Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

I know of no undertaking more important to the growth, success and survival of America than the education of our people.

Our forefathers knew it:

Historical Timeline of Public Education in the US

1647: The General Court of the Massachusetts Bay Colony decrees that every town of fifty families should have an elementary school and that every town of 100 families should have a Latin school.

1790: Pennsylvania state constitution calls for free public education but only for poor children. It is expected that rich people will pay for their children’s schooling.

1817: A petition presented in the Boston Town Meeting calls for establishing of a system of free public primary schools. Main support comes from local merchants, businessmen and wealthier artisans. Many wage earners oppose it, because they don’t want to pay the taxes.

1820: First public high school in the U.S., Boston English, opens.

1827: Massachusetts passes a law making all grades of public school open to all pupils free of charge.

1851: State of Massachusetts passes first its compulsory education law.

Today, free education, grades K – 12, is available to virtually all Americans, and mostly mandatory for those 18 and under. This education is paid for by monetarily non-sovereign governments: State, county, city, village — i.e., it is paid for by taxpayers.

Through time, mechanization and technology have made America’s competitiveness and success dependent on education beyond grade 12.

1945: At the end of World War 2, the G.I. Bill of Rights gives thousands of working class men college scholarships for the first time in U.S. history.

The “Ten Steps to Prosperity” (below) contains two steps directly addressing education:

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

The November 30th issue of Time Magazine contains an article titled, “But can America afford this approach to solving the student debt,” by Haley Sweetland Edwards:

“I’m a correspondent at TIME. Previously, I was an editor at the Washington Monthly, where I wrote about policy and regulation. I studied philosophy and history at Yale and journalism and politics at Columbia.”

Some thoughts from Ms. Edwards’s article:

Tens of millions of Americans collectively owe $1.3 trillion in student debt.

In the past eight years, the federal government has quietly, almost imperceptibly, changed the rules of the loan game. It has made itself the primary bank for students and put in place an expansive new safety net.

Rather than owing for-profit lenders, students will owe dollars to the federal government, which being Monetarily Sovereign, has no need to collect dollars from students.

A key provision allows all federal borrowers to cap their monthly payments at 10% or 15% of their discretionary income and wipes any remaining balance off the books after 20 or 25 years.

The great “improvement” is that students will not be in debt for life; they will be in debt “only” for their first 20-25 years after college, the prime family-building times of their lives.

Paying this debt effectively will require their children to apply for school debt, and so the cycle will continue.

Bush and Rubio have advanced higher-education plans that would overhaul the accreditation process to clear the wary for new, online institutions offering cut-rate degrees.

The thought of online institutions offering cut-rate degrees to the masses, makes one shiver.

It is the perfect right-wing solution, guaranteed to widen the gap between the rich (who can afford the best brick-and-mortar universities), and the rest (who will be “educated” by cut-rate, online schools.)

Hillary Clinton offers a smorgasbord approach, including cutting loan-interest rates, expanding existing grant programs and offering rewards to colleges that keep their tuition low.

In short, she offers the typical left-wing, complex, convoluted Obamacare-esque sort of, not quite, pretend solution to two problems that need real solutions: Eliminating onerous student debt and educating our population.

And now, for the inevitable Big Lie:

But this new federal safety net contains serious flaws. The Brookings Institution estimated that it could cost taxpayers $250 billion over the next 10 years.

Wrong, of course. Taxpayers do not fund federal spending. That is the basis for Monetary Sovereignty, and is the fundamental difference between the Monetarily Sovereign federal government and the monetarily non-sovereign state and local governments.

And here, Ms. Edwards repeats the Big Lie:

It allows (students) to run up vast debts . . . and to leave future taxpayers holding the bag.

Oh, well, it is ever thus. Anyway, she gets down to the rest of the problem:

Perhaps most damning, while the program takes the pressure off students, it does nothing to control the actual price of tuition, which has risen like crazy for years.

It also arguably makes it more likely that tuition will rise even more quickly in the future, as students’ ability to pay becomes a moot point.

First, it won’t really be a “moot point,” because student still will pay. The rich ones will pay out of their own checkbooks, and the rest again will take out loans. The loan payments merely will be capped.

But let’s get beyond the details and explore the theory, which is: Federal support makes ability to pay moot, so prices will rise. Is this a justifiable concern and is it a real problem?

The closest parallel I can think of is Medicare. It pays most of the doctors’ bills. And if you ever review those bills to see what Medicare pays doctors, you will find that far from being out of control, they are so “in control,” that most doctors are underpaid.

With but few exceptions, doctors net less today than they did in the pre-Medicare days. Medicare actually has held down fees. So much for the effects of the “moot point.”

Though health care costs have risen, most of that rise can be attributed to more sophisticated and expensive tests with more sophisticated and expensive machines and better hospital facilities. (Are you old enough to remember when nearly all hospital rooms were “doubles,” “triples” or “wards”?)

But, let’s say, for argument sake, that university tuitions do rise dramatically, because of the “moot point” effect, and that the federal government pays a great deal more, and schools and teachers get rich. Here’s what would happen:

–The government would pump more dollars into the economy, which would grow the economy.

–The public schools would receive more dollars, requiring less state taxes to support them.

–Some private schools would expand and improve their facilities while others simply would get rich

–Teachers’ pay would increase, resulting in more people and better people wanting to be teachers.

–Students wouldn’t have to shop around for scholarships, some of which require free labor (Think: Athletic scholarships)

–Schools wouldn’t have to shop around for donors, many of whom come with “strings” (Think: Koch brothers dictating curriculums)

Frankly, I can’t imagine a single reason why rising, federally funded tuitions would be harmful, and if there are any, surely the benefits would outweigh them.

Ms. Edwards’s article includes many interesting points, and I advise you to read it in the Time Magazine issue. But all her points have to do with loan capping, scholarships and grants, and none really levels the playing field between the rich and the rest, and none eliminates the financial penalty for attending college.

So we are left with two questions:

1. Is it in America’s best interests for all those who want a college education to be able to afford it?

2. Should the federal government fund what is in the nation’s best interests?

At the end of World War II, our answer to both questions was, “Yes.” Sadly, we have drifted away from sense and into the Big Lie. We have made it more difficult to earn a college education, when we should be making it easier.

Bottom line: The entire student loan program is unforgivable, in every sense of that word.

Rodger Malcolm Mitchell

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

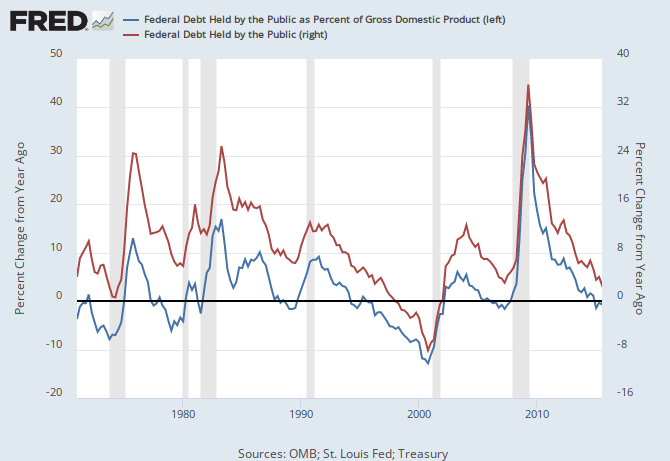

THE RECESSION CLOCK

Recessions come only after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

THIS WEEK IN CRAZY

LikeLike

Wrongheaded article of the day from The Committee for a Responsible Federal Budget:

That’s 2.3 trillion stimulus dollars remaining in the economy, rather than being taken from your and my pockets.

Such a tragedy.

LikeLike

“When interest is included, the emerging tax extenders deal could add nearly $850 billion to the debt this decade and $2.3 trillion by 2035.” ~ Committee for an Irresponsible Federal Budget

Nonsense. Since the U.S. government does not borrow its spending money, Maya MacGuineas et. al. cannot rightly claim that “tax extenders” (i.e. extensions of tax breaks) will automatically force the Treasury to sell an extra $115 billion per year in T-securities for the next 20 years.

And even if the Treasury did have to sell an extra $115 billion per year in Treasury securities, the U.S. government (including the Fed) would buy 41% of the securities. Why is it a “debt crisis” when the U.S. government owes itself?

According to the web site below, 49% of T-securities are purchased by investors (both international and private domestic).

Of the remainder, 28% are purchased by various U.S. government agencies, 13% are purchased by the Fed, 13% are purchased by state and local governments, and 5% are purchased by “other” (whatever that means).

The interest money paid for all T-securities in FY 2016 will be about $240 billion, including the money that the U.S. government will pay itself. That $240 billion will all be created out of thin air. So where is the “debt crisis”?

https://www.nationalpriorities.org/campaigns/us-federal-debt-who/

Why then is Maya MacGuineas complaining about “tax extenders”? You’d think that she would be happy that the rich are being taxed less.

Indeed she is happy, but she is paid to continually ring the alarm bell about a “federal debt crisis,” and “entitlements” being “unsustainable.” Her goal (her Holy Grail) is the privatization of Medicare and Social Security.

American workers pay about $1.1 trillion in FICA taxes each year. Maya MacGuineas wants that $1.1 trillion a year to go each year to the Wall Street thieves and gamblers, including her own husband, who works for Goldman Sachs.

LikeLike

“In short, the typical left-wing, complex, convoluted Obamacare-esque sort of, not quite, pretend solution to two problems that need real solutions: Eliminating onerous student debt and educating our population.”…….. Clinton is not a leftist (either one), Obama is not a leftist. They are 70s-esque Rockefeller Republicans. And some would argue that they are to the right of those Rock-Repubs. The Democratic party is not a leftist organization. Sanders is a leftist, and he advocates for free tuition for colleges and universities.

LikeLike

You are 100% correct. I stand corrected.

LikeLike

Roger some of the worst obstacles to solving this problem don’t come from policymakers or even banksters. They come in the forms of tightly held platitudes offered and repeated n masses by those unable to perceive changing conditions even as they witness them. The student loan issue can’t even be presented to the larger population as a valid problem in need of solution until those recognizing it as such learn to answer two challenges offered those supporting the status quote and intending to shut the whole debate down before it gets started.

The first opens with “they knew it was a loan when they took it, nobody forced them into it, why shouldn’t they have to pay, and usually quickly pivots to “if they picked a better major they wouldn’t have trouble paying,” etc.

The second usually begins with the refrain “back when I was” and moves to a recitation of all the challenges the narrator somehow surmounted as he or she matured, with or without a college education, and ends with “and today I [fill in your favorite success story ending].”

I can’t complain too much in a sense. I earn a very good living that puts me very squarely within the upper rungs of the trustee class but find myself trapped by the very career and life balance constraints Ms. Harris has so eloquently and accurately described either in response to your blog or on her own and which need no repetition here.

I can’t help but wonder why my peers, who are educated and many of whom know how to advocate and navigate within complex systems don’t put up more resistance to working ever longer hours for less and less and less purchasing power in sheer terror of the next quarterly analyst call where “rightsizing” may be offered as the prescriptive leech to cure next quarter’so earnings. How did we all get this stupid?

All that aside, I would love to hear your pithy rejoinder to the two questions I referenced.

Many thanks.

LikeLike

It begins with the fact that America needs college-educated people. Unless one understands that, the discussion ends right there.

If many people didn’t take the loan, they wouldn’t be able to afford college. That is bad for America.

Is the definition of a “better” major one that leads to a higher paying job? That leaves out teachers, artists (painters, musicians, writers, dancers), scientists and other low paying, but valuable professions.

Now my question: What is the logic that makes grades 1-12 free, but makes 13+ expensive?

LikeLike

I suspect those arguing with you would point at K-12 as basic education meaning that necessary to have people function at some minimally acceptable level. Perhaps the counter is that today’s challenges require an adjustment of our definition of the minimum functional requirements for those within our society. I can see no logic that bears out.

LikeLike

Marco Rubio wants to “reform” college financing via a scheme devised by the ultra-right-wing Cato Institute (which is funded by the Koch brothers).

Some people liken Rubio’s scam to indentured servitude, in which students receive a college education in return for agreeing to work for a company for a set period of time (say, ten years).

However this criticism is not exactly correct. If it were, then at least students would have a job for ten years.

No, Rubio’s scam strengthens the extortion racket. Instead, of being indebted to bankers for student loans, venture capitalists would finance your college education in return for a percentage of your wages…for life.

After all, venture capitalists are entitled to a return on their investment, right?

College is free in Iceland, Brazil, Solvenia, Germany, Norway, Finland, and Sweden. However you must pay for your own room and board. All these countries have university programs in English.

France charges tuition – but only 200 dollars at public universities. Denmark only charges foreigners for tuition, unless a foreigner is on an exchange program, or has a tie to Denmark or the EU.

In Mexico, college is nearly free, despite the country being locked in a drug war.

>>>Why do these nations have free or nearly free college?

Because, like Rodger (and unlike the average American) these nations view higher education as more of a public than a private benefit. And some of these nations, like Germany, are eager to expand the number of skilled workers.

Meanwhile in the USA, it’s all about widening the Gap below you (which causes the Gap to be widened above you).

LikeLike