adopt more austerity (always more), they will cut Portugal off. Since Portuguese politicians want to stay on the Troika payroll, they will keep the euro currency, which means they too will start stealing from depositors, in order to keep local bankers afloat.

The euro-zone nations have deposit insurance, but since all money consists of loans from the Troika, and debt from the sale of bonds, the deposit insurance does not really exist. “Yes, there is insurance to protect your deposits, but you must surrender your deposits to keep that insurance current.”

Slovenia is on the edge of total collapse because of the euro currency, and is trying to stay afloat by feverishly selling off public banks and other pubic assets at fire-sale prices. Prime Minister Alenka Bratusek remains committed to the euro, since Troika bankers are the only thing that protects her from the mob. All leaders of euro-zone nations are puppet dictators of the Troika. All banks in the euro-zone are now machines for wealth extraction.

Cyprus could sell its 13.9 tons of gold reserves, Spain its 281.6 tons, Portugal its 382.5 tons, and Italy its 2,451.8 tons, but the sales would have to be to China, or India, or some other sucker. Troika bankers are not interested in gold, since they control something far more valuable, which is the banking and currency system that gives gold its value. (Most people think the reverse, that gold gives value to banking and currency systems.) France sold off 17.4 tons of gold in 2009.

In other news, President Vladimir Putin has announced that Russia will spend 1.6 trillion rubles ($52 billion) on its space program through 2020. Meanwhile the USA has no space program, since all Americans serve the bankers. The Fed alone gives $45 billion per month to Wall Street.

LikeLike

Hi Mark. You mentioned this worm, John Cochrane a couple of months back . Soon after, I gave myself the misfortune of viewing his “Grumpy Economist” Blog. Who could trust in anything this fool says with comments such as: “Wholesale, retail trade and transportation cost 14.6% of GDP, while all manufacturing is only 11.5% of GDP. We spend more to move stuff around than to make it!” I’m sure a 10 year old off the street could figure out why this is not a problem. Know any 10 year olds looking for a cushy academic gig?

LikeLike

Good point, Steve. The ratio of manufacturing to transport is irrelevant, since both are part of GDP.

John Cochrane of the U. of Chicago says, “We spend more to move stuff around than to make it!”

So what? The word “spend” implies that the money leaves the U.S. economy, when in fact we spend it on each other. It’s called GDP. (If we want to include spending on imports, then we must shift from GDP to GNP.)

Average Americans in their selfishness fail to understand that GDP means spending on each other, and that austerity means a reduction in spending on each other.

On a different note regarding selfishness, the Greeks have always had a problem with this. In Greece, people hate each other, and don’t trust each other. Every Greek says he is honest, and that every other Greek is corrupt. The resulting lack of solidarity and community spirit left Greece wide open for a Troika attack. It’s pretty much the same in all peripheral nations.

Germans and Frenchmen hate each other too, but they hate outsiders even more. This gives them solidarity when they financially attack other nations.

However, while hate and arrogance build empires, they also destroy those same empires, sooner or later. This is inevitable. After the wolves eat all the prey, they eat each other.

LikeLike

What is supply and demand you ask?

It’s a proven theory that shows that prices are a product of supply and demand…

It’s as simple as 1+1=2.

The socialists on this blog believe in it and so do i. Than why are our net suggestions so different?

I can only guess.. perhaps political affilition? Perhaps political gain? Perhaps it’s just too hard to let the tit go.

More SUPPLY of dollars without an increase in the supply of goods and services causes prices to rise.

No change in the SUPPLY of dollars without a decrease in the supply of goods and services causese prices to drop.

No change in the SUPPLY of dollars with an increase in the supply of goods and services causes prices to drop significantly.

Now, can anyone tell me which distribution of wealth above is fair and which one is not?

– is it the one where our government prints new dollars, which as shown above, steal others’ purchasing power for the benefit of unions, public leeches and the rich.

Or

– is it the ones where the market adjusts the purchasing power of citizens without bias? Is there anyone on this board that ever went to purchase something and got agitated over too cheap prices? Anyone?

Let’s start being honest… you may fool some of us some of the time, but you cannot fool all of us all of the time…

LikeLike

“It’s a proven theory that shows that prices are a product of supply and demand.”

~ Sir Schizoid

Ah yes, the dream world in which all people are rational actors in a fair market, and prices are always a direct product of natural supply and demand. Such a world never existed, except in the fantasies of economics professors, plus certain deranged people. (Ahem.)

In the REAL world, supply can remain unchanged, while speculation causes prices to skyrocket.

In the REAL world, supply can be kept artificially scarce via monopolies, causing prices to skyrocket.

In the REAL world, prices can be manipulated by the control of money.

In the REAL world, the larger and more developed a nation, the more it operates by politics and groupthink, rather than ordinary supply and demand.

LikeLike

Prices to skyrocket? Are you serious? Tell us which market player can make the market to skyrocket? Name one?????

Monopolies are the product of………GOVERNMENTS….. Medical in dustry anyone? Go look at every single monopoly and you will find a government behind it… every single one….

In a market economy and even in a Central Bank economy, the market is MUCH MUCH MUCH larger. The issue is not the market, the issue is a group of thugs that cling to the government to fleeze the rest.

The larger player in our economy is the Central Bank, the Fed. I’ve mentioned it before, keep an eye on the Japan Central Bank (JCB). It is the biggest market player in Japan too, and it is about to prove that not even the Central Bank can manipulate the much bigger market. The market is about to teach the JCB a lesson. I hope you are learning from this.

LikeLike

You also miss that by supply and demand i’m referring to the supply and demand for dollars. To add, there is always some sort of speculation on any market, whether free or not.

But there is much more when we, as a society, have moral hazzards; bailing out irresponsible banks, investors, home owners. Guess what, thesame group of people are at it again.

So, speculation per se is not bad if you are allowed to reap rewards as well as lossess. It is bad when you reap rewards and socialize losses. Not only because it isn’t fair, but because it creates moral hazzards.

My point above is that a constant money supply is better than an increasing one because increases in productivity makes each dollar more valuable, basically sharing the wealth automatically, no need for handouts. Savers would get beneft from a strong currency, as well as those getting minimum wage because their labor will get them more.

The real world is one of deceit, make the others believe we cannot live without a central bank or with large banks or without handouts to the ‘poor’, where sitting in ones butt is valued more than contributing to society.

One day our children will read about these days and believe me, their digust will be about our lack of bravery, our willingness to give up our rights for a mirrage of ‘safety and guarantees. They will look back and see and we sat back and allowed our leaders to step on the constitution, our corporate leaders to break the law while making themselves rich, our banks to take us hostage while our leaders bailed them out on our backs, while irresponsible home owners got rewarded while responsible tax payers got shafted, we allowed the medical industry to build a monopoly, we gave up our livelihoods for what only appears to be the safety and guarantees of our government. What fools are we to not be able to see that it is us paying the bills? That it is us that are losing our safety, that it is us that guarantee our lifelihoods. We as a society, have fell into the deepest depths. That is what our children will remember sir.

This will only end when we remove the central bank and peg to gold. Not because gold is pretty, but because our cowards in dc won’t be able to mortgage our livelihoods for the benefit of a few chosen ones. This is nota fantasy, our current system may not be a fantasy but it’sa fallacy.

LikeLike