Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity starves the economy to feed the government, and leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

One of the most important and timely equations in economics is:

Federal Deficits = Net Private Savings + Net Imports

This neither is theory or even hypothesis. It is an accounting description of U.S. dollar flow. No economist disputes this equation.

The equation shows that federal deficits are the ultimate source of all dollars, and despite economically suicidal efforts to reduce deficits, if there were no deficits there would be no dollars. Without federal deficits, your net savings — even Bill Gates net savings — would be zero.

“Deficit” and “debt” fool most people, because these words sound negative. But think about it this way:

A federal “deficit” occurs when the federal government creates and spends more dollars than it receives in taxes. Similarly, when the government runs a surplus, the government takes more dollars out of the economy than it sends into the economy. A government surplus is the economy’s deficit.

The added dollars from federal deficit spending go to one of two places:

1. Into the U.S. economy, where they become Net Savings, or

2. To foreign economies to pay for Net Imports

Thus, the equation: Federal Deficits = Net Private Savings + Net Imports

Banks create dollars by lending, but those are not net dollars. For every dollar created by a bank, a loan obligation also is created –- the new dollars are offset by new obligations, so they net to zero. Only the federal government creates net savings dollars.

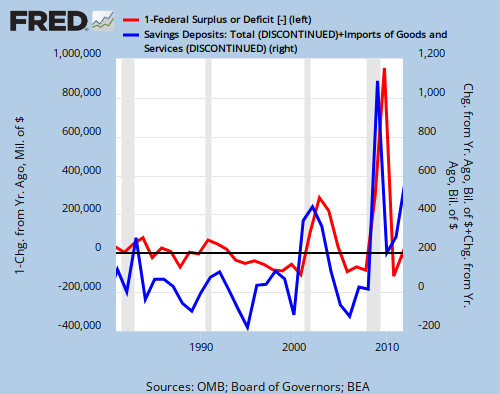

Lately, the blogosphere has been crackling with graphs illustrating this simple concept. First, I received an Email from several economists, containing an illustrative graph from Warren Mosler’s site. Then, I sent them back the following graph which shows Federal Deficits (red line) and Total Savings Deposits at all Depository Institutions plus Imports of Goods and Services (BOPMGSA)

(The lines would be exactly coincident but for slight measurement differences. Also, “Total Savings Deposits at all Depository Institutions” is not identical with Net Private Savings, and Imports of Goods and Services is not Net Imports.)

The graph makes this point clear: The more deficits rise, the more net savings rise.

The misnamed “deficit” is the source of all net dollars, i.e. all net private savings. Cutting deficits cuts private savings, which depresses the economy. Cutting deficits is a prescription for depression.

The Tea Party, Romney/Ryan, the Chicago Tribune, AARP and the Wall Street Journal editors all act on behalf of the upper 1% income group. They tell you the myth that federal deficit and debt are “unsustainable” and should be reduced. They never explain why a Monetarily Sovereign nation cannot “sustain” its deficits.

The 1% wants you to believe the myth, because that belief leads to your acceptance of cuts to social benefits and a large and growing income gap between the 1% and the 99%.

Reducing the deficit takes dollars out of the economy. When the government deficit spends, dollars flow into your pockets. When the government taxes, dollars flow out of your pockets. It’s that simple.

Because the government is Monetarily Sovereign it can create endless dollars. It does not need taxes. It does not need to borrow the dollars it creates. It can support endless Medicare, endless Medicaid and endless Social Security and never bounce a check.

Federal social programs will be in financial trouble only if the government cuts federal spending. It’s a self-fulfilling action. The more deficit cutting, the more financial trouble, which (according to the 1%) “requires” more deficit cutting, and on and on, until the lower 99% are sucked dry.

Don’t let the 1% starve you to feed a Monetarily Sovereign government that does not need to be fed. Vote against all tax increases and benefit cuts.

(By the way, if the Ryan budget doesn’t really cut Medicare, but actually “saves” Medicare, why does Ryan repeatedly assure those 55 and older, that the plan will not apply to them? Does he think we are so selfish we don’t care what happens to our kids?)

Rodger Malcolm Mitchell

Monetary Sovereignty

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

Rodger, so well put… but how does the 1% specifically benefit by propagating this deficit myth? Why would the 1% even care about increasing the income/wealth gap? I would think they’d be interested in maximizing their absolute $$ (net asset value). How would eliminating FICA even hurt them in any way?

LikeLike

As I have mentioned in previous posts, the 1% is less interested in their dollar income than in the dollar gap between them and the 99%. This phenomenon is universal.

If all your friends make $20K per year, you would feel rich making $50K. But, visualize that all your friends make $1 million per year. Now, you feel poor. It’s the gap that counts. Look at athletes who make $10 million, but pout because other athletes make $20 million.

As a former employer, I repeatedly found that absolute salaries mean little, but comparative salaries mean much.

The deficit myth forces the government to reduce spending, most of which benefits the 99%. So spending reductions reduce the income of the 99% more than the income of the 1%, thus increasing the gap.

LikeLike

Rodger,

Just wanted to say this is a nice description.

I am not sure if you did it on purpose or not but I did want to thank you for not saying that taxes destroy money or that taxes do not pay for gov spending.

IMHO I think to get MS across to people it is better just to say that “taxes takes money out of the economy” and that the gov has the ability to spend as much as it wants.

One other suggestion when you say the gov does not have to borrow you may want to make a note that legally it must borrow but only because it is a law or that only by law does the gov have to borrow.

Also here is another piece that I am looking into. When you say bank loans are not net dollars…no argument…(although what about the multiplier effect??) but can’t the feds add to the overall reserves within the system by printing money without the gov spending/deficits, that is my understanding??

In any case this is a good description…… not that I am a supporter of MS, I still have problems with the actual economic aspects of MS ie… saying that just having more dollars is necessarily a good thing or putting more dollars into the economy is the same as actual savings or that it will help grow the economy when the economy may already have too much money or when MS discounts the loss of purchasing power by just printing more money through deficit spending and so on but those are other issues.

LikeLike

Sorry, but since Deficits = Spending – Taxes, the equation in the post shows that taxes do destroy net dollars by reducing deficits, and taxes do not pay for federal spending. Simple algebra.

LikeLike

RMM,

When you say without deficits there would be no dollars, how does that account for the $55 trillion or so in demand deposits. Even though the asset and liability nets to zero, for the purpose of economic activity, does the ‘loans create deposits’ mechanism count as dollars? And, isn’t most “spendable” money in exstence right now created that way?

LikeLike

Without deficits there would be no net dollars. Without net dollars there could be no loans.

LikeLike

Can you explain this further: “Without net dollars there could be no loans” ?

LikeLike

Net dollars are what are deposited in bank accounts. Without net dollars, there would be no dollars to lend.

LikeLike

Great chart, Roger. Sharing.

One small question on the chart — is the blue line based on net imports, or on gross imports ?

LikeLike

“Banks create dollars by lending, but those are not net dollars. For every dollar created by a bank, a loan obligation also is created –- the new dollars are offset by new obligations, so they net to zero.”

Where does the interest go in this case?

Does the interest go out of existence also or does it remain in the bank and thus the private sector?

LikeLike

The interest also is not net dollars, as it is a debit on the bank’s own savings.

LikeLike

Good question. It was gross.

Here is the graph using “NET EXPORTS”:

LikeLike

I am just wrapping my brain around this…so bear with me please. I have long believed that we have made major errors in accounting when GDP included things that I consider EXPENSES…attorney fees, insurance, health care, as PRODUCTIVITY, while considering things like INFRASTRUCTURE and EXPENSE…while I consider those ASSETS/PRODUCTION. That being said, I look at your graph and the brown DEPRESSION/RECESSION areas happen when deficits go up. Please respond to that. I can see that when the government spends on anything, that STAYS IN THIS COUNTRY…and out of the hands of the 1% who squirrel it away instead of circulating it there is some kind of ADDITION to the economy, but still…money spent on things like health care or FEES…I am beginning to see that the money still circulates, but what happens when we keep consuming stuff from CHINA?

LikeLike

When we import, dollars flow out of the country and do not add to GDP.

LikeLike

I understand the part about imports…how about GDP methods of calculation being useless numbers? infrastructure as expenses and fees as production?

LikeLike

GDP calculation isn’t useless numbers. GDP calculation includes investments in final goods and services, by individuals and government. Roads, bridges and other infrastructure are counted as are the fees involved in final production.

Transfer payments (i.e Social Security) aren’t included, because nothing is produced. The key words are:

Gross (not net)

Domestic (not foreign)

Production (not transfer payments)

LikeLike

What a horrible, horrible idea. Taking money out of the productive private sector and spending it in the parasitic public sector is a recipe for economic catastrophe. Doesn’t communism ever run out of euphonious guises?

LikeLike

TallDave, Rodger does not advocate taking money out of the private sector, he advocates pumping money INTO the private sector. That is done by deficit spending. The government’s spending is the private sector’s income.

LikeLike

Right.

“Taking money out of the productive private sector” (i.e. federal taxes) is a “recipe for catastrophe.” The federal government doesn’t need the tax dollars. In fact, it destroys them upon receipt.

Federal taxes are counter-stimulative.

Not sure what communism has to do with it, however.

LikeLike